Tag Archive: On Economy

The Dying Middle Class

As expected, Ms. Yellen smiled last week, announcing no change to the Fed’s extraordinary policies. For the last eight years, she has been aiding and abetting the largest theft in history. Thanks to ZIRP (zero-interest-rate policy) and QE (quantitative easing), every year, about $300 billion is transferred from largely middle-class savers to largely better-off speculators, financial asset owners, and the biggest borrowers during that period –...

Read More »

Read More »

Credit Crisis in Waiting

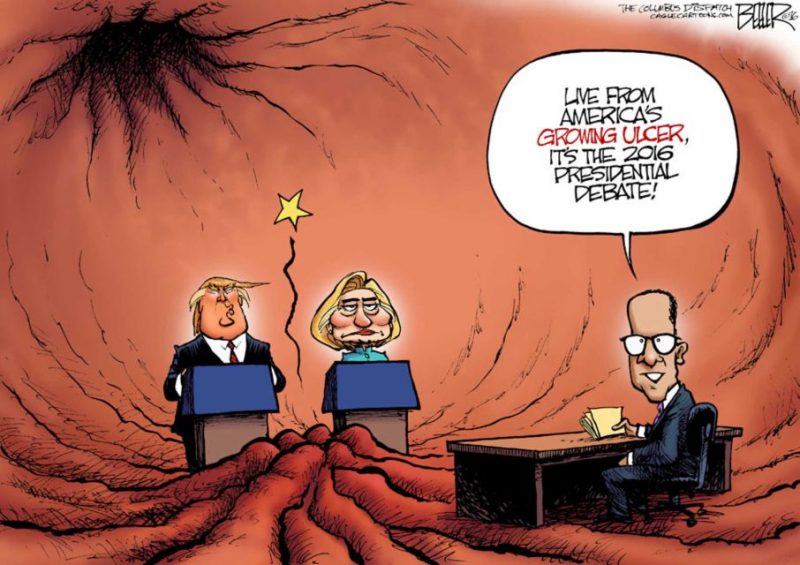

Clowns in the Coliseum DUBLIN – The presidential debate began long after our bedtime, here in Ireland. So we got up this morning, rubbed our eyes, and watched the highlights. “Lowlights” is perhaps a better way to describe it:

Read More »

Read More »

The Fed and the Everything Bubble

John Hussman on Recent Developments We always look forward to John Hussman’s weekly missive on the markets. Some people say that he is a “permabear”, but we don’t think that is a fair characterization. He is rightly wary of the stock market’s historically extremely high valuation and the loose monetary policy driving the surge in asset prices.

Read More »

Read More »

The Italian Dilemma

The sudden panic about a potentially imminent Italian banking sector collapse back in July has somewhat subsided for now, but sooner or later the issue will inevitably rear its ugly head again.

Read More »

Read More »

The Undemocratic Nature of TTIP

Mounting Resistance Thousands of people recently demonstrated in Brussels against free trade deals negotiated by the EU. This happened just days before a meeting of EU trade ministers in Bratislava last Friday, which was considered the last push to salvage the Transatlantic Trade and Investment Partnership (TTIP) between the EU and the United States.

Read More »

Read More »

Japan’s Planners Ratchet up Monetary Experimentation

It was widely expected that the BoJ would announce something this week after it promised to perform a comprehensive review of its monetary policy. It certainly did deliver a major tweak to its inflationary program, but its implications were seemingly not entirely clear to everybody (probably not even to the BoJ).

Read More »

Read More »

Great Causes, a Sea of Debt and the 2017 Recession

NORMANDY, FRANCE – We continue our work with the bomb squad. Myth disposal is dangerous work: People love their myths more than they love life itself. They may kill for money. But they die for their religions, their governments, their clans… and their ideas.

Read More »

Read More »

Get Ready for a New Crisis – in Corporate Debt

OUZILLY, France – We’re going back to basics here at the Diary. We’re getting everyone on the same page… learning together… connecting the dots… trying to figure out what is going on. We made a breakthrough when we identified the source of so many of today’s bizarre and grotesque trends. It’s the money – the new post-1971 dollar. This new dollar is green. You can buy things with it.

Read More »

Read More »

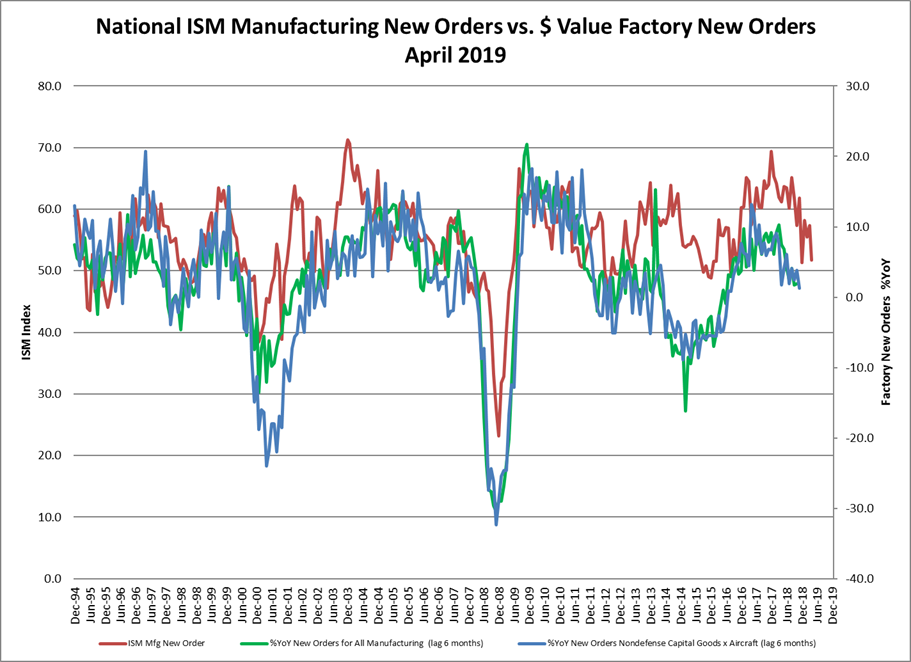

The Strikingly Weak ISM Purchasing Manager Indices

We are always paying close attention to the manufacturing sector, which is far more important to the US economy than is generally believed. The ISM index shows striking weakness.

Read More »

Read More »

Follow the Money

PARIS – It’s back to Europe. Back to school. Back to work. Let’s begin by bringing new readers into the discussion… and by reminding old readers (and ourselves) where we stand. US economic growth: average annual GDP growth over time spans ranging from 120 to 10 years (left hand side) and the 20 year moving average of annual GDP growth since 1967

Read More »

Read More »

Cash Bans and the Next Crisis

Money sometimes goes “full politics”. Take poor Kenneth Rogoff at Harvard. He wants a dollar with a voter registration card, a U.S. flag on its windshield, and a handgun in its belt – the kind of money that supports the Establishment and votes for Hillary.

Read More »

Read More »

How is Real Wealth Created?

An Abrupt Drop. Let’s turn back to our regular beat: the U.S. economy and its capital markets. We’ve been warning that the Fed would never make any substantial increase to interest rates. Not willingly, at least. Each time Fed chief Janet Yellen opens her mouth, out comes a hint that more rate hikes might be coming.

Read More »

Read More »

US Economy – Curious Pattern in ISM Readings

Head Fake Theory Confirmed? This is a brief update on our last overview of economic data. Although we briefly discussed employment as well, the overview was as usual mainly focused on manufacturing, which is the largest sector of the economy by gross output.

Read More »

Read More »

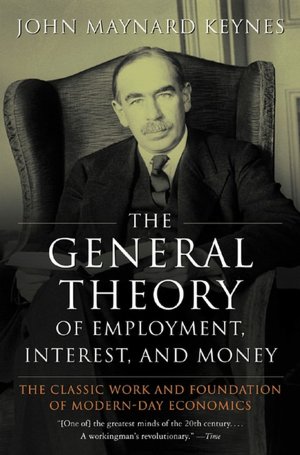

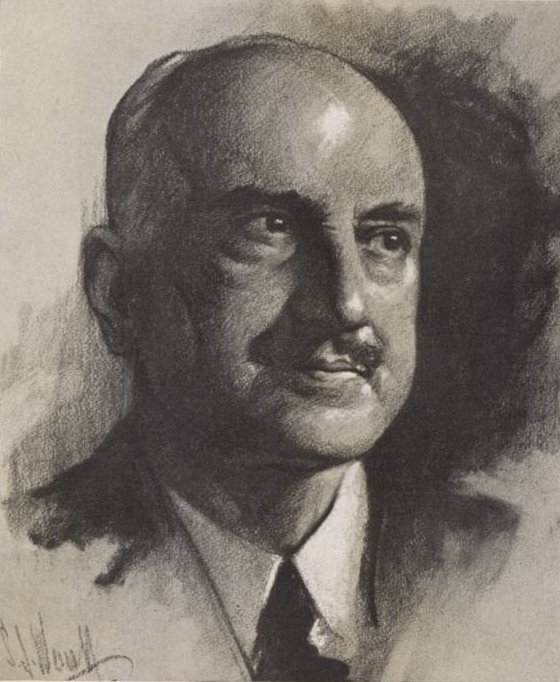

John Maynard Keynes’ General Theory Eighty Years Later

The “Scientific” Fig Leaf for Statism and Interventionism. To the economic and political detriment of the Western world and those economies beyond which have adopted its precepts, 2016 marks the eightieth anniversary of the publication of one of, if not, the most influential economics books ever penned, John Maynard Keynes’ The General Theory of Employment, Interest and Money.

Read More »

Read More »

Shrewd Financial Analysis in the Year 2016

“Markets make opinions,” says the old Wall Street adage. Perhaps what this means is that when stocks are going up, many consider the economy to be going great. Conversely, when stocks tank it must be because the economic sky is falling.

Read More »

Read More »

How Does It All End? Part II

Low Rates Forever, Nothing much is happening in the money world. The press reports that traders are hanging loose, wondering what dumb thing the Fed will do next. Rumor has it that it may decide to raise rates in September, or maybe November… or maybe not at all.

Read More »

Read More »

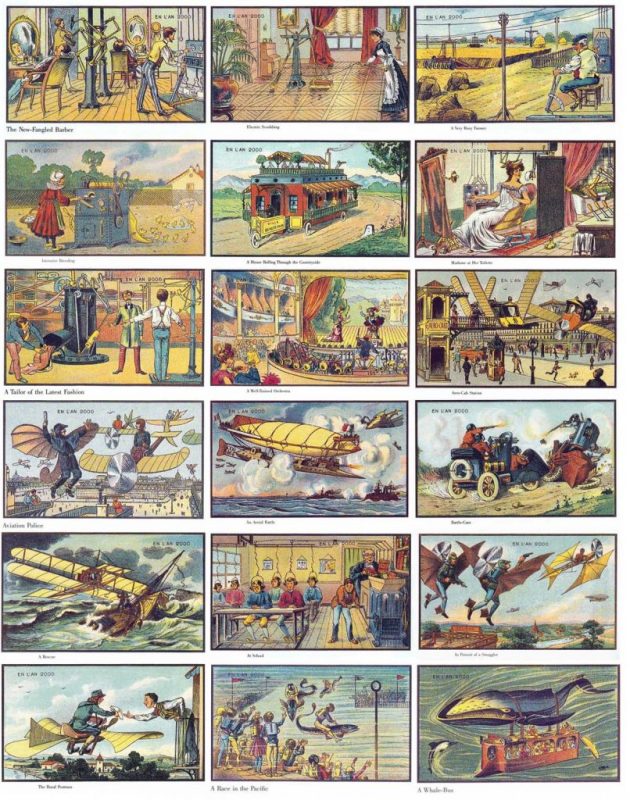

How Does It All End?

In 1900, a survey was done. “What do you see coming?” asked the pollsters. All of those people questioned forecast better times ahead. Machines were just making their debut, but already people saw their potential. You can see some of that optimism on display today in the Paris Metro. In the Montparnasse station is an illustration from the late 1800s of what the artist imagined for the next century.

Read More »

Read More »

The Idea that Overseas Manufacturing Jobs will Return to the US is Pure Fantasy

As we enter the final lap of the presidential race in the United States, as always, the two candidates will say just about anything to secure your vote. And of course the economy is a major topic of conversation. Loud calls for both higher wages and more jobs dominate the rhetoric. Naturally, Hillary Clinton and Donny Trump claim they can easily solve both of these problems. I can only laugh at their certitude. They are so wrong… and like true...

Read More »

Read More »

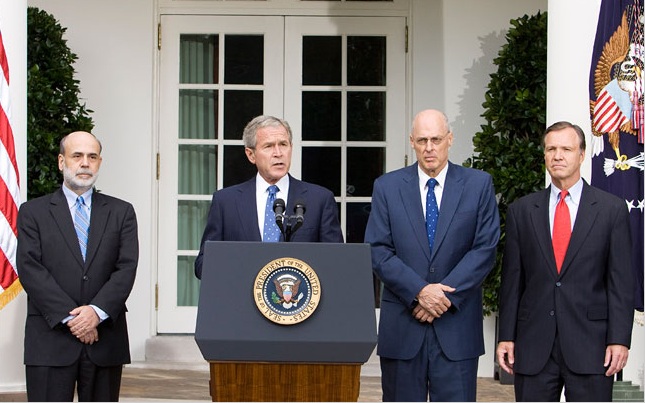

Loose Monetary Policy and Social Inequality

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative...

Read More »

Read More »

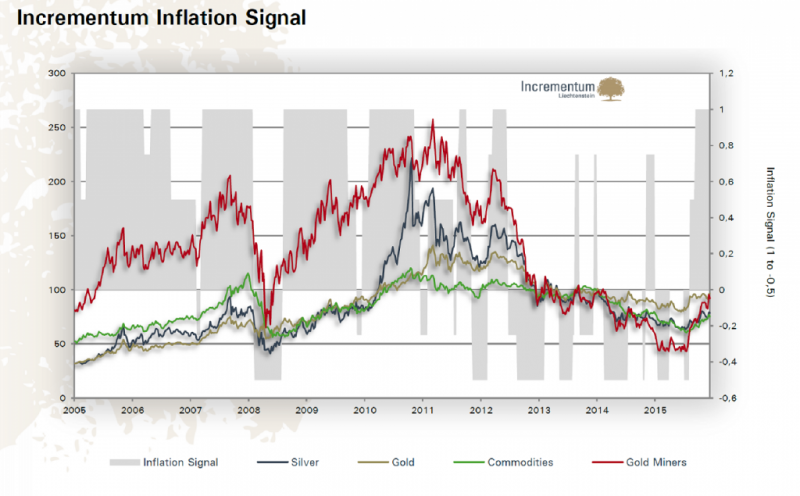

Incrementum Advisory Board Meeting, July 2016

The quarterly meeting of the Incrementum Fund’s advisory board was held on July 19. A pdf transcript of the discussion can be downloaded via the link below. We were once again joined by special guest Brent Johnson, the CEO of Santiago Capital. One topic: Helicopter money.

Read More »

Read More »