The “Scientific” Fig Leaf for Statism and Interventionism

To the economic and political detriment of the Western world and those economies beyond which have adopted its precepts, 2016 marks the eightieth anniversary of the publication of one of, if not, the most influential economics books ever penned, John Maynard Keynes’ The General Theory of Employment, Interest and Money.

The mere fact that the book is lauded by TIME magazine on the cover should give everyone pause. We have taken it upon us to read this tome in its entirety, which proved to be quite a slog (the effects alternated between putting us to sleep and making us shake our head in wonderment as to how anyone familiar with economic theory could have taken this stuff seriously at the time of its publication). The idea was that in order to criticize an economic and political philosophy, one should know what it is actually about. That is by the way one of the many differences between us and Keynesians like Mr. Krugman, who occasionally publishes critical appraisals of Austrian economic theory, although he has evidently not read a single word of it. He has that in common with his hero Keynes, who according to Gottfried Haberler wrote a scathing review of Mises’ Theory of Money and Credit without having read it (!) – not exactly a display of intellectual honesty. It is unfortunately true though, as the cover spells out, that this book is the, or at least a “foundation of modern-day economics”. In case you were wondering why the economy is seemingly mired in perpetual malaise, look no further. Readers who lack the patience to face the superficiality, boredom and endless contradictions of the original text may want to check out Henry Hazlitt’s extensive critique The Failure of the “New Economics” (pdf, available for free), which makes the exercise a lot more interesting and entertaining. As an aside, putting quote marks around “New Economics” was entirely legitimate. Most of what Keynes wrote had already been propagated by a long line of interventionist cranks who preceded him, refuted by their contemporaries.

Sadly, even to this day, despite its thorough refutation by lights such as Henry Hazlitt and other eminent scholars, the General Theory, which spawned “Keynesianism” and its later variants, remains supreme in academics, financial markets, and public policy.

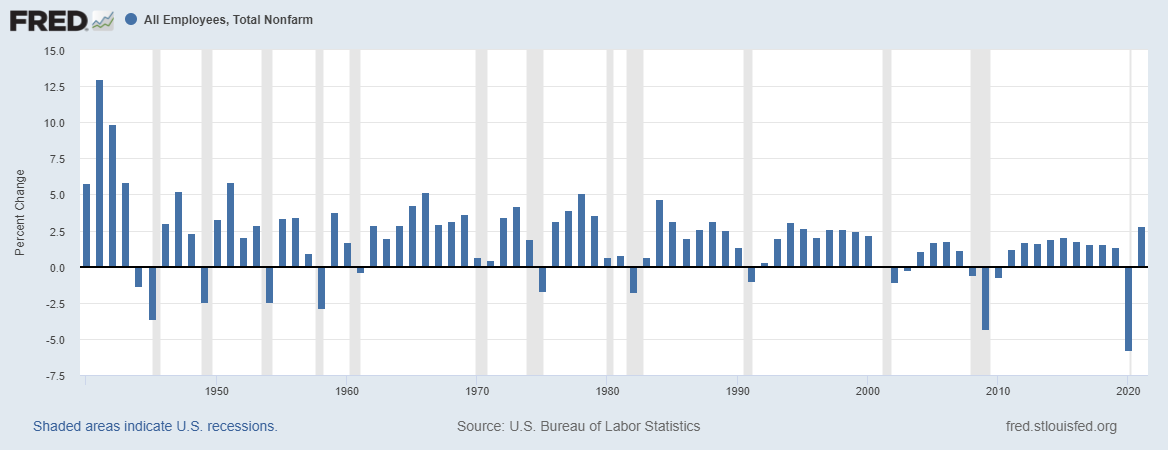

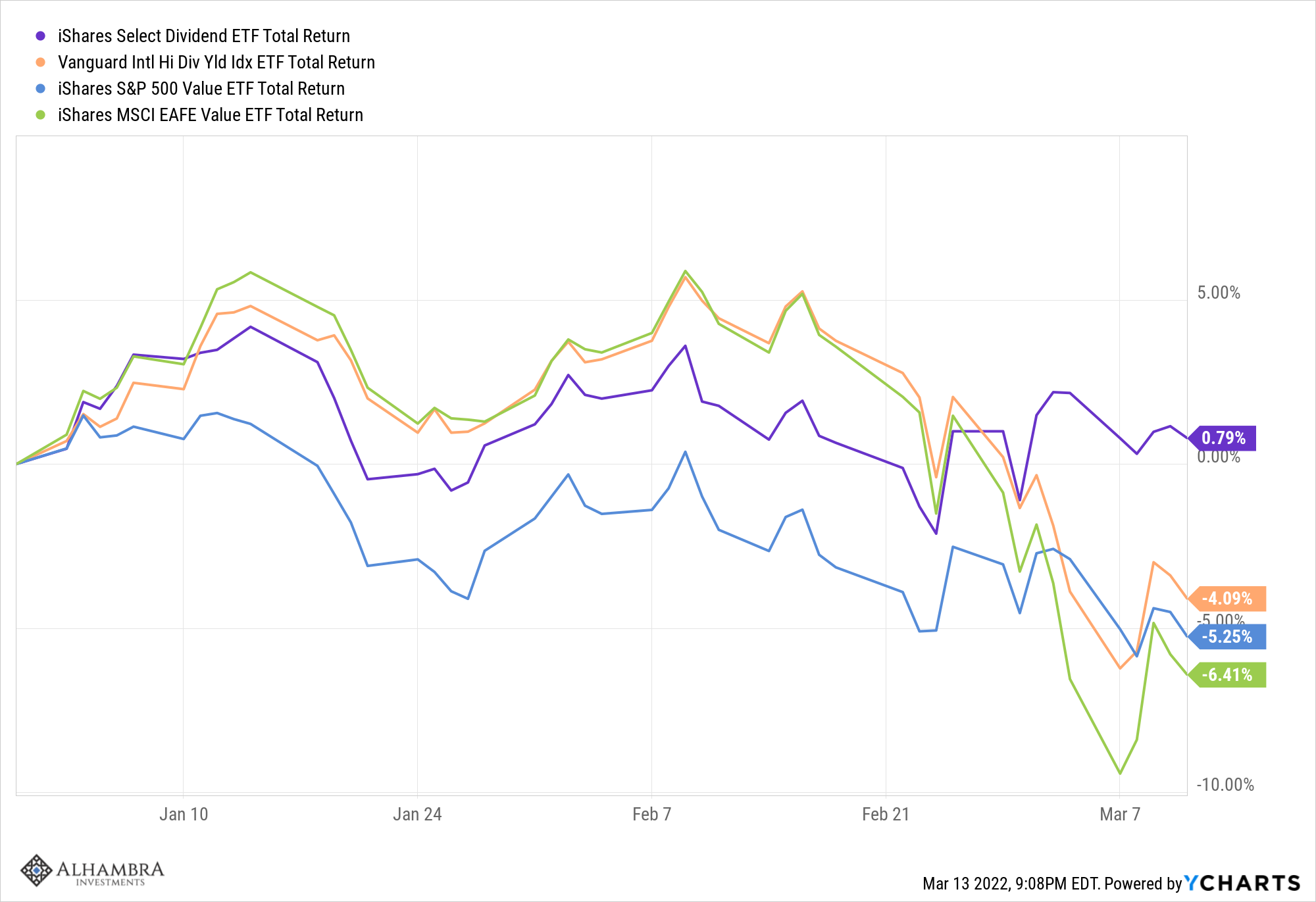

Despite its outlandish theoretical flaws and nonsensical economic jargon and the catastrophic empirical evidence of its failure to prevent financial downturns or “stimulate” sustainable growth, Keynesianism remains the ruling paradigm of economic thought. Why?

A number of trenchant reasons have been given for the General Theory’s continued dominance, however, one stands above all else: Keynesian economics provides the intellectual justification for economists, statisticians, technocrats, bureaucrats and policy wonks in their exalted positions as “fine tuners” of economies the world over.

Since markets are to Keynes and his disciples inherently unstable from erratic investment spending and aggregate demand, it is up to these theoreticians steeped in the knowledge of their master’s teachings to ameliorate any economic fluctuations.

Intellectual Dishonesty in the Pursuit of Privilege and Power

The General Theory came on the scene at a propitious time during the height (or more accurately the depth) of the Great Depression, which in 1936, despite Roosevelt’s New Deal and other Western nation states’ initiatives, had not improved conditions.

Keynesianism was actually a “middle way” between all out Soviet-style central planning and that of laissez-faire capitalism. Primarily through fiscal policy, the economy would be kept on an even keel under the astute management of Keynesian-trained economists.

Naturally, this appealed to academics and intellectuals the world over who correctly envisioned positions of power and influence in expanded state apparatuses.

As history has shown, Keynesianism was to become more than a remedy for the Depression, but would remain applicable after the crisis dissipated. The General Theory was based, in part, on the (false) notion that the capitalist system is inherently unstable and is therefore in need of state intervention.

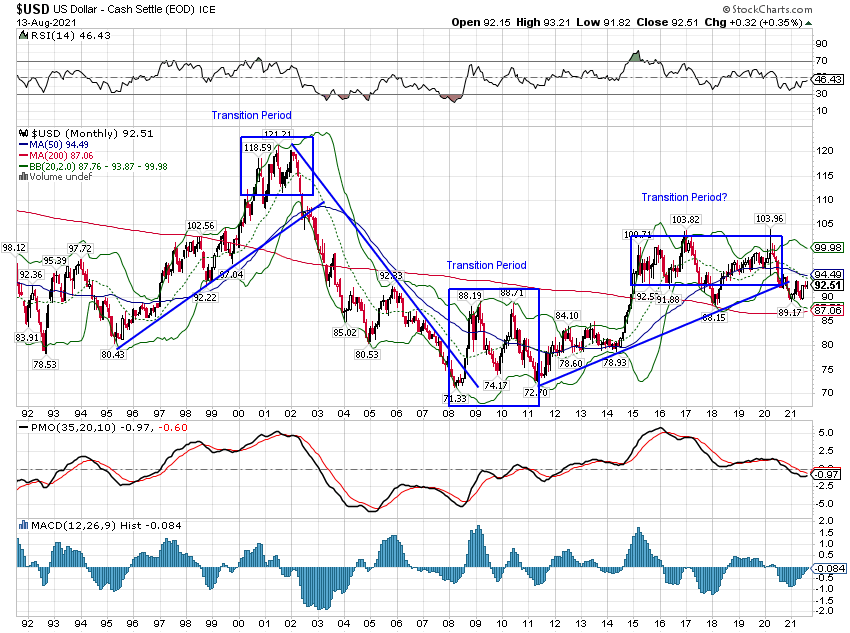

Keynes deliberately ignored the scholarship at the time, which demonstrated that the instability was not a “market failure,” but a monetary disorder caused by artificial credit expansion generated by the central banks, especially the Federal Reserve.

The enthusiasm for the General Theory came at first from younger economists while it was (rightly) dismissed by many of their elders as incomprehensible. Yet, its lack of clarity was appealing to the novices, since they would become the Creed’s interpreters.

Paul Samuelson – although he evidently realized that Keynes’ book was confused and full of contradictions, he propagated its tenets anyway. In order to grasp what an unreconstructed statist and central planning advocate Samuelson was, consider that the 1989 edition of his famous text book Economics: An Introductory Analysis still contained a chart that purported to show when exactly the economy of the Soviet Union would overtake the US economy – this was accompanied by the remark “The Soviet economy is proof that, contrary to what many skeptics had earlier believed, a socialist command economy can function and even thrive” – the complete economic and political implosion of this “thriving” command economy followed less than two years later – in essence, it was the biggest bankruptcy in history. As Yuri Maltsev (a Soviet economist who had fled the socialist paradise) told Dick Cheney in the late 1980s (paraphrasing): “The CIA has it wrong; the Soviet economy is not 50% of the US economy – it is at most 5%”. Maltsev was of course correct. Robert Higgs (who met Samuelson in person at the MIT and was quite taken aback by his arrogance and condescension) notes about his obsession with mathematics and equilibrium models: “Nothing has done more to render modern economic theory a sterile and irrelevant exercise in auto-eroticism than its practitioners’ obsession with mathematical, general-equilibrium models.” Amen to that. Samuelson bears a great deal of responsibility for the spread of physics envy and positivism in economics, even though he conceded that his beloved models might be useless if they were based on false premises – which happens to hit the nail on the head. An an aside, Samuelson provides additional proof – if that is still needed – that the Nobel Prize for Economics (which is handed out by a central bank) is very often a contrary indicator.

Photo via mit.edu

Not all, however, were entirely overwhelmed by their mentor’s magnum opus as Paul Samuelson candidly admitted:

[The General Theory] is a badly written book: poorly organized. . . . It abounds in mares’ nests of confusions. . . . I think I am giving away no secrets when I solemnly aver – upon the basis of vivid personal recollection – that no one else in Cambridge, Massachusetts, really knew what it was all about for some twelve to eighteen months after publication.*

Despite such an assessment, Keynesianism was never seriously challenged by its adherents; it opened too many lucrative policy making doors to be refuted. That Keynesianism continues to reign supreme, despite its theoretical and empirical bankruptcy, speaks volumes of the state of Western intellectual and academic life.

Instead of the pursuit of truth and the refutation of error, the Western intelligentsia is primarily concerned with securing privilege and power for itself. At one time such status was gained by honest inquiry into social questions and issues, now it is obtained in the justification of the expansion of state power. Very few turn down such enticements!

Conclusion

Societies are the product of ideas. Since the release of the General Theory, the Western world has been under the destructive sway of Keynesianism, which has resulted in stagnation, financial turmoil, and eventual collapse. Until Keynes and his nutty theories are rejected, the economic malaise will continue.

Reference:

* Quoted in Murray N. Rothbard, “Keynes, the Man.” In Mark Skousen, ed., Dissent on Keynes: A Critical Appraisal of Keynesian Economics. New York: Praeger Publishers, 1992, p.184

Image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: John Maynard Keynes,newslettersent,On Economy