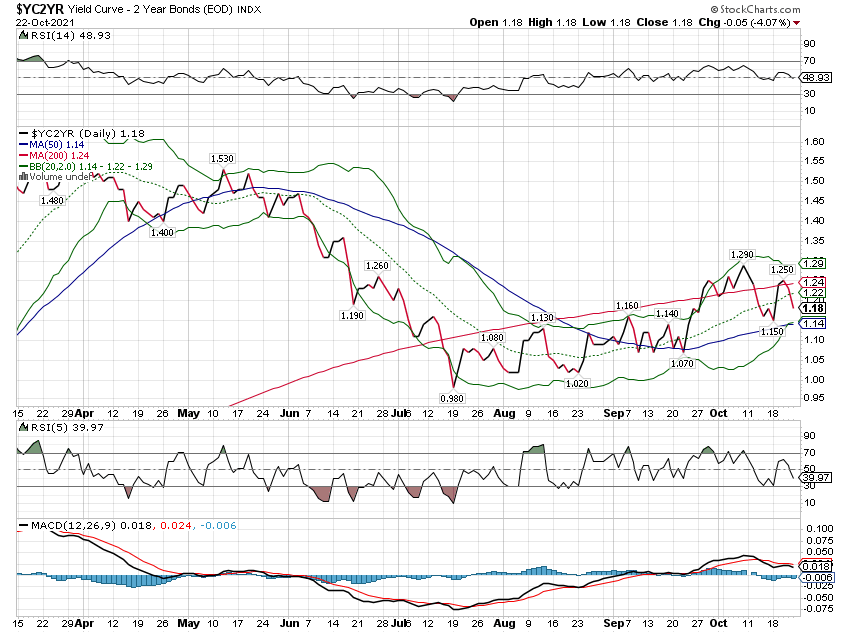

Low Rates ForeverNothing much is happening in the money world. The press reports that traders are hanging loose, wondering what dumb thing the Fed will do next. Rumor has it that it may decide to raise rates in September, or maybe November… or maybe not at all. It hardly matters. The Fed has created an unnatural, hothouse economy. Neither banks, nor business, nor investors fear a frost. None suffers drought or flood. The feds have worked so hard, for so long, to protect them from the real, outside world. Now, they can only survive in the strange world where light, water, and temperature are all controlled and they can get the Miracle-Gro of money at the lowest rates in 5,000 years. Open the doors? Turn off the water? No chance. The Fed will never, ever return to normal market-discovered interest rates – at least, not willingly. There are too many precious orchids in that hothouse. They vote. They make campaign contributions. They employ millions of workers. And they can’t survive in the outside world. Just look at the numbers. The U.S. has total credit market debt of about $64 trillion. Even at a super-easy 2%, it means that it costs $1.3 trillion a year to pay the interest. Or, about 7% of GDP. |

So far, the Fed has hiked the FF rate just once, by 25 basis points. That hardly matters though, since the Fed maintains its balance sheet at the bloated level reached after three QE operations. Banks are holding large excess reserves as a result, and the federal funds market is therefore a mere shadow of its former self. The FF rate has no practical significance anymore – the effect of rate hikes is mainly psychological, due to the feedback loop between credit markets and the Fed’s policy stance. It cannot influence the activities of banks that no longer need to borrow reserves in order to expand credit. In short, although Fed policy is relatively “tight” compared to that of other major central banks at the moment, it remains extremely loose considered on its own. |

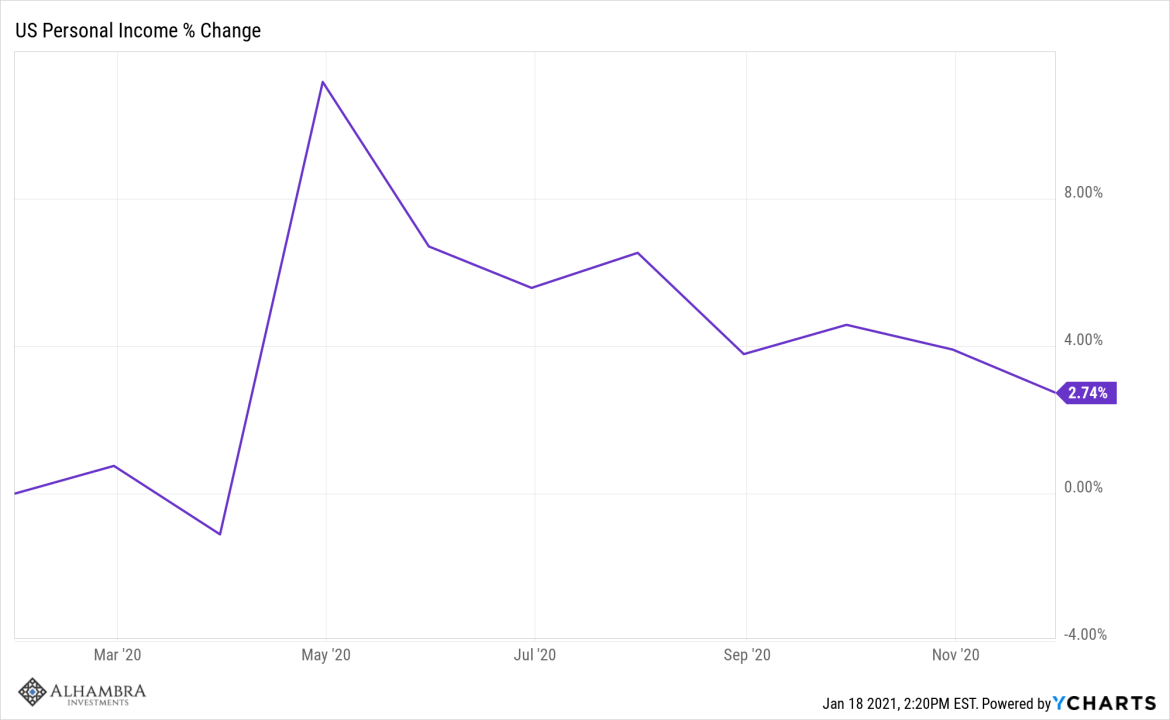

| That leaves the economy in a precarious balance – where it has just enough income to pay expenses. Growth, if you believe the figures, is less than 2%. Now, add just 1% to interest rates. What do you get?

Another $650 billion of GDP that must be devoted to interest payments, or more than 1 out of every 10 dollars’ worth. Suddenly, billions – perhaps trillions – of investments, speculations, capital improvements, households, small businesses, and major corporations would be in trouble. Many would go broke. And the whole financial system could freeze up, just like it did in 2008. Open the window in September? Maybe. But only a crack. And then shut it fast when the weather turns cold! How does this all end? We continue to wonder in Part II of our foreword to Jim Davidson’s new book, The Breaking Point: You can catch up on Part I here. |

U.S. non-financial corporate debtUS non-financial corporate debt (red line; corporate bonds and bank loans) and the Wilshire Total Market Index. The stock market bubble is highly dependent on the continued expansion of this giant debt-berg, as corporations incur a lot of debt for financial engineering purposes, chiefly stock buybacks. In spite of the often belabored large amount of cash held by companies, net debt has soared to new record highs as well; moreover, corporate cash is very unevenly distributed. The vast bulk of it is held by just a handful of large companies. Consider the time period highlighted by the blue box (you may need a magnifying glass): this tiny dip in debt was the extent of deleveraging attending the “great financial crisis”. Obviously, a real deleveraging episode would lead to an irrevocable systemic collapse. Monetary “normalization” will never happen. |

The Final Form of Human GovernmentWhen Francis Fukuyama wrote his landmark essay “The End of History?” in 1989, the battles of the 20th century seemed to be over. We had reached the “endpoint of mankind’s ideological evolution and the universalization of western liberal democracy as the final form of human government,” he wrote. With the Cold War over, modern democratic capitalism could now be perfected. U.S. companies could hustle their products to 1.5 billion more consumers, recently come out from behind the former Iron Curtain. And the U.S. wouldn’t need to spend so much on defense. That was the most obvious and immediate benefit to the U.S. – a “peace dividend.” Billions of dollars could now be liberated from the defense budget and put to better use elsewhere. Things were looking up. As China and the Soviet Union went, so went the rest of the world. Soon, everyone was trying to learn the latest buzz words from globalized business schools… setting up factories to make things for people who really couldn’t afford them… gambling on Third World debt (with a guarantee from the feds in their back pocket)… trading stocks of companies that used to belong to the government… and aiming to get their sons and daughters into Stanford so they would be first in line for a job at Goldman Sachs. |

|

Google It!Things got even better when, in the late 1990s, it looked as though the Information Age had freed us from the constraints of the Machine Age. Forget axles and drive trains. Forget oil wells. Two things held back growth rates, or so it was said at the time: ignorance and resources. You needed educated scientists and trained engineers to design and build a railroad. You also needed material inputs. Iron ore, copper, steel, and so on – and most important: energy. Education took time and money. And Stanford could only handle a few thousand students. Most people – especially those in Africa, Asia, and Oklahoma – had no easy access to the information they needed to get ahead. The Internet changed that. You want to build a nuclear reactor? Google it! You want to know how Say’s Law works? Or Boyle’s Law? Or the Law of Unintended Consequences? It’s all there. With enough imagination you can almost see an Okee in a trailer in Muskogee, studying metallurgy online. You can almost see him driving up to Koch Industries in Wichita with a plan for a new way to process Tungsten. And if you drink enough and squint hard, you can almost bring into focus a whole world of people, studying, comparing, inventing, innovating… which leads – at the speed of an electron bouncing around a hard drive – to a whole, fabulous universe of hyper-progress. |

Indeed – Google can tell you how to build a nuclear reactor. Among the top four results there are even instructions for constructing a really cheap one in the basement (which a 14-year old kid in Michigan promptly did) – click to enlarge. |

Gassy IdeasMIT has only 11,319 students. But with the Internet, millions of people all over the world now have access to more or less the same information. There are even free universities that package learning, making it easy to study and follow along. Now, there is an almost unlimited number of scientists and engineers – not to mention the shrinks, bone crackers, and social scientists ready to put on their thinking caps to make a better world. Surely, we will see an explosion of new patents, new ideas, and new inventions. As for resources, the lid had been taken off that pot, too. In the new Information Age, you shouldn’t need so much steel or so much energy. It only takes a few electrons to become a billionaire. After all, how much rolled steel did Bill Gates make? How much dirt did Larry Ellison move? The capital that really matters is intellectual capital, not physical resources. Or so they said. If you used your brain you could disrupt traditional businesses, disintermediate the middlemen, and reduce the need for energy and resources. The new economy was light, fast-moving, and infinitely enriching. There were no known limits on how fast this new economy could grow! Those were the gassy ideas in the air in the late-1990s. Investors were intoxicated. They drove up the prices of dot-com companies to dizzy levels. And then, of course, the Nasdaq crashed. |

Nasdaq Composite |

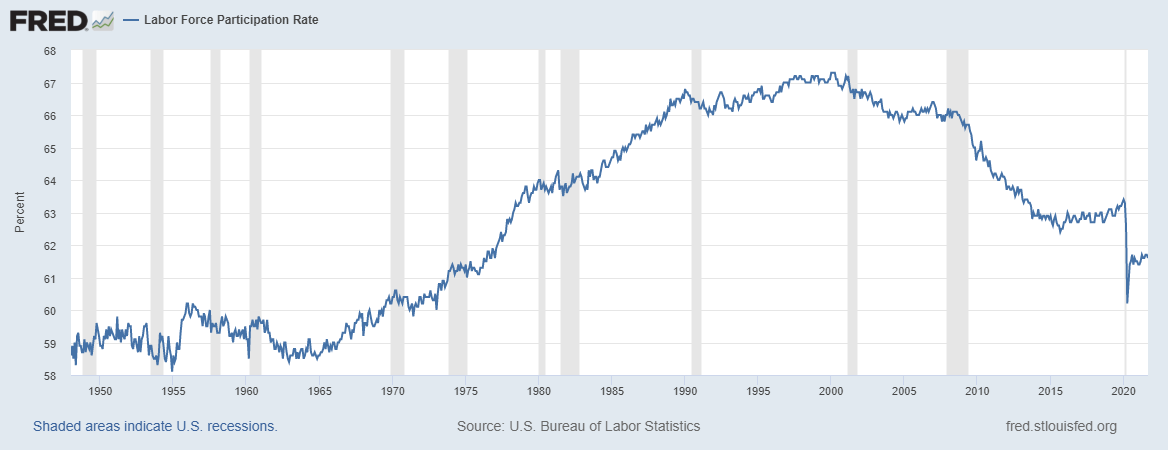

Sullen TeenagerOne by one, the illusions, scams, and conceits of the late 20th century – like pieces of bleak puzzle – came together: No “peace dividend” – the military and its crony suppliers increased their budgets. No “End of History” – that was all-too-obvious on Sept. 9, 2011. No “hyper-progress”, no “Great Moderation”, no “Goldilocks” economy – all of that came to an end Sept. 15, 2008, when Lehman Bros. declared bankruptcy. And as far as producing real, measurable wealth – the Internet, too, was a dud. By 2015, the World Wide Web had already been around for two decades. And economic growth rates were averaging only half those of a half-century before. As the new century matured into a sullen teenager, the ground was littered with scales, fallen from the eyes of millions of parents. The entire 21st century was a flop. People hadn’t gotten richer at all. Instead, they had gotten poorer. Depending on how you measured it, the typical white man had lost as much as 40% of his real earnings since the century began. People rubbed their eyes and looked harder; the picture came into sharper and more ghastly focus. Now, they saw that the promise of material progress and political freedom was a sham. In the U.S., economic growth rates fell in every decade since the 1970s. Real wage growth slowed, too… and even reversed. And so twisted had the financial system become that the least productive sector – government – was the only one with easy access to capital. Government now was more powerful, more intrusive, and more over-bearing than ever… and able to borrow at the lowest rates in history. |

A chart we have shown before: GDP growth is evidently inversely correlated with the extent of credit and money supply expansion. In other words, reality is the exact opposite of what the world’s central planners and their countless claqueurs and courtiers keep asserting. It is noteworthy that the information revolution was marked by especially poor output growth, but it seems highly likely that this was also primarily due to accelerating credit and money supply expansion (credit booms result in capital consumption; the planners seem largely unaware of this, probably because they know nothing about capital theory). |

Deeper BreakdownThere were signs of a deeper breakdown, too. Soldiers returning from the Mideast were killing themselves in record numbers. The fellow in the trailer in Muskogee was likely to be a minimum-wage meth addict watching porn on the Internet rather than studying metallurgy. Debt had reached a record high – at 355% of GDP. Real peace seemed as remote as real prosperity. And then, in June of 2016, the Republican Party chose New York real estate developer (and former Democrat) Donald Trump as their presidential nominee – the most unlikely standard bearer for a major political party in U.S. history. |

|

| For most Republicans, Mr. Trump had only one qualification of importance: He was not Hillary Clinton.

Ms. Clinton, perhaps more than any other politician, was the face of The Establishment. She had her fingerprints on every piece of the dark puzzle – the decline in wages and GDP, the rise of Wall Street and “The One Percent”, the wars, the debt… and the Deep State itself. How these things came to be, and where they lead, is the subject of much speculation. And it is the subject of James Dale Davidson’s The Breaking Point. The delight of the book is that it approaches these issues in an original and interesting way. Thomas Piketty (the rich get richer), Robert Gordon (the important innovations are already behind us), Joseph Tainter (it’s too complicated) – all have theories about why the 21st century is such a disappointment. Davidson connects the dots, too… but more dots… and more unexpected dots… than perhaps anyone. In the end, writes Davidson,

That is why Donald Trump stood confidently before the American people in the summer of 2016 promising to “make America great again.” His listeners knew something was deeply wrong. And they wanted desperately to believe that Mr. Trump could fix it. |

Charts by: St Louis Federal Reserve Research, StockCharts, Casey Research

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: Deep State,Donald Trump,Fed Funds Rate,Hillary Clinton,newslettersent,On Economy,On Politics