Criminalizing CashMoney sometimes goes “full politics”. Take poor Kenneth Rogoff at Harvard. He wants a dollar with a voter registration card, a U.S. flag on its windshield, and a handgun in its belt – the kind of money that supports the Establishment and votes for Hillary. Writing last month in the Wall Street Journal under the headline “The Sinister Side of Cash”, he noted that:

|

Kenneth Rogoff(see more posts on Kenneth Rogoff, )Etatiste tool Kenneth Rogoff, whose authoritarian jeremiads against cash currency we have first discussed and criticized in 2014 in “Meet Kenneth Rogoff, Unreconstructed Statist”. As Hans-Hermann Hoppe once noted: “Intellectuals are now typically public employees, even if they work for nominally private institutions or foundations. Almost completely protected from the vagaries of consumer demand (“tenured”), their number has dramatically increased and their compensation is on average far above their genuine market value. At the same time the quality of their intellectual output has constantly fallen. What you will discover is mostly irrelevance and incomprehensibility. Worse, insofar as today’s intellectual output is at all relevant and comprehensible, it is viciously statist.” Photo credit: Andrew Harrer / Bloomberg |

| Of course, large notes do make it easier for criminals to operate. Like cellphones. And sunglasses. And automobiles with air-conditioning. But that’s what money is supposed to do: make it easier for an economy to function. You use it as you please.

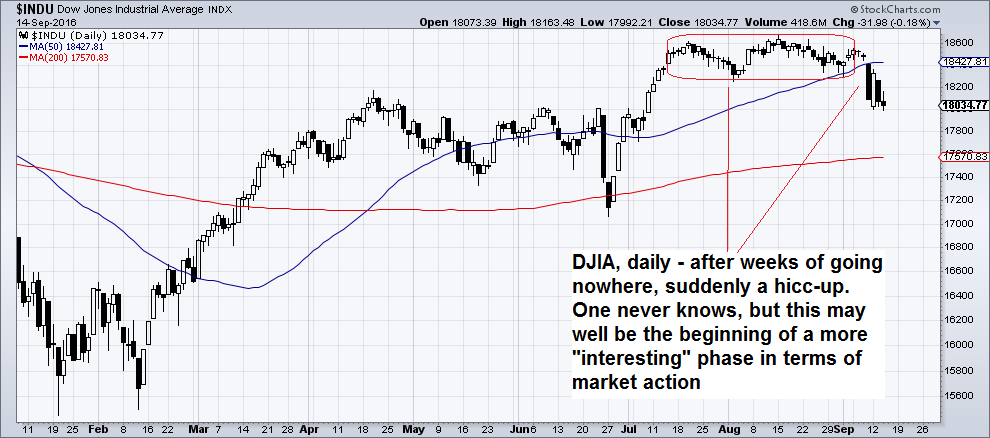

Yes, dear reader, we are back to our regular beat. Money. But what’s this? Finally, we’re beginning to see some action. You’ll recall that the markets have been eerily quiet – with less movement in stocks than we’ve seen in the last 100 years. What gives? Perhaps it was the calm before the storm. The Dow fell nearly 400 points last Friday. We don’t know. It could be the calm before the storm. Or it could be the calm before more calm. |

Dow Jones Industrial Average Index(see more posts on Dow Jones Industrial Average, ) |

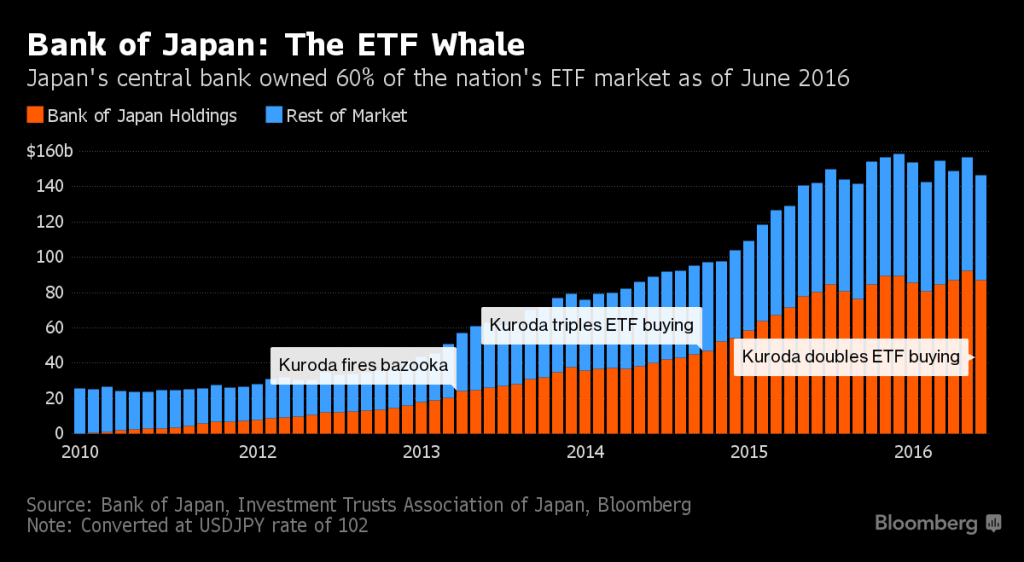

How It All EndsThere’s something fundamentally tranquilizing about having a central bank that gives out the word that it’s got your back. The Bank of Japan is buying bonds AND stocks (by way of exchange-traded funds), pushing up prices for both. Under its €1.7 trillion ($1.9 trillion) QE program, the European Central Bank bought so many government bonds, it ran out of new bonds to buy. So, this summer, it added corporate bonds to its shopping list. According to Reuters, it will soon run out of corporate bonds, too. Then it will have to follow the Bank of Japan’s lead and wade into the stock market, if it wants to keep its QE program going. And in the U.S., the Yellen Fed continues to jive and diddle, teasing investors with the threat of “normalizing” interest rates, but having neither the desire nor the fortitude to act. We’ve been wondering how it ends. Bear markets are facts of life. But if the central bank has set its face to stopping them, then what? Central banks – in the current system – can create unlimited amounts of fake money. They can use this money to buy real financial assets. Theoretically, they could buy all the world’s stocks and bonds. And theoretically, they can leave the feds with almost complete ownership of the planet’s capital. The rich get richer (selling their assets to the feds at inflated prices). The poor get poorer (as the misallocation of capital increases, price signals are distorted and real wealth is wasted). What goes wrong? Everything. As in politics, the gap between theory and practice is as wide as the Sargasso Sea. |

Bank of Japan: The ETF Whale(see more posts on Bank of Japan, )Looking at this chart of the BoJ’s ETF holdings, one may be forgiven for wondering at which point the Japanese economy becomes fully socialist. It appears to us the central bank is not fully aware of the implications of its actions (or maybe it is, which arguably would be even worse in this case). |

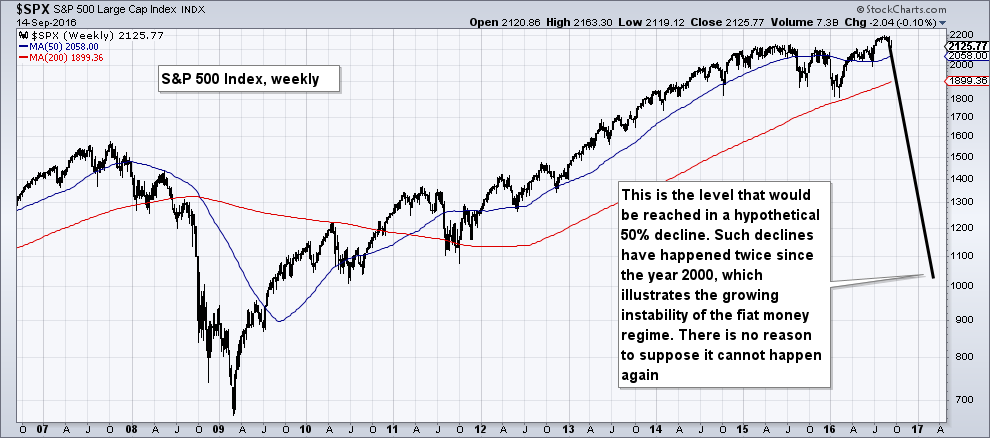

The Next CrisisEven with the largest bidder in the world on their side, investors can still panic. That would mean a big drop in asset prices, high-profile bankruptcies, and a new crisis. Things move fast. The feds may step in with more QE buying, but they may be a dollar short and a day late. A 20% drop in stock prices is equal to a loss of about $5 trillion in the U.S. alone. The bond market is roughly twice the size of the stock market, so add a 20% drop there and you’re talking real money – a total loss of $15 trillion – which could easily happen in a few days. Now, imagine a drop similar to the 2008-09 plunge. In round numbers, equities lost 50%. Today, there’s about $60 trillion worth of stocks worldwide, so that would be a $30 trillion loss. If the bond market fell in sync, you’d be looking at another $60 trillion or so, or a total loss of market capital of $90 trillion. What would the feds do? Yes, they would buy stocks and bonds. But they would buy at market prices. Owners would still take big losses. And the feds wouldn’t stop there. We are now almost eight years into the central bank’s various “stimulus” programs; they have coincided with the weakest recovery on record. After taking account of inflation, incomes for most Americans are lower today than they were in 2007. Clearly, reducing the cost of credit doesn’t work – even with yields on roughly $13 trillion worth of bonds in negative territory. |

S&P 500 Large Cap Index(see more posts on S&P 500 Large Cap Index, )A hypothetical 50% decline would target a level just above 1000 in the SPX. There is reason to assume that bond markets would not serve as a safe haven next time around – on the contrary, they are more likely to be the trigger of the next crisis. |

Fire Up the WhirlybirdsSo what’s next? When the next crisis hits, central bankers will rush back into their tool rooms and bring out something new. It will no doubt include “helicopter money.” This is the term economist Milton Friedman used to describe direct giveaways of newly minted money without any corresponding increase in the government’s budget deficit. Huge new infrastructure projects will be announced. Tax credits, tax cuts, minimum guarantee incomes – we don’t know what the feds will come up with. But watch out… With the carrot will come the sticks. The feds will impose measures to crack down on tax cheats, tighten the noose on black-market operators, and shut off funds to causes they don’t like. They’ll use their money helicopters to “drone” you. That is, they’ll make sure you do with your money as they please. Mr. Rogoff’s nutty suggestion to restrict cash could become law. |

It cannot be stressed often enough: a ban on cash currency will be a major step toward total enslavement. Many people are not aware of the significance of the debate, and to many the arguments of the statist opponents of cash may well sound superficially reasonable. Economic freedom is constantly under attack. This is probably the overarching reason for the poor performance of developed economies, which in turn provokes ever more restrictions, regulations and interventions. We shudder to think of the madness that awaits when the latest central bank policy-induced bubble bursts. Image via 24hgold.com |

Charts by: StockCharts, Bloomberg

Chart and image captions by PT

The above article originally appeared as “This Is How the Feds Will Ban Cash” at the Diary of a Rogue Economist, written for Bonner & Partners.

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of Japan,central banks,Dow Jones Industrial Average,Kenneth Rogoff,newslettersent,On Economy,On Politics,S&P 500 Large Cap Index