Tag Archive: newslettersent

FX Daily, September 12: Dollar Sports Heavier Tone as Yesterday’s Bounce Runs out of Steam

The sporadic updates continue while I am on a two-week business trip. Now in Barcelona, participating in TradeTech FX Europe. The euro advanced yesterday from NOK9.30 to NOK9.40. It is consolidating in a tight range today. The election results may have been a bit closer than expected, but the weight on the krone yesterday seemed to stem more from the unexpectedly soft inflation report.

Read More »

Read More »

Red Cross launches new bond to tap private money

The Swiss-run International Committee of the Red Cross (ICRC) has launched the world’s first ‘Humanitarian Impact Bond’, which encourages private sector investment in humanitarian programmes. The innovative “payment-by-results” model centres on a five-year private placement programme entitled the ‘Programme for Humanitarian Impact Investments’, or PHII, which will be executed with the support of the Swiss government and Swiss bank Lombard...

Read More »

Read More »

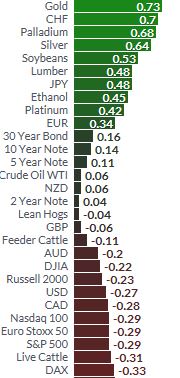

Safe Haven Gold Rises To $1338 as U.S. Warns of ‘Massive’ Military Response

Safe haven gold extends rally to 11-month high after North Korea nuke test and U.S. warns of ‘massive’ response. Asian and European stocks fall, bonds flat, gold, silver, palladium, Swiss franc rise as Korea tensions flare as North Korea tests ‘hydrogen bomb’. North Korea prepares for possible ICBM launch says S. Korea. U.S. warns of ‘massive,’ ‘overwhelming’ military response to North Korea after meeting with Trump. Trump weighing new economic...

Read More »

Read More »

The Government Debt Paradox: Pick Your Poison

“Rule one: Never allow a crisis to go to waste,” said President Obama’s Chief of Staff Rahm Emanuel in November of 2008. “They are opportunities to do big things.” At the time of his remark, Emanuel was eager to exploit the 2008 financial crisis to raid the public treasury. With the passage of the American Recovery and Reinvestment Act in February 2009, Emanuel’s wish was granted.

Read More »

Read More »

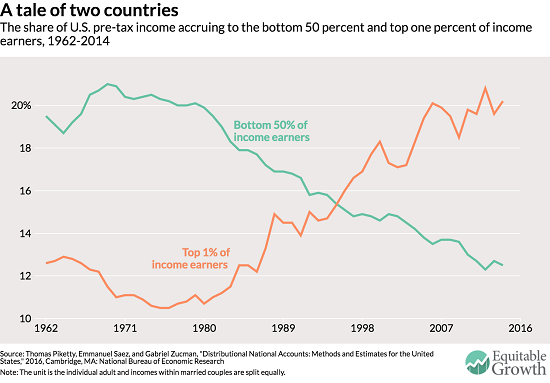

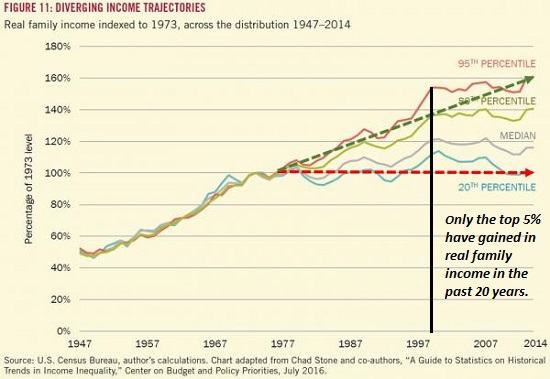

The Insanity of Pushing Inflation Higher When Wages Can’t Rise

In an economy in which wages for 95% of households are stagnant for structural reasons, pushing inflation higher is destabilizing. The official policy goal of the Federal Reserve and other central banks is to generate 3% inflation annually. Put another way: the central banks want to lower the purchasing power of their currencies by 33% every decade. In other words, those with fixed incomes that don't keep pace with inflation will have lost a third...

Read More »

Read More »

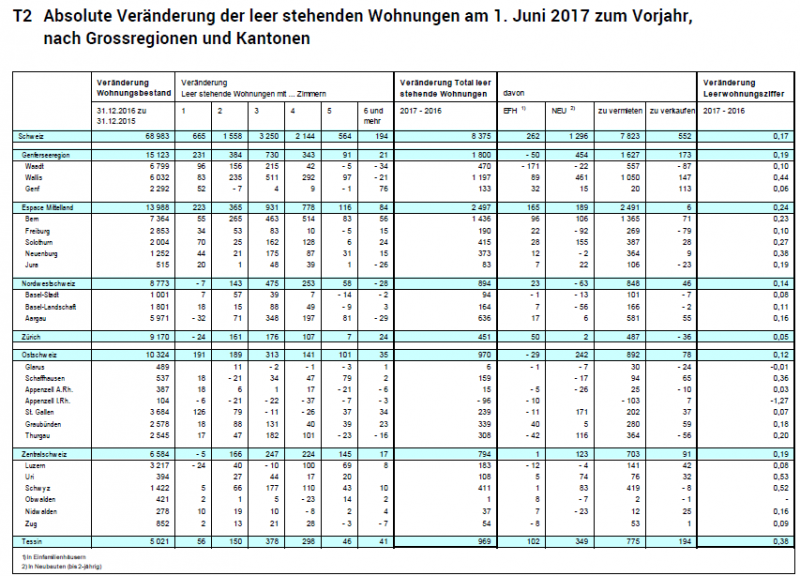

Swiss Real Estate: The Empty Dwellings Rate Continues to Increase

On 1 June 2017, there were 64'893 empty dwellings in Switzerland, i.e. 1.47% of the entire country's dwelling stock (including single-family houses). This figure represents an increase of 8375 empty dwellings compared with the previous year, i.e. a rise of almost 15%.

Read More »

Read More »

FX Weekly Preview: Forces of Movement in FX: The Week Ahead

The dollar has been declining since the start of the year, but the causes have changed. The drag from US politics may be exaggerated, while European and Japanese politics are worrisome. The economic data may continue to be a drag on US yields, especially if core CPI slips again.

Read More »

Read More »

“Things Have Been Going Up For Too Long” – Goldman CEO

“Things have been going up for too long…” – Goldman Sachs’ CEO. Lloyd Blankfein, Goldman CEO “unnerved by market” (see video). Bitcoin bubble is no outlier says Bank of America Merrill Lynch. Bubbles are everywhere including London property. $14 trillion of monetary stimulus has pushed investors to take more risks. We are now in a new era of bigger booms and bigger busts – BAML. “Seeing signs of bubbles in more and more parts of the capital market”...

Read More »

Read More »

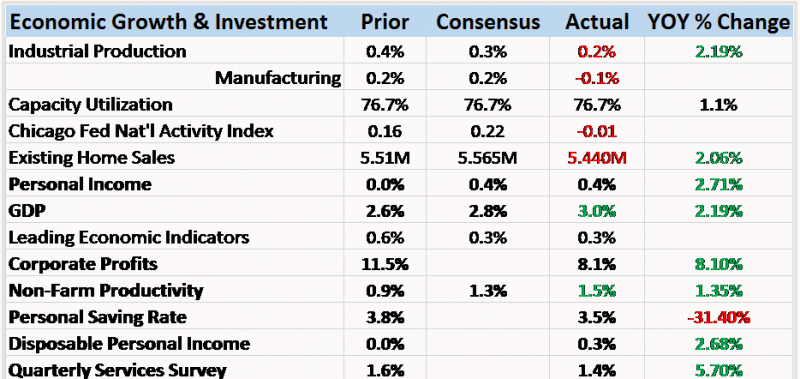

Bi-Weekly Economic Review: Waiting For Irma

This update will be a bit shorter than usual. I’m in Miami awaiting Hurricane Irma. As of now, it looks like the eye of the storm will make landfall near Key West and continue west of us with the Naples/Ft. Myers area at risk. Or at least that’s the way it looks right now. I’ve done a lot of these storms though – I lost a house in Andrew in ’92 – and you never know what these things will do. We are secure in a house that survived Andrew with barely...

Read More »

Read More »

Chiasso accepts tax payments in bitcoin

Switzerland ramped up its bid to become a global hub for financial technology (fintech) and cryptocurrency start-ups with the decision by a town on the Italian border to accept tax payments in bitcoin. Chiasso announced that it would take bitcoin to settle up to CHF250 ($265) of tax bills from the start of next year.

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

EM FX ended the week on a mixed note, but still capped off a strong week overall. US data this week could challenge the market’s dovish take on the Fed. For now, though, the global liquidity outlook still seems to favor further gains in EM.

Read More »

Read More »

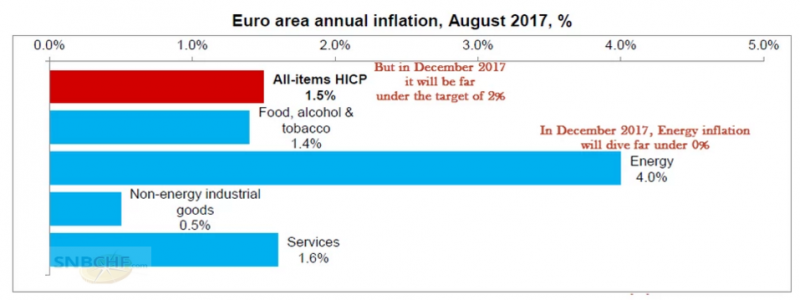

FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach.

Read More »

Read More »

Hard times continue for Swiss private banks

Over half of private banks in Switzerland analysed by KPMG last year experienced net outflows of client cash. In a difficult period for finance, many could be forced to shut down or be bought out. “Implement truly radical change, or continue to see performance deteriorate.” This was the message of a study released Thursday by audit group KPMG with the University of St. Gallen, evaluating the performance of 85 Swiss private banks.

Read More »

Read More »

Government plans to tackle high roaming charges

Switzerland is one of the most connected countries on the planet, but mobile and internet users in still grumble about lack of choice, unwelcome cold-calling from companies, and high roaming charges when travelling abroad.

Read More »

Read More »

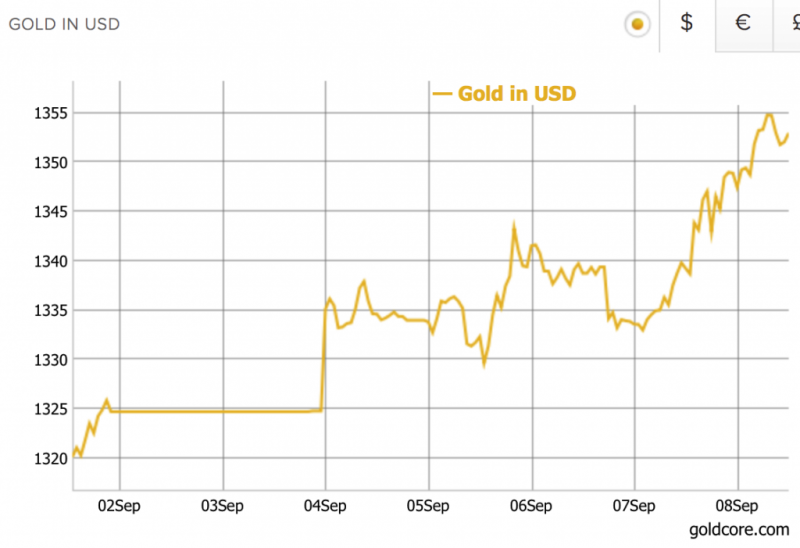

Gold Has 2 percent Weekly Gain, 18 percent Higher YTD – Trump’s Debt Ceiling Deal Hurts Dollar

Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy. Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower. Euro Stoxx flat for week – S&P 500, Nikkei down 0.65% and 2.2%. Geo-political concerns including North Korea, falling USD push gold 2.1% in week. Gold prices reach $1,355 this morning following Mexico earthquake. Safe haven demand sees gold over one year high, highest since August 2016.

Read More »

Read More »

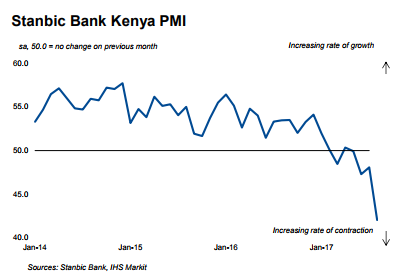

Global PMI Roundup; August 2017

The first few days of any calendar month are now flooded with PMI data. Mostly due to Markit’s ongoing and increasing partnerships, we now have access to economic or business sentiment from and for almost anywhere in the world. It isn’t clear, however, if that is a good or useful development. For example, we can see quite plainly that there is a whole bunch of trouble brewing in Kenya. The Stanbic Bank/Markit Kenya PMI fell to a record low 42.0 in...

Read More »

Read More »

Why We’re Doomed: Stagnant Wages

The point is the present system cannot endure. Despite all the happy talk about "recovery" and higher growth, wages have gone nowhere since 2000--and for the bottom 20% of workers, they've gone nowhere since the 1970s. Gross domestic product (GDP) has risen smartly since 2000, but the share of GDP going to wages and salaries has plummeted: this is simply an extension of a 47-year downtrend.

Read More »

Read More »

Emerging Markets: What has Changed

South Korea completed installation of the THAAD missile shield. Indonesia is considering issuing its first global IDR-denominated sovereign bonds. Taiwan is undergoing a cabinet shuffle. Brazil has seen some positive political developments.

Brazil’s central bank signaled that the easing cycle is nearing an end and that the pace of easing will slow. Chile’s central bank boosted its growth forecasts.

Read More »

Read More »

Le retour de l’or sur la scène monétaire mondiale?

Mars 2009, le gouverneur de la Banque populaire de Chine M Zhou Xiaochuan revint dans le cadre d’une conférence intitulée Reform the international Monetary System sur la vision de Keynes au sujet du bancor.Pour lui, le système centré sur le dollar américain et les taux de changes flottants, plus ou moins librement, devrait être repensé.

Read More »

Read More »

The number of Swiss brewers continues to rise despite declining beer consumption

A recent report shows a 2% drop in average Swiss beer consumption in 2016. Over the last 20 years it has dropped 4% to 54.9 litres per person. On its own this would be no cause for alarm, however in 2016, the number of breweries in Switzerland rose by 21% to 753. Since 2011, the number is up 118% from 345. The website bov.ch lists 794 breweries in Switzerland so it is possible that the number has grown further since government statistics were...

Read More »

Read More »