Tag Archive: newslettersent

Central Bank Investment Strategies

A survey of central banks and sovereign wealth funds by Invesco sheds light on their investment plans. The traditional separation of markets and the state may be helpful for ideological arguments, but the real situation is more complicated. Central banks and their investment vehicles (sovereign wealth funds) are market participants. In some activities, such as custodian, central banks compete with the private sector.

Read More »

Read More »

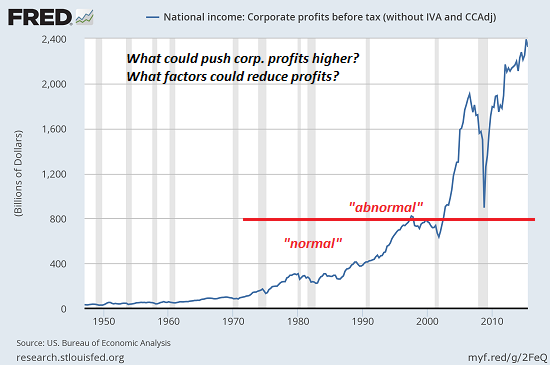

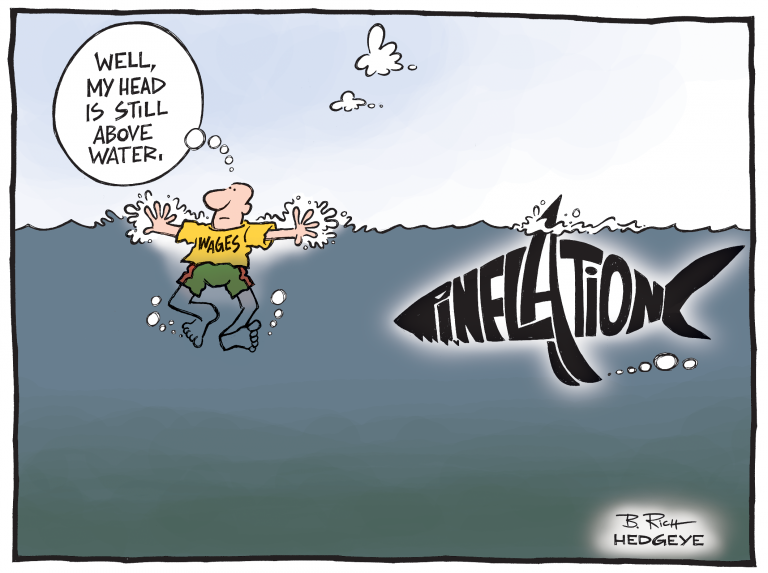

We Are All Hostages of Corporate Profits

We're in the endgame of financialization and globalization, and it won't be pretty for all the hostages of corporate profits. Though you won't read about it in the mainstream corporate media, the nation is now hostage to outsized corporate profits. The economy and society at large are now totally dependent on soaring corporate profits and the speculative bubbles they fuel, and this renders us all hostages: Make a move to limit corporate profits or...

Read More »

Read More »

The Great Reset, Report 8 July 2018

Before it collapsed, the city of Rome had a population greater than 1,000,000 people. That was an extraordinary accomplishment in the ancient world, made possible by many innovative technologies and the organization of the greatest civilization that the world had ever seen. Such an incredible urban population depended on capital accumulated over centuries. But the Roman Empire squandered this capital, until it was no longer sufficient to sustain...

Read More »

Read More »

FX Daily, July 09: Possibility of a Soft Brexit Excites Sterling (too Early?)

After a little wobble, sterling has responded favorably to the resignation of the UK Brexit team led by David Davis. The idea is that a path to a softer Brexit is good for sterling. In fairness, it is a bit early to reach this conclusion, and the softer dollar tone puts wind in sterling's sale. There is a GBP244 mln sterling option at $1.3375 that expires today. The June highs were set in the $1.3450-$1.3470 area.

Read More »

Read More »

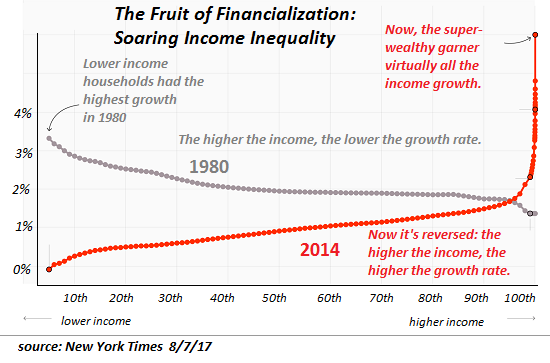

FX Weekly Preview: Macro Considerations for the Capital Markets

The triumphalism that followed the fall of the Berlin Wall nearly three decades ago has evaporated. The Great Financial Crisis and inexorable widening of income and wealth inequalities within countries undermined claims of moral and economic superiority. Liberal democracies are fighting a rearguard action and the rise of illiberal regimes.

Read More »

Read More »

Germany alleged to have spied on Swiss firms in Austria

A dozen branches of Swiss firms in Austria were targeted by German spies between 1999 and 2006, according to the SonntagsBlick newspaper which has seen documents belonging to Germany’s federal intelligence service BND. Part of the data was allegedly handed to the United States. The Sunday newspaper said the Swiss firms targeted by German spies in Austria included the pharmaceutical company Sandoz, which belongs to the Novartis Group, the logistics...

Read More »

Read More »

The USA Is Now a 3rd World Nation

I know it hurts, but the reality is painfully obvious: the USA is now a 3rd World nation. Dividing the Earth's nations into 1st, 2nd and 3rd world has fallen out of favor;apparently it offended sensibilities. It has been replaced by the politically correct developed and developing nations, a terminology which suggests all developing nations are on the pathway to developed-nation status.

Read More »

Read More »

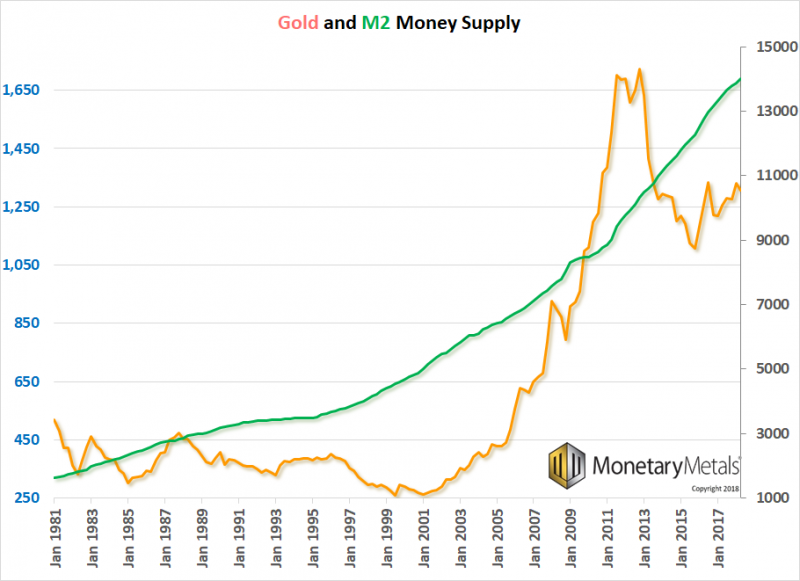

Gold $10,000 In Currency Reset as Russia, China Gold Demand To Overwhelm Futures Manipulation (GOLDCORE VIDEO)

Is the currency reset or global monetary reset (GMR) upon us? Russia dumped half their US Treasuries in April ($47.4 billion out of the $96.1 billion it had held) and bought 600k ozs of gold worth less than $800 million in May. Has the IMF “pegged” gold to SDRs at 900 SDR per ounce? China stops buying US Treasuries and quietly accumulates gold.

Read More »

Read More »

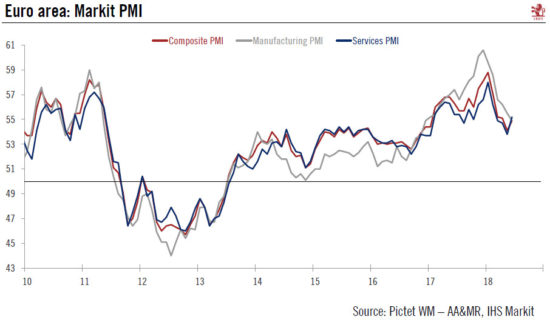

Euro area: a slight rebound

The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany.

Read More »

Read More »

TV Recording could be under threat in Switzerland

With TV recording there’s no need to miss programmes just because they’re on at the wrong time. And, when it’s time to watch them, it’s easy to fast forward through the adverts, something that can’t be done when watching live. In Switzerland, television recording is offered by big distributers, such as Swisscom, Sunrise and UPC. Broadcasters don’t provide it.

Read More »

Read More »

Credit Suisse: “Our Risk Appetite Index Is Near Panic”

Sure, it's been a bad year for investors, with the S&P posting the smallest of gains in the first half (all of which thanks to tech stocks) after several hair-raising, monthly incidents including February's vol-spike, April's real yield scare, May's Emerging Market massacre and June's trade war fears as shown in the following Citi chart...

Read More »

Read More »

‘Hidden’ transport costs on the rise

A government study has found that the so-called ‘external costs’ of various modes of transport collectively increased by almost CHF1 billion during the period 2010-2015. For walkers and cyclists, however, benefits outweigh the costs.

Read More »

Read More »

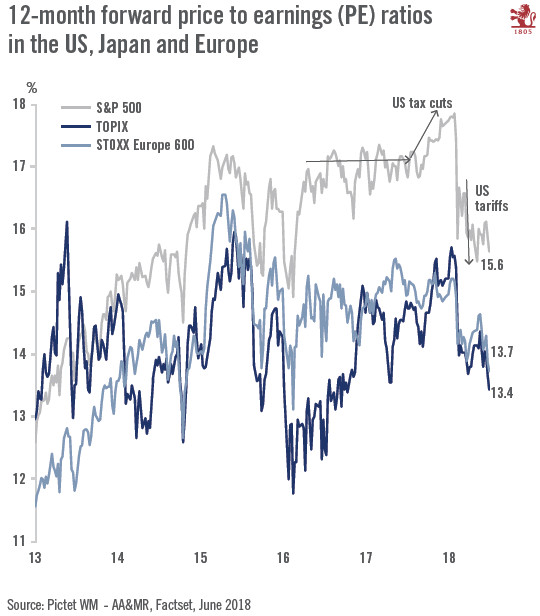

House View, July 2018

On a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer.

Read More »

Read More »

Federal Council appoints Martin Schlegel as new Alternate Member of the SNB Governing Board

At its meeting of 4 July 2018, the Federal Council appointed Martin Schlegel as the new Alternate Member of the Governing Board of the Swiss National Bank (SNB), following the proposal of the SNB’s Bank Council. He will take up the position of Deputy Head of Department I as of 1 September.

Read More »

Read More »

Thousands of Swiss firms are unregistered

About 13,000 companies are not listed in the commercial register – a serious problem, notes the Swiss Federal Audit Office. Increased cooperation with the tax authorities could be a solution. On Wednesday the office published an evaluation of how Switzerland has been combating corruption over the past decade – since it’s been following a recommendation of the Council of Europe Group of States against Corruption (GRECO).

Read More »

Read More »

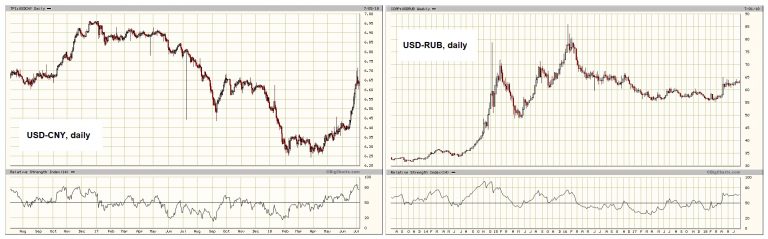

FX Daily, July 06: Dollar Slips After Tariffs and Before Jobs Data

The first set of US tariffs aims specifically at China were implemented, and the retaliatory actions were also launched. The tariffs cover hundreds of goods, though the initial amount of trade covered is relatively small at $34 bln. Tariffs on another $16 bln are in the pipeline and could be put into effect in a few weeks. The US is threatening to ramp up its response by imposing a tariff on another $200 bln of Chinese goods, though the details...

Read More »

Read More »

Let there be Bitcoin! And it was Bitcoin!

Bitcoin’s origin can be traced back to September 15, 2008. This is the day the investment bank Lehman Brothers announced its bankruptcy and the financial crisis reached its peak. With the bankruptcy of Lehman Brothers a ripple effect set in, several other banks had to be saved by their patrons, the states. These bail-outs wreaked havoc on the debt of many countries, which is why central banks initiated their massive government bond purchase...

Read More »

Read More »

The Gathering Storm

July 4th is an appropriate day to borrow Winston Churchill's the gathering storm to describe the existential crisis that will envelope America within the next decade. There is no single cause of the gathering storm; in complex systems, dynamics feed back into one another, and the sum of destabilizing disorder is greater than a simple sum of its parts.

Read More »

Read More »