Tag Archive: newslettersent

Mythbusting: Why Bitcoin Can Never Go To Zero

Bitcoin’s polarizing effect has people on both ends of the scale either proclaiming it is going to the moon or it is going to zero. The volatile, unprecedented, and revolutionary monetary system that is cryptocurrency has a future that not many can accurately predict, but as time has gone on, the idea that Bitcoin is going to zero seems more and more far fetched.

Read More »

Read More »

FX Daily, July 05: Dollar is Mixed on Eve of US Jobs and Tariffs

The US dollar is softer against most of the major currencies and mixed against the emerging market currencies. European currencies firmer, with the continued recovery of the Swedish krona on the back of a more hawkish central bank, and the euro poking through $1.17 for the first time in over a week with the help of strong factory orders report from Germany. Central and East European currencies are leading among emerging markets. Asian equities...

Read More »

Read More »

Ueli Maurer hat recht: Der Erste, der einsieht, dass die SNB sich hoffnungslos verrannt hat

„An der Grenze des Erträglichen“ – so beurteilt Bundesrat und Finanzminister Ueli Maurer die Bilanz der Schweizerischen Nationalbank (SNB). Als ehemaliger Präsident des Zürcher Bauernverbandes ist Maurer zu einer Milchbüchlein-Rechnung fähig. Als Inhaber des eidgenössischen Buchhalter-Diplomes kann er auch eine Bilanz beurteilen.

Read More »

Read More »

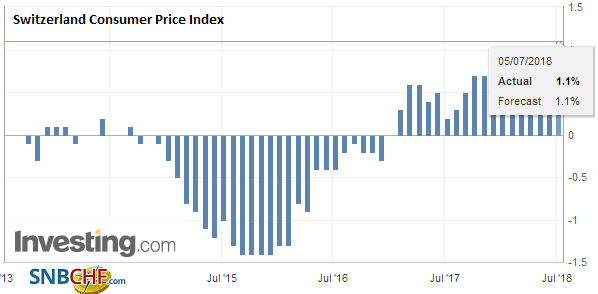

Swiss Consumer Price Index in June 2018: +1.1 percent YoY, Stable MoM

The consumer price index (CPI) remained stable in June 2018 compared with the previous month, reaching 102.1 points (December 2015=100). Inflation was 1.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

Swiss VAT might rise to fund lower company tax rates

Historically, Switzerland has offered certain foreign companies special preferential tax deals in order to attract them. In response to international pressure, the current system is to be phased out replacing preferential tax rates with lower universal ones in the hope that these companies will stay.

Read More »

Read More »

How To Create Your Own Personal Gold Standard And Currency Reserve

Did you know that for 99.2% of recorded human history, money was backed by a gold standard? And only for the last 47 years has the world largely moved away from the gold standard. It is easy to feel like we are on top of the world in 2018. Technology has never been better or more easily accessible. The standard of living is rapidly rising.

Read More »

Read More »

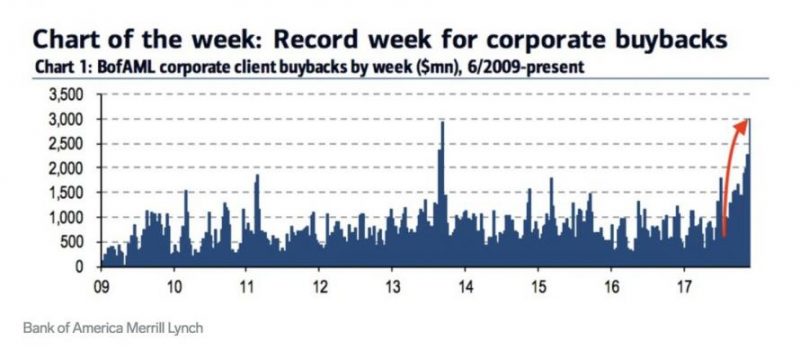

“Stock Markets Look Ever More Like Ponzi Schemes”

The FT has reported this morning that: Debt at UK listed companies has soared to hit a record high of £390bn as companies have scrambled to maintain dividend payouts in response to shareholder demand despite weak profitability. They added: UK plc’s net debt has surpassed pre-crisis levels to reach £390.7bn in the 2017-18 financial year, according to analysis from Link Asset Services, which assessed balance sheet data from 440 UK listed...

Read More »

Read More »

US Vs China – Is It ‘Art Of The Deal’ Or Economic Warfare?

While monetary tightening remains the main risk for global stock markets, the threat of a trade war continues to dominate the headlines...

Read More »

Read More »

Mining giant Glencore faces US corruption probe

Swiss commodities mining and trading giant Glencore has been subpoenaed by the United States Department of Justice (DoJ) in relation to its activities in Nigeria, the Democratic Republic of Congo (DRC) and Venezuela.

Read More »

Read More »

FX Daily, July 03: Markets Trying to Stabilize

The global capital markets are trying to stabilize. US equities recovered from early losses yesterday but this was not enough to stop Asian equities from extending recent losses. The MSCI Asia Pacific Index slipped 0.2% for the sixth decline in the past seven sessions, However, several local markets, including China, Australia, and Korea advanced.

Read More »

Read More »

Swiss intercity trains in for a makeover

The Swiss Federal Railways is revamping its intercity IC2000 fleet at a cost of approximately CHF300 million ($302 million). The first completely renovated trains will be put back into operation in early 2019. The 341 wagons should be fit for another 20 years on the rails after their makeover.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended Friday mixed, capping off a mostly softer week. TRY, MXN, and RUB were the top performers and the only ones up against USD, while ARS, CLP, and BRL were the worst. Looking ahead, US jobs data on Friday pose some risks to EM, coming on the heels of a higher than expected 2% y/y rise in PCE. China will also remain on the market’s radar screen, with the first snapshots of June economic activity just starting to emerge. We remain...

Read More »

Read More »

FX Daily, July 02: Third Quarter Begins With a Thump

The window dressing ahead of the end of Q2 failed to signal a turn in sentiment. Equity markets have taken back those gains and more. The US dollar is broadly firmer, though it was coming off its best levels near midday in Europe, and the three-basis-point slippage puts the US 10-year yield at 2.83%, its lowest in more than a month.

Read More »

Read More »

Swiss Retail Sales, May: +0.2 percent Nominal and -1.2 percent Real

Turnover in the retail sector rose by 0.2% in nominal terms in May 2018 compared with the previous year. Seasonally adjusted, nominal turnover fell by 1.2% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Swiss public broadcaster to phase out 250 jobs

The Swiss Broadcasting Corporation (SBC), swissinfo’s parent company, announced on Thursday a series of belt-tightening measures, including the elimination of 250 full-time positions over the next four years. The SBC is initiating a four-year savings and redeployment programme aimed at saving CHF100 million ($100 million), which will be re-invested across its various business and language units.

Read More »

Read More »

FX Weekly Preview: Trade and Data Driving Markets

US President Trump is intent on disrupting the post-WWII arrangement that prioritized and ideological conflict over economic rivalries. Last week, it was reported that Trump told his counterparts at the G7 summit that NATO was as bad as NAFTA. NATO's annual meeting is July 12.

Read More »

Read More »

Emerging Markets: What Changed

PBOC fixed USD/CNY at the highest level since December 14. Bank Indonesia delivered a larger than expected 50 bp to 5.25%. Bulgarian Prime Minister Boyko Borissov survived a second no-confidence vote this year. Turkish President Recep Tayyip Erdogan was re-elected but with sweeping new powers. Saudi Arabia, Kuwait, and UAE are reportedly in talks to help stabilize Bahrain.

Read More »

Read More »

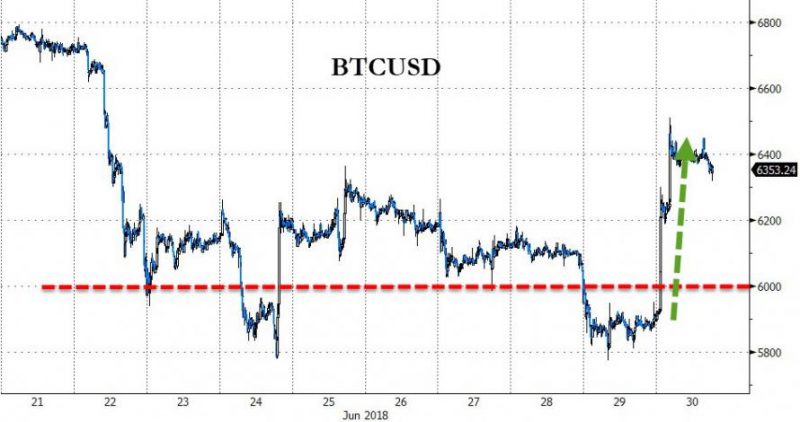

Bitcoin Soars Most In 3 Months, Back Above $6,000

After crossing below $6,000 for the 4th time in a week yesterday, Bitcoin surged overnight - jumping by as much as 10% at one point, the most in 3 months. The 10% surge is a notable outlier after weeks of constant downward pressure, but we note it's already fading modestly along with the rest of cryptos.

Read More »

Read More »