Tag Archive: newslettersent

Switzerland’s “harmful tax regime” gets it on EU grey list

This week EU Finance ministers came out with a list of countries it thinks don’t measure up to its definition of good tax behaviour. There are two categories: blacklist and so-called “grey list”. Black is bad and grey is heading toward good, but not yet there. Switzerland is on the “grey list”.

Read More »

Read More »

The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of International Settlements, the...

Read More »

Read More »

Emerging Markets: What Changed

China eased curbs on coal use for heating in the northern provinces to cope with colder weather. Poland announced a cabinet shuffle. Poland’s lower house approved the controversial judicial reform bill. President Trump announced that the US recognizes Jerusalem as Israel’s capital. Brazil COPOM was more dovish than expected after cutting rates 50 bp to 7.0%. Chile central bank cut its 2017 and 2018 inflation forecasts and shifted to a more dovish...

Read More »

Read More »

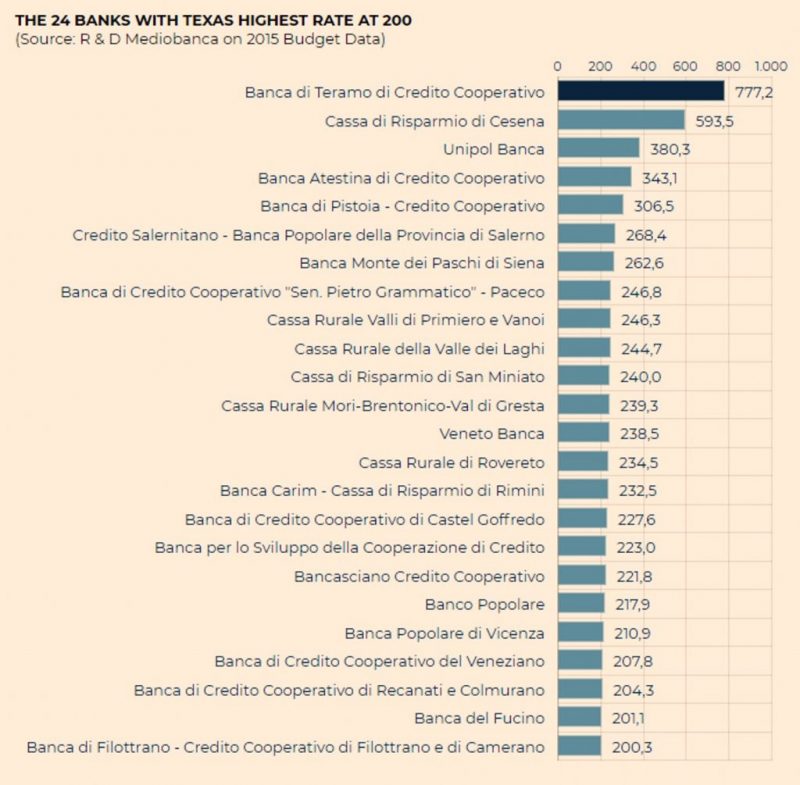

Bailins Coming In EU – 114 Italian Banks Have Non Performing Loans Exceeding Tangible Assets

Bailins Coming In EU – 114 Italian Banks Have NP Loans Exceeding Tangible Assets. Italy opposes ECB proposal that holds banks to firm deadlines for writing down bad loans. Italy’s banks weighed down under €318bn of bad loans. New ECB rules could ‘derail’ any recovery in Italy’s financial system. Draft proposal requires banks to provision fully for loans that turn sour from 2018. ECB insists banks have better access to collateral on delinquent debt...

Read More »

Read More »

The Party of Spend More vs. the Party of Tax Less

The Senate just passed a 500-page tax reform bill. Assuming it lives up to its promise, it will cut taxes on corporations and individuals. Predictably, the Left hates it and the Right loves it. I am writing to argue why the Right should hate it (no, not for the reason the Left does, a desire to get the rich).

Read More »

Read More »

Comment les cédules hypothécaires suisses alimentent le marché européen des produits dérivés

Beaucoup d’emprunteurs ne se rendent pas compte qu’en concluant le contrat, ils acceptent que leur hypothèque soit transmise à des tiers. […] Les clauses de transmission de l’hypothèque à des tiers sont pratique courante, comme il ressort de nos prises de renseignement auprès [d’UBS,] Credit Suisse, Banque cantonale de Zurich et Raiffeisen.

Read More »

Read More »

FX Daily, December 08: Brexit Talks Move to Stage II, While Greenback Remains Firm

Sufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week's EU summit. To be sure, "sufficient progress," which the diplomatic-speak that does not mean that any agreement has really been reached, but rather that the UK has made a few concessionary signals.

Read More »

Read More »

L’Union européenne fait semblant de lutter contre l’évasion fiscale. Attac

Les paradis fiscaux lovés au coeur de l’UE, de l’Asie et des Etats-Unis d’Amérique sont occultés… L’analyse vire à la farce! Après avoir étudié la situation de 92 pays en matière de lutte contre l’évasion fiscale, l’Union européenne n’en retient donc que 17 sur sa liste noire des paradis fiscaux. Parmi ces États dits « non-coopératifs » on trouve, entre autres, le Panama, la Tunisie, les Emirats arabes unis, Trinité et...

Read More »

Read More »

Airbnb charges some customers more than others, particularly the Swiss

Many Swiss residents travel to neighbouring eurozone countries for their holidays. These countries are close and Swiss francs go far there. However, to get the most out of a strong currency you need a good exchange rate. If a Swiss resident presenting euro cash at a checkout in Germany or France was told they couldn’t pay in euros because they live in Switzerland – “I’m sorry sir but you live in Switzerland, you must pay in Swiss francs at our...

Read More »

Read More »

“Gnomes Of Zurich” In Panic As Saudi Corruption Crackdown Sparks Flood Of Money Laundering Inquiries

There are two divergent views on the crackdown on corruption by Saudi Arabia’s crown prince, Mohammed bin Salman (MBS), which led to the arrest and detention of 200 princes, ministers and former ministers. On one hand, it was a masterstroke which will earn political capital with the Saudi people and catalyse an Arab Spring in which MBS is a modernizing reformer who will liberalise Islam.

Read More »

Read More »

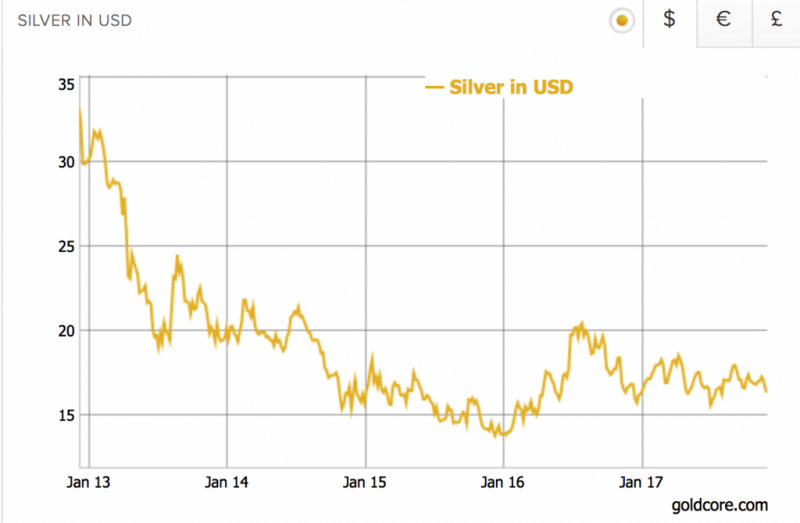

Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries

Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries. Increased efforts in green energy and advanced technology set to boosts silver’s demand. Four-year supply deficit set to increase due to fewer mine openings and discoveries. Bank manipulation may be why silver under performing. TD Securities and the Bank of Montreal expect silver to be best performing precious metal in 2018.

Read More »

Read More »

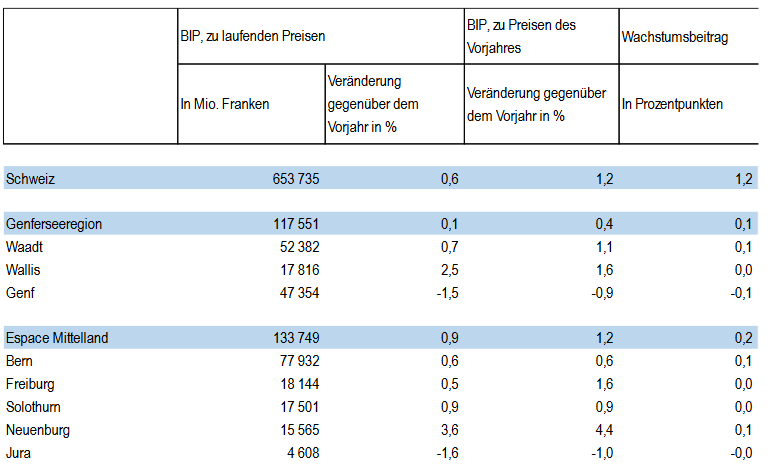

Gross domestic product by canton in 2015: Economic activity slowed down in Switzerland in 2015

Gross domestic product (GDP) growth slowed between 2014 and 2015 in most cantons. Nevertheless, the cantons of Neuchâtel (+ 4.4%), Schaffhausen (+ 2.9%), Schwyz (+ 2.9%) and Zug (+ 2.8%) recorded a clearly positive development. The canton of Zurich once again made the biggest contribution to the nationwide growth.

Read More »

Read More »

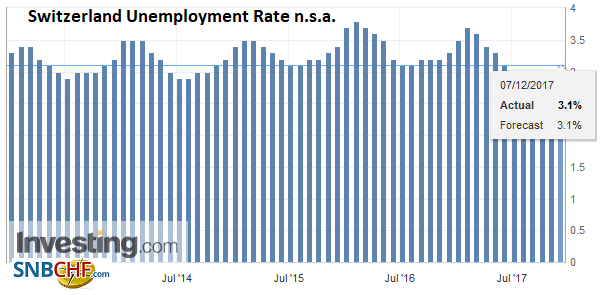

Switzerland Unemployment in November 2017: Up to 3.1 percent from 3.0 percent, seasonally adjusted decreased to 3.0 percent from 3.1 percent

Registered unemployment in November 2017 - According to the State Secretariat for Economic Affairs (SECO) surveys, at the end of November 2017 there were 137'317 unemployed registered at the Regional Employment Centers (RAV), 2'517 more than in the previous month. The unemployment rate rose from 3.0% in October 2017 to 3.1% in the month under review. Compared with the same month of the previous year, unemployment fell by 11,911 persons (-8.0%).

Read More »

Read More »

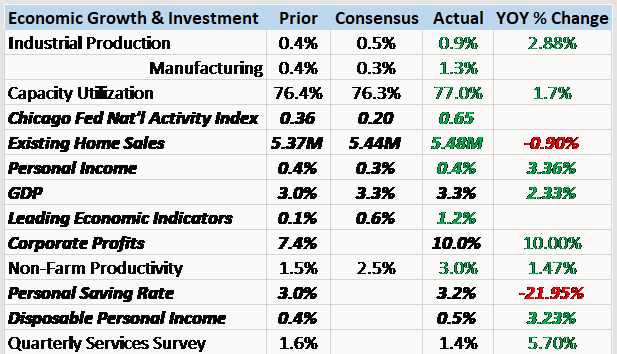

Bi-Weekly Economic Review: Who You Gonna Believe?

We’ve had a pretty good run of data recently and with the tax bill passing the Senate one would expect to see markets react positively, to reflect renewed optimism about economic growth. We have improving economic data on pretty much a global basis. It isn’t a boom by any stretch of the imagination but there is no doubt that the rate of change has recently been more positive.

Read More »

Read More »

FX Daily, December 07: Equities and Oil Stabilize

Global equities are stabilizing today after the recent downside pressure. The MSCI Asia Pacific Index snapped an eight-day slump with a 0.4% gain, led by a rebound in Tokyo and India. European markets are firm, with the Dow Jones Stoxx 600 up around 0.25% near midday in London. All sectors are higher but telecom and real estate are performing best, while energy and health care are laggards.

Read More »

Read More »

Great Graphic: Euro Pushes below November Uptrend

Euro is lower for the third day, the longest downdraft in a month and a half. It violated the November uptrend. It is testing the $1.1800 area, which houses a few technical levels (retracement, moving average and congestion).

Read More »

Read More »

An Interview with GoldCore Founder, Mark O’Byrne

“Uber-bull predictions of gold at over $5,000 per ounce are not beyond the realms of possibility…” So says GoldCore founder and self-confessed gold bug, Mark O’Byrne. Indeed, I recently caught up with Mark to get his thoughts on gold and what’s going on with it right now… But before we got to the nitty-gritty, I started by asking him a little about his background.

Read More »

Read More »

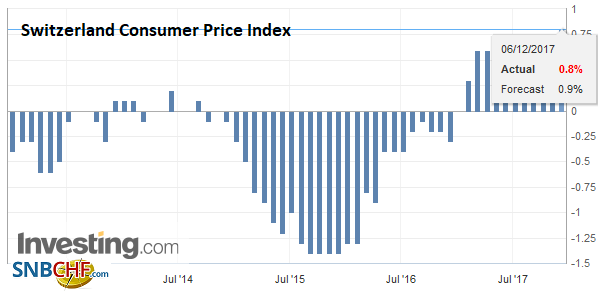

Swiss Consumer Price Index in November 2017: Up +0.8 percent against 2016, -0.1 percent against last month

The consumer price index (CPI) fell by 0.1% in November 2017 compared with the previous month, reaching 100.9 points (December 2015=100). Inflation was 0.8% compared with the same month of the previous year.

Read More »

Read More »

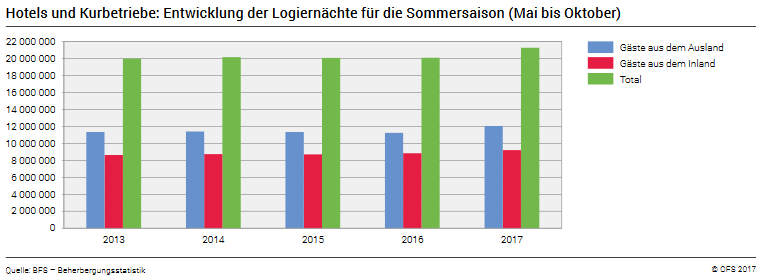

Tourist accommodation during the 2017 summer season: Big increase in overnight stays in hotel

The hotel sector registered 21.3 million overnight stays in Switzerland during the summer tourist season (from May to October 2017). This represents an increase of 5.9% (+1.2 million overnight stays) compared with the same period a year earlier. With a total of 12.1 million overnight stays, foreign demand rose by 7.3% (+823,000). Domestic visitors registered a 4.0% increase (+356,000) with 9.2 million units.

Read More »

Read More »

FX Daily, December 06: Equity Slump Continues, Lifts Bonds, Bolsters Yen

The swoon in equities, perhaps sparked by a rotation spurred by potential US tax changes, is continuing today. It is providing a risk-off mood, which is expressed in the foreign exchange market as a stronger yen. The most compelling answer of yen strength is not that investors are buying yen as a haven.

Read More »

Read More »