Tag Archive: newslettersent

Oil: Supply and Demand Drivers

Oil prices have recovered more than 50% of the decline since the mid-September peak. The next retracement objectives are found near $82 a barrel for Brent and $76.5 for WTI basis the continuation futures contract. The immediate consideration is that supplies have tightened.

Read More »

Read More »

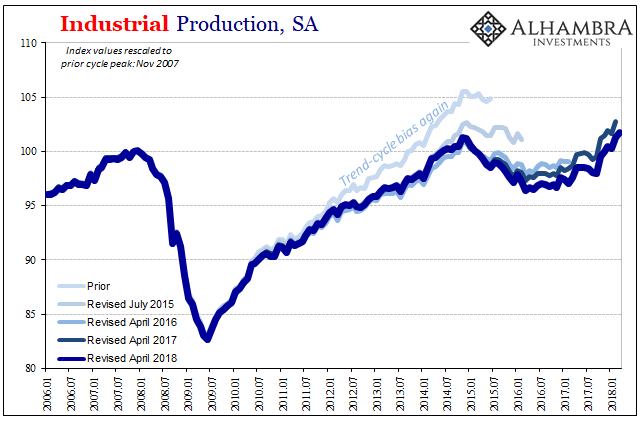

Why The Last One Still Matters (IP Revisions)

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of operative history.

Read More »

Read More »

The future of cities

The digital revolution has launched a wave of innovation in the world’s cities, says MIT’s Carlo Ratti, providing opportunities to improve urban mobility and create better workspaces for the changing nature of work. These are exciting times for cities, according to Carlo Ratti, Director of MIT’s Senseable City Lab and co-founder of Carlo Ratti Associati architecture studio.

Read More »

Read More »

FX Daily, April 25: Dollar Regains Luster, but Consolidation Likely Ahead of Key Events and Data

The US dollar reversed lower yesterday after US yields softened and equities tumbled. However, the greenback has bounced back, and has extended its gains against the major currencies except the euro and sterling. The on-the-run and generic US 10-year yields are edging above 3%.

Read More »

Read More »

Swiss authorities allowed isopropanol exports to Syria

Switzerland authorised the export to Syria of five metric tons of the chemical isopropanol in 2014, which can be used to make sarin gas, Swiss public television, RTS, reports. The Organization for the Prohibition of Chemical Weapons (OPCW) announced in May 2014 that Syria had destroyed its stock of 120 metric tons of isopropanol.

Read More »

Read More »

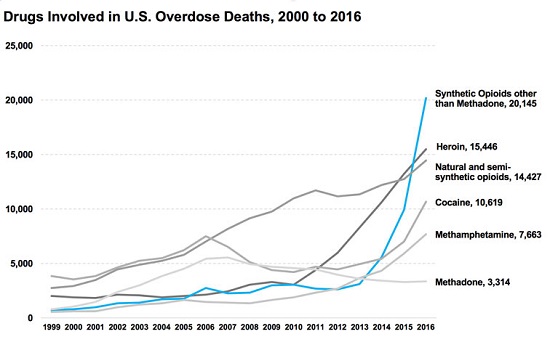

Our Strange Attraction to Self-Destructive Behaviors, Choices and Incentives

Self-destruction isn't a bug, it's a feature of our socio-economic system. The gravitational pull of self-destructive behaviors, choices and incentives is scale-invariant, meaning that we can discern the strange attraction to self-destruction in the entire scale of human experience, from individuals to families to groups to entire societies.

Read More »

Read More »

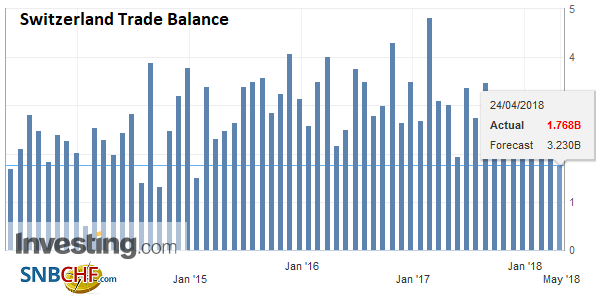

Swiss Trade Balance Q1 2018: The positive trend continues

In the first quarter of 2018 and on a seasonally adjusted basis, foreign trade confirmed the positive trend of previous quarters. Both traffic directions have also reached record levels. Exports increased by 0.2% and imports by 4.1%. The divergent evolution of inflows and outflows has led to the smallest trade surplus in four and a half years.

Read More »

Read More »

Swiss finance minister sees ‘clearly improved’ ties with US

Relations between Switzerland and the United States have improved under the Trump administration, Finance Minister Ueli Maurer told Swiss public radio, SRF, on Saturday. Maurer is heading a Swiss delegationexternal link, together with Economics Minister Johann Schneider-Ammann and Thomas Jordan, Chairman of the Swiss National Bank, which is attending the International Monetary Fund (IMF) and the World Bank Group spring meetingsexternal link in...

Read More »

Read More »

FX Daily, April 24: Stalled US Rates Steal Greenback’s Thunder

The US dollar looked set to launch a new leg higher, but rates stalled, which in turn is unleashing some mild corrective pressures. The US two-year yield has been unable to extend its increase beyond 2.50%, while the 10-year rate has stalled within a whisker of the 3% psychological threshold. The greenback's momentum did indeed carry it, but by late morning on the Continent, a consolidative tone was evident.

Read More »

Read More »

Great Graphic: Aussie Tests Trendline

It is not that the Australian dollar is the weakest currency this month. Its 0.4% decline puts it among the better performers against the US dollar. However, it has fallen to a new low for the year today. The losses have carried to a trendline drawn off of the early 2016 low near $0.6800.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous.

Read More »

Read More »

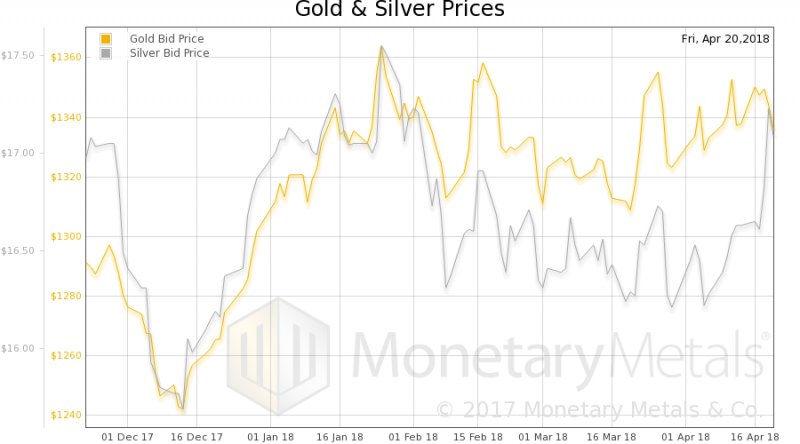

Silver Bullion Remains Good Value On Positive Supply And Demand Factors

Silver bullion remains good value on positive supply and demand factors. Industrial demand set to continue to climb from 2017, into 2018 and beyond. Speculators are bearish on silver as net short positions in silver futures reach record. Investment demand sees silver ETF holdings at eight-month high of 665.4 million ozs. 2017 saw fifth consecutive annual physical deficit in scrap silver, of 26 moz. Global silver mine production fell 4% last year,...

Read More »

Read More »

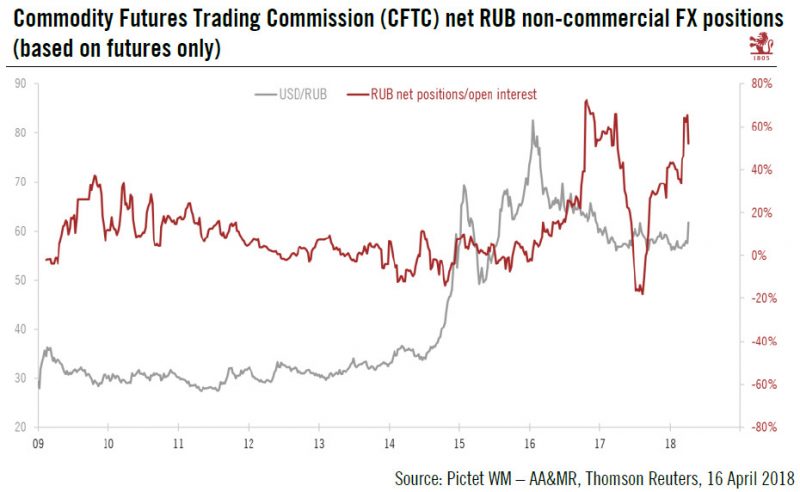

Russian rouble: significantly undervalued but quite risky

On 6 April, the Trump Administration announced additional and more severe sanctions against Russia “in response to the totality of the Russian government's ongoing and increasingly brazen pattern of malign activity around the world”. US sanctions target seven Russian oligarchs, 12 companies controlled by them, and 17 high-ranking government officials. The measures freeze any US assets held by those targeted and cut them off from US finance, trade...

Read More »

Read More »

FX Daily, April 23: Rising Rates Help Extend Dollar Gains

The new week has begun much like last week ended, with rising rates helping to extend the dollar's recent gains. The US 10-year yield is flirting with the 3.0% threshold. The two-year yield is firmer, and, like in the second half of last week, the US curve is becoming a little less flat. The market, as we had anticipated, was not so impressed with North Korea's measures, and Korea's Kospi edged lowed, and the region-leading KOSDAQ fell a little...

Read More »

Read More »

FX Weekly Preview: Markets and Macro

Worries about a trade war appear to have eased, at least for the moment, but that does not make investors worry-free. The concerns have shifted toward rising US interest rates, perhaps more than anything else, but general anxiety seems elevated.

Read More »

Read More »

New All Time Record Highs For Gold In 2019

New all time record highs for gold in 2019. ‘Powerful bull market’ will likely send gold to $5,000 to $10,000. If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’. Traditional portfolio of stocks and bonds will not protect investors. “Gold will replace bonds as the go-to hedge”.

Read More »

Read More »

Emerging Markets: What Changed

The Reserve Bank of India is tilting more hawkish. Tensions on the Korean peninsula are easing. The Trump administration reversed course on Russia sanctions. Turkey is heading for early elections.

Raul Castro stepped down as president of Cuba. Mexico polls show continued gains for Andres Manuel Lopez Obrador.

Read More »

Read More »

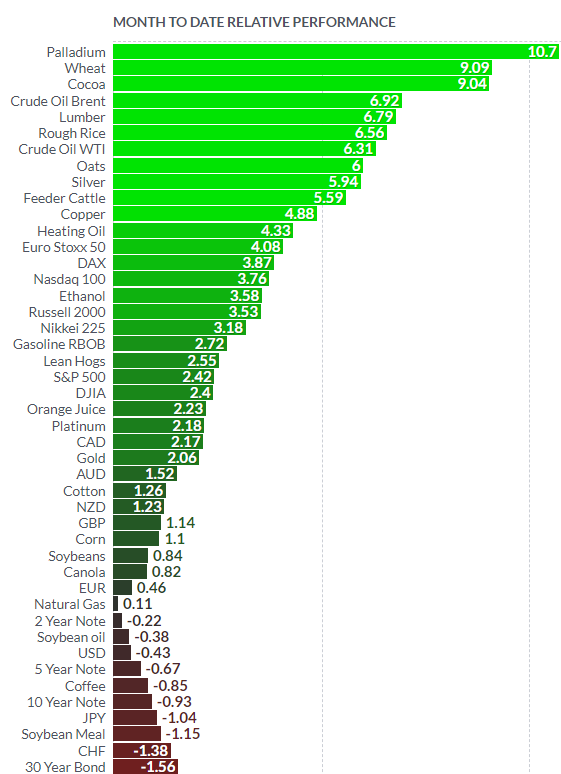

Palladium Bullion Surges 17percent In 9 Days On Russian Supply Concerns

Palladium bullion has surged a massive 17% in just nine trading days. From $895/oz on Friday April 6th to over $1,052/oz today (April 19th). The price surge is due to palladium being due a bounce after falling in the first quarter and now due to Russian supply concerns. In a volatile month, precious metals and commodities have been the clear winners so far, with palladium having the greatest gains of all – up 10.7% in April (see table below).

Read More »

Read More »