Tag Archive: newslettersent

FX Daily, April 30: Merger Monday

Three large corporate deals were announced. T-Mobile appears to have finally figured a way to secure Sprint. It is a $26.5 bln equity tie-up. Marathon Petroleum is reportedly taking Andeavor for $20 bln in cash and stock. Sainsbury is reportedly in advanced talks to buy Walmart's Asda chain for GBP7.3 bln (~$10 bln) in an equity and cash transaction.

Read More »

Read More »

FX Weekly Preview: Next Week in Context

A year ago, the Dutch and French elections signaled that UK referendum to leave the EU and the US election of Trump did not usher in a populist-nationalist epoch, such as the one that proceeded the last great financial crisis. The euro gapped higher and did not look back.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a firm note, capping off a generally softer week overall. TRY and PHP were the best performers last week, while CLP and ZAR were the worst. US core PCE, ISM manufacturing, FOMC meeting, and jobs data all pose risks to EM this week. We remain a bit defensive on risk assets in general now.

Read More »

Read More »

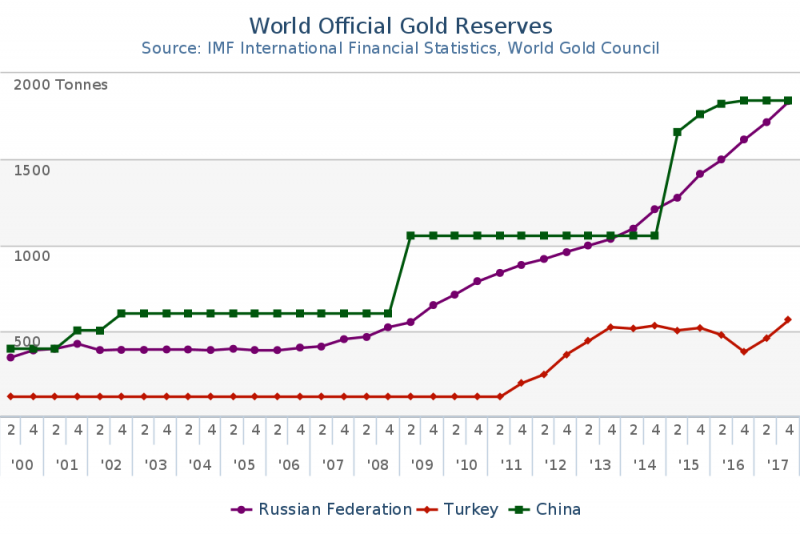

Russia Buys 300,000 Ounces Of Gold In March – Nears 2,000 Tons In Gold Reserves

Russia buys 300,000 ounces of gold in March and nears 2,000t in gold reserves. Russia now holds just over 1,861 tonnes, more than officially reported by China at 1,842t. Both Russia and China have the power to destabilise US dollar by dumping dollar-denominated assets. Turkey has removed all gold held in the U.S. opting for Bank of England and BIS. Turkey follows trend set by both Germany, Netherlands and others to remove gold reserves stored in...

Read More »

Read More »

Basel airport – night time take-offs to be cut in half

For those who fly regularly, living close to an airport might be convenient, but it’s also noisy. To reduce noise, Basel-Mulhouse airport has decided to reduce the number of flights taking off between 11pm and midnight by half, according to a press release. Unlike Geneva airport, which is located entirely on Swiss soil but still operates a French side, Basel-Mulhouse, Switzerland’s third major airport is on French territory, but run by the Swiss.

Read More »

Read More »

La dette bat des records et menace l’économie mondiale

L’endettement mondial, qui a atteint 164.000 milliards de dollars en 2016 et représente 225% du PIB mondial, représente un risque pour l’économie, a prévenu mercredi le FMI. L’endettement mondial atteint des records, sous l’impulsion de la Chine, au point de dépasser largement les niveaux de 2009, juste après la faillite de la banque Lehman Brothers, et de représenter un risque pour l’économie, a prévenu mercredi le FMI.

Read More »

Read More »

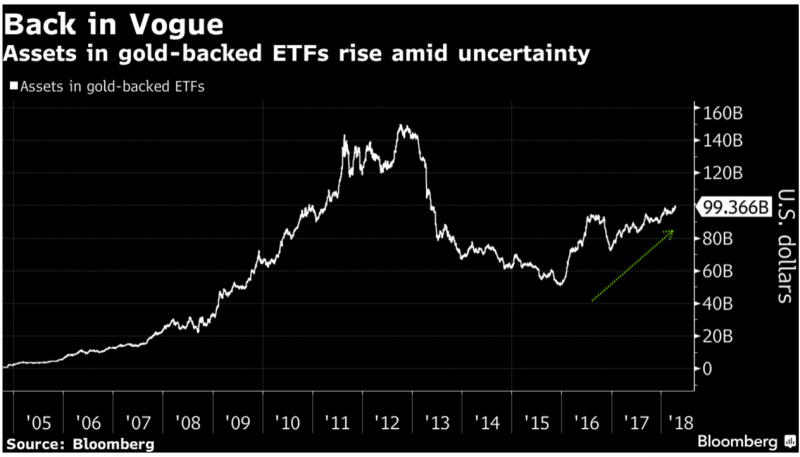

Family Offices and HNWs Invest In Gold Again

Family Offices and HNWs Are Investing In Gold Again. Rising interest by family offices and high-net-worth (HNW) into gold bullion investments. Gold ETF assets have reached almost $100 billion due to HNWs and pension funds’ increased demand. Volatility in equities, concerns over trade wars, Trump’s Presidency and other economic worries are spurring demand for gold coins and bars. Prudent money ‘trickle’ back into gold as investors are reminded of...

Read More »

Read More »

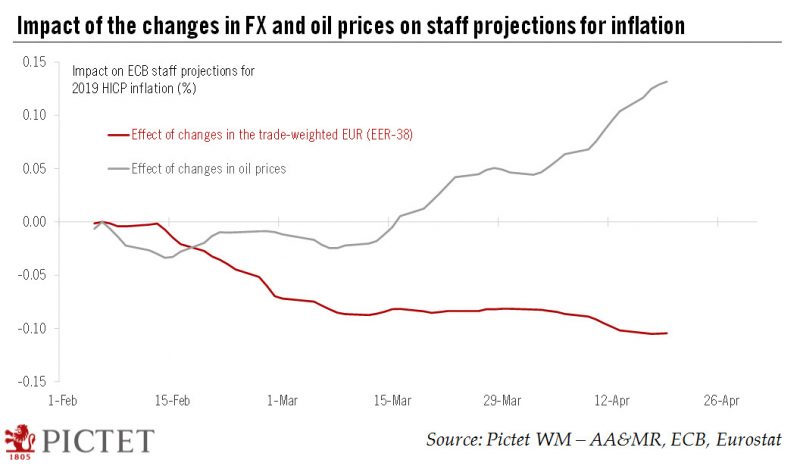

The ECB’s steady hand

Another ECB meeting, another balanced message of confidence and prudence. Unsurprisingly, the statement mentioned the deterioration in the data flow since March, but our impression is that the ECB is largely brushing off concerns about a soft patch in the economy for the moment.

Read More »

Read More »

Taxes – one in seven in some Swiss cantons has unpaid tax

The cantons of Neuchâtel (14.7%) and Geneva (14.6%) have the highest percentages of taxpayers owing money, according to the newspaper SonntagsBlick. Fribourg (12.6%), Bern (9.5%) and Luzern (6.5%) complete the top-five. Vaud (5.9%), Basel-City (5.5%) and Zurich (2.4%) are further down. Aargau (2.0%) and Uri (1.0%) sit at the bottom with fewest with oustanding tax payments.

Read More »

Read More »

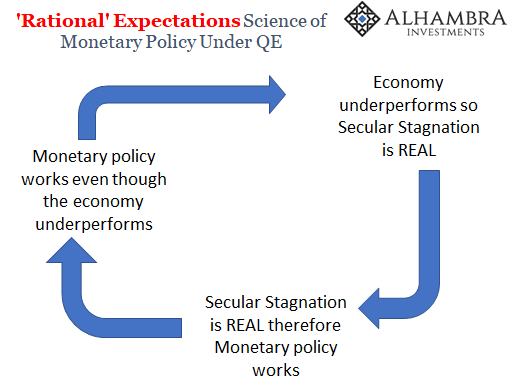

The Science of Japanification

The term itself gives it away. They called it quantitative easing for a specific reason. Both words mean to convey substantial concepts. The first part, quantitative, was used because it sounds deliberate, even scientific. It implies a program where great care and study was employed to come up with the exact right amount. It’s downright formulaic, where you intend that by doing X you can predictably create Y.

Read More »

Read More »

‘New buyer found’ for ailing Monetas blockchain firm

Troubled Swiss blockchain payments firm Monetas has found a new mystery buyer to pull it out of the mire, swissinfo.ch has learned. The company has run into major problems in the last few months, including enforced bankruptcy proceedings and the acrimonious failure of a previous takeover. “We are in the process of completing the purchase formalities with a buyer of Monetas.

Read More »

Read More »

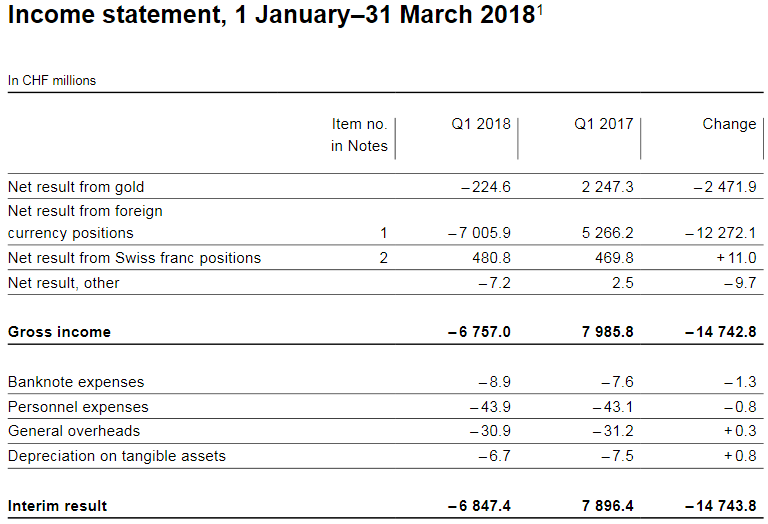

SNB loses 6.8 billion in Q1/2018

The Swiss National Bank (SNB) reports a loss of CHF 6.8 billion for the first quarter of 2018. A valuation loss of CHF 0.2 billion was recorded on gold holdings. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are therefore to be expected, and only provisional conclusions are possible as regards the annual result.

Read More »

Read More »

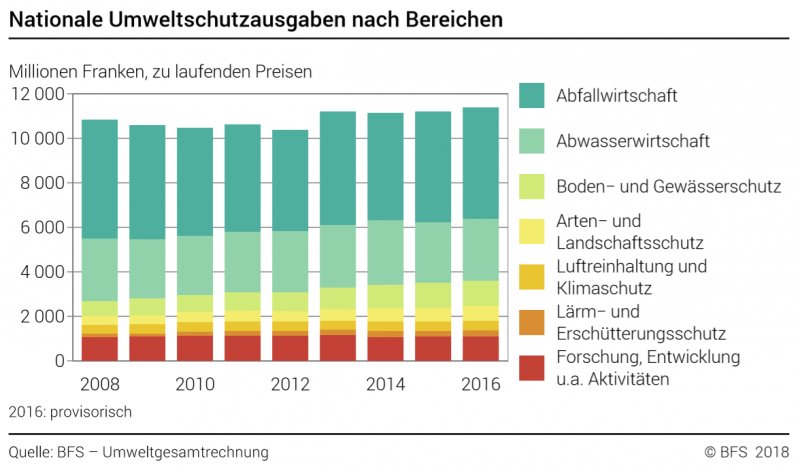

Switzerland spent CHF 11.4 billion on environmental protection in 2016

Neuchâtel, 26 April 2018 (FSO) - In 2016, 11.4 billion francs were spent on the environment, equivalent to 1.7% of gross domestic product (GDP). Since 2008, environmental expenditure has increased by 5%. Two thirds were spent on wastewater and waste management. Overall, expenditure in these two areas decreased by 5%, while it increased by 34% in the other environmental sectors. These initial estimates are based on the environmental accounts...

Read More »

Read More »

Swiss travel and watch firms named best places to work

Swiss International Air Lines has been ranked as the most attractive employer in a survey on the 150 largest companies in Switzerland. Zurich Airport came in second, followed by watchmaker Patek Philippe. The survey, published by Dutch recruitment agency Randstadexternal link on Thursday, asked 4,800 people aged 18-65 where they would like to work.

Read More »

Read More »

FX Daily, April 27: Dollar Puts Finishing Touches on Best Week Since November 2016

The US dollar's recent gains have been extended, and it is having one of its best weeks since November 2016. The Dollar Index is up 1.7% for the week, as US session is about to start. Though it took this week's gains to change market's narrative, the fact of the matter, as we have pointed out is that April is the third consecutive month in which the Dollar Index fell in only one week. That translates into rising 10 of the past 13 weeks.

Read More »

Read More »

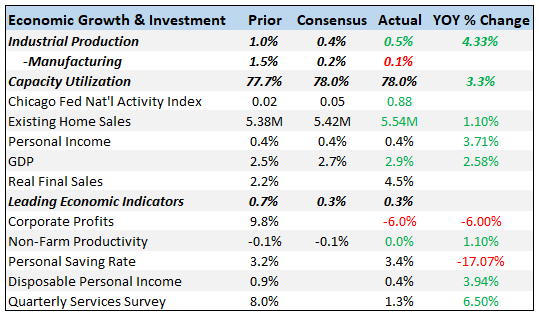

Bi-Weekly Economic Review: Interest Rates Make Their Move

How quickly things change in these markets. In the report two weeks ago, the markets reflected a pretty obvious slowing in the global economy. In the course of two weeks, what seemed obvious has been quickly reversed. The 10-year yield moved up a quick 20 basis points in just a week, a rise in nominal growth expectations that was mostly about inflation fears.

Read More »

Read More »

From Fake Boom to Real Bust

More is revealed with each passing day. You can count on it. But what exactly the ‘more is of’ requires careful discrimination. Is the ‘more’ merely more noise? Or is it something of actual substance? Today we endeavor to pass judgment, on your behalf.

Read More »

Read More »

BNS, une perte révélatrice d’une stratégie potentiellement dévastatrice

L’endettement et la spéculation sont au coeur de la stratégie de la BNS. On met quand et comment le stop? Il semblerait que la BNS fasse des pertes sur ce premier trimestre 2018 de 5 milliards. Une paille au vu de ce que nous pourrions craindre pour l’avenir. Mais le scoop n’est pas là. Il est dans la composition des causes de cette perte. Une des causes est révélatrice des mensonges des « experts » et de leurs relais un peu partout.

Read More »

Read More »

FX Daily, April 26: Euro Remains Soft Ahead of Draghi

The euro made a marginal new low early in European turnover and held barely above the spike low on March 1 to $1.2155. So far, today is the first session since January 11 that the euro has not traded above $1.22. The euro stabilized as the European morning progressed, but there seems to be little real buying interest it ahead of Draghi's press conference following the ECB decision.

Read More »

Read More »

Weekly Technical Analysis: 23/04/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, WTI oil futures

The USDCHF pair touched the bullish channel’s resistance that appears on the chart, and the price might be forced to show some temporary decline to test the support base formed above 0.9790 before resuming the rise again. In general, we will continue to suggest the bullish trend supported by the EMA50, depending on the organized trading inside the mentioned bullish channel, noting that our next target is located at 0.9900, while holding above...

Read More »

Read More »