Tag Archive: newslettersent

FX Daily, May 07: Greenback Starts Week on Firm Note

The US dollar recovered from a softer tone in early Asia and is higher against nearly all the major and emerging market currencies as North American market prepare to start the new week. The news stream is light and investors remain on edge geopolitical concerns remain elevated. Oil prices are extending gains, and WTI is above $70 a barrel for the first time since November 2014. Alongside an inverse yield curve, a jump in oil prices typically...

Read More »

Read More »

FX Weekly Preview: Geopolitics Becomes More Salient as Monetary Policy Plays for Time

Say what one will, US President Trump is vigorously projecting what he believes are American interests. There is virtually no sign of the isolationism that many observers had anticipated. Indeed, as we have argued, the America First rejection of the League of Nations that Trump harkens back to was not isolationist as much as unilateralist. And the same is true of the Trump Administration.

Read More »

Read More »

Emerging Markets: What Changed

Bank Indonesia is taking measures to stabilize the local bond market. The Philippine central bank is tilting more hawkish. Czech National Bank cut its inflation forecasts. The Turkish government is loosening fiscal policy to drum up popular support. S&P downgraded Turkey to BB- with stable outlook. Argentina officials are taking significant measures to support the peso. Brazil central bank made a subtle shift in its FX intervention strategy.

Read More »

Read More »

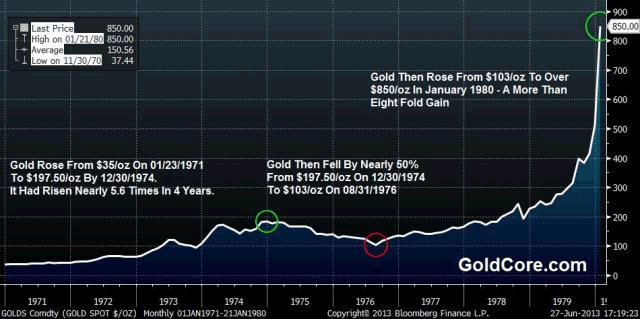

Own Some Gold and Avoid Overvalued Assets

We could be heading for a golden age – or a return to the 1970s. The cost to the US government of borrowing money for a decade came within sniffing distance of 3% yesterday. The US ten-year Treasury yield is sitting at 2.96% as I write this morning, having got to 2.99% yesterday. Does this really matter? After all, 3% is just another number.

Read More »

Read More »

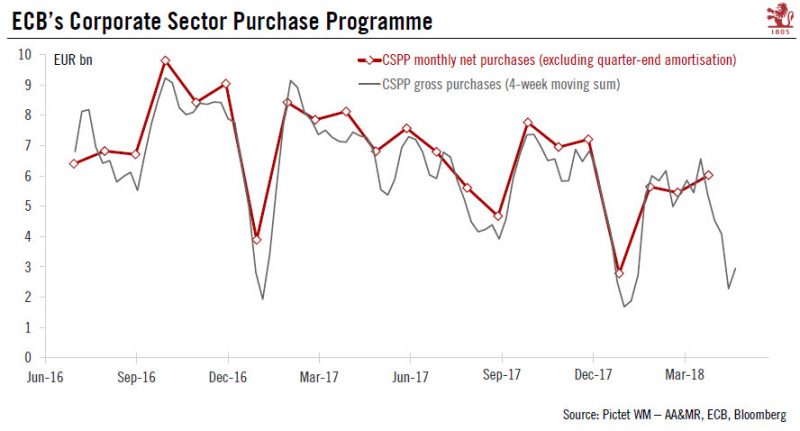

Europe chart of the week – Corporate Sector Soft Patch

Next week’s detailed breakdown of ECB QE monthly data will reveal a marked slowdown in the pace of corporate bonds purchases in April (Corporate Sector Purchase Programme, or CSPP). Indeed, weekly holdings data have been consistent with gross purchases of around EUR3bn in April, down from EUR5.8bn on average in Q1. There are several possible explanations for the drop in gross purchases, but redemptions are not one of them, as they amounted to just...

Read More »

Read More »

Results of the Annual General Meeting 2018 of UBS Group AG

UBS shareholders approved all the Board of Directors’ proposals at today’s Annual General Meeting in Basel. Shareholders confirmed the re-election of the Chairman and the members of the Board of Directors. They elected Jeremy Anderson and Fred Hu as new members of the Board. They approved the payment of an ordinary dividend of CHF 0.65 per share, an increase compared with the previous year.

Read More »

Read More »

“Blood In The Streets” Of U.S. Gold Bullion Coin Market

Sales of U.S. Mint American Eagle gold coins dropped to their weakest April since 2007, while silver coin purchases for the month rose 10 percent higher than last year, U.S. government data showed on Monday. The U.S. Mint sold 4,500 ounces of American Eagle gold coins in April, down 25 percent from the year prior. However, April sales were up 29 percent from March.

Read More »

Read More »

House View, May 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes. In spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration. Volatility is still higher than last year, and has increased noticeably in the bond market once again.

Read More »

Read More »

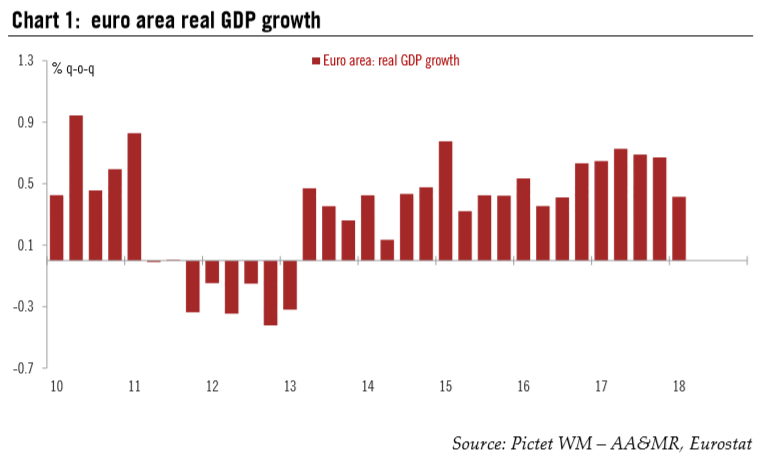

Policy normalisation may be delayed in Europe

Taking stock of recent dovish shifts in European central banks’ communication and reaffirming our broadly constructive macro outlook.The European Central Bank (ECB) does not seem overly concerned about the soft patch in the economy in Q1 and appears willing to collect more data before they start discussing the timing and modalities of the next policy steps. We expect the ECB to hint at an imminent end to asset purchases at its June meeting, but to...

Read More »

Read More »

Thousands of Swiss take to streets to mark May Day

Workers and activists have been celebrating May Day in Switzerland with rallies in numerous cities urging their government to address employment issues, such as equal pay. Around 50 rallies and events are planned across Switzerland. On Tuesday morning, 13,000 took part in a demonstration in Zurich city centre. Other major rallies were held in Basel in the morning, and in Bern and Geneva in the afternoon.

Read More »

Read More »

Look Past Disappointing Jobs Data, Luke

The US jobs report was broadly disappointing. However, the Federal Reserve will look through it and investors should too. A June hike is still by far the most likely scenario. The US created 164k net new jobs in April, and when coupled with the 32k upward revision in March, it was near expectations.

Read More »

Read More »

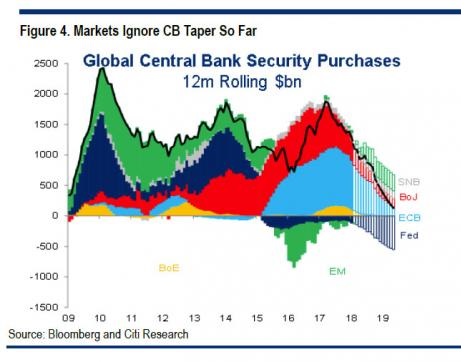

Taking the Pulse of a Weakening Economy

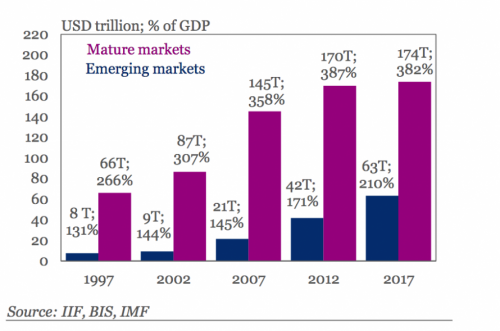

Corporate buybacks provide the key analogy for the economy as a whole. Central banks have been running a grand experiment for 9 years, and now we're about to find out if it succeeds or fails. For 9 unprecedented years, central banks have pushed the pedal of monetary stimulus to the metal: near-zero interest rates, monumental purchases of bonds, mortgage-backed securities, stocks and corporate bonds.

Read More »

Read More »

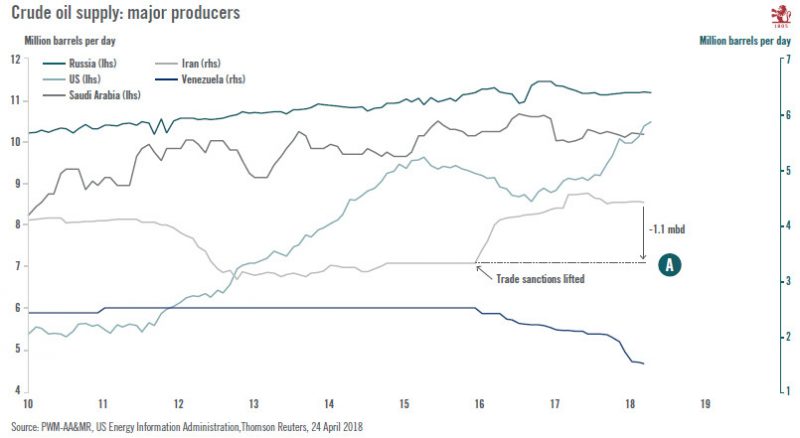

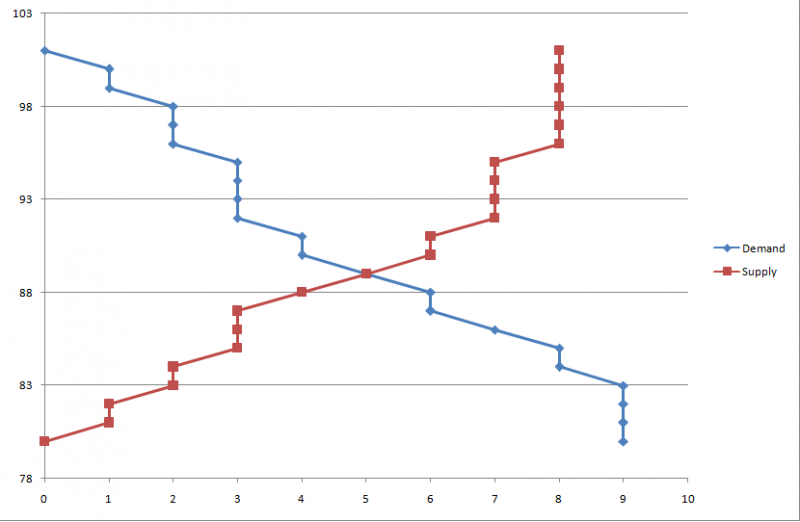

The Oil Curse Comes to Washington

Prices rise and prices fall. So, too, they fall and rise. This is how the supply and demand sweet spot is continually discovered – and rediscovered. When supply exceeds demand for a good or service, prices fall. Conversely, when demand exceeds supply, prices rise.

Read More »

Read More »

Why sovereign money would hurt Switzerland?

Ladies and gentlemen Today, the Swiss Institute of Banking and Finance at the University of St. Gallen celebrates its 50th anniversary. Let me extend my sincere congratulations on reaching this milestone. Our financial system has evolved steadily over the past five decades. In the early years of the institute, the world was still dominated by … Continue reading »

Read More »

Read More »

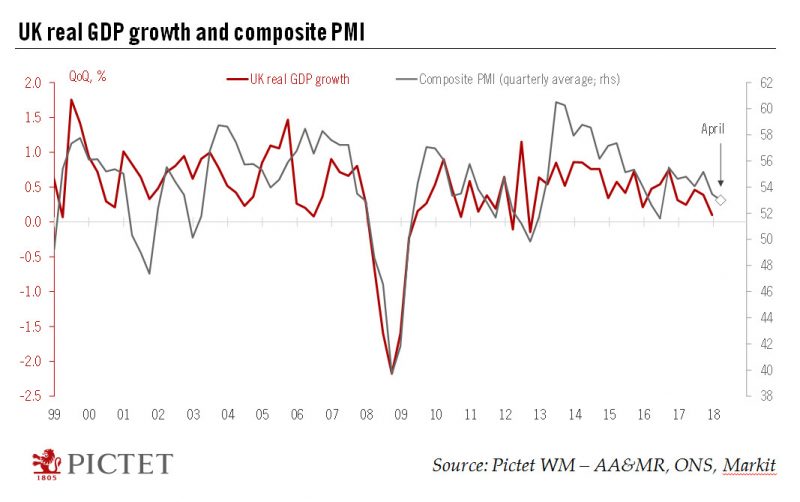

Euro area growth: somewhere between hard and soft data

According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.4% q-o-q in Q1 2018 (1.7% q-o-q annualised, 2.5% y-o-y), in line with consensus expectations (0.4%) and down from an upwardly revised figure of 0.7% q-o-q for Q4 2017. The implications of the growth slowdown on ECB staff projections should remain limited, in our view.

Read More »

Read More »

Demand for organic food grows strongly in Switzerland

One in ten fresh food items sold in Switzerland last year was organic, according to the Federal Office for Agriculture. The market share of organic products rose from 4.6% in 2007 to 9% in 2017, while the share of fresh organic food sold in Switzerland rose from just under 6% to 11.5% over the same period, the agriculture office reported on Tuesday.

Read More »

Read More »

FX Daily, May 04: US Jobs-Not the Driver it Once Was

The US dollar fell last month in response to the disappointing non-farm payroll report. However, in general, the jobs report is not the market mover that it was in the past. With unemployment is at cyclical lows of 4.1% and poised to fall further. Weekly jobless claims and continuing claims at or near lows in a generation, though over qualification is more difficult than previously.

Read More »

Read More »

What Lies Beyond Capitalism and Socialism?

The status quo, in all its various forms, is dominated by incentives that strengthen the centralization of wealth and power. As longtime readers know, my work aims to 1) explain why the status quo -- the socio-economic-political system we inhabit -- is unsustainable, divisive, and doomed to collapse under its own weight and 2) sketch out an alternative Mode of Production/way of living that is sustainable, consumes far less resources while providing...

Read More »

Read More »

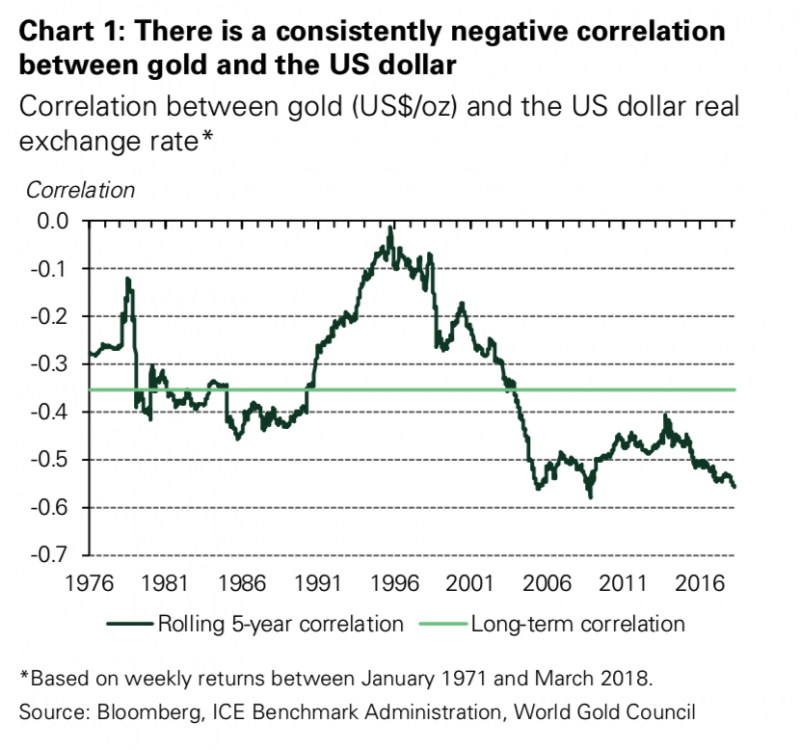

Gold Price Increasingly Influenced By Declining Dollar Rather Than Interest Rates

Gold Price Gains Due To Declining Dollar Rather Than Interest Rates. Investors should not be put off by higher interest rates, World Gold Council research finds they do not always have a negative impact on gold. Only short-term movements in gold are ‘heavily influenced by US interest rates’. Correlation between US interest rates and gold is waning, with US dollar a better indicator of short-term gold price. New findings will reassure gold investors...

Read More »

Read More »

Trilogie des Fiatgeldes (III): Vollgeld ist reines Staatsgeld und somit längst erprobt

Als Abraham Lincoln (1809-1865) zur Finanzierung des „American Civil War“ bei den Banken um Kredit nachsuchte, sah er sich mit Zinsen von 24 bis 36% konfrontiert. Lincoln sträubte sich gegen solchen Zinswucher und suchte nach einer anderen Lösung. Sie kam von Colonel „Dick“ Taylor, einem Geschäftsmann aus Illinois. „Just get to Congress to pass a bill authorizing the printing of full legal tender treasury notes

Read More »

Read More »