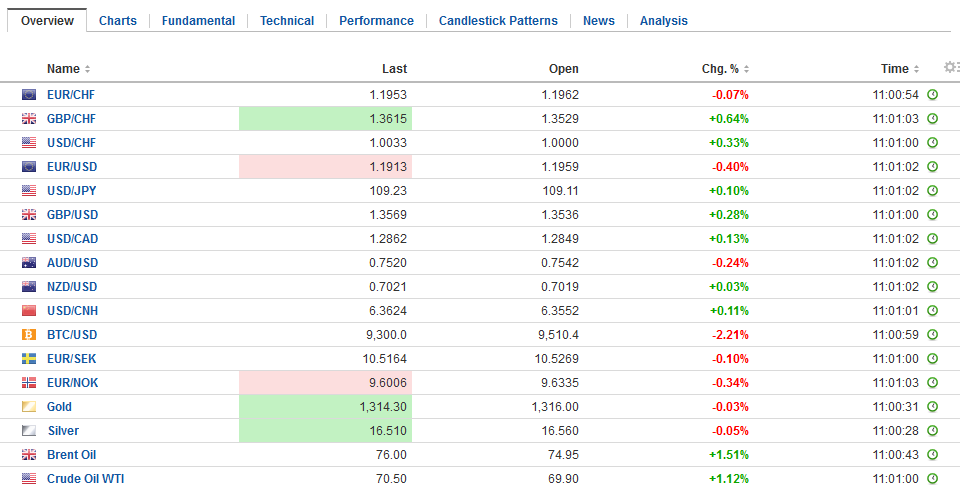

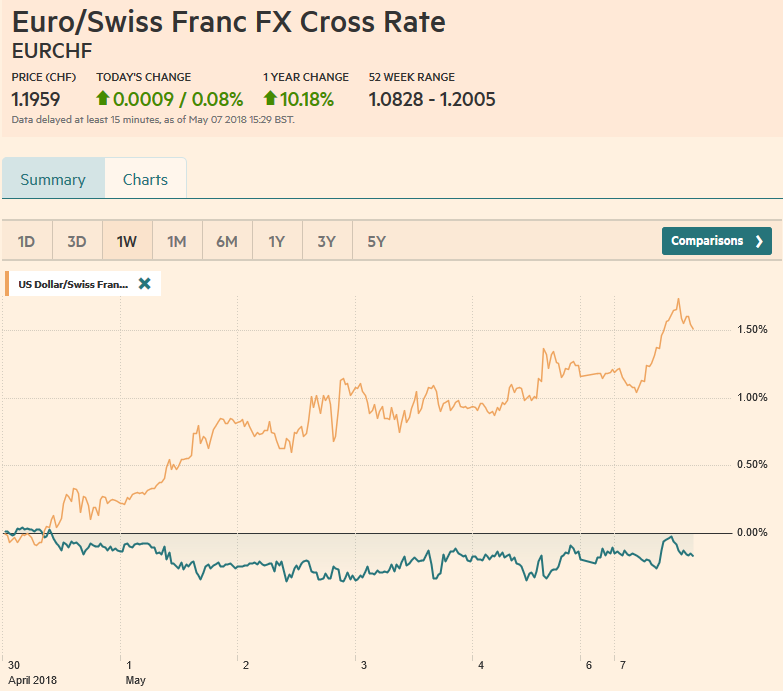

Swiss FrancThe Euro has risen by 0.08% to 1.1959 CHF. |

EUR/CHF and USD/CHF, May 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar recovered from a softer tone in early Asia and is higher against nearly all the major and emerging market currencies as North American market prepare to start the new week. The news stream is light and investors remain on edge geopolitical concerns remain elevated. Oil prices are extending gains, and WTI is above $70 a barrel for the first time since November 2014. Alongside an inverse yield curve, a jump in oil prices typically proceeds economic downturns. The past appreciation of the euro may have taken a toll. Export orders fell 2.6%. However, orders from within the eurozone fell 3% and less (2.5%) outside the area. Still, domestic orde5rs rose 1.5%. |

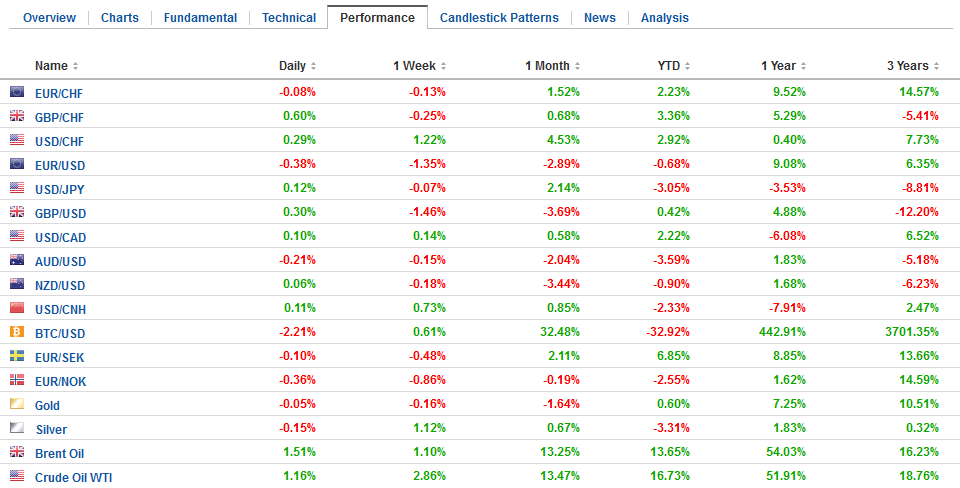

FX Daily Rates, May 07 |

| The selling pressure on the euro has thus far been unable to extend the pre-weekend decline that saw the euro trade to almost $1.1910. Options struck at $1.1960-$1.1970 today (~421 mln euros) marks intraday resistance. On a break of $1.1900, there is little in the way of important chart points until closer to $1.18.

The dollar has pushed through the pre-weekend high against the yen after initially slipping toward JPY108.75 in Asia. Japan’s markets re-opened for the first time since the middle of last week. Offers around JPY110 last week stymied the dollar rise, but the market does not appear to have given up. A move above JPY109.50 is the last hurdle before the ceiling can be challenged. There are three sets of option expires today that may shape the range. On the downside, there almost $400 mln struck at JPY109.00-JPY1090.10. Reinforcing the cap is a little more than $600 mln strikes at JPY109.95-JPY110.00. And on the top side, there is a $400 mln strike in JPY110.15-JPY110.20. |

FX Performance, May 07 |

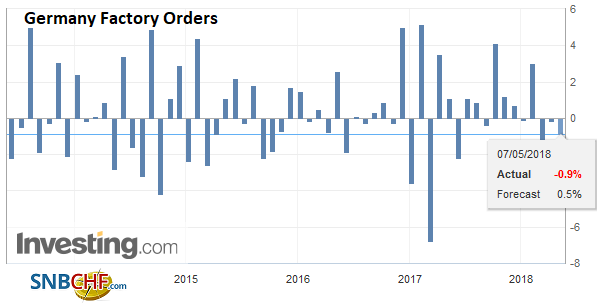

GermanyThe euro edged higher in Asia, but sellers reemerged in front of $1.1980 before the disappointing Germany factory orders report. Rather than increase by 0.5% as economists expected, March orders fell 0.9%. Adding insult to injury, the February gain of 0.3% was revised to -0.2%. Factory orders had fallen 3.5% in January. The March decline is the third in a row, the longest streak in three years. Factory orders fell by an average of 1.5% in Q1 18 after a 1.2% average rise in H2 17. |

Germany Factory Orders, Jun 2013 - May 2018(see more posts on Germany Factory Orders, ) Source: Investing.com - Click to enlarge |

While the focus in on US-Chinese trade, today’s reserve figures offer a little distraction. Given the dollar’s appreciation against other reserve currencies in April, many had anticipated a decline in the dollar value of Chinese holdings. The decline turned out to be a bit more than expected. Chinese reserves fell to $3.124 trillion from $3.143 trillion in March. The market project a decline of around $11 bln and instead reserves fell nearly $18 bln. Chinese officials have lightened some controls on capital outflows, seeming less concerned.

As the dollar appreciates, it exerts downward pressure on the value of reserves. Also, as the dollar rises, the downward pressure on emerging market currencies reduces local officials needs to intervene. The reduced intervention also means less official demand for Treasurys/MBS. The decline in the value of China’s reserves can be explained through valuation adjustments, and it is difficult to anticipate the change in China’s holdings of US Treasuries based solely on the change in reserves. Less intervention from EM countries may be partly blunted by demand from oil producers. The higher oil price may translate into an increase in Treasury holdings.

Meanwhile, the US quarterly refunding will be held this week. The US will raise $73 bln in coupon offerings (3, 10, and 30-year paper), which is nearly 10% more than the Q1 refunding. The question is not about whether the paper will be sold. The issue is at what price and to whom. Recent auctions have seen softer foreign official and investor demand. When primary dealers rather than end users absorb the supply, greater upward pressure on yields is expected over time.

Sterling has been confined to a less than half a cent range today. The focus is two-fold. First, the Bank of England meets later this week. Expectations for a hike have all but evaporated. Still, some suspect that sterling’s recent decline, including 3% fall in the past three weeks on a trade-weighted basis, may yet encourage a rate hike this week. This is clearly a minority view. The second issue is that the government’s Brexit strategy is in disrepair. What appeases the hard Brexit key cabinet officials alienates Parliament, and this chasm continues to grow. Sterling is trading within the pre-weekend range (~$1.3485-$1.3585), and North American players have little incentive to break it.

The dollar-bloc currencies are trading heavier, led by a 0.4% decline in the Australian dollar. The Canadian and New Zealand dollars are off half as much. There are nearly A$800 mln options struck between $0.7500 and $0.7515 that expire today.

With a little economic data on tap in North America speeches by four Fed regional presidents may provide some color. Still, after last week FOMC statement, the increase in the core PCE deflator and the respectable employment report, the market remains confident of June hike.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,EUR/CHF,Germany Factory Orders,newslettersent,USD/CHF