Tag Archive: newslettersent

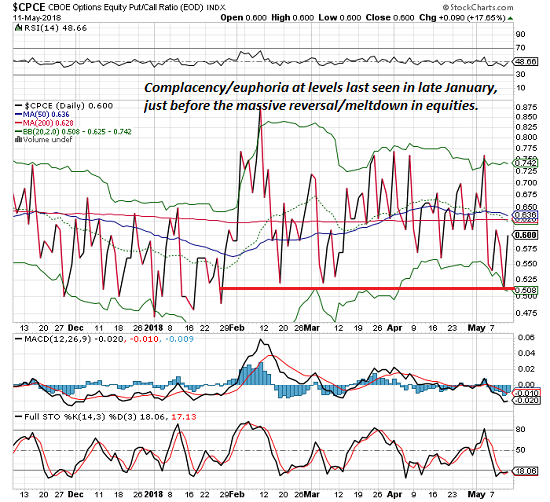

A Funny Thing Happened on the Way to Market Complacency / Euphoria

Fortunately for Bulls, none of this matters. A relatively reliable measure of complacency/euphoria in the stock market just hit levels last seen in late January, just before stocks reversed in a massive meltdown, surprising all the complacent/euphoric Bulls. The measure is the put-call ratio in equities. Since this time is different, and the market is guaranteed to roar to new all-time highs, we can ignore this (of course).

Read More »

Read More »

Oil price highest in 3 years, gold ready to follow

U.S. withdraws from Iran nuclear deal. Oil jumps past $70. Argentina hikes interest rates to 40%. S. 10 year disparity. Western buying returns to gold. Gold and silver both ended slightly up in a week dominated by heightening geopolitical news, weakening inflation data, and emerging market concerns.With gold closing the week at $1,318 (up 0.28%), €1,104 (0.37%), and £973 (0.2%).

Read More »

Read More »

Swiss median monthly wage exceeds CHF6,500 ($6,506)

A government survey analysing wage structures in the Alpine nation found that the median salary for a full-time job in 2016 was CHF6,502 ($6,509) for the entire Swiss economy. The bottom 10% of Swiss earners had a salary of less than CHF4,313 ($4,317), while the best paid 10% earned more than CHF11,406 ($11,418) a month.

Read More »

Read More »

Swiss share tax data with 41 nations

For the first time, Switzerland’s Federal Tax Administration (FTA) has sent details on advance tax rulings to its partners in the spontaneous exchange of information deal. The FTA announced on Tuesdayexternal link that it had transmitted a first batch of 82 reports to a total of 41 states, including Britain, France, Germany, the Netherlands and Russia. Some reports were exchanged with several partner countries.

Read More »

Read More »

FX Daily, May 14: US Dollar Slips in Quiet Turnover

The US dollar is sporting a softer profile against most of the major and emerging market currencies to start the new week. It already seemed to be tiring in the second half of last week. With today's mild losses, Dollar Index is off for a fourth consecutive session, the longest losing streak in over a month. The US and China appear to have taken measure to diffuse the trade tensions between the world's two largest economies.

Read More »

Read More »

FX Weekly Preview: Fed Can Look Through the Data Easier than the ECB and BOJ

Geopolitical issues will continue to bubble below the surface for the capital markets. The fallout from the reimposition of US sanctions on Iran has apparently helped lift oil prices in the face of the rising dollar, which often acts as a drag. In the coming days, the US will take the symbolic step of moving its embassy to Jerusalem.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday on a week note and capped of another generally negative week. Worst performers last week were ARS, BRL, and TRY while the best were ZAR, RUB, and KRW. We remain negative on EM FX and look for losses to continue. US retail sales data Tuesday pose further downside risks to EM FX.

Read More »

Read More »

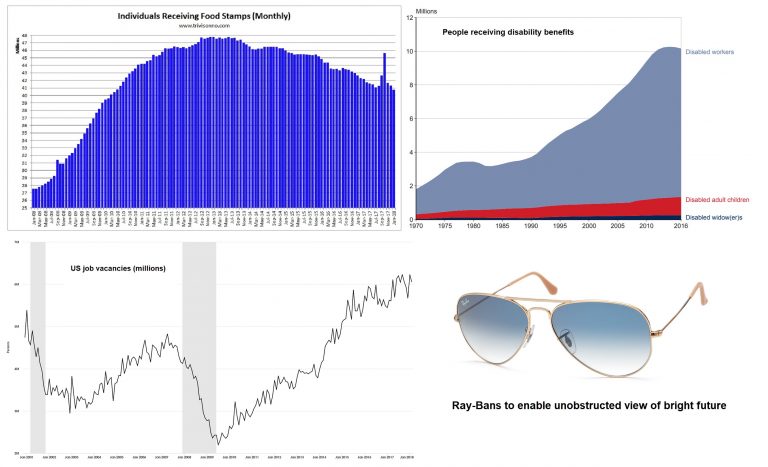

How to Get Ahead in Today’s Economy

This week brought forward more evidence that we are living in a fabricated world. The popular story-line presents a world of pure awesomeness. The common experience, however, falls grossly short. On Tuesday, for example, the Labor Department reported there were a record 6.6 million job openings in March. Based on the Labor Department’s data, there were enough jobs available – exactly – for the 6.6 million Americans who were actively looking for a...

Read More »

Read More »

Late trains – Switzerland’s delay hotspots

The cliché of Swiss trains always being on time is challenged by data published on the website opentransportdata.swiss. Analysis of this data by 20 Minuten, shows the most frequently delayed trains arrive from Italy. Mendrisio, near the Italian border in the canton of Ticino, was the worst performing station with 30% of trains delayed by 3 minutes or more. Italian delays also affect Swiss trains from Domodossola and Brig.

Read More »

Read More »

How Safe Are We? Our Blindness to Systemic Dangers

How do we explain our obsession with relatively low risk dangers and our collective blindness to manufactured/marketed scourges that kill tens of thousands of people annually? If you've bought a new vehicle recently, you may have noticed some "safety features" that strike many as Nanny State over-reach. You can't change radio stations, for example, if the vehicle is in reverse.

Read More »

Read More »

Gold Mining Supply Looks Set To Decline

Global demand for gold is increasing while new discoveries of gold remain small. Gold mining output in Australia is forecast to decrease by 50% in the next eight years. Decline in global gold mining supply makes a price increase almost certain.

Read More »

Read More »

Swiss unemployment lower than it’s been in years

The Swiss unemployment rate was 2.7% in April – a level last seen in July 2012. Last month, 119,781 people were registered as without work in Switzerland – 10,632 fewer than the previous month. This brought the overall unemployment rate down from 2.9% in March to 2.7% in April, reported the State Secretariat for Economic Affairsexternal link on Tuesday.

Read More »

Read More »

Swiss economics minister upbeat about Mercosur free trade deal

Switzerland is close to concluding a free trade agreement with the four Mercosur countries – Argentina, Brazil, Uruguay and Paraguay – within the framework of the European Free Trade Association (EFTA), Swiss Economics Minister Johann Schneider-Ammann told reporters in Bern following his South America visit. Schneider-Ammann has just returned from a seven-day visit to the four South American countries, accompanied by 50-strong delegation of Swiss...

Read More »

Read More »

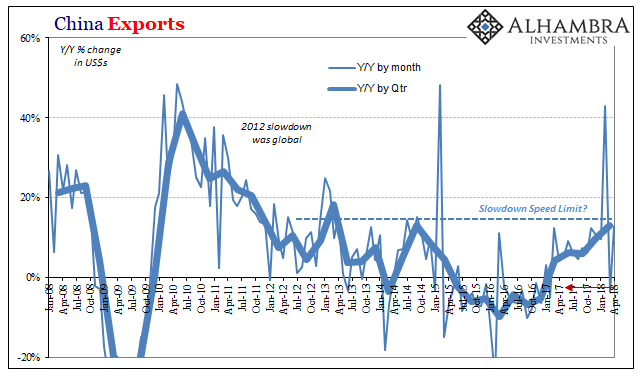

What China’s Trade Conditions Say About The Right Side Of ‘L’

Chinese exports rose 12.9% year-over-year in April 2018. Imports were up 20.9%. As always, both numbers sound impressive but they are far short of rates consistent with a growing global economy. China’s participation in global growth, synchronized or not, is a must. The lack of acceleration on the export side tells us a lot about what to expect on the import side.

Read More »

Read More »

US Money Supply Growth Jumps in March , Bank Credit Growth Stalls

There was a sizable increase in the year-on-year growth rate of the true US money supply TMS-2 between February and March. Note that you would not notice this when looking at the official broad monetary aggregate M2, because the component of TMS-2 responsible for the jump is not included in M2. Let us begin by looking at a chart of the TMS-2 growth rate and its 12-month moving average.

Read More »

Read More »

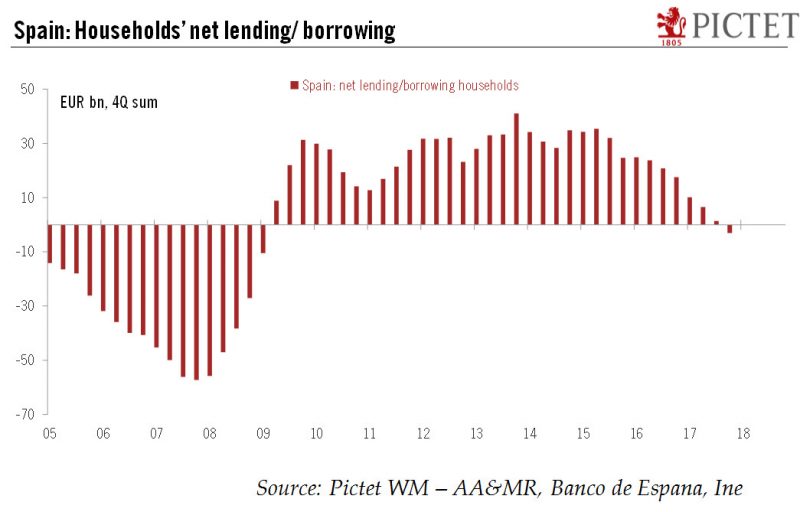

Spaniards back in the mood to borrow

Before the financial crisis, the real estate bubble and the parallel growth in borrowing meant that the indebtedness of Spanish households spiralled ever higher, reaching a peak of 84.7% of GDP in Q2 2010. Since then, Spanish’s households have tightened their belt, with indebtedness falling to 61.3% of GDP in Q4 2017.

Read More »

Read More »

Switzerland remains top international wealth management hub

Switzerland remains the world’s largest wealth management centre for international assets, but the air is getting thinner at the top and other financial hubs are gaining ground, according to a global report. A total of $1.84 trillion (CHF1.85 billion) of international assets were managed in Switzerland at the end of 2017, says the latest Deloitte Wealth Management Centre Rankingexternal link, published on Friday. This is around 7% less than in 2010.

Read More »

Read More »

FX Daily, May 11: Dollar Momentum Sapped, Near-Term Pullback Likely

The US dollar pulled back following yesterday's slightly softer than expected CPI report and this likely marks the beginning of a new phase, with the dollar moving lower. Investors have learned over the past two weeks that neither wages nor consumer prices are accelerating. There is little reason in the recent string of data or official comments to suggest a more hawkish path for monetary policy (e.g., four rate hikes this year).

Read More »

Read More »

Watching Imports

The US trade deficit, a sensitive political topic these days, declined sharply in March. It had expanded significantly (more deficit) in January and February, reaching nearly -$76 billion (seasonally adjusted) in the latter month, before posting -$68 billion in the latest figures. Exports rose while imports fell in March, making for the largest single month change in the trade condition in many years.

Read More »

Read More »

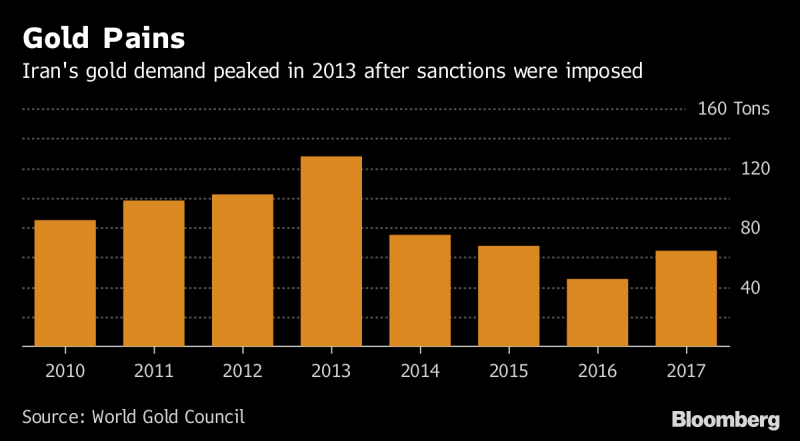

Iran’s Gold Demand May Surge On Trump Sanctions

Iran’s gold demand will probably be “strong” for the next few months and then gradually decline as U.S. sanctions start to take effect, according to the researcher who covers the country for Metals Focus Ltd. After a previous set of sanctions was imposed on Iran in 2012, it took two years for the country’s gold demand to start falling, according to data from the World Gold Council.

Read More »

Read More »