Tag Archive: newslettersent

Vive la Revolution! Brexit and a Dying Order

A Dying Order Last Thursday, the Brits said auf Wiedersehen and au revoir to the European Union. On Friday, the Dow sold off 611 points – a roughly 3.5% slump. What’s going on?

Read More »

Read More »

Great Graphic: Sterling Monthly Chart and Outlook

Sterling's losses are not simply a product of thin liquidity or panic. Both main political parties are in disarray just when strong leadership is needed. The rough projection pre-vote of what could happen on Brexit suggests $1.20-$!.2750.

Read More »

Read More »

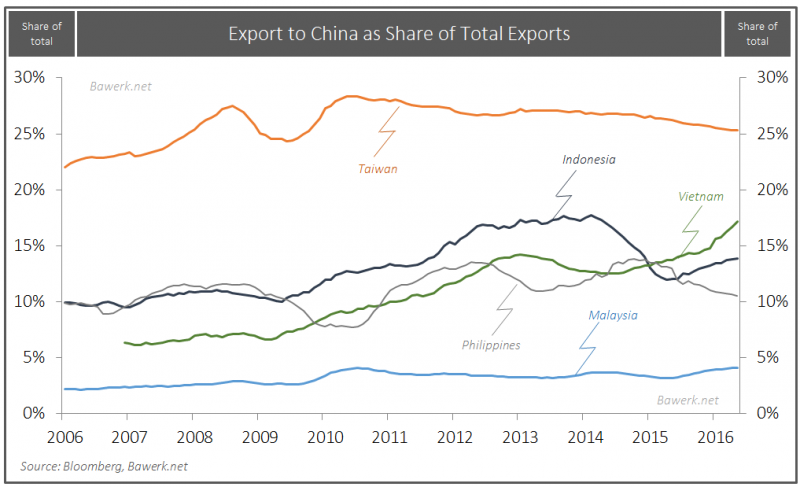

South China Sea: Storm in an Indian Ocean Teacup

With global attention focused on BREXIT calamity, potentially more important questions are being overlooked, and especially in the South China Sea where storms are currently brewing between China and a range of littoral states for strategic control of territorial waters.

Read More »

Read More »

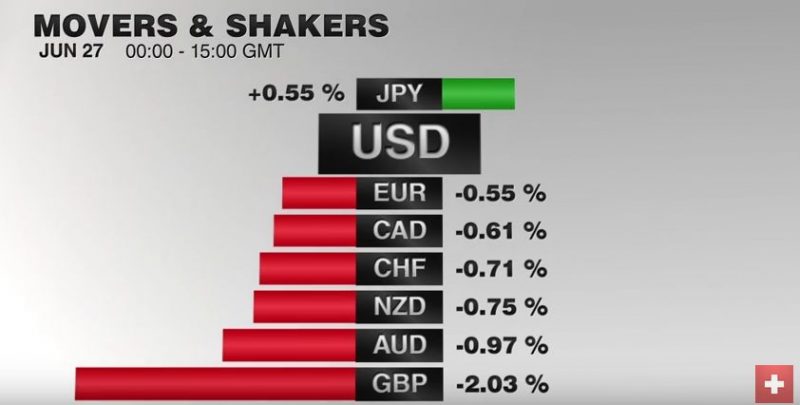

FX Daily, June 27: Post-Referendum Confusion Continues

Sterling has been sold beyond the panic low seen when it became clear that UK voters were choosing to leave the EU though nearly every economists warned of at least serious short- to medium-term negative economic implications.

Read More »

Read More »

UK Seeks Divorce, Rajoy Needs a Shotgun Marriage

Center-right PP won the Spanish election. Anti-EU forces were setback. Rajoy needs a coalition partner.

Read More »

Read More »

Quitting the Cucumber Affair

Winners and Quitters Vince Lombardi, the famous American football coach, once said, “Winners never quit and quitters never win.” Maybe he meant that winners overcome obstacles to reach their goals while quitters give up and fall short… or somethin...

Read More »

Read More »

Another Sexual Assault Gets Refugees Banned From Pools In Austria

Authorities in the Austrian town of Mistelbach issued a temporary pool ban for refugees following a sexual assault by a “dark-skinned’ man on a 13-year-old girl. German and Swiss are issuing leaflets how to behave in pools.

Read More »

Read More »

Emerging Market Preview: Week Ahead

The Brexit vote is a game-changer for EM. While the direct impact on EM is limited, the damage to market sentiment is undeniable. And to make matters worse, there will be a protracted period of uncertainty as the UK and the EU negotiate the divorce proceedings.

Read More »

Read More »

FX Weekly Preview: Post-Brexit: Week One

The EU response to Brexit is important. The EU summit and the talks with Turkey are very important. Brexit leaders seem as surprised and unprepared for the results as anyone. And a preview on economic data for the week.

Read More »

Read More »

Cool Video: Early Thoughts on Brexit Implications with FT’s John Authers

The Financial Times' John Authers visited me at Brown Brothers Harriman to discuss the initial implications. The situation is very fluid and there are many moving pieces. In Chinese, the characters for crisis are "danger" and "opportunity."

Read More »

Read More »

El-Erian: Cash is more valuable than ever

Mohamed El-Erian, chief economic adviser at Allianz Global Investors. says that Investors shouldn’t underestimate the role of cash in their portfolios We should add that the Swiss Franc is one of the most important havens for holding cash.

Read More »

Read More »

Weekly Speculative Positions: Speculators Cut Currency Exposure ahead of FOMC, BOJ, and Brexit

The CFTC reporting week ending June 21 covers the day FOMC and BOJ meetings and ends two days before the UK referendum. The overarching theme was the reduction of exposure. This is not measured by net positions but by gross positions. Of the eight currencies we track, six saw a reduction of gross long positions and a six saw a reduction in the gross short positions.

Read More »

Read More »

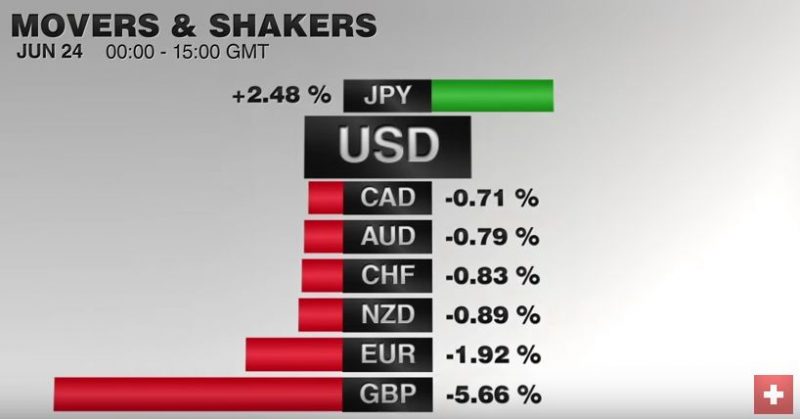

FX Weekly Review: June 20 – June 24: Dollar Appreciates with Brexit

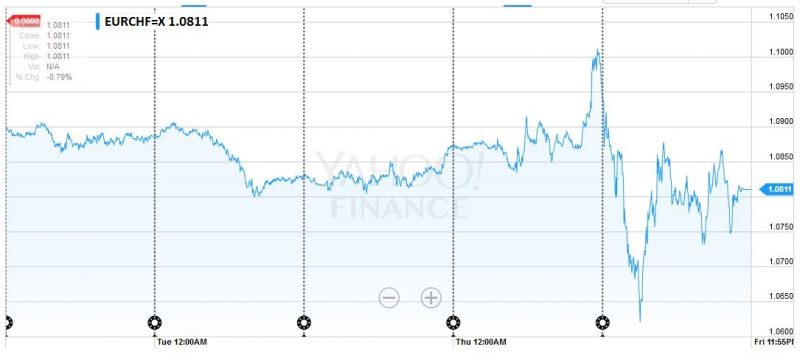

The dramatic reaction to the UK decision to leave the European Union has changed the technical condition in the foreign exchange market. The EUR/CHF peaked shortly before the Brexit referendum, when traders were anticipating a yes. It found its trough when the No was published. Then the SNB intervened.

Read More »

Read More »

Britain’s Dreams of a ‘Swiss Miracle’ Look More Like Fantasy

To help explain why the British voted to leave the European Union, look to Switzerland.

The famously neutral Swiss rejected membership in the European Economic Area, a potential steppingstone to the European Union, in a 1992 referendum, but Switzerland didn’t formally withdraw its dormant application until last week, when the Swiss Parliament decided to terminate it.

Read More »

Read More »

Rule Britannia

What a glorious day for Britain and anyone among you who continues to believe in the ideas of liberty, freedom, and sovereign democratic rule. Against all expectations, the leave camp somehow managed to push the referendum across the center line, with 51.9% of voters counted electing to leave the European Union.

Read More »

Read More »

The EU Begins to Splinter, a new Tsunami for Kuroda

Early this morning one might have been forgiven for thinking that Japan had probably just been hit by another tsunami. The Nikkei was down 1,300 points, the yen briefly soared above par.

Read More »

Read More »

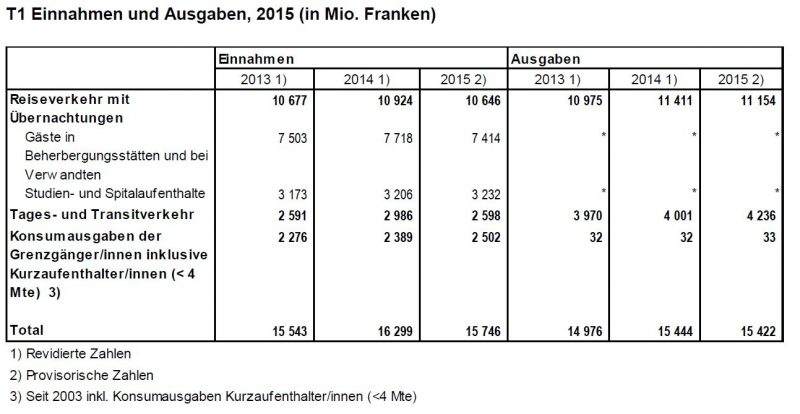

Tourism balance of payments 2015: Tourism balance of payments affected by strong franc

The strong franc in 2015 made Switzerland less attractive to foreign tourists, whereas holidays abroad maintained their appeal to Swiss residents. Foreign tourists spent CHF 15.7 billion in Switzerland in 2015, 3.4% less than in 2014, while the spending of Swiss tourists abroad remained constant at CHF 15.4 billion (-0.1%). According to initial estimates from the Federal Statistical Office, the tourism balance of payments remained in positive...

Read More »

Read More »

FX Daily, June 24: Brexit Sends Shock Waves, SNB Intervenes

The UK's decision to leave the EU spurred a dramatic risk-off move through the capital markets. The dollar, yen, and gold soared. Equities and emerging market assets sold off hard. The SNB had to intervene.

Read More »

Read More »

Brexit shakes global markets and the SMI

The Swiss Market Index (SMI) is set to post a modest gain this week despite confirmation that the UK has decided to leave the European Union. The SMI opened almost 7% lower following the announcement before recovering.

Read More »

Read More »