Tag Archive: newslettersent

Why the Fed Will Talk Down the Dollar

And right now, in the wake of Brexit, tighter monetary policy is clearly not an option. Plus, a stronger dollar (by virtue of the “peg”) strengthens the Chinese Yuan and the Saudi Riyal… something neither country will tolerate.

Read More »

Read More »

FX Daily, July 01: Markets Head Quietly into the Weekend

EUR/CHF finished the week after Brexit with slight improvement of 0.18%. The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney's comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08.

Read More »

Read More »

FX Daily, June 30: Calm Continues, but Rot Below the Surface

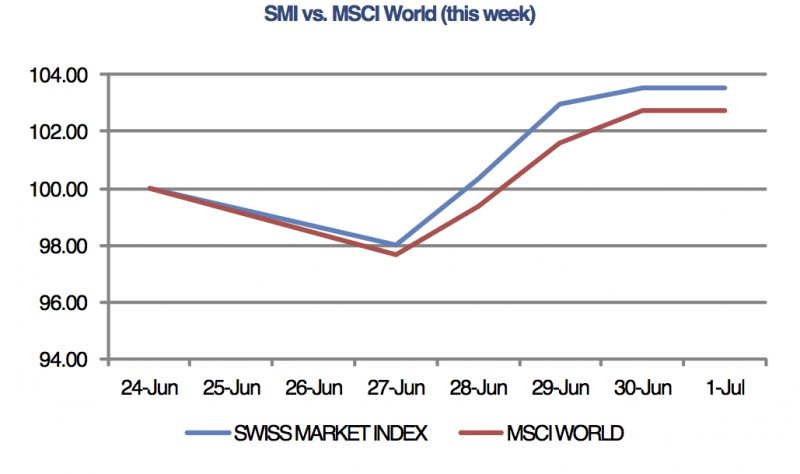

During the week the Swiss Franc lost momentum. It could regain speed only on June 30, after BoJ Carney's speech.

Read More »

Read More »

Great Graphic: What are UK Equities Doing?

Domestic-oriented UK companies have been marked down. The outperformance by UK's global companies is a negative view of sterling. The drop in interest rates is in anticipation of a recession and easier BOE policy.

Read More »

Read More »

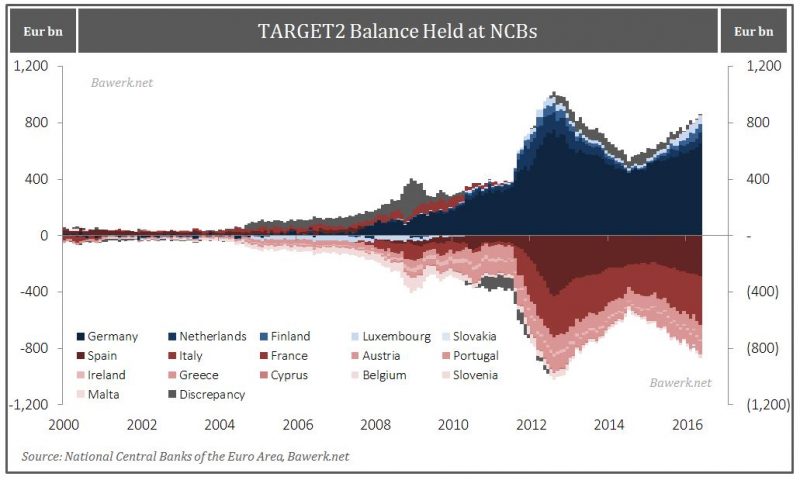

Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized.

Read More »

Read More »

The Coming End of the “Third Way” System

We recently discussed the post-Brexit landscape with a friend (in fact, our editor), who bemoaned that “the EU is led by a drunkard”. Our immediate reaction to this was to exclaim: “That’s the best thing about the EU!”

Read More »

Read More »

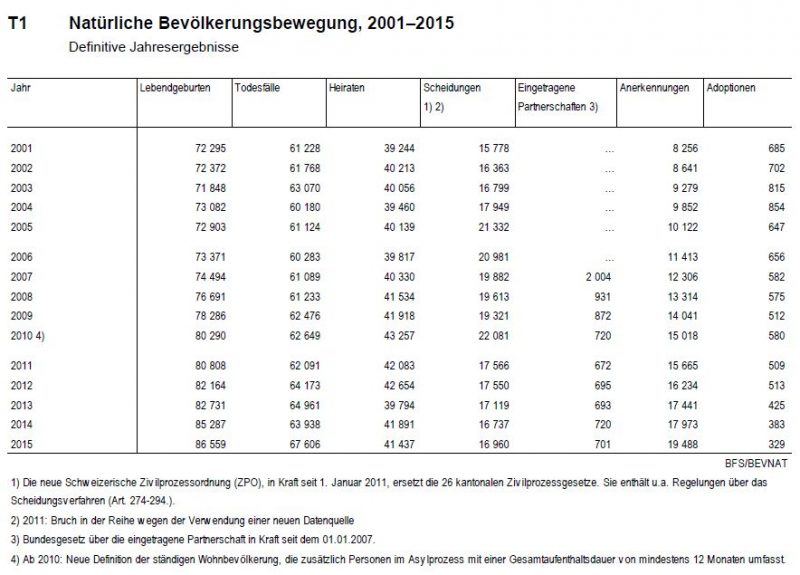

Natural population change 2015: Swiss population increases not only thanks to immigration

The Swiss population not only increases thanks to immigration, but also with the natural change: More live births than deaths. This is different from countries like Russia, Germany or Italy.

Read More »

Read More »

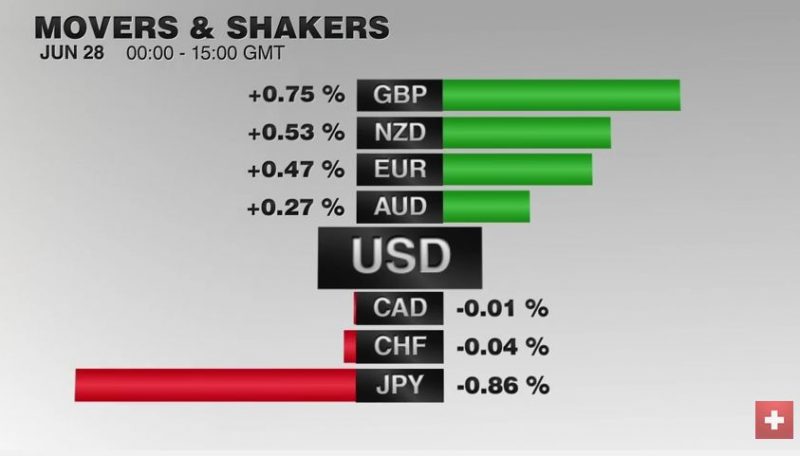

FX Daily, June 29: Fragile Calm Ahead of Quarter-End

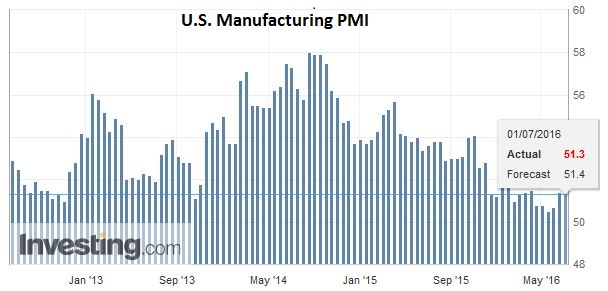

Sterling is firmer, but quarter-end considerations seem to be the key driver. Poor Japanese retail sales keep focus on policy response likely next month. New Zealand and Australian dollars are leading today's advance against the US dollar.

Read More »

Read More »

The Worst is Yet to Come–Don’t be Seduced by the Price Action

The two-day bounce in sterling seems technically driven rather than fundamental. The Brexit decision has set off a unfathomable chain of events whose impact and implications are far from clear. The economic hit on the UK may spur a BOE rate cut, even if not QE, as early as next month.

Read More »

Read More »

BofA: To Save Markets Central Banks Just Made Inequality And Populism Even Worse

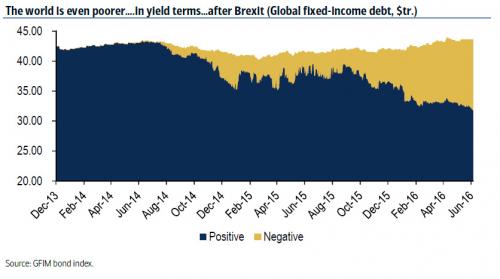

There is a large dose of irony to the post-Brexit market response: while on one hand stocks have soared and as of today the S&P500 has already recouped more than half its post-Brexit losses (the SPX sank 5.7% peak-to-trough since the referendum and has since bounced 3.5%) an even sharper reaction has been observed in bonds.

Read More »

Read More »

There Is Now A Staggering $11.7 Trillion In Negative Yielding Debt

It was not even a month ago when we last looked at the total amount of negative yielding debt around the globe, and were shocked to find that according to Fitch, for the first time in history (obviously), there was over $10 trillion in negative yielding debt. Fast forward 4 weeks later, and the grand total is now $1.3 trillion higher, or $11.7 trillion.

Read More »

Read More »

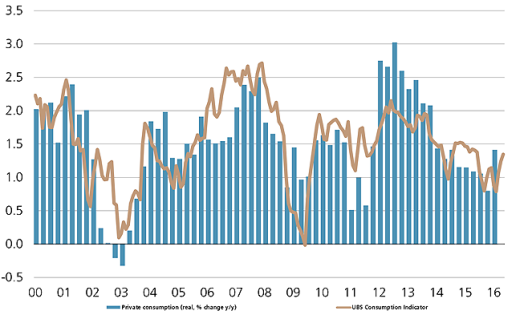

Switzerland UBS Consumption Indicator May: Rising from a low level

The UBS Consumption Indicator rose to 1.35 points in May from 1.24, extending its positive month-on-month run. The indicator was, however, adversely affected by the recently released employment figures for 1Q 2016.

Read More »

Read More »

Swiss Balance of Payments and International Investment Position 2015

The Swiss National Bank (SNB) is publishing the annual Swiss Balance of Payments and International Investment Position report today. This year, the report is being released earlier – in May instead of August, as in previous years. It is based on the dataset for the fourth quarter of 2015, which was released with the press release of 21 March 2016 headed ‘Swiss balance of payments and international investment position, Q4 2015 and review of the year...

Read More »

Read More »

FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday's; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today.

Read More »

Read More »

Swiss Sovereign money initiative: war on bankers but not on central banksters

Iceland has gained the admiration of populists in recent years by doing that which no other nation in the world seems to be willing or capable of doing: prosecuting criminal bankers for engineering financial collapse for profit.

Read More »

Read More »

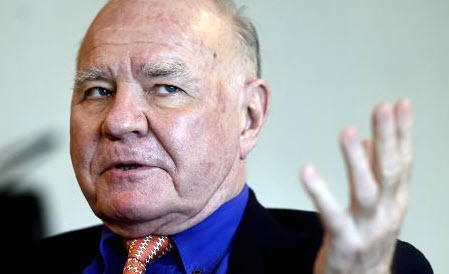

“Brexit Sends A Clear Message To Sick Political Elite” Marc Faber Sees “Only Good Contagion”

"We're moving into a global recession that has nothing to do with Brexit," warns Marc Faber stressing that Britain leaving the EU would not be disastrous, saying that if Switzerland can operate in a "single" market and outside of the EU so can Britain.

Read More »

Read More »

How Exceptional are Conditions?

If conditions are exceptional, isn't BOJ intervention more likely? If conditions are exceptional, the ban on European government supporting banks might not be valid. Italy is leading the charge in Europe.

Read More »

Read More »