BrexitVolatility remained high with markets rebounding from last week’s heavy losses as tensions began to ease following the UK referendum. Bargain hunters took advantage of badly beaten up sectors on bets that central banks would ride to the rescue of investors by providing additional stimulus to avert disaster. Mark Carney, governor of the Bank of England, reassured markets that a rate cut could come as early as this summer but also warned that there’s only so much the central bank can do to protect the UK economy. The FTSE 100 Index closed at its highest level since August 2014 after the pound sold off further, helping exporters and multinationals.

|

|

Global News and MarketsElsewhere, final first quarter US GDP growth was revised slightly higher this week to 1.1% from 1%. According to economists, the lackluster figure is not enough to materially alter the economic outlook of the United States.

|

|

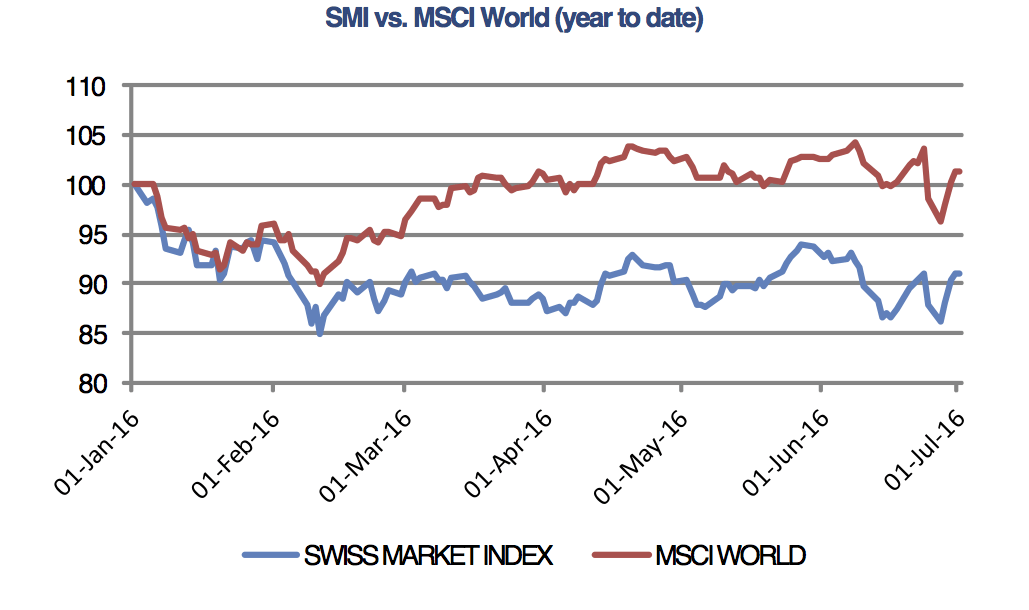

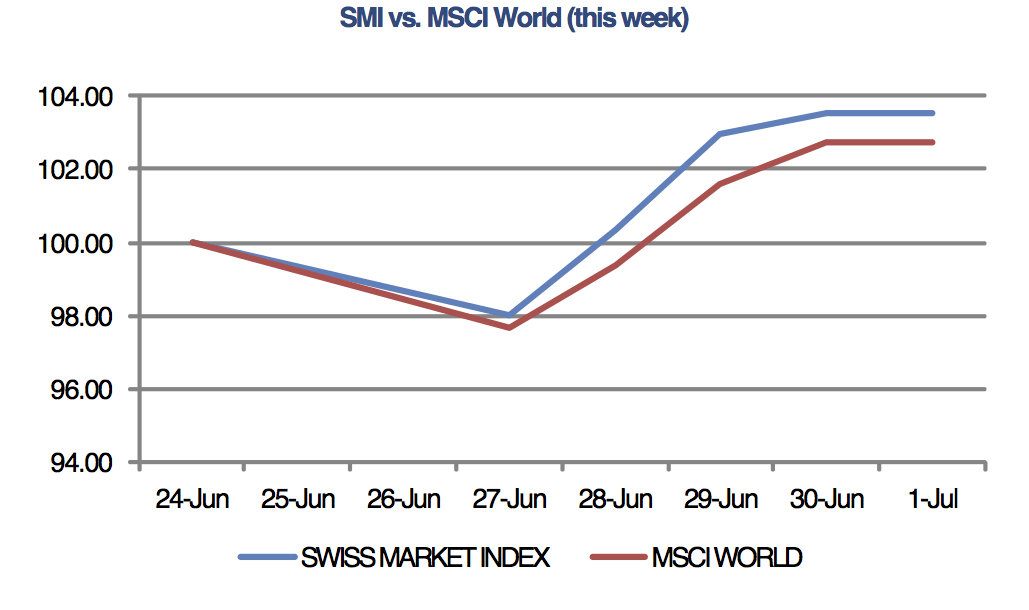

SMI and MSCI WorldIn Switzerland the release of the KOF Economic Barometer, which attempts to forecast Swiss domestic growth for the next 6 months, was reported above its historical average. The strength of the Swiss franc however remains a challenge for exporters.

|

|

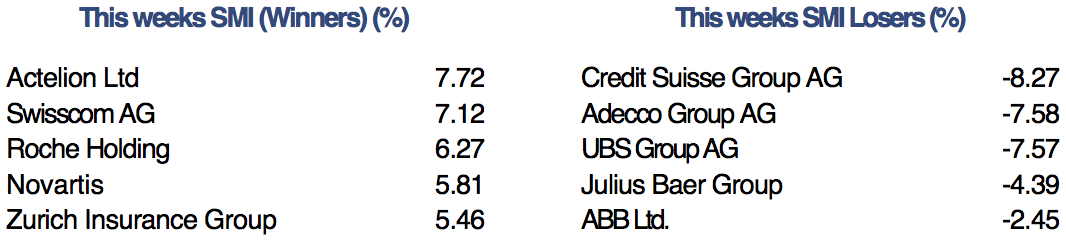

CompaniesIn company news, Nestlé rose after investors responded positively to the surprise appointment of Mark Schneider as successor to Chief Executive Officer, Paul Bulcke. Schneider is the first outsider to be given the CEO job at Nestlé in almost a century. The appointment of Schneider, whose background is in the medical industry, supports Nestle’s goal to redefine itself as a scientifically-driven nutrition and health food company. |

|

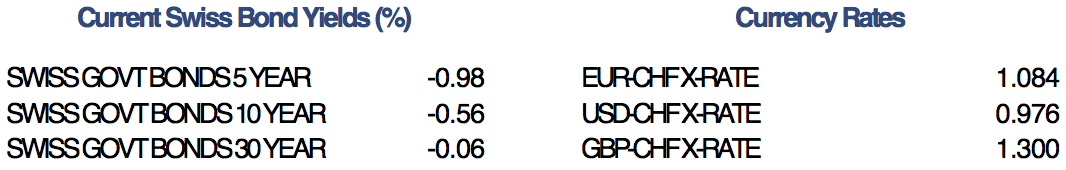

Bond yields and currencies |

|

Weekly performance of SMI and MSCI World |

For more stories like this on Switzerland follow us on Facebook and Twitter.

Full story here Are you the author? Previous post See more for Next postTags: Brexit,Editor's Choice,newslettersent,SMI Swiss Market Index,Switzerland KOF Economic Barometer