Tag Archive: newslettersent

Shrewd Financial Analysis in the Year 2016

“Markets make opinions,” says the old Wall Street adage. Perhaps what this means is that when stocks are going up, many consider the economy to be going great. Conversely, when stocks tank it must be because the economic sky is falling.

Read More »

Read More »

FX Weekly Review, August 29 – September 2: Disappointing Jobs Data Doesn’t Break the Buck

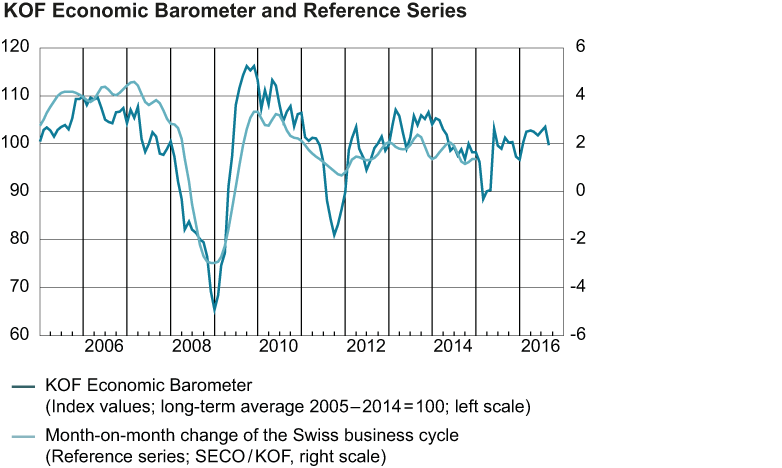

During this week the Swiss Franc index lost against both dollar and euro. The CHF index ended one percent down. Despite not convincing US jobs, the dollar index ended in positive territory.

Read More »

Read More »

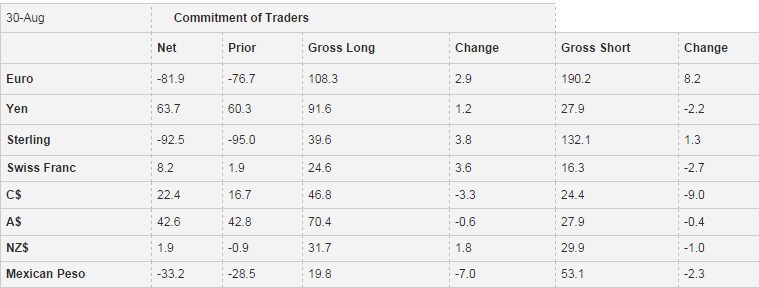

Weekly Speculative Positions: Rising Swiss Franc Longs

Speculative activity remained light in the latest CFTC reporting period ending August 30. There were no gross position adjustments that we recognize as significant; 10k contracts or more. There were only three gross adjustments by speculators of more than 4k contracts. With the higher EUR/CHF FX rate and weaker U.S. jobs date, speculators went long CHF by 8.2K contracts.

Read More »

Read More »

US Jobs Disappoint, Risk of Sept Hike Recedes, Dollar Falls

Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged.

Read More »

Read More »

European and Swiss stocks higher on bank rally

The Swiss Market Index, along with other European markets, is trading slightly higher this week after financials rallied on merger and acquisition rumors and hopes for improved growth. European banks, the industry group battered the most so far this year, lead gains after it emerged that Deutsche Bank AG and Commerzbank AG executives held talks about a potential merger in early August this year.

Read More »

Read More »

Swiss banks cut 4.1 percent of local jobs in first half as profit falls

Banks in Switzerland reduced their domestic workforce by 4.1 percent in the first half as companies combined and made cost cuts to stem declining profitability, a survey by the nation’s main bank association showed.

Read More »

Read More »

How Does It All End? Part II

Low Rates Forever, Nothing much is happening in the money world. The press reports that traders are hanging loose, wondering what dumb thing the Fed will do next. Rumor has it that it may decide to raise rates in September, or maybe November… or maybe not at all.

Read More »

Read More »

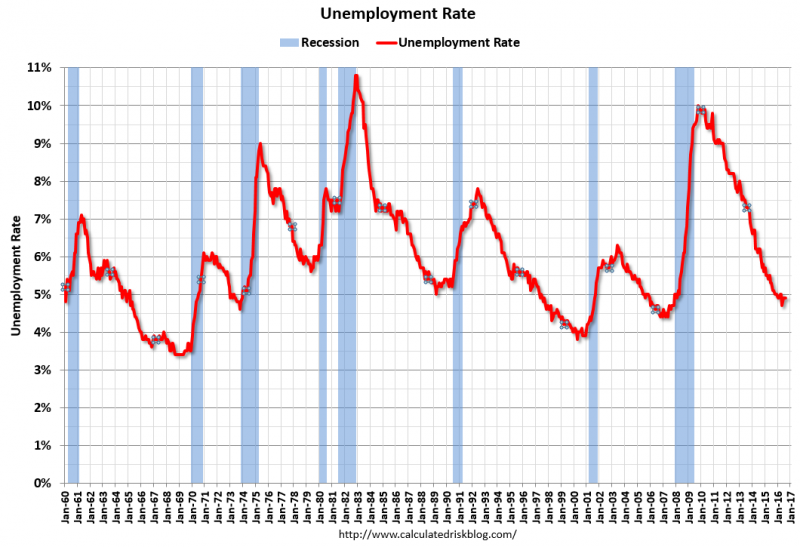

Intriguing Eruditions: The weak month of the stock market

On Tuesday, I noted the end of summer and the entrance into one of the weakest months of the year statistically speaking. “We can confirm BofAML’s point by looking at the analysis of each month of September going back to 1960 as shown in the chart below."

Read More »

Read More »

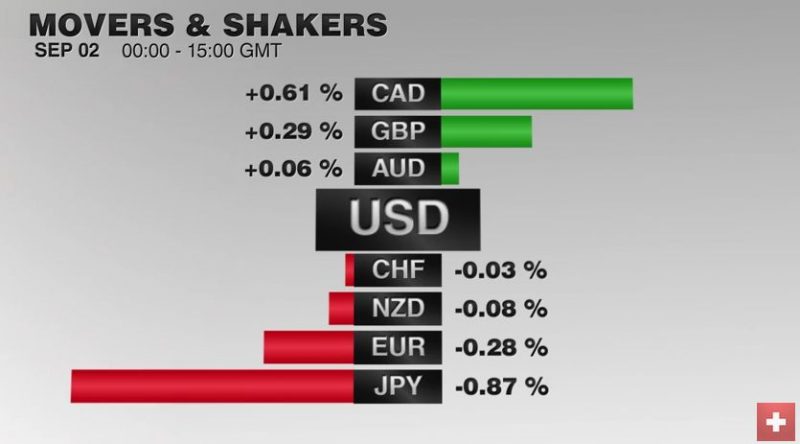

FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More »

Read More »

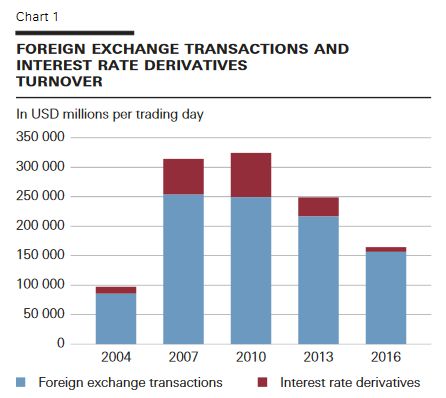

SNB Survey: 2016 Foreign Exchange Turnover

This press release presents the results for a Swiss National Bank (SNB) survey on turnover in foreign exchange and derivatives markets. The request for data was sent to 30 banks that operate in Switzerland and have a sizeable share in the foreign exchange and over-the-counter (OTC) derivatives markets. These banks reported the turnover of their domestic offices.

Read More »

Read More »

FX Daily, September 01: A Couple of Surprises to Start the New Month

The new month has begun with a couple of surprises. The biggest surprise has been the record jump in the UK manufacturing PMI to 53.3 from 48.3. A much smaller rebound was expected in August after the Brexit shock drop in July.

Read More »

Read More »

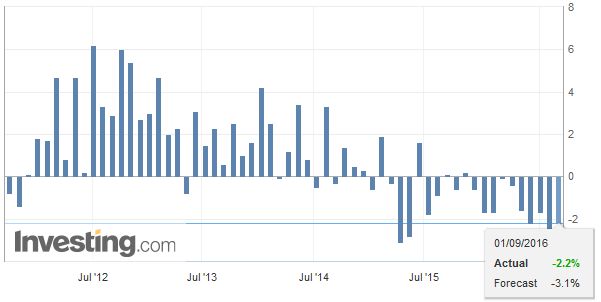

Swiss Retail Sales -2.6 percent nominal (YoY) and -2.2 percent real (YoY)

Turnover in the retail sector fell by 2.6% in nominal terms in July 2016 compared with the previous year. This decrease has been ongoing since January 2015. Seasonally adjusted, nominal turnover rose by 0.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

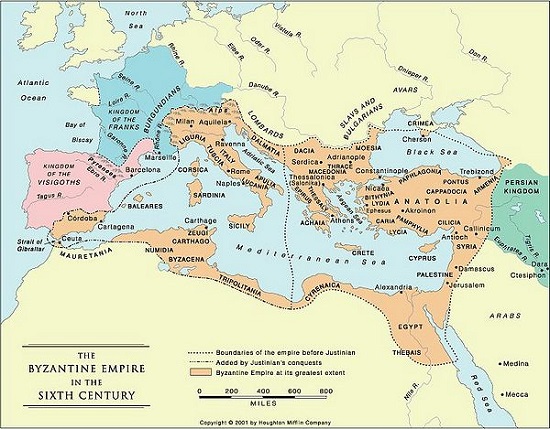

The “Secret Sauce” of the Byzantine Empire: Stable Currency, Social Mobility

One of my reading projects over the past year is to learn more about empires:how they are established, why they endure and why they crumble. To this end, I've recently read seven books on a wide variety of empires. The literature on empires is vast, so this is only a tiny slice of the available books. Nonetheless I think these 7 titles offer a fairly comprehensive spectrum:

Read More »

Read More »

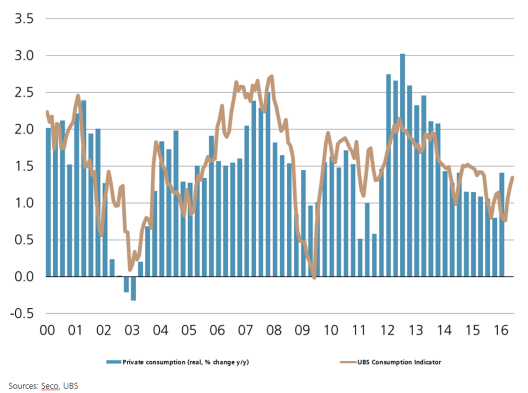

Switzerland UBS Consumption Indicator July: Car buyers turn on cruise control

In July, the UBS consumption indicator rose to 1.32 points from 1.21. A slight downward adjustment of the June figure and above-average car sales generated the increase. However, the disappointing June figures for tourism and sluggish consumer sentiment slightly curbed this upward trend.

Read More »

Read More »

FX Daily, August 31: Dollar Bides Times, Month-End at Hand, Jobs Data Ahead

The US dollar is a little softer against most of the major and emerging market currencies. The exception is the Japanese yen, where the greenback has moved above JPY103 for the first time in a month. The tone is consolidative as the market awaits assurances that the jobs growth this month has been sufficiently strong as to keep the prospects of a September meeting still alive.

Read More »

Read More »

Great Graphic: Oil is Looking Crude

Oil is breaking down. Doubts are growing over output freezes while US inventories rise. The technicals are poor.

Read More »

Read More »

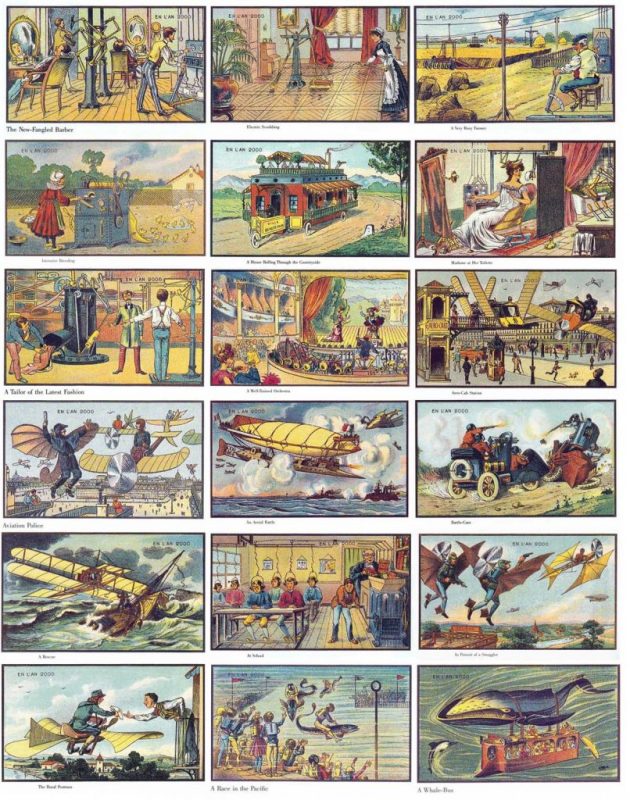

How Does It All End?

In 1900, a survey was done. “What do you see coming?” asked the pollsters. All of those people questioned forecast better times ahead. Machines were just making their debut, but already people saw their potential. You can see some of that optimism on display today in the Paris Metro. In the Montparnasse station is an illustration from the late 1800s of what the artist imagined for the next century.

Read More »

Read More »

Spain’s Political Deadlock Likely Leads to Third Election

Rajoy is hoping to form a minority government this week. It seems unlikely to succeed, which could lead to an election on Christmas. Regional elections and corruption trials may change Spain's political dynamics.

Read More »

Read More »