Tag Archive: newslettersent

Emerging Market Preview: Week Ahead

EM FX has started the week mixed. Some relief was seen as US rates stalled out last week, but this Friday’s jobs number could be key for the next leg of this dollar rally. On Wednesday, the Fed releases its Beige book for the upcoming June 13 FOMC meeting, where a 25 bp hike is widely expected. We believe EM FX remains vulnerable to further losses.

Read More »

Read More »

Gold And Silver Bullion Obsolete In The Crypto Age?

What is the outlook for the global economy, financial markets, crypto currencies such as bitcoin and gold and silver bullion in the digital age? Fresh insights as CrushtheStreet.com interview Mark O’Byrne who gives his diagnosis on the outlook for gold in 2018, and looks at the long-term relevance of precious metals in the digital age of crypto and the blockchain alongside Bitcoin’s emergence as a potential digital store of value.

Read More »

Read More »

Results of the 2017 survey on payment methods

In the autumn of 2017, the Swiss National Bank (SNB) conducted a survey on payment methods for the first time. The aim of the survey is to obtain representative information on payment behaviour and the use of cash by house holds in Switzerland, and to ascertain the underlying motives for this behaviour.

Read More »

Read More »

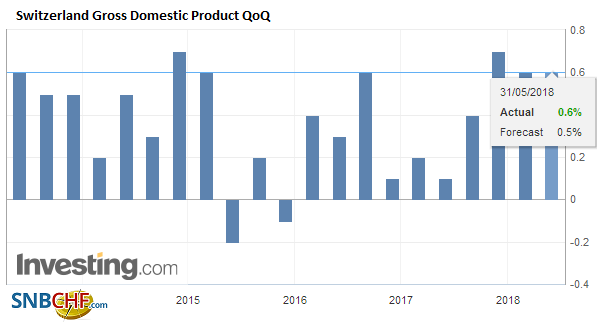

Switzerland GDP Q1 2018: +0.6 percent QoQ, +2.2 percent YoY

Switzerland’s real gross domestic product (GDP) grew by an above-average 0.6% in the 4th quarter of 2017.1 Growth was broad-based across the various business sectors, with manufacturing, construction and most service sectors, particularly financial services, providing momentum. On the expenditure side, growth was underpinned by consumption and investment in construction but was hindered by investment in equipment and foreign trade.

Read More »

Read More »

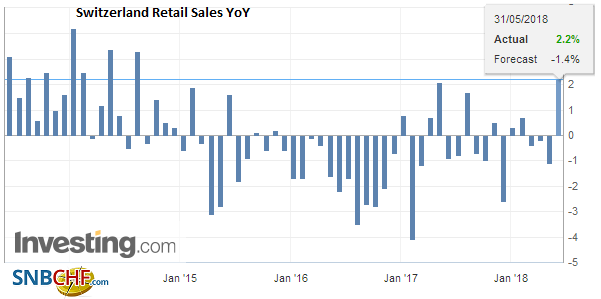

Swiss Retail Sales, April: +2.2 Percent Nominal and -0.1 Percent Real

Turnover in the retail sector rose by 2.2% in nominal terms in April 2018 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Nestlé to cut up to 500 jobs in Switzerland

Swiss food giant Nestlé plans to cut as many as 500 computer-service jobs in Switzerland as part of a restructuring plan to increase profitability, the company announced on Tuesday. Nestlé will be outsourcing the IT jobs to Spain, according to a press releaseexternal link published on the company’s website.

Read More »

Read More »

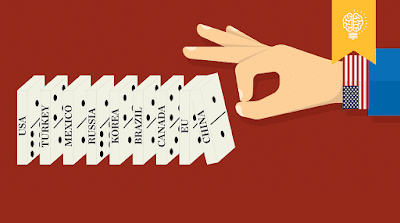

FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today's activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. Moreover, the US push on trade is intensifying again.

Read More »

Read More »

America 2018: Dicier by the Day

Scrape all this putrid excrescence off and we're left with a non-fantasy reality: everything is getting dicier by the day. If we look beneath the cheery chatter of the financial media and the tiresomely repetitive Russian collusion narrative (that's unraveling as the Ministry of Propaganda's machinations are exposed), we find that America in 2018 is dicier by the day.

Read More »

Read More »

Crowdfunding Platforms Boom in Switzerland

Swiss crowdfunding platforms dealt with CHF375 million ($377 million) in 2017, almost three times as much as the previous year. Some 160,000 people supported a crowdfunding project. Over the past eight years, more than half a billion francs have been collected via the “swarm-based form of financing”, said the Lucerne University of Applied Sciences and Arts on Monday.

Read More »

Read More »

FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday's lows. While the political situation in Italy is worrisome, many observers suspect that the new banking rules exacerbated the illiquidity that explains outsized moves.

Read More »

Read More »

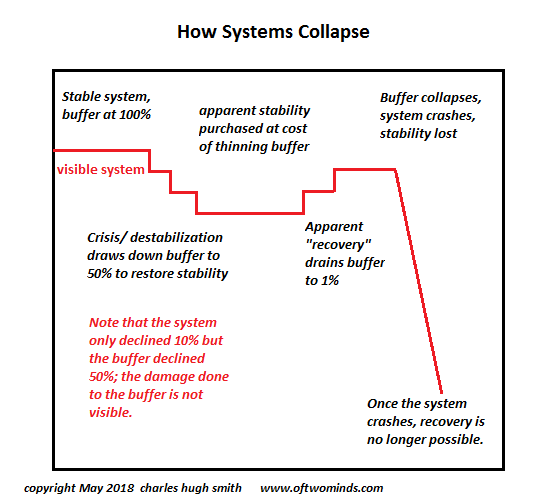

How Systems Collapse

This is how systems collapse: faith in the visible surface of abundance reigns supreme, and the fragility of the buffers goes unnoticed. I often discuss systems and systemic collapse, and I've drawn up a little diagram to illustrate a key dynamic in systemic collapse. The key concepts here are stability and buffers. Though complex systems are never static, but they can be stable: that is, they ebb and flow within relatively stable boundaries...

Read More »

Read More »

Le bilan de la BNS, Une arme de destruction massive

Chers amis lecteurs, voici le drame de la Suisse. Il s’appelle « Politique monétaire non conventionnelle« . Une arme de destruction massive que personne n’ose approcher, ni même aborder! Elle consiste en l’art de se faire un bilan sans bases réelles et avec en contreparties de l’endettement!

Read More »

Read More »

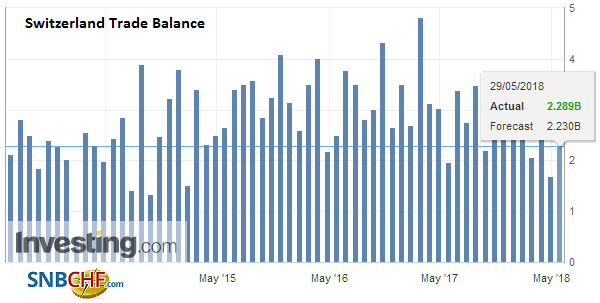

Swiss Trade Balance April 2018: Foreign Trade Caps at a High Level

In recent months, both exports and Swiss imports have been apathetic. On April 1, 2018, and after seasonal adjustment, they respectively stagnated and fell by 3.4%. The chemistry-pharma has sealed the result in both directions of the traffic. The trade balance closed with a surplus of 2.8 billion francs.

Read More »

Read More »

Switzerland second hardest working nation in Europe

Recent statistics show that the average full-time employee in Switzerland worked 42.6 hours a week. This is slightly less than an average Icelander (42.9) – the longest working – but 13% longer than the average in leisurely France (37.4), the european nation putting in the fewest hours.

Read More »

Read More »

What Happened Monday?

Italian politics dominated Monday's activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections.

Read More »

Read More »

“Sell In May And Go Away” – A Reminder: In 9 Out Of 11 Countries It Makes Sense To Do So

Most people are probably aware of the adage “sell in May and go away”. This popular seasonal Wall Street truism implies that the market’s performance is far worse in the six summer months than in the six winter months. Numerous studies have been undertaken in this context particularly with respect to US stock markets, and they confirm that the stock market on average exhibits relative weakness in the summer.

Read More »

Read More »

Les économistes de Suisse disent NON à Monnaie pleine. Sondage KOF.

Les économistes d’universités et d’instituts de recherche de Suisse ont été invités à donner leur avis sur la votation, du 10 juin 2018. Malgré le message ambitieux: « Pour une monnaie à l’abri des crises : émission monétaire uniquement par la banque nationale !», le titre n’a pas suffi à accrocher les répondants à l’enquête d’opinion menée par le Centre de recherche économique KOF de l’Ecole Polytechnique de Zurich.

Read More »

Read More »