Tag Archive: newslettersent

Record restaurant closures blamed on strong franc

More than three times as many pubs and restaurants disappeared in Switzerland last year as the year before. The catering industry points the finger at the strong franc, responsible for more bankruptcies (+4.4%) and fewer new openings (-25%).

Read More »

Read More »

FX Weekly Preview: Political Crises in Europe Rivals Economic Data and Trade to Drive Capital Markets

The end of the Greek assistance program that allowed them to keep their primarily official creditors whole, and the broad expansion in the eurozone, was supposed to usher in a new period of convergence. Monetary union was once again feted as a success, and some observers were forecasting a substantial increase in the euro as a reserve asset.

Read More »

Read More »

Emerging Markets: What Changed

President Trump canceled the planned summit with North Korea’s Kim Jong Un. Malaysia’s new Finance Minister Lim was sworn in along with 13 other cabinet ministers. Philippine central bank cut reserve ratios for commercial banks by one percentage point to 18% effective June 1. The United Arab Emirates opened up its economy to more foreign investment.

Read More »

Read More »

Gold Back Above $1300 – Trump Cancels Historic Summit – Silver “Ready To Breakout”

– Trump Cancels Historic Summit with North Korea. – US 10-Year Falls Below 3%, Gold Jumps Back Above $1300. – “Inflation Overshoot Could Be Helpful” – Latest FOMC Minutes. – Gold Demand in Turkey as Lira falls sharply, true inflation near 40%. – EU Crisis Looming as Italy Plan Outright ‘Money Printing’ with ‘Mini-Bots’. – Silver Trading in Tight $1 range, Pressure Building for a Breakout.

Read More »

Read More »

High Swiss Drug Prices – Campaign Presents a Solution to Swiss government

This week, the Swiss NGO Public Eye, launched a campaign for more affordable medicine in Switzerland under the slogan: protect patients, not patents. The NGO says high prices, of cancer drugs in particular, is not only an issue affecting developing nations but wealthy ones too. It says that cancer treatments in Switzerland often cost over CHF 100,000 a year.

Read More »

Read More »

The Currency of PMI’s

Markit Economics released the flash results from several of its key surveys. Included is manufacturing in Japan (lower), as well as composites (manufacturing plus services) for the United States and Europe. Within the EU, Markit offers details for France and Germany.

Read More »

Read More »

‘Nightmare Scenario’ For EU Bond Markets As Anti-Euro Italian Goverment Takes Power

Firebrand populists of Left and Right are poised to take power in Italy, forming the first “anti-system” government in a major West European state since the Second World War. Leaders of the radical Five Star Movement and the anti-euro Lega party have been meeting to put the finishing touches on a coalition of outsiders, the “nightmare scenario” feared by foreign investors and EU officials in equal measure.

Read More »

Read More »

Switzerland Drops in Economic Competitiveness Ranking

While Switzerland remains in the top five with the same other four countries in this year’s IMD World Competitiveness Ranking, it slipped from second to fifth place. The United States rose from fourth to first, second and third places went to Hong Kong and Singapore, and fourth place to the Netherlands.

Read More »

Read More »

Globally Synchronized Asynchronous Growth

Industrial Production in the United States rose 3.5% year-over-year in April 2018, down slightly from a revised 3.7% rise in March. Since accelerating to 3.4% growth back in November 2017, US industry has failed to experience much beyond that clear hurricane-related boost. IP for prior months, particularly February and March 2018, were revised significantly lower.

Read More »

Read More »

Gold Looks A Better Bet Than UK Property

Dominic Frisby of Money Week looks at the historical relationship between UK house prices and gold (including some great charts), and concludes that your money is better off in the yellow metal than bricks and mortar.

Read More »

Read More »

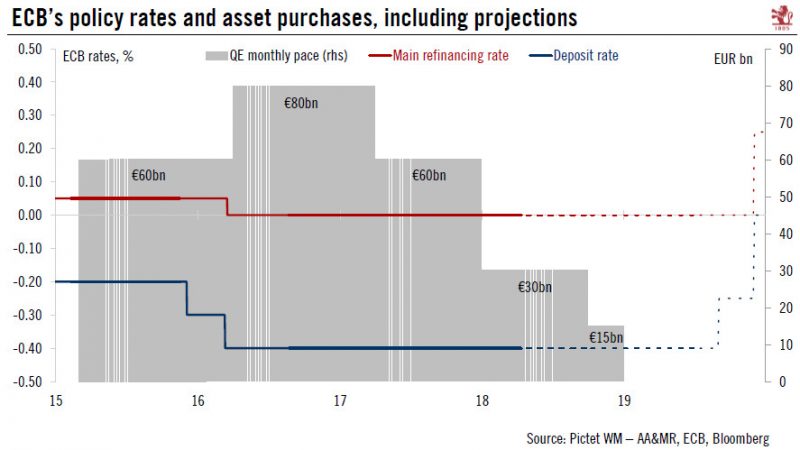

ECB: contingency plans

A look at different scenarios for the ECB’s exit from quantitative easing and its expected rate hiking cycle.Our baseline scenario for ECB normalisation still holds. We expect QE to end in December 2018 and a first rate hike in September 2019. The ECB is likely to wait until its 26 July meeting to make its decisions on QE and forward guidance.Still, downside risks have risen to the point where another open-ended QE extension can no longer be ruled...

Read More »

Read More »

FX Daily, May 25: US Dollar Loses Momentum Ahead of the Weekend

The euro and sterling were sold through yesterday's lows in Asia, but rebounded in Europe, with the help of mildly constructive data in the form of the German IFO and details of UK Q1 GDP. The IFO climate measure matched the April reading and thereby snapped a five-month slide. The expectations component slipped, but the current assessment improved.

Read More »

Read More »

Switzerland Remains in Top Five for Competitiveness Despite Fall

Switzerland has dropped from second to fifth place in an annual ranking of the world’s most competitive economies, whilst the United States have moved up three places to the top. Switzerland’s fall is due mainly to “a slowdown in exports, job growth and international investment”, says the Lausanne-based IMD business schoolexternal link, which compiles the 63-country ranking.

Read More »

Read More »

Sustainability Boils Down to Scale

Only small scale systems can sustainably impose "skin in the game"-- consequences, accountability and oversight. Several conversations I had at the recent Peak Prosperity conference in Sonoma, CA sparked an insight into why societies and economies thrive or fail: It All Boils Down to Scale. In a conversation with a Peak Prosperity member who goes by MemeMonkey, MemeMonkey pointed out that social / economic organizations that function well at small...

Read More »

Read More »

Is Political Decentralization the Only Hope for Western Civilization?

A couple of recent articles have once more made the case, at least implicitly, for political decentralization as the only viable path which will begin to solve the seemingly insurmountable political, economic, and social crises which the Western world now faces.

Read More »

Read More »

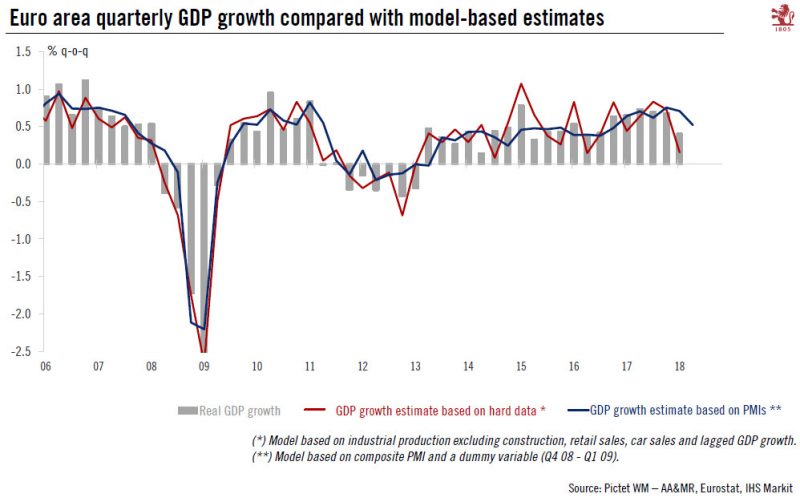

PMIs point to downside risk to near term euro area growth

Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago.

Read More »

Read More »

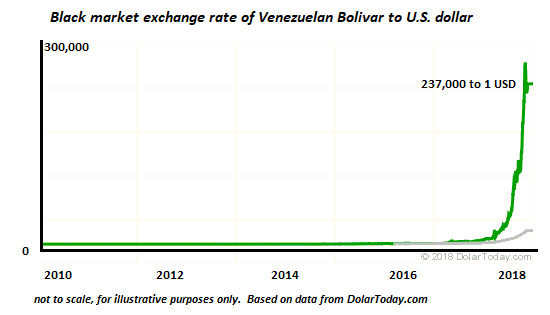

FX Daily, May 24: Greenback Pushes Lower

The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the Canadian dollar. It is also softer against most of the emerging market currencies. The chief exception is the Turkish lira. Yesterday's 300 bp rate hike could only stem the rot momentarily and the lira's 2.3% decline today, wipes out 2/3 of the annual rate increase.

Read More »

Read More »

Swiss pharma suspected of delaying generic competition

The United States Food and Drug Administration (FDA) published Thursday a list of pharmaceutical companies that include Basel-based Novartis and Roche, all of which are suspected of hindering the development of generic versions of their own medicines. Over 150 complaints were filed.

Read More »

Read More »

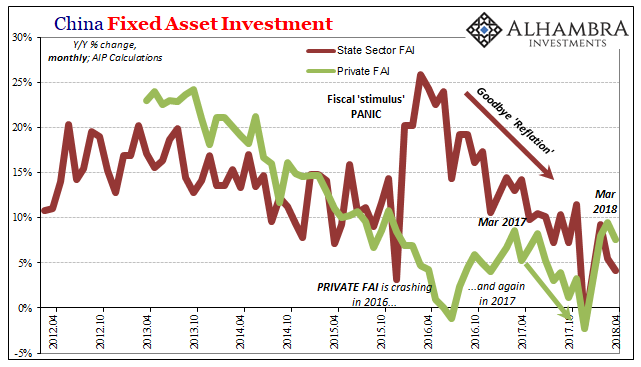

Anchoring Globally Synchronized Growth, Or We Gave Up Long Ago?

January was the last month in which China’s National Bureau of Statistics (NBS) specifically mentioned Fixed Asset Investment (FAI) of state holding enterprises (or SOE’s). For the month of December 2017, the NBS reported accumulated growth (meaning for all of 2017) in this channel of 10.1%. Through FAI of SOE’s, Chinese authorities in early 2016 had panicked themselves into unleashing considerable “stimulus.”

Read More »

Read More »

Tales from “The Master of Disaster”

Daylight extends a little further into the evening with each passing day. Moods ease. Contentment rises. These are some of the many delights the northern hemisphere has to offer this time of year. As summer approaches, and dispositions loosen, something less amiable is happening. Credit markets are tightening. The yield on the 10-Year Treasury note has exceeded 3.12 percent.

Read More »

Read More »