Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago.

The deterioration in business sentiment in France and Germany was likely amplified by transitory factors once again. Outside the two largest euro area countries, activity rebounded to a three-month high.

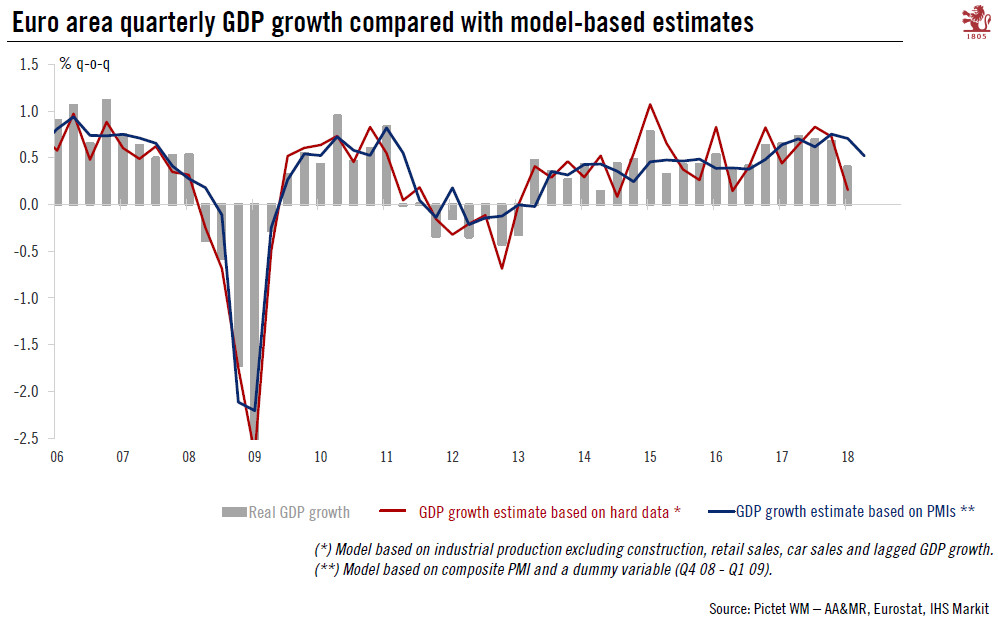

The euro area composite PMI remains consistent with 0.4-0.5% q-o-q growth in Q2, only marginally lower than ECB staff projections. However, downside risks are rising and the ECB is likely to wait until July before it makes a decision on QE.

The timing of the next ECB announcement is no longer the main question, in our view: we expect a decision on QE to be postponed to the 26 July meeting as the ECB waits for additional data to reassess the situation. In the meantime, weaker growth will likely fuel speculation over the ECB’s contingency plans, including the possibility of a longer QE extension aimed at influencing rate hike expectations. We are not there yet, but the risks are rising.

Following another set of disappointing euro area PMI indices, downside risks to the near term growth outlook have increased further. There was no shortage of explanations for the soft patch in Q1 – including strikes, weather conditions, flu, Easter, or capacity constraints – but if the slowdown was extended into Q2, the bigger picture would change.

Markit indicated that some transitory factors have likely weighed on activity once again, including “an unusually high number of public holidays”. For all the noise in the data, it is worth noting that all PMI components remain above their historical average. But, evidence of weaker underlying demand is accumulating with new orders still falling at a worrying pace. Moreover, higher oil prices have fuelled “an ill-timed resurgence in cost pressures” as opposed to the endogenous adjustment in wage growth and core inflation that the ECB is hoping for.

| Тhe euro area composite PMI, down to 54.1 in May, remains consistent with GDP growth of around 0.4-0.5% in Q2, only marginally below the ECB staff assumption of 0.5%, although the whole profile will likely be revised following the Q1 release (0.4% vs 0.7% expected). The timing of the next ECB announcement is no longer the main question, in our view: we expect adecision on QE to be postponed to the 26 July meeting as the ECB waits for additional data to reassess the situation. In the meantime, weaker growth will likely fuel speculation over the ECB’s contingency plans, including the possibility of a longer QE extension aimed at influencing rate hike expectations. We are not there yet, but the risks are rising.

Following another disappointing set of business sentiment indicators, speculation over a longer extension of QE is rising. |

Eurozone GDP growth |

|

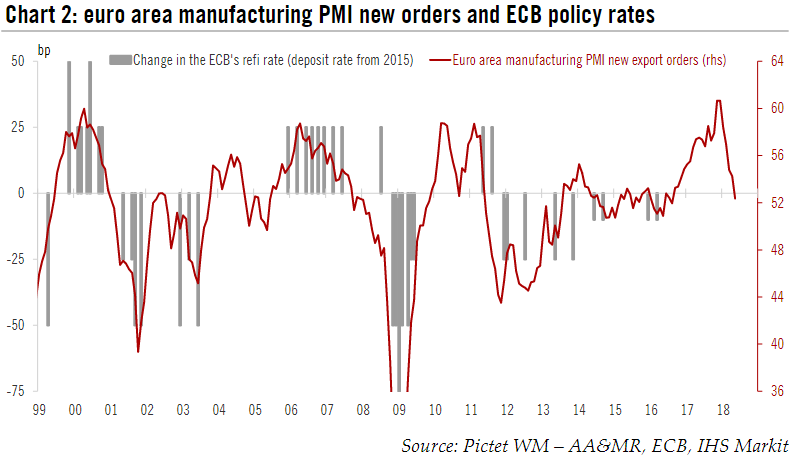

Markit noted that oil prices and rising wages were pushing costs higher, but “weak final demand means firms are struggling to pass these higher costs onto customers”. In ECB jargon, the “ hawkish moderation” scenario is being challenged by the data. Note that for the first time in nearly two years, one PMI component fell back in to ECB easing territory (manufacturing PMI new export orders, see Chart 2), although other forward-leading indicators as well as price pressure gauges remained in tightening territory.

We have maintained our 2018 euro area GDP growth forecast of 2.3% in the wake of surprisingly strong data in late 2017. The weakness in Q1 data was broadly consistent with our projections. The risks have now clearly moved to the downside as GDP growth may be edging closer to our estimate of potential at a faster pace than we expected.

|

Eurozone Manufacturing PMI and Policy Rates |

|

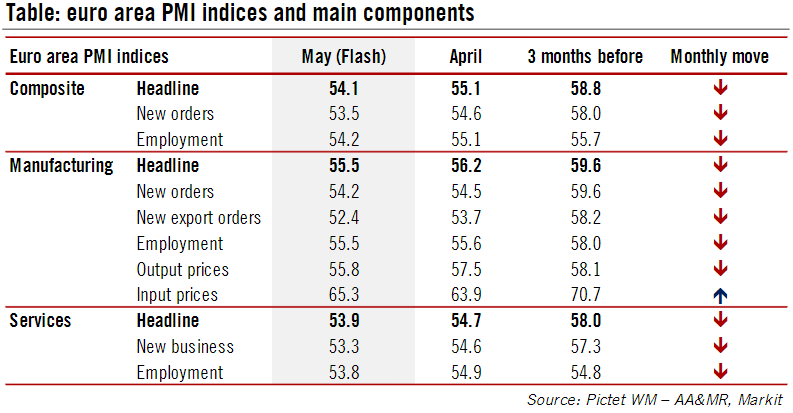

Looking at the details, the euro area flash PMI decreased for a fourth consecutive month, by 1.0 points to 54.1 in May, below consensus expectations (55.1). Activity eased both in the services (-0.8 point to 53.9) and manufacturing sector (-0.7 point to 55.5). Manufacturing new export orders fell for the fifth month in a row, to a 21-month low. Employment softened in the services sector. Meanwhile PMIs remained consistent with capacity being constrained albeit to a lesser extent than in the previous month.

In France, the flash PMI indices disappointed due to a large fall in the services sector, from 57.4 to 54.3 in May, a 16-month low consistent with a further loss of momentum in the private sector. Markit provided little information as regards the drivers of the weakness in business sentiment, although we suspect that strikes in the transportation sector weighed on activity. The good news came from an unexpected rebound in the manufacturing PMI, from 53.8 to 55.1, where the pace of growth was in line with the average over the expansion cycle. Overall details were mixed, including in terms of new orders, employment and input prices, with firms reporting pressure from higher wages and fuel costs. Our expectation remains that a broader set of indicators, including national business surveys, will remain consistent with a modest rebound in activity in Q2, following 0.3% q-o-q GDP growth in Q1, but downside risks have clearly increased.

In Germany, flash PMIs weakened across the board albeit by a smaller margin than French indices , to 56.8 in the manufacturing sector (15-month low) and 52.1 in the services sector (20 -month low). Markit once gain noted that transitory factors may have distorted the data, including “some anecdotal evidence suggesting that the timing of public holidays during the month has led to workers taking days off to bridge the holidays and weekends”. Still, the PMIs provided additional evidence of weaker underlying demand as reflected in a drop in forward-looking indicators such new orders. While external demand remained stronger overall, export orders did soften as well.

Last but not least, Markit indicated that outside the two largest euro area countries, “growth accelerated to a three-month high across the rest of the region as a whole”. With business sentiment likely to remain under pressure in Italy, we suspect that Spain was the main (only) driver of upside surprises in the PMIs in May.

|

Eurozone PMI Table |

Full story here Are you the author? Previous post See more for Next post

Tags: euro area growth,Macroview,newslettersent