Tag Archive: newslettersent

Davos Staff May Sleep In Shipping Containers As Billionaires Swarm Resort

With January just around the corner, the world's billionaires, CEOs, politicians and oligarchs prepare to take their private planes to Davos, Switzerland for their annual convocation at the World Economic Forum, where they discuss such diverse topics as global warming due to greenhouse gases (which exempts Gulfstream jets) and the dangers of record wealth inequality (which exempts them), while snacking on $39 hot dogs and $50 Caesar salads.

Read More »

Read More »

Fake News? It’s All Fake!

BALTIMORE – In January of this year, the Empire Herald reported that a “meth-addled couple” had eaten a homeless man in New York City’s Central Park. Later, Now8News reported that a can of cookie dough had “exploded in a woman’s vagina”; the woman was alleged to be shoplifting.

Read More »

Read More »

A Tale of Two Housing Markets: Hot and Not So Hot

If we had to guess which areas will likely experience the smallest declines in prices and recover the soonest, which markets would you bet on?

Read More »

Read More »

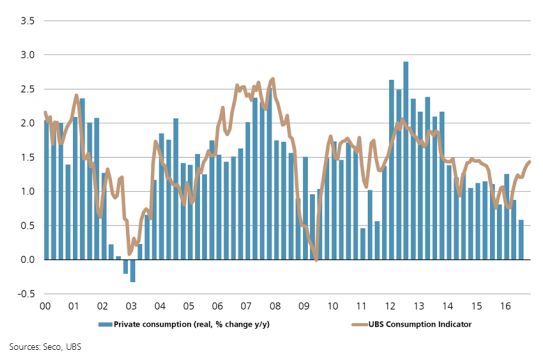

Switzerland UBS Consumption Indicator November: Subdued private consumption in 2017 despite solid November figures

The UBS Consumption Indicator climbed to 1.43 points in November from 1.39. Another strong month in domestic tourism and the positive trend on the automobile market made the rise possible. Initially a solid start is to be expected for 2017, but momentum is expected to subside.

Read More »

Read More »

Cool Video: Double Feature on Bloomberg

I am finishing the year like I began it, on Bloomberg Television, talking about the dollar and Fed policy. Bloomberg has made two clips of my interview available.

Read More »

Read More »

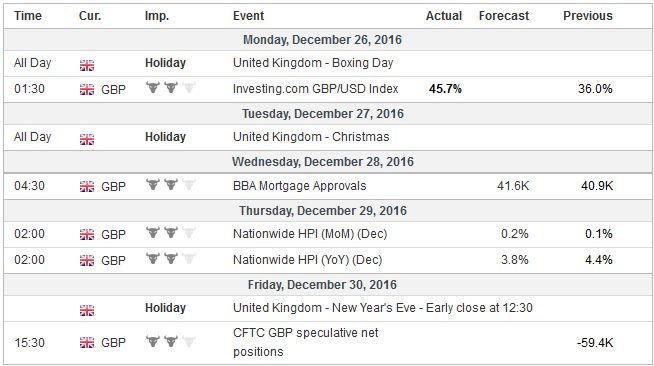

FX Daily, December 28: Short Note for Holiday Markets

Economic data: Japan stands out with industrial production in Nov rising 1.5%, the most in five months. It was a little less than expected, but the expectations for Dec (2%) and Jan (2.2%) are constructive.

Read More »

Read More »

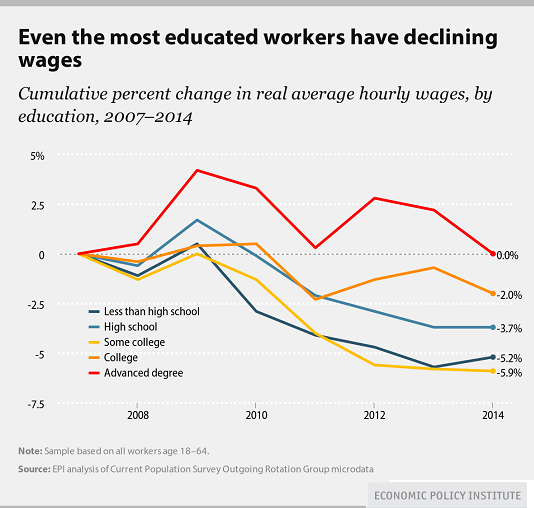

Great Graphic: Real Wages

This Great Graphic caught my eye. It was tweeted by Ninja Economics. Her point was about immigration. German had much higher immigration than the UK, but also saw real wage increase of nearly 14% in the 2007-2015 period, while real wages in the UK fell nearly 10.5%.

Read More »

Read More »

Grab-Bag of Resolutions for 2017

Here's a grab-bag of resolutions with something for just about every persuasion. I resolve to never utter or write the word "Trump" in 2017. (Good luck with that...)

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: SNB intervenes, while Speculators go Long CHF

The Fed has hiked rates and with this fait accomplis speculators sold the news. They closed their short CHF and opened new CHF longs. The SNB, however, intervened again for 0.5 billion CHF.

Read More »

Read More »

FX Daily, December 27: Markets Becalmed in Wait-and-See Mode

As skeleton teams return to the trading desks in New York, the US dollar is largely where they left it at the end last week. Japanese markets were open yesterday, while UK, Australia, New Zealand, Hong Kong and Canadian markets are still closed today.

Read More »

Read More »

Crisis of Meaning = Crisis of Work

Allow me to connect two apparently unconnected dots. Dot #1: The last sugar plantation in Hawaii is closing down, ending more than a century of plantation life in the 50th state.

Read More »

Read More »

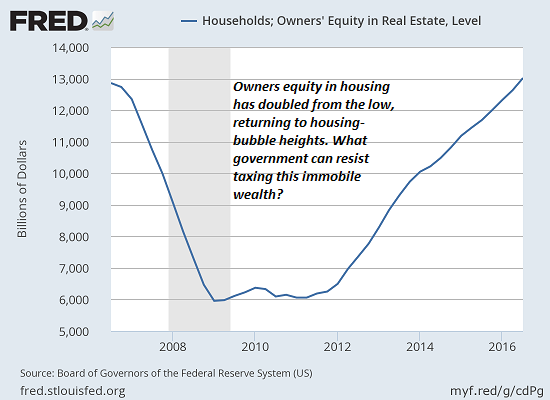

When Assets (Such as Real Estate) Become Liabilities

It will be the middle class that accepted the notion that "real estate is the foundation of family wealth" that will be stripmined by higher taxes on immobile assets such as real estate.

Read More »

Read More »

FX Outlook 2017: Politics to Eclipse Economics

Investors are familiar with a broad set of macroeconomic variables that often drive asset prices. Many are familiar with corporate balance sheets, price-earning ratios, free cash flow, Q-ratio, and the like.

Read More »

Read More »

Weekly Speculative Positions: After Fed Rate Hike, Speculators Close their Short CHF and Open Long CHF

The expiry of the December currency futures may spurred more than normal speculative position adjusting. The out-sized 27.9k contract jump in the speculative gross long Swiss franc futures position is a prime example.

Read More »

Read More »

FX Weekly Review, December 19 – December 23: Assessment of the Dollar’s Technical Condition

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM gained some limited traction as last week ended. However, renewed concerns about China could limit this bounce as President Xi signaled the possibility that growth could fall below the government’s 6.5% target.

Read More »

Read More »

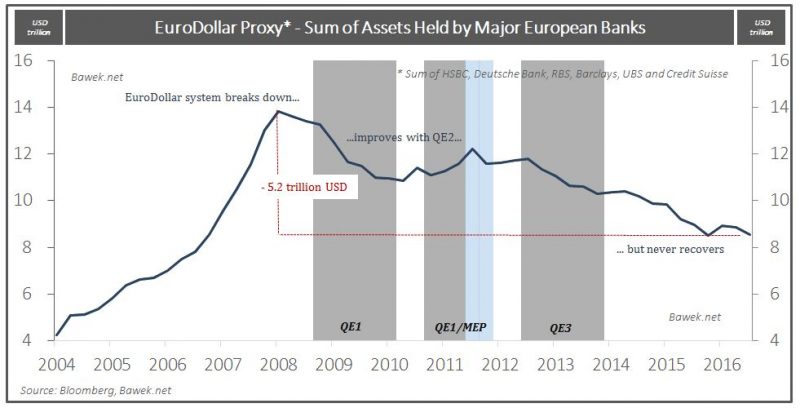

How to Invest in the New World Order

In our latest Toward a New World Order, Part III we ended by promising to look closer at investment implications from the political and economic shift we currently find ourselves in; and that story must begin with the dollar.

Read More »

Read More »