Tag Archive: newslettersent

Cool Video: CNBC’s Power Lunch-China and Mexico

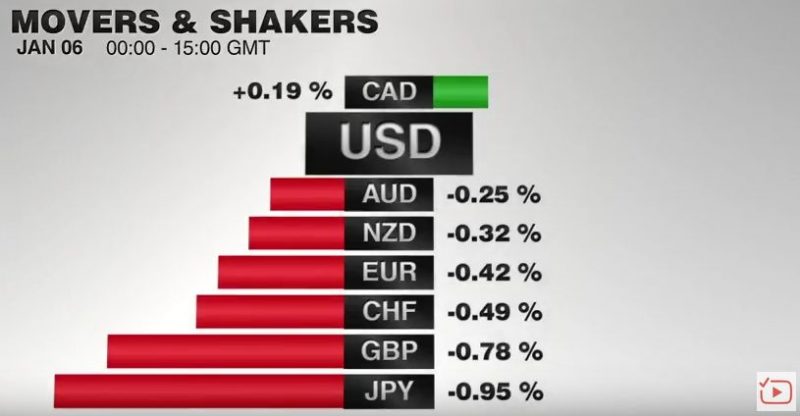

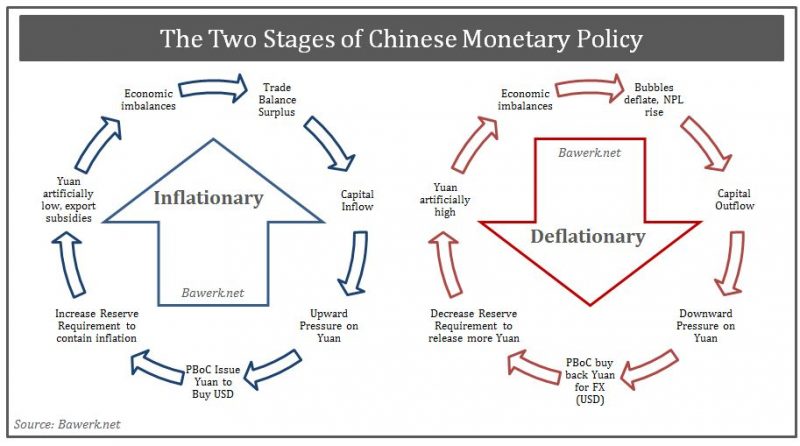

Two central banks were particularly active today. Chinese officials appear to be engineering short squeeze that has lifted the yuan 1.2% over the past two sessions. While this does not sound like much, it is a record two-day move, for the still closely managed currency.

Read More »

Read More »

2016 saw fewer passengers on Switzerland’s highest railway

The train, which takes sightseers to the Jungfraujoch in the Bernese Alpes, carried 916,500 passengers in 2016, significantly fewer than the year before. In 2015, a record 1,007,000 made the journey.

Read More »

Read More »

We Can Only Afford One, So Choose Wisely: Social Security/Medicare, Cartel Cronyism or Inflation (a.k.a. Central Banking)

Here's the problem with central banks seeking higher inflation: costs go up but wages don't. It's easy to quantify the annual cost of Social Security/Medicare, and not so easy to calculate the cost of Cartel Cronyism and Central Bank-created inflation.Cartel cronyism is a hidden tax on the entire economy, as is Central Bank-created inflation.

Read More »

Read More »

FX Daily, January 06: Dollar Consolidates Losses, Peso Firms while Yuan Reverses

I am reading a lot about the pound in 2017 which is likely to be as volatile as in 2016. But the Franc is a harder beast to predict. Loosely tracking the euro but subject to its own rules and trends GBPCHF could be an interesting pair to watch in 2017. There are numerous global events which can shape the direction on the Franc and clients looking to exchange pounds into Francs or move Francs back to the UK should be considering the path ahead.

Read More »

Read More »

Switzerland Consumer Price Index in December 2016: 0.0 percent against 2016, -0.1 percent against last month

Energy prices in Switzerland turned around from a minus 2.4% in November to a +6.8% in December. Oil prices had seen its trough exactly one year ago.

Especially in Germany and Spain, this translated into inflation rates, that are close to the ECB target rate of 2%.

Read More »

Read More »

A Few Thoughts Ahead of the US Jobs Report

ADP and Non-Manufacturing ISM lend credence to our fear of a disappointing national jobs report. Economists estimate only a small part of the manufacturing jobs loss can be traced to trade policy. 19 states increased min wage at the start of the year, but the impact on the nation's average weekly earnings will likely be too small to detect.

Read More »

Read More »

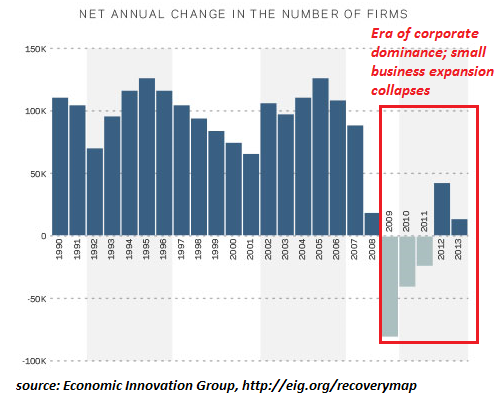

Prosperity = Abundant Work + Low Cost of Living

If we seek a coherent context for the new year, we would do well to start with the foundations of widespread prosperity. While the economy is a vast, complex machine, the sources of widespread prosperity are not that complicated: abundant work and a low cost of living.

Read More »

Read More »

FX Daily, January 05: Dollar Slide but Resilience Demonstrated while Yuan Squeezed Higher

There are two main developments. First, the high degree of uncertainty expressed in the FOMC minutes and the repeated references to the strong dollar spurred a wave of dollar selling. The dollar retreated in Asia, but European participants saw the pullback as a new buying opportunity.

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

Fragmentation and the De-Optimization of Centralization

Many observers decry the loss of national coherence and purpose, and the increasing fragmentation of the populace into "tribes" with their own loyalties, value systems and priorities. These observers look back on the national unity of World War II as the ideal social standard: everyone pitching in, with shared purpose and sacrifice. (Never mind the war killed tens of millions of people, including over 400,000 Americans.)

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

FX Daily, January 04: Consolidation in Capital Markets

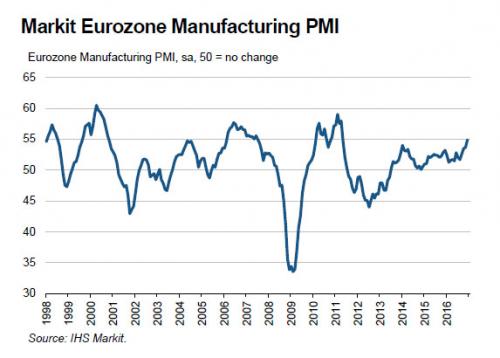

GBP/CHF rates have jumped during the first official day of trading in 2017, with the pair hitting 1.2657 at today’s high. The Pound gained support this morning following positive UK Manufacturing data, which came in well above market expectation. This increased market confidence in the UK economy and the Pound has ultimately benefited as a result, gaining a cent on the CHF.

Read More »

Read More »

A Few Takeaways from the Latest IMF Reserve Figures

Overall reserve holdings hardly changed in Q3. China continues to bleed its reserves from unallocated to allocated. Sterling's share of new reserves warns it may be losing some allure.

Read More »

Read More »

Chinese Philosopher Kings, Losing their Yuan FX Religion?

It took a while, but the world are slowly coming to grips with the simple fact that the red-suzerains in Beijing are not the infallible leaders en route to a new superior economic model as they thought they were. All the craze that emanated from the spurious work of Joshua Cooper Ramo, which eventually led to works like “How China’s Authoritarian Model Will Dominate the Twenty-First Century,” are slowly catching up to reality.

Read More »

Read More »

European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia's major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April 2011.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: SNB Intervenes, Speculators Short CHF again

Last week's data: FX: EUR/CHF was between 1.07 and 1.0750. SNB sight deposits: SNB intervenes for 0.7 bn. CHF at the EUR/CHF 1.07 level. CHF Speculative Positions Speculators went net short CHF with 10K contracts, this is still far from the 26.K contracts record.

Read More »

Read More »

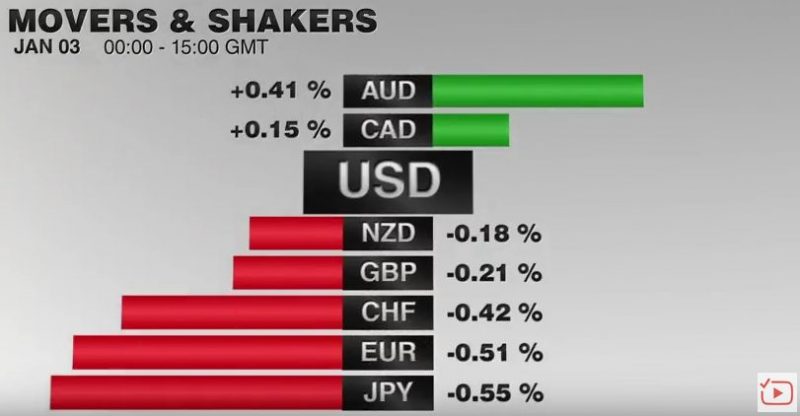

FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling's earlier losses were recouped following news that the manufacturing PMI jumped to 56.1, its highest since June 2014.

Read More »

Read More »