Tag Archive: newslettersent

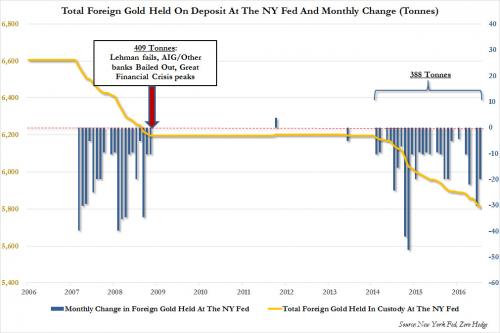

Gold Withdrawals From The NY Fed Accelerate, Hit 388 Tons Since 2014

First it was Germany who redeemed 120 tons of physical gold from the NY Fed in 2014; then it was the Netherlands who "secretly" redomiciled 122 tons of gold; then last May, we learned that Austria would be the third "core" European nation to repatriate most of its offshore gold, held primarily in the Bank of England, redepositing it in Vienna and Switzerland.

Read More »

Read More »

Finland Unleashes Helicopter Money In “Greatest Societal Transformation Of Our Time”

Finland is about to launch an experiment in which a randomly selected group of 2,000–3,000 citizens already on unemployment benefits will begin to receive a monthly basic income of 560 euros (approx. $600). That basic income will replace their existing benefits. The amount is the same as the current guaranteed minimum level of Finnish social security support.

Read More »

Read More »

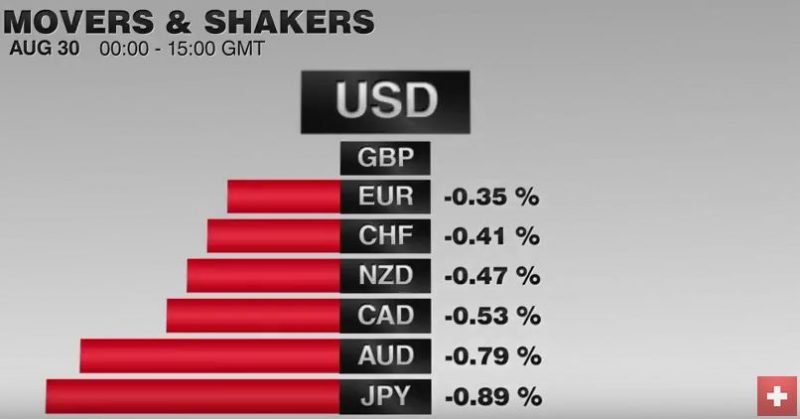

FX Daily, August 30: Greenback Remains Firm, Awaiting Fresh Cues

The US dollar is trading firmly, largely within yesterday's ranges. The odds implied by the September Fed fund futures eased to 36% from 42% before the weekend, but ahead of Fischer's Bloomberg TV appearance, and tomorrow's ADP employment estimate, the market seems cautious about fading the dollar's strength.

Read More »

Read More »

Natural Rates and Terminal Fed Funds

The neutral or natural interest rate is linked to potential growth. Potential growth has fallen so has the neutral rate. The implication is that the FOMC has made the bulk of the adjustment on its long-term Fed funds forecast.

Read More »

Read More »

US Presidential Election – How Reliable are the Polls?

Is Clinton’s Lead Over Trump as Large as Advertised? Once upon a time, political polls tended to be pretty accurate (there were occasional exceptions to this rule, but they were few and far between). Recently there have been a few notable misses though. One that comes to mind is the Brexit referendum.

Read More »

Read More »

Central Banks = Welfare for the Wealthy

The fact that central banks provide welfare for the wealthy is now entering the mainstream. The fact that all central bank policies since 2008 have dramatically increased wealth and income inequality is now grudgingly being accepted as reality by mainstream economists and the financial media. The central banks' PR facade of noble omniscience on behalf of the great unwashed masses has cracked wide open.

Read More »

Read More »

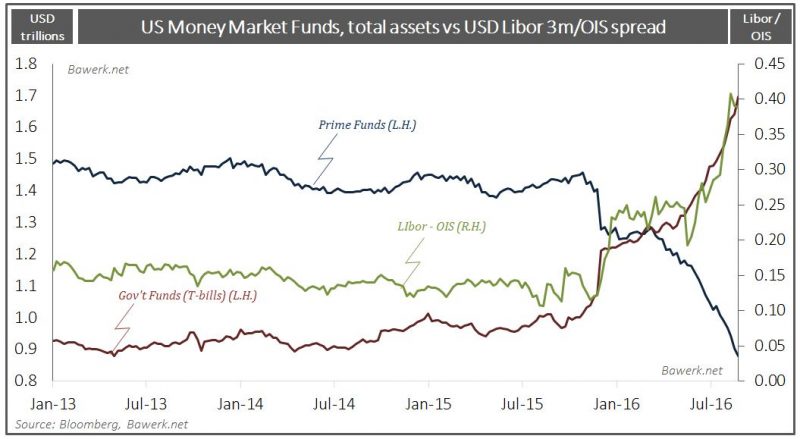

Mission Creep – How the Fed will justify maintaining its excessive balance sheet

FOMC have changed their normalizing strategy several times and we now see the contours of yet another shift. The Federal Reserve was supposed to reduce its elevated balance sheet before moving interest higher as it would be impossible to increase the fed funds rate in the old fashioned way when the market was saturated with trillions of dollars in excess reserves.

Read More »

Read More »

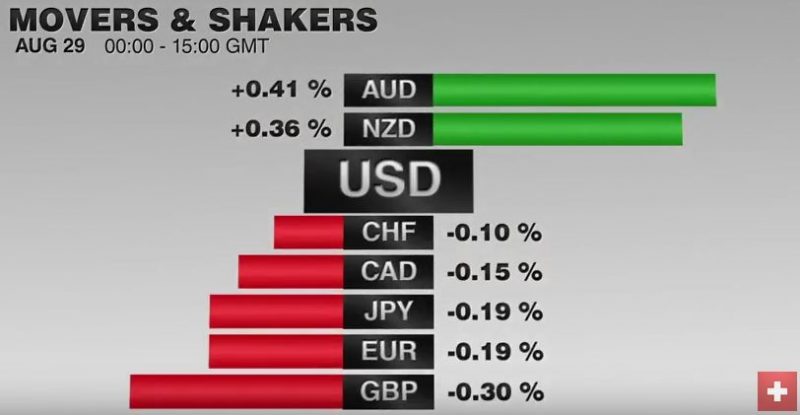

FX Daily, August 29: Dollar Gains Extended, but Momentum Fades

The US dollar staged a strong pre-weekend rally on hints that the Fed will raise rates before the end of the year. There was initially follow through dollar buying in Asia before a more stable tone emerged in Europe, where London markets are closed for a bank holiday. The easing of the dollar’s upside momentum may set the stage for a bout of profit-taking later today and tomorrow.

Read More »

Read More »

Great Graphic: Low Wages in US Rising

The bottom of the US wage scale is rising. The added wage costs are being blunted by less staff turnover, hiring and training costs. It is consistent with our expectation of higher price pressures.

Read More »

Read More »

Trump By a Landslide?

If we believe the mainstream media and the Establishment it protects and promotes, Trump has no chance of winning the presidential election. For starters, Trump supporters are all Confederate-flag waving hillbillies, bigots, fascists and misogynists. In other words, "good people" can't possibly vote for Trump.

Read More »

Read More »

The Idea that Overseas Manufacturing Jobs will Return to the US is Pure Fantasy

As we enter the final lap of the presidential race in the United States, as always, the two candidates will say just about anything to secure your vote. And of course the economy is a major topic of conversation. Loud calls for both higher wages and more jobs dominate the rhetoric. Naturally, Hillary Clinton and Donny Trump claim they can easily solve both of these problems. I can only laugh at their certitude. They are so wrong… and like true...

Read More »

Read More »

Loose Monetary Policy and Social Inequality

It has been almost eight years since former U.S. President George W. Bush warned the world that “without immediate action by Congress, America could slip into a financial panic and a distressing scenario would unfold.” The government’s response to the crisis was a USD700 billion rescue package that was supposed to prevent U.S. banks from collapsing and encourage them to resume lending, which was soon to be followed by a series of Quantitative...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note, as Fed tightening expectations ratcheted up.The December Fed funds futures contract has an implied yield of 0.5%,the highest since June 2. Note that on June 3, US rates plunged after the May jobs shocker (+38k). If the hawkish Fed storyline can be maintained, then EM will have trouble getting traction. This Friday’s jobs report for August will be key, with consensus at +185k vs. +255k in July.

Read More »

Read More »

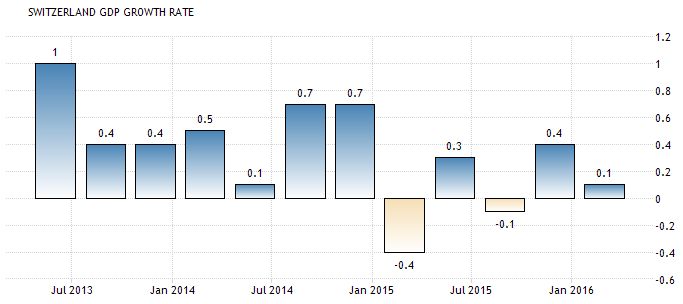

Swiss national accounts 2015: Slow GDP growth in 2015

In 2015 the Swiss economy registered a growth in gross domestic product (GDP) of 0.8% at the previous year's prices (+2.0% in 2014). Taking a slight decrease in the general price level into account, GDP at current prices grew by 0.3% (2014: +1.4%). This modest increase is in keeping with a difficult monetary environment. The gross national income (GNI) at current prices registered an increase of 1.6% following an improved balance of income with...

Read More »

Read More »

FX Weekly Preview: Yellen Pushes Divergence Front and Center

The summer dynamics of the capital markets has changed by the enhanced prospects of a Fed hike. Equity markets and other risk assets look particularly vulnerable. Sterling may do better against the euro than the dollar.

Read More »

Read More »

FX Weekly Review, August 22 – August 26: Swiss Franc Loses Most Gains Again

After winning 5% against the dollar index last week, the Swiss Franc index lost 3% again. CHF lost against both USD and EUR. Reason: An increased probability of a rate hike in the U.S.

Read More »

Read More »

Wir wollen nicht in die EU. Stoppt diese SNB!

Politischen Druck auf die SNB hält Wirtschaftsprofessor Aymo Brunetti für „fatal in einer derart schwierigen Situation“. Dabei macht die SNB Politik, sie führt die Schweiz in den Euro.

Read More »

Read More »

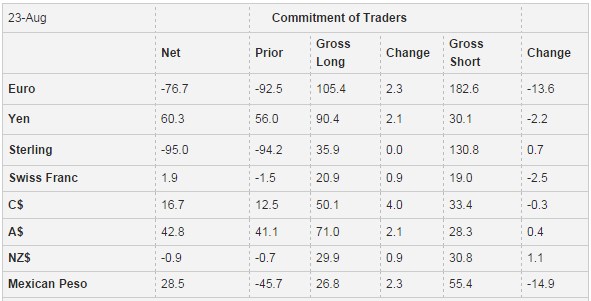

Weeky Speculative Positions: Euro Shorts Trimmed, More Sterling Shorts, Long CHF again

Three weeks ago speculators went net short in CHF, when the U.S. jobs report was published. Now the net position shifted to long again. Last week GBP shorts increased but Euro Shorts were reduced.

Read More »

Read More »

Emerging Markets: What has Changed

Reserve Bank of India Deputy Governor Patel has been named to succeed Governor Rajan. Political risk is back in South Africa. The Colombian government and the FARC rebels have reached a final peace agreement. S&P cut the outlook on Mexico’s BBB+ rating from stable to negative.

Read More »

Read More »