Tag Archive: newslettersent

Swiss Industrial Production Q2: Minus 1.2 percent YoY, Construction: Minus 4.1 percent YoY

Industrial production in the secondary sector declined 1.6% in 2nd quarter 2016 in comparison with the same quarter a year earlier. Turnover fell by 2.6%.

Read More »

Read More »

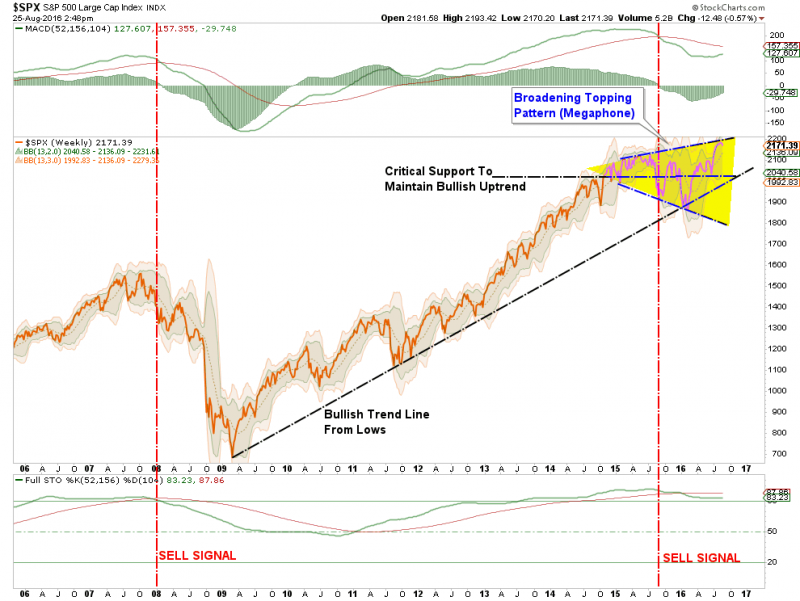

Weekend Reading Negative Rates: The Coin Flip Market

As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party.

Read More »

Read More »

FX Daily, August 26: And now for Yellen…

Yellen's presentation at Jackson Hole today is the highlight of the week. It also marks the end of the summer for many North American and European investors. It may be a bit of a rolling start for US participants, until after Labor Day. However, with US employment data next Friday, many will return in spirit if not in body.

Read More »

Read More »

Market round up – all eyes on Jackson Hole

The Swiss Market Index along with global stocks are trading flat this week ahead of Federal Reserve’s Janet Yellen’s Friday speech at the central bank’s annual Jackson Hole Summit.

Read More »

Read More »

China’s Great Divide: A New Cultural Revolution?

In Asia, it's generally seen as unpatriotic to criticize one's country in public, even if you disagree with its direction and leadership. The cultural norm is to maintain the "face" of one's country by hiding its ills from outsiders. This reticence is especially evident in China, which suffers from the memory of being subjugated by the Western imperialist powers in the late 19th century and early 20th century.

Read More »

Read More »

FX Daily, August 25: Narrow Ranges Prevail as Breakouts Fail

The US dollar remains mostly within the ranges seen yesterday against the major currencies.The market awaits fresh trading incentives and the end of the summer lull, which is expected next week. The Jackson Hole Fed gathering at which Yellen speaks tomorrow is seen as the highlight of this quiet week.

Read More »

Read More »

‘Last Economist Standing’ John Taylor Urges “Less Weird Policy” At Jackson Hole

I attended the first monetary-policy conference there in 1982, and I may be the only person to attend both the 1st and the 35th. I know the Tetons will still be there, but virtually everything else will be different. As the Wall Street Journal front page headline screamed out on Monday, central bank Stimulus Efforts Get Weirder. I’m looking forward to it.

Read More »

Read More »

Negative interest pushes Switzerland’s 2016 budget into positive territory

Switzerland’s budget for 2016 is looking better than expected. Instead of a shortfall of CHF 0.5 billion, the latest figures forecast a surplus of CHF 1.7 billion. Overall income was up CHF 1.2 billion and costs were down CHF 1.0 billion. This CHF 2.2 billion shift took the annual forecast from CHF -0.5 billion to CHF 1.7 billion. The biggest driver of the change was the effect of negative interest rates.

Read More »

Read More »

FX Daily, August 24: Narrowly Mixed Greenback in Summer Churn

The US dollar is going nowhere fast. It is narrowly mixed against the major currencies. The market awaits for fresh trading incentives, with much hope placed on Yellen's presentation at Jackson Hole at the end of the week. Is it too early to suggest that the build-up ahead of it is too much?

Read More »

Read More »

Great Graphic: GDP Per Capita Selected Comparison

US population growth has been greater than other major centers that helps explain why GDP has risen faster. GDP per capita has also growth faster than other high income regions. The US recovery is weak relative to post-War recoveries but it has been faster than anticipated after a financial crisis and shows little evidence of secular stagnation.

Read More »

Read More »

Britain’s Brexit binge on Swiss watches

The pendulum for Britain has swung back to positive, and it’s tourists who’ve pushed it there.Britain was one of the few bright spots for Swiss watch exports in July, rising 13.4 percent from a year earlier and counteracting a massive 26 percent drop in June, according to data published by the Federation of the Swiss Watch Industry on Tuesday.

Read More »

Read More »

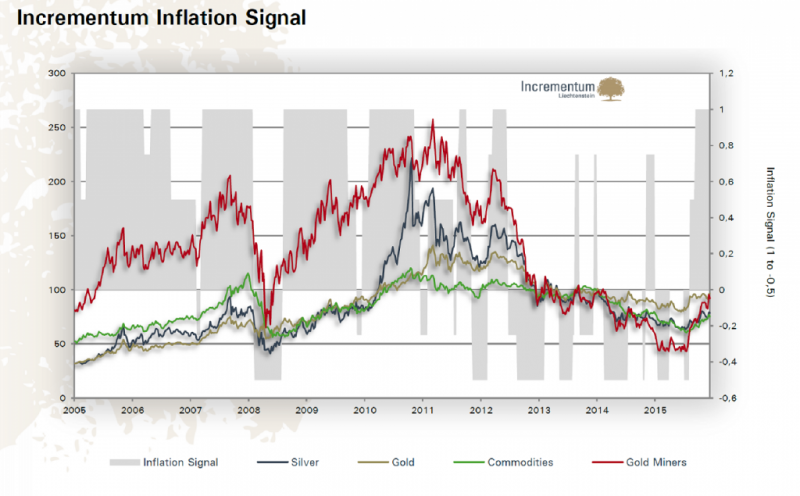

Incrementum Advisory Board Meeting, July 2016

The quarterly meeting of the Incrementum Fund’s advisory board was held on July 19. A pdf transcript of the discussion can be downloaded via the link below. We were once again joined by special guest Brent Johnson, the CEO of Santiago Capital. One topic: Helicopter money.

Read More »

Read More »

Party Like It’s 1999

OUZILLY, France – The farther you get from the big city, or the international press… the closer you get to reality. The myth and claptrap disappears as distance shortens. Imagination gives way to fact. Gone is global warming, for instance. Instead, you find – as we did when we drove to Nova Scotia for a summer holiday in the 1990s – that it will be “75 degrees in Halifax again today… No relief in sight.”

Read More »

Read More »

What Are the Odds that the 2020-2022 Olympics Will Be Cancelled?

In the modern era (1896-present), the Olympics have only been cancelled in wartime: 1916 (World War I), 1940 and 1944 (World War II). But world war is not the only circumstance that could derail the Olympics; a global crisis in energy, finance or geopolitics could send the risks and costs of the Olympics beyond the reach of most participants.

Read More »

Read More »

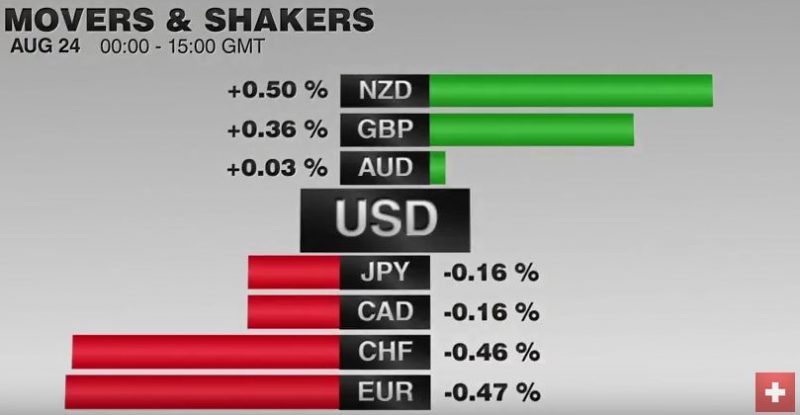

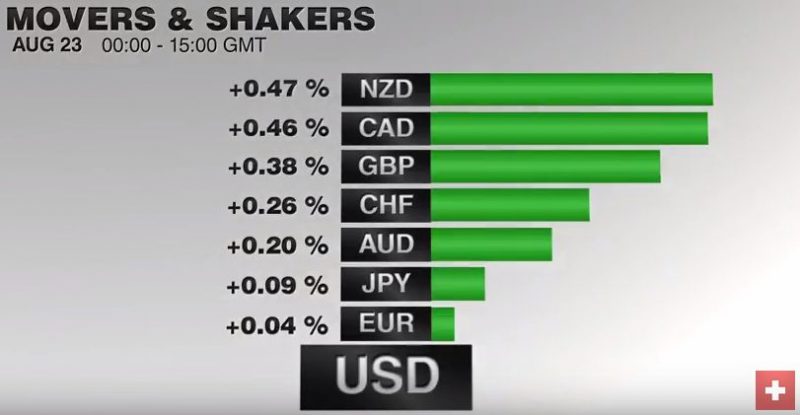

FX Daily, August 23: Broadly Mixed Dollar in a Mostly Quiet Market

The US dollar is mostly little changed against the major, as befits a summer session.There are two exceptions.The first is the New Zealand dollar. Comments by the central bank's governor played down the need for urgent monetary action and suggested that the bottom of cycle may be near 1.75% for the cash rate, which currently sits at 2.0%.This means that a cut next month is unlikely. November appears to be a more likely timeframe.

Read More »

Read More »

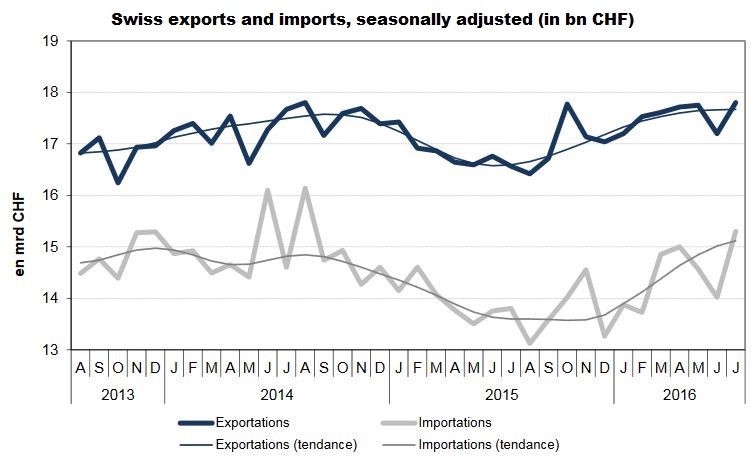

Swiss Exports + 7.9 percent YoY, Imports +11.8 percent. Trade Surplus +2.9 bn CHF, Exporters Increase Prices

We do not like Purchasing Power or Real Effective Exchange Rate (REER). For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to neighbours. In July 2016, Swiss Exports were up 7.9% YoY (in real terms: + 2.4%) and imports 11.8% YoY (in real terms: + 8.2%). Exporters could even raise prices, as we see in the difference...

Read More »

Read More »

FX Daily, August 22: Fischer Joins Dudley; Waiting for Yellen

Last week, some market participants were giving more credence to what seemed like dovish FOMC minutes than to NY Fed President Dudley's remarks that accused investors of complacency over the outlook for rates. Yesterday, Vice-Chairman of the Federal Reserve Fischer seemed to echo Dudley's sentiment, and this has underpinned the dollar and is the major spur of today's price action.

Read More »

Read More »

Dollar Weakness and Fed Expectations

Dollar weakness does not line up with increased perceived risk of Fed hiking rates. Frequently the rate differentials lead spot movement. Some now turning divergence on its head, claiming too expensive to hedge dollar-investments so liquidation. TIC data, though, shows central banks not private investors, were the featured sellers in June, the most recent month that data exists.

Read More »

Read More »