We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to neighbours.

In July 2016, Swiss Exports were up 7.9% YoY (in real terms: + 2.4%) and imports 11.8% YoY (in real terms: + 8.2%). Exporters could even raise prices, as we see in the difference between nominal and real. The difference between nominal and real reflect the fact that in particular pharmaceuticals and chemical exporters could increase their prices in Swiss Franc. Rising import prices come with higher oil prices.

Text translated from the French release of Swiss customs.

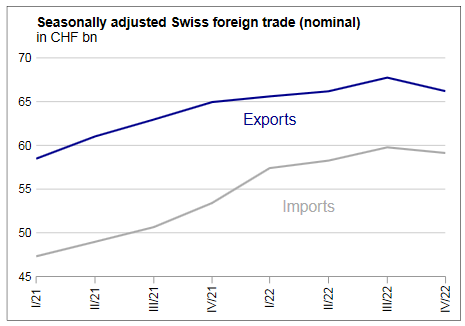

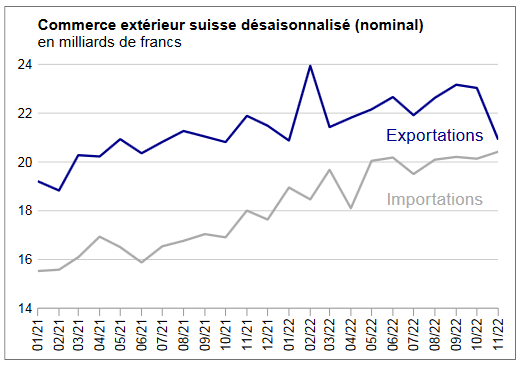

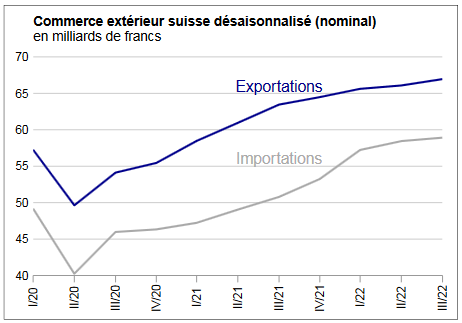

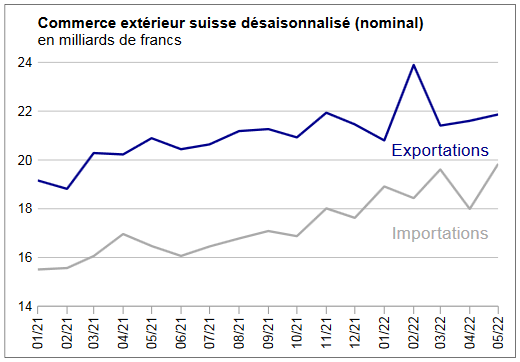

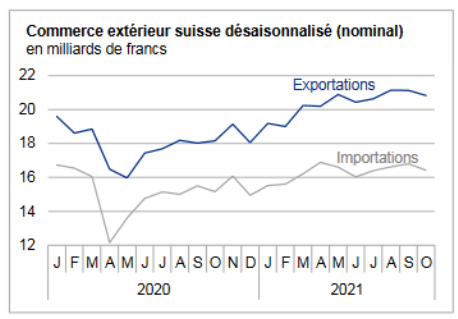

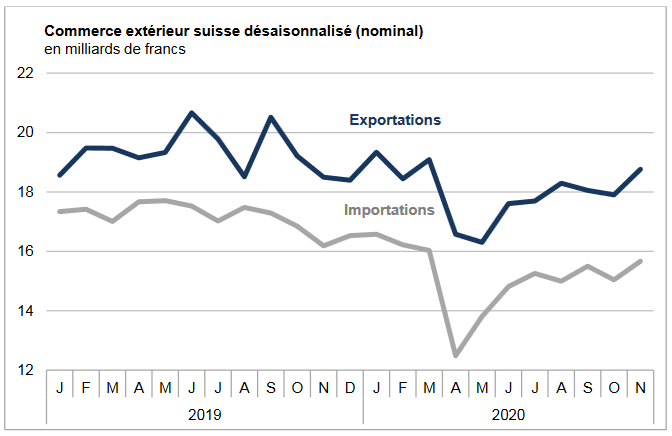

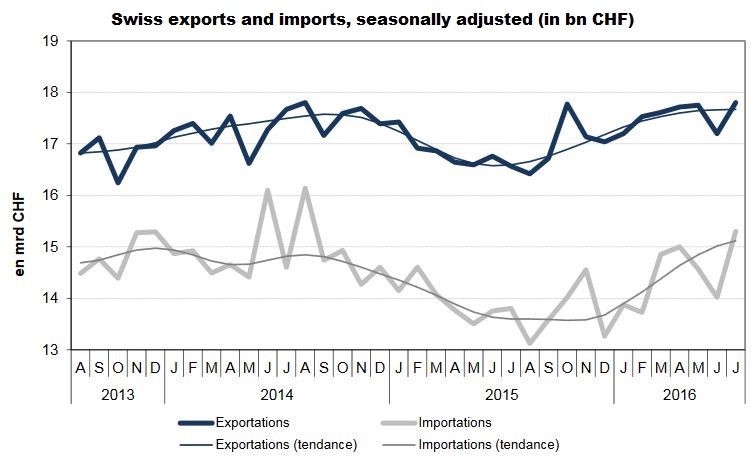

Exports and Imports YoY DevelopmentIn July 2016, Swiss exports declined due to two working days less. Adjusted for this difference, exports were up 7.9% YoY (in real terms: + 2.4%) and imports 11.8% YoY (in real terms: + 8.2%). Exports and Imports MoM DevelopmentCompared with June 2016, seasonally adjusted exports rose by 3.5% (in real terms: + 5.5%). Thus the positive trend that began in mid-2015 continues. Imports up 11.8% year on year (real: + 8.2%). In seasonally adjusted terms (compared the previous month), they showed growth of 9.1% (real terms: + 9.2%), confirming their upward trend of previous months.

|

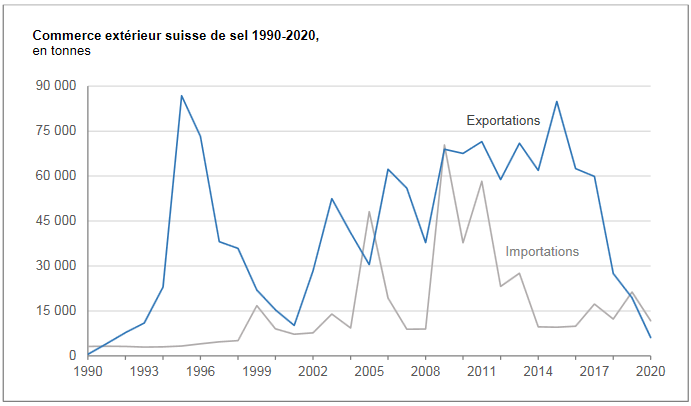

Click to enlarge. From Swiss Customs |

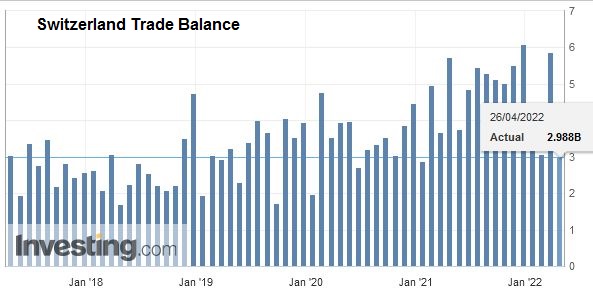

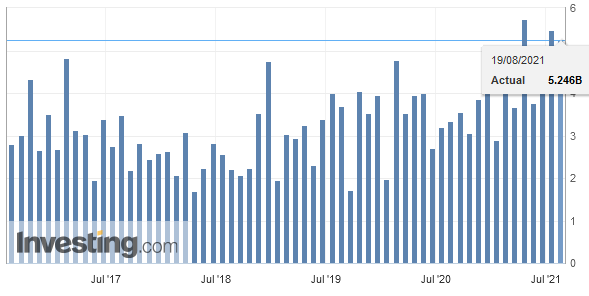

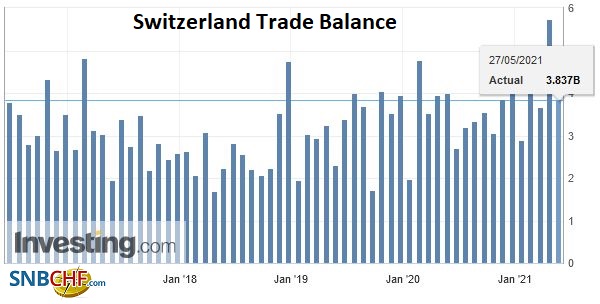

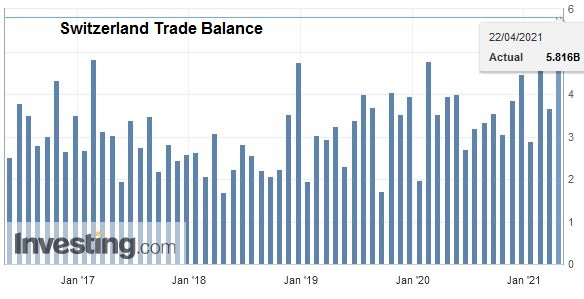

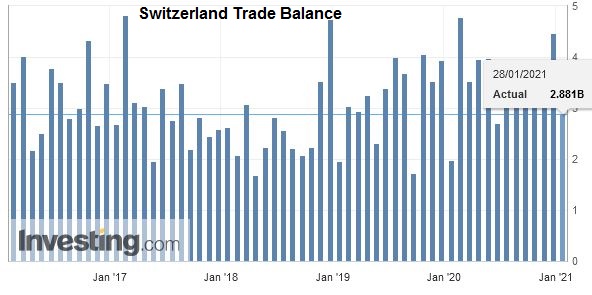

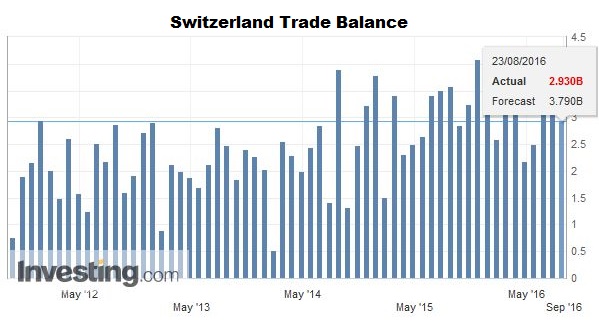

Trade BalanceThe trade balance was in surplus of 2.93 billion francs. This was less than analysts expected. Sector findings

|

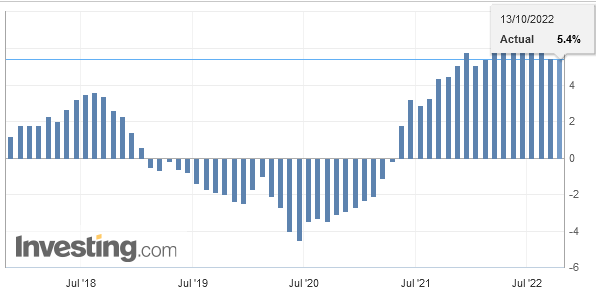

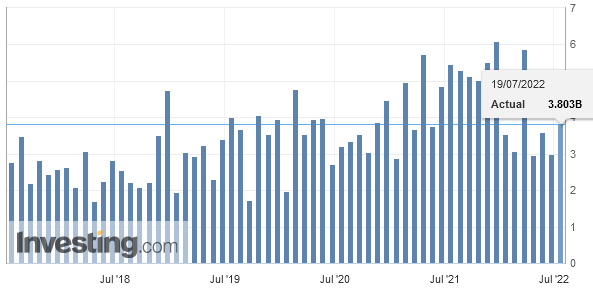

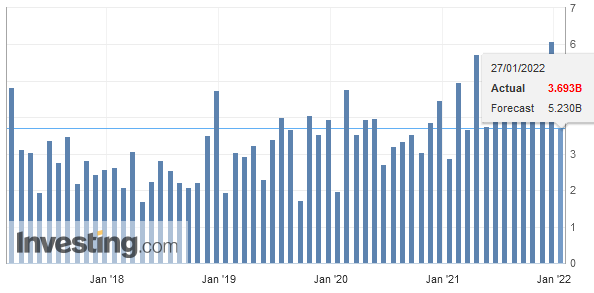

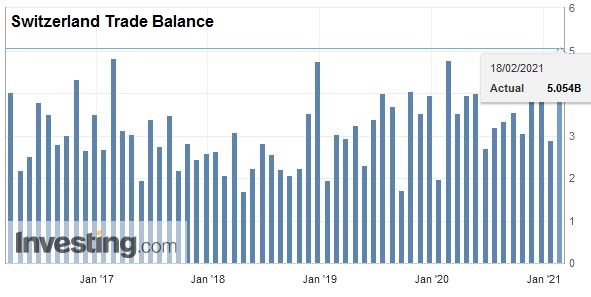

Click to enlarge. Source Investing.com |

Are you the author? Previous post See more for Next post

Tags: newslettersent,Switzerland Exports,Switzerland Imports,Switzerland Trade Balance