Tag Archive: newslettersent

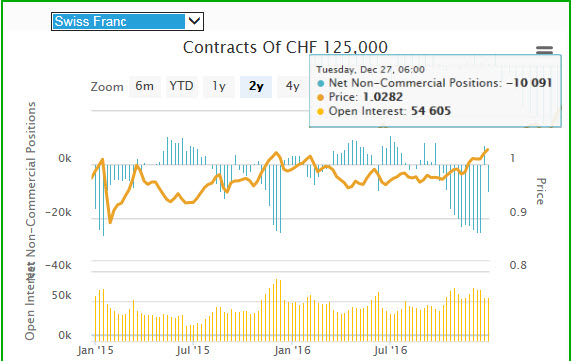

Weekly Speculative Positions: Speculators go short CHF again after a brief period of Long CHF

The sudden adjustment of CHF speculative positions ended (see last week's post) . Speculators went net short CHF USD with 10K contracts, this is still far from the 26.K contracts record. We should wait for another Fed rate hike, to reach these levels again.

Read More »

Read More »

FX Weekly Preview: What You Should Know to Start the First Week of 2017

Data has already been reported. Trends reversed in the last two weeks. US jobs data may disappoint. It will take a few more weeks to lift some of the uncertainty hanging over the markets.

Read More »

Read More »

Emerging Market: Week Ahead Preview

EM FX was a mixed bag over the past week. Dollar softness vs. the majors allowed some in EM to gain traction, with ZAR and PEN the biggest gainers since Christmas. On the other hand, ARS TRY, and INR were the biggest losers. With markets coming back to life, we expect EM to remain broadly under pressure as the same major investment themes remain in place.

Read More »

Read More »

Modi’s Great Leap Forward

India’s Prime Minister, Narendra Modi, announced on 8th November 2016 that Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes would no longer be legal tender. Linked are Part-I, Part-II, Part-III, Part-IV, Part-V, Part-VI and Part-VII, which provide updates on the demonetization saga and how Modi is acting as a catalyst to hasten the rapid degradation of India and what remains of its institutions.

Read More »

Read More »

Global Recession and Other Visions for 2017

Today’s a day for considering new hopes, new dreams, and new hallucinations. The New Year is here, after all. Now is the time to turn over a new leaf and start afresh. Naturally, 2017 will be the year you get exactly what’s coming to you. Both good and bad. But what else will happen?

Read More »

Read More »

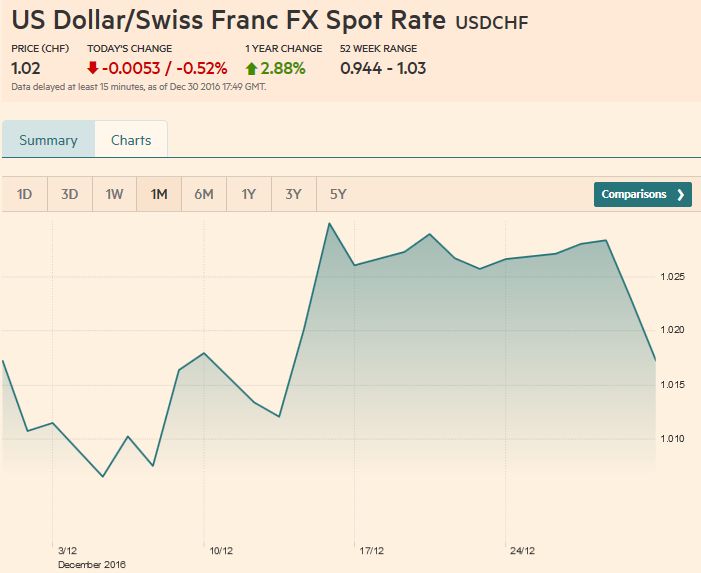

FX Weekly Review, December 26 – 30: Dollar Correction Poised to Continue

The technical condition of the US dollar, which has been advancing through most of the Q4 16, has been deteriorating This led us to anticipate a consolidative or corrective phase.

Read More »

Read More »

Why I’m Hopeful

Readers often ask me to post something hopeful, and I understand why: doom-and-gloom gets tiresome. Human beings need hope just as they need oxygen, and the destruction of the Status Quo via over-reach and internal contradictions doesn't leave much to be happy about.

Read More »

Read More »

Why the Fed Destroyed the Market Economy

Swing voters are a fickle bunch. One election they vote Democrat. The next they vote Republican. For they have no particular ideology or political philosophy to base their judgment upon.

Read More »

Read More »

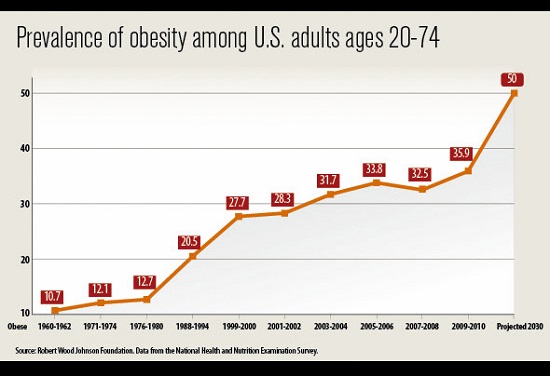

Ungovernable Nation, Ungovernable Economy

Yesterday I described the conditions that render the U.S. ungovernable. Here is a chart of why the U.S. economy will also be ungovernable. Longtime readers are acquainted with the S-curve model of expansion, maturity, stagnation and decline.

Read More »

Read More »

What Triggers Collapse?

A variety of forces will disrupt or obsolete existing modes of production and the social order.

Though no one can foretell the future, it is self-evident that the status quo—dependent as it is on cheap oil and fast-expanding debt—is unsustainable. So what will trigger the collapse of the status quo, and what lies beyond when the current arrangements break down? Can we predict how-when-where with any accuracy?

All prediction is based on...

Read More »

Read More »

SMI set to end 2016 in negative territory

In the last week of the year, the Swiss Market Index deepened its loss for the year as banks continued lower on low trading volumes. The SMI is set to end 2016 with an annual loss of 6.8% as banking and pharmaceutical giants pulled the index down in a year of turbulent trading. A volatile 2016 started with a brutal equity sell off as investors dumped global stocks on fears of an accelerating economic slowdown in China. The Brexit vote in June...

Read More »

Read More »

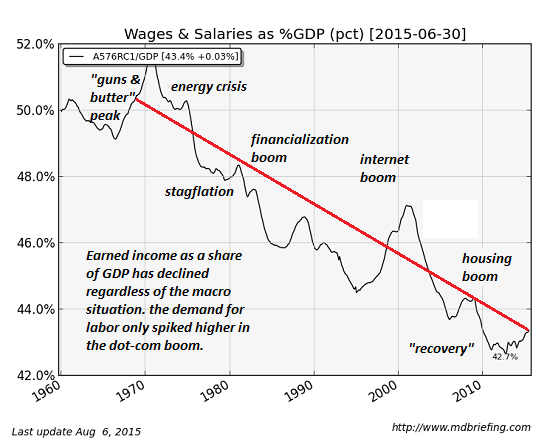

Will Tax Cuts and More Federal Borrowing/Spending Fix What’s Broken?

Charles Hugh Smith combines the best graphs on the declining wage share of GDP in this post. He answers the question if the tax cuts and more federal borrowing and spending can solve what is broken in the U.S. economy.

Read More »

Read More »

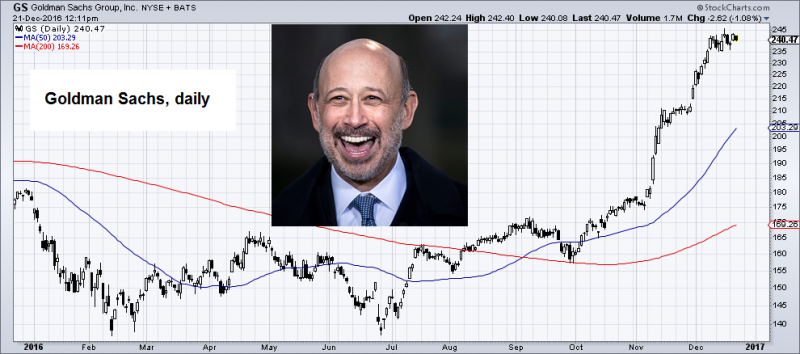

How You Become a Crony

BALTIMORE – Who’s the biggest winner so far? “Government Sachs!” Fortune magazine reports that the winningest person since Trump’s election is Goldman Sachs CEO Lloyd Blankfein.

Read More »

Read More »

When Did Our Elites Become Self-Serving Parasites?

When did our financial and political elites become self-serving parasites? Some will answer that elites have always been self-serving parasites; as tempting as it may be to offer a blanket denunciation of elites, this overlooks the eras in which elites rose to meet existential crises.

Read More »

Read More »

FX Daily, December 30: Dollar Slips into Year End

In exceptionally thin conditions that characterize the year-end markets, a reportedly computer-generated order lifted the euro from about $1.05 to a little more than $1.0650 in a few minutes early in the Asian sessions.

Read More »

Read More »

Miners, including Swiss-based Glencore, unearth a profit bonanza with rally set to last into 2017

Miners had been digging in one of Australia’s oldest collieries for almost a century until operations wound down a year ago, the victim of plunging global commodity prices.

Read More »

Read More »

Fake News, Mass Hysteria and Induced Insanity

We've heard a lot about "fake news" from those whose master narratives are threatened by alternative sources and analyses. We've heard less about the master narratives being threatened.

Read More »

Read More »

India’s Rapid Progression Toward a Police State

India’s Prime Minister, Narendra Modi, announced on 8th November 2016 that Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes would no longer be legal tender. Linked are Part-I, Part-II, Part-III, Part-IV, and Part-V, which provide updates on the demonetization saga and how Modi is acting as a catalyst to hasten the rapid degradation of India and what remains of its institutions.

Read More »

Read More »

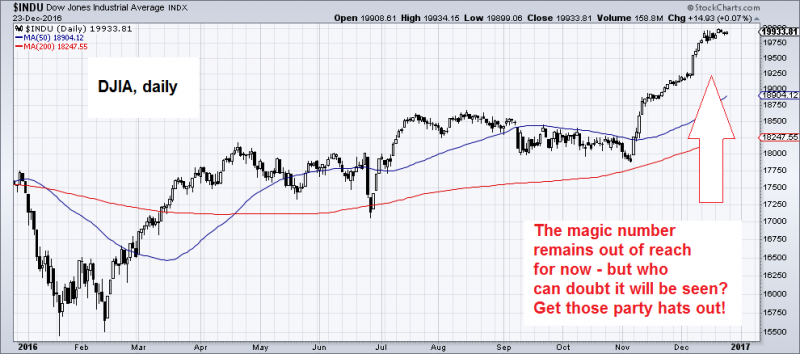

Wreck the Halls

Despite the best efforts of the bulls to make history happen, they’ve been unable to ‘git-r-done.’ At the time of this writing, the Dow is facing another bout of arrested development; it has yet to notch 20,000 for the very first time.

Read More »

Read More »

FX Daily, December 29: Dollar, Equities and Yields Fall

In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer.

Read More »

Read More »