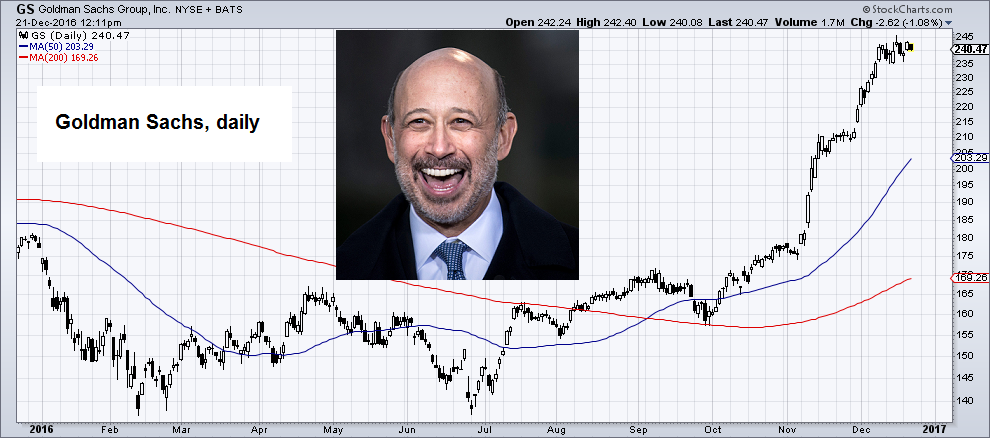

Trump BumpBALTIMORE – Who’s the biggest winner so far? “Government Sachs!” Fortune magazine reports that the winningest person since Trump’s election is Goldman Sachs CEO Lloyd Blankfein. Goldman’s stock price is back to where it was just before the last crash in 2008. And Blankfein is back in high cotton, too; his holdings in the firm have gained $140 million in the last four weeks. Donald Trump pledged to take the elite down a notch. So far, they’re going in the opposite direction. Worldwide, they’re up about $4.4 trillion, as their stocks have soared in the “Trump Bump.” Many of America’s best investors – including Carl Icahn and Ray Dalio – think this is just the beginning. And with some of the nation’s most successful moneymen at his side, including a former Goldman guy in the Treasury, many people are betting that Trump will bring a sustained boom. We’ve been looking at crony capitalism. Our hypothesis is that it is funded by the feds’ fake money and enabled by their regulations. So far, we’ve looked at ex-Goldman banker Steven Mnuchin, Trump’s pick for secretary of the Treasury. While he was making a fortune at Goldman, a major Main Street company, Sears was turned into a Wall Street victim. Its stock is down quite a bit. And it is expected to declare bankruptcy in a few months. Wilbur Ross, Trump’s new man for the Department of Commerce, used federal regulation of imports to make a billion dollars in the steel industry. Jack Welch, a member of Trump’s financial advisory team, used the credit-fueled boom of the 1980s and 1990s to turn Main Street manufacturer General Electric into a leveraged, go-go finance company. Its stock has gone nowhere in the last 15 years. |

Goldman Sachs Group GS actually trades at a new all time high. It is really difficult to find pictures of Lloyd Blankfein in which he is not laughing or at least grinning, but his perpetual good mood is certainly understandable. People like him are often said to be “laughing all the way to the bank”. The saying would have to be slightly modified in his case, since he basically is the bank. - Click to enlarge |

| Today, we look at two more of Trump’s advisers, Blackstone Group CEO Stephen Schwarzman and BlackRock CEO Larry Fink. If nothing else can be said about these two, they have stones! Schwarzman and Fink are two of Wall Street’s most powerful CEOs. Both know how to play the game. But what sort of game is this? Who wrote the rules? Who wins and how? | |

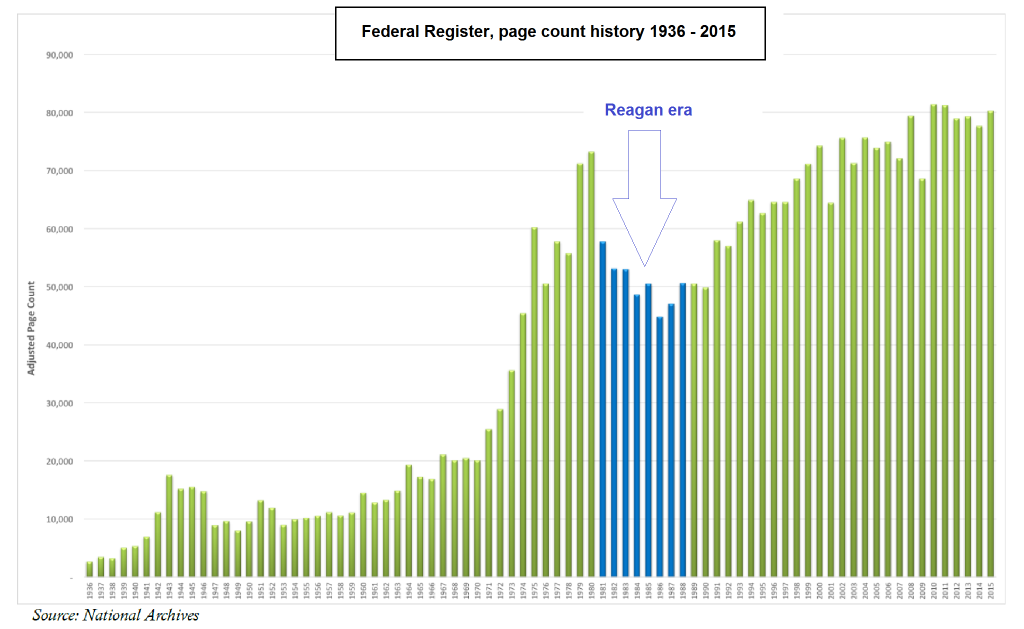

Poison IvyRegulations generally give an advantage to one or more cronies. One industry is favored. Another is punished. Costs, delays, and burdens are imposed. Often, there is little analysis or public discussion. And then, the regulations grow like poison ivy, choking startup competitors and wasting time and money; soon, people all over the country are itching for a change. Several of Trump’s cabinet picks say they are determined to trim these vines. And “The Donald” has proposed a new rule – cutting rules:

Fewer rules would be good for the public – improving efficiency and competition. But cronies would suffer. Which makes us wonder… The Reagan administration managed to spray some Roundup around the D.C. swamp. Regulatory growth slowed. Temporarily. But the evil weeds were soon growing again, faster than ever. Only the public has an interest in cutting back the rules and keeping the system honest. And the public doesn’t control the process – the swamp critters do. |

Federal Register In the first six years of the Reagan administration the number of federal regulations actually declined noticeably. Not surprisingly, it is a time period fondly remembered for its optimism and strong economic growth. It didn’t last – Leviathan soon reasserted itself in its full splendor. The official objective of regulations is always “protection of the public”. In reality, most of them impoverish the public and restrict liberty (in particular economic freedom), while expanding the power of the State and enriching assorted crony interests. - Click to enlarge |

How the Rich Got RicherNews comes that investment management behemoth BlackRock is moving into new digs in Hudson Yards, in Lower Manhattan. The company has some $5 trillion in assets, making it perhaps the most successful capitalist business in history. The feds’ cheap financing caused a bubble in the housing, mortgage, and finance sectors. In our daily e-letters, we tracked that bubble, day by day, from around 2004 until it blew up in 2008. BlackRock’s role was significant. It created $5.5 trillion in mortgage-backed derivatives, which blew up in 2008. Housing prices crashed, leaving 20 million Americans underwater and 4 million in foreclosure. Meanwhile, up on Park Avenue, Stephen Schwarzman was taking the other side of the trade. His private equity outfit, the Blackstone Group, bet against subprime mortgages and sold off most of its real estate in 2006 and 2007, getting rid of about $60 billion worth of property investments. Then, after the crash, Blackstone made another sharp move. It bought up houses at bargain prices. It spent $10 billion and acquired 50,000 homes. |

BlackRock had its fingers in the housing pie both on the way down and during the subsequent recovery. That was certainly a case of rather fortuitous timing, for which the group can’t be faulted per se – it is hard to say how losing money would have improved the situation. The problem with the bubble and its aftermath is that it left a great many innocent bystanders holding the bag. Moreover, the root cause has never been identified in the official narrative, and hence has never been addressed. On the contrary – today the Fed and all the TBTF banks are bigger and more powerful than ever, while the GSEs have been fully nationalized. Photo via occupy.com - Click to enlarge |

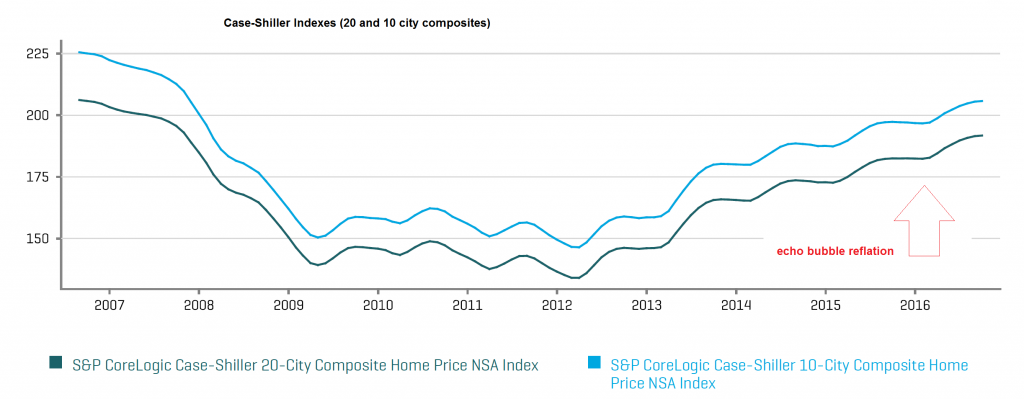

Fake Money, Fake SystemThe elegance and chutzpah of it were breathtaking. The financial industry created the bubble, lending the feds’ fake money – money that no one ever earned or saved – to people who had no business borrowing it, so they could buy overpriced houses they couldn’t afford. Then, after the inevitable blow-up, Blackstone bought houses that had been heavily discounted by the accident its dark, lithic brethren had helped to cause. A bold move by Blackstone? Yes. Risky? Maybe not. The fix was in. The Fed brought forth another big round of financing. This time, interest rates went into the cellar and stayed there until the sector was fully reflated. The Case-Shiller Home Price Indices show house prices up about 30% over the last six years. Assuming the boys at Blackstone operated efficiently – covering their costs with rents – they would have about a $3 billion unrealized capital gain. And now, they are taking the whole kit and caboodle public, selling their real estate investment trusts to mom-and-pop investors who have been forced into stocks by the Fed’s ultra-low interest rate policy. Thus did the financial industry use its preferential access to the Fed’s EZ credit to create the housing bubble and then use it to convert private property – people’s homes – into a tradable asset owned by Wall Street. Left-wingers will say Fink and Schwarzman are “greedy capitalists.” But money makes people in its own image. Fake money has created a false financial system and turned capitalists into cronies. Sad. |

Case Shiller |

Charts by: StockCharts, Competitive Enterprise Institute, S&P

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.

Full story here Are you the author?

Previous post See more for Next postTags: newslettersent,On Economy,On Politics