Tag Archive: newslettersent

FX Daily, December 21: Dollar Mixed in Thinning Activity, Dow 20,000 Watch Continues

The US dollar is narrowly mixed as the holiday markets make for light turnover. Global equity markets are not finding much encouragement from the new record highs by the Dow Jones Industrials. There have been a few developments to note.

Read More »

Read More »

You Know what Happened to Nominal Exchange Rates, but What about Effective Exchange Rates?

Yen is up slightly this year on an effective trade weighted basis. The euro has gained about 1% this year on an effective trade weighted basis. Sterling's decline has been significant on an effective basis. The yuan's decline looks to have corrected overshoot and is still holding an 11-year uptrend on the BIS real effective basis.

Read More »

Read More »

The Reign of Bubble Finance

Financialization Genius BALTIMORE – When we left you last time, we were in the middle of describing the crooked hind leg of crony capitalism. We used billionaire businessman Wilbur Ross – Donald Trump’s pick for the Department of Commerce – for illustration purposes. Not that there is anything wrong with Mr. Ross. He plays the game, just as everyone else does. He’s particularly good at it.

Read More »

Read More »

Police say no terror links to Zurich mosque gunman

Police say the man responsible for the shooting incident at the Zurich Islamic Centre on Monday evening was a 24-year-old Swiss with Ghanaian roots. They said there appears to be no link to radical groups. The man's motive for the mosque shooting and a separate murder on Sunday remains unclear.

Read More »

Read More »

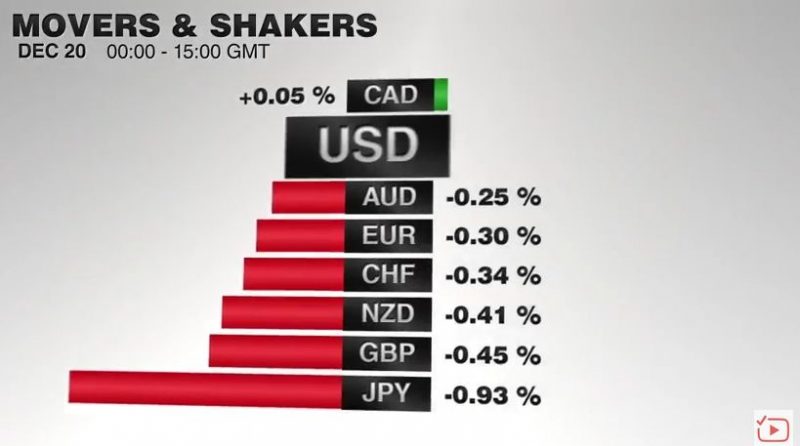

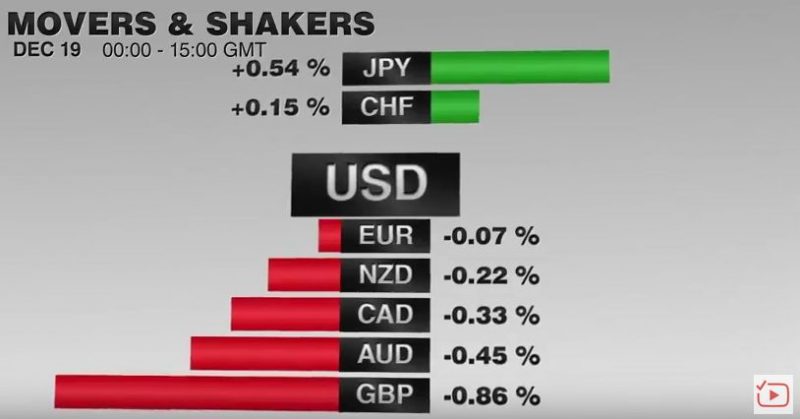

FX Daily, December 20: Yen Surrenders Yesterday’s Gains, while Euro Struggles to Hold above $1.04

The yen's incredible ride this year has been recapitulated in recent days. Consider that before last weekend; the US dollar reached a little above JPY118.40. At its extreme yesterday, the dollar fell to JPY116.55. Today it reached traded near JPY118.25 in the European morning, where it was encountering some offers.

Read More »

Read More »

Swiss National Bank further strengthens provisions for currency reserves

The Swiss National Bank uses a strange formula on the basis of economic growth for the provisions for FX losses. It would be much easier to connect this number to the size of the balance sheet, e.g. 10% of the balance sheet.

Read More »

Read More »

Swiss to avoid EU clash as immigration bill passes final hurdle

After three years of uncertainty, Switzerland may just have solved its immigration dispute with the European Union. Lawmakers in Bern on Friday passed a bill designed to curb EU immigration by giving locals a head start on filling job vacancies. By supporting the measure — which sidesteps quotas — they aim to prevent a deeper dispute that could cost the country crucial trade deals.

Read More »

Read More »

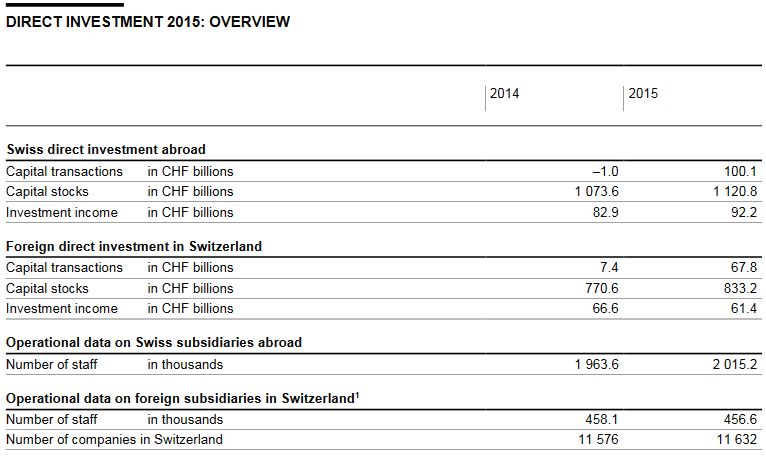

Direct Investments in 2015

Swiss direct investment abroad. Companies domiciled in Switzerland invested CHF 100 billion abroad, compared with disinvestment of CHF 1 billion the year before. Thus, Swiss direct investment abroad was significantly above the average for the past ten years. At CHF 54 billion, over half of the investment was made by finance and holding companies (2014: CHF 3 billion).

Read More »

Read More »

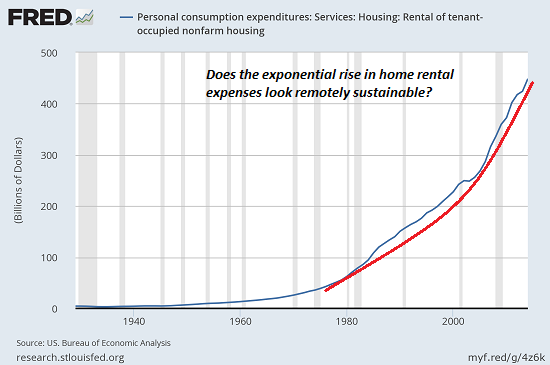

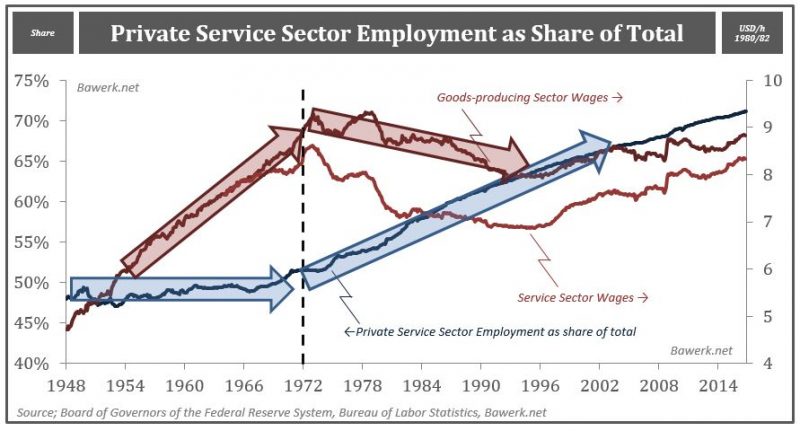

What Have the “Experts” Gotten Right? In the Real Economy, They’re 0 for 5

If the "experts" were assessed on results, they'd all be fired. The mainstream media continually hypes the authority of "experts," i.e. people with a stack of credentials from top institutions. But does the mainstream media ever check on whether the "experts" got anything right? Let's compare the "experts" (conventional PhD economists) diagnoses and fixes with the results of their policies.

Read More »

Read More »

FX Daily, December 19: EUR/CHF Dives under 1.07

Once again a line in sand for the Swiss National Bank is broken. The EUR/CHF falls under 1.07. But trading algorithms are like this: When the EUR/USD is falling, then the EUR/CHF must follow. The SNB decided not to intervene any more at 1.07.

Read More »

Read More »

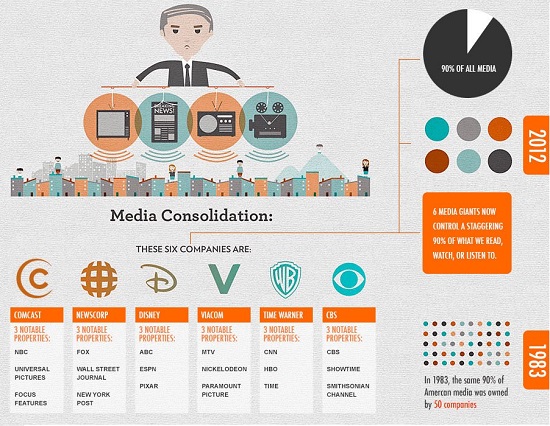

Toward A New World Order, part III

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

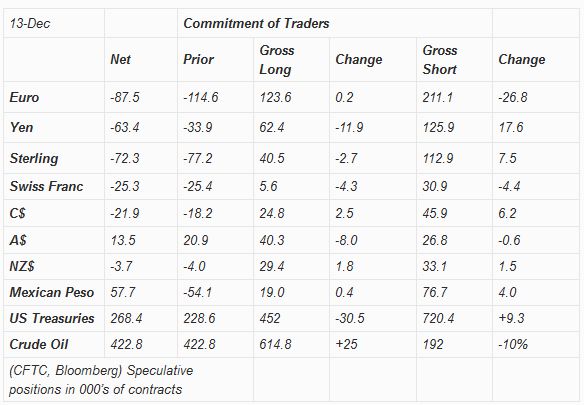

Weekly Speculative Positions: Short CHF Close to Records of 2015

The net short CHF speculative position is close to reaching new records. Shortly before the end of the peg, speculators were net short CHF by 26.4K contracts. Now we are at 25.4K.

Read More »

Read More »

FX Weekly Preview: Twas the Week Before Christmas, Amidst Powerful Trends

The Nikkei, the dollar-yen and 10 yr US yield have risen nine of the past 11 weeks. The Dollar Index and 2 yr US yields have risen while gold has sold off in eight of past 11 weeks. Issue in next two weeks, profit-taking or trend extension? Spoiler alert: I expect some profit-taking.

Read More »

Read More »

Has the Fed Turned “Hawkish?”

Juiced, Stimulus, in a general sense, is something that causes an action or response. A ringing alarm clock may prompt someone to exit their slumber. Or a fist to the gut may force someone to gasp for breath.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended the weak on a soft note, as the hawkish Fed decision continued to have reverberations for global markets. Worst performers in EM last week were CLP (-3.3%), ZAR (-2%), and KRW (-1.5%). With little fundamental news expected this week, markets may take a more consolidative tone, especially with the holidays approaching. However, we continue to believe that the global backdrop for EM remains negative.

Read More »

Read More »

BIS: A Paradigm Shift on Bond Yields?

Review of recent BIS report. US election spurred a substantial change in sentiment. Equity and bond market reactions are roughly similar to when Reagan was elected, with the dollar, at least initially, stronger than then.

Read More »

Read More »

FX Weekly Review, December 12 – December 16: Fed Lifts Dollar, but Consolidation may be on Tap

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

Swiss-based Glencore’s Rosneft deal reopens battle for Russian commodities

In the cutthroat world of commodities trading, there’s no bigger prize than Russia. The country of Vladimir Putin has it all: oil, natural gas, aluminum, nickel, wheat, coal and many other riches. The world’s biggest trading houses have jostled over it for decades.

Read More »

Read More »