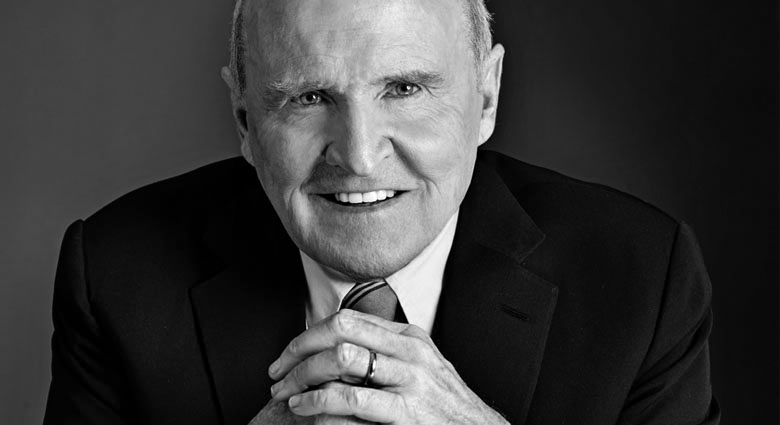

Financialization GeniusBALTIMORE – When we left you last time, we were in the middle of describing the crooked hind leg of crony capitalism. We used billionaire businessman Wilbur Ross – Donald Trump’s pick for the Department of Commerce – for illustration purposes. Not that there is anything wrong with Mr. Ross. He plays the game, just as everyone else does. He’s particularly good at it. But today, we’ll look at another Olympian money man – the chairman of Trump’s new Strategic and Policy Forum and private equity magnate, Stephen Schwarzman. We remind readers that we are criticizing neither Mr. Schwarzman nor Mr. Trump. We’re just trying to understand how it works. Then we’ll take a guess about where it will lead. Also on Mr. Trump’s new advisory board – which is supposed to help the president-elect bring jobs back to America – is former General Electric CEO Jack Welch.´Welch could provide an equally rich illustration of the “financialization” trend. He took a Main Street manufacturing and engineering firm – one of the most admired in the world – and turned it into a bubble-finance company. |

The steel magnate in his command center. He is one of a number of particularly alert entrepreneurs who were able to make the most of the bubble era ushered in by Nixon’s adoption of the confetti money system. And he even has a crystal ball! Obviously, that explains a lot. Photo via timschaefermedia.com - Click to enlarge |

| After 600 acquisitions, GE was heavily in debt and deeply in the finance business. GE Capital – the company’s financial services unit and the tail that now wags this dog – has 35,000 employees and capital of half a trillion dollars.

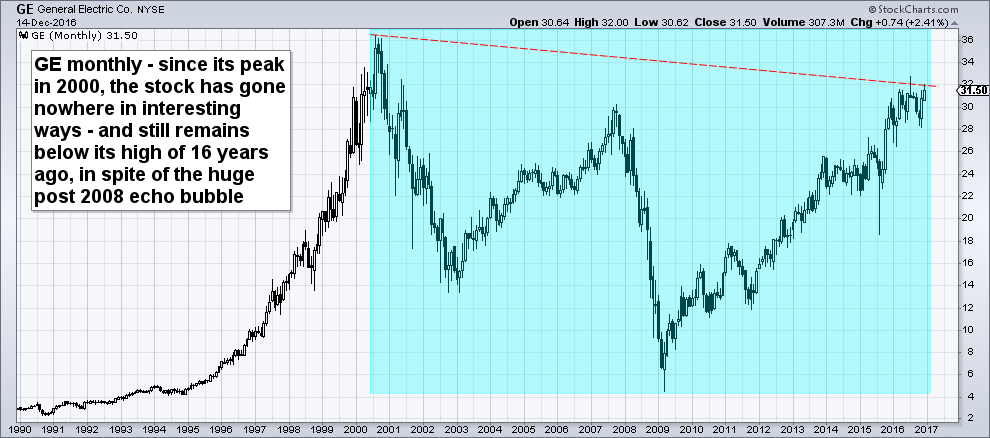

GE shares sold for a split-adjusted $36 at the beginning of this century. Now, after the biggest wash of free money the stock market has ever seen, shareholders have been soaked; the stock is worth less than at its peak in 2000. |

General Electric Co. - monthly GE shareholders didn’t have much to celebrate over the past 16 years, unless they purchased the stock after the 2008 collapse. The US true money supply has more than quadrupled since 2000 and stock prices have been among the biggest beneficiaries of this enormous monetary inflation – but GE shareholders were left empty-handed anyway. - Click to enlarge |

| Meanwhile, Jack walked away, taking with him the largest severance package in history – valued at about $420 million. As far as we know, Mr. Welch didn’t invent anything. He didn’t sing a hit song or star in a blockbuster movie.

He was a salaried employee of a well-established and profitable business… risking neither time nor money. After Mr. Welch was finished with it, the business was in worse shape than it was when he took over at the helm. And yet, he ended up with a fortune estimated at more than $700 million. That’s financialization! |

Bubble profiteer Jack Welch – why is this man grinning you may ask? Simple: while GE shareholders buying into his legacy haven’t made a dime in 16 years, he walked away from the company with a $700 million fortune, not least due to a “golden parachute” of $420 million he received for jumping ship. Best of all, he didn’t have to take any personal risks to amass this huge pile of money. Photo via jonathangifford.com - Click to enlarge |

“Politicizing” BusinessThe only real revolution in human affairs began thousands of years ago and continues to this day: the gradual replacement of brute force with market-based persuasion. It is never all or nothing, of course. Politics will always be with us. So will markets. A business that becomes “political” is a danger to its owners. Employees stab each other in the back, fight over choice offices, and scramble for a place in the corporate hierarchy. More important, they take the company’s eye off the ball and its vital capital out of the business. That’s what happened at GE. Properly functioning free-market economies flush out these companies through the process of “creative destruction.” “Political” businesses can’t compete with companies that are focused on satisfying their customers and investing for the future. But sometimes, entire economies become more political – and the people and companies in them react by becoming more political, too. That is really what happened to the U.S. economy over the last 40 years. Smart hustlers teamed up with the government. And together they used the feds’ fake money, the feds’ fake savings, the feds’ fake interest rates, and the feds’ labyrinthine legislation and regulation to hijack wealth from the honest Main Street economy. So, when we talk about how the U.S. economy was “financialized” after 1980, what really happened is that it was “politicized.” As politics became more pervasive, more of the nation’s output was up for grabs as spoils of politics. |

As German sociologist and historian Franz Oppenheimer pointed out in his seminal work “The State”, there are two ways of obtaining income: by economic means (by trading with other market participants on a voluntary basis, offering goods and/or services to them), or by political means (essentially theft under the color of law). The former method creates the wealth that can be appropriated by the latter method. The latter method only works as long as a significant part of the population can be persuaded that the State is a legitimate agency that is actually different from other mafia type organizations. This is incidentally the main reason why education has been usurped by the State. The democratic State generally gives its citizens the opportunity to join those who obtain their income by political means and allows for “mixed” approaches as well, such as the cronyism discussed here. Although perhaps technically not incorrect, we hesitate to refer to it as crony capitalism, because capitalism has a definitive meaning to us and we see no point in besmirching the term (we would prefer if its original meaning as a term describing the free market economy were widely readopted). “Corporatism” or “fascism lite” may be better descriptors. |

An Angel EverywhereCuriously, even the political system itself becomes more political. It used to be that the Democrats and the Republicans held each other’s ambitions in check. The Democrats were in favor of wealth distribution at home. But they didn’t like to see the U.S. government throwing its money around overseas. Republicans, on the other hand, considered the federal government a devil at home but an angel overseas. Now, both sides of the aisle have come together with high fives and bear hugs… the government is an angel everywhere, they’ve concluded. |

Similar to many of the other founding fathers, James Madison was a fount of remarkably perceptive soundbites on politics. Here is he is telling us quite clearly why the “bi-partisan” war party alliance must be rejected by those who prefer liberty to tyranny (and who doesn’t?). Fighting monsters abroad and the blow-back it invites invariably leads to tyranny at home – imperceptibly at first, but as time passes it certainly becomes ever more obvious. Thus there is now a “Patriot” act, a “Military Commissions Act”, a “National Defense Authorization Act”, a vast new security bureaucracy, ubiquitous surveillance of the citizenry, and a major drive to destroy all aspects of privacy and increase the power of agencies of the State. Ironically this is often justified with a famous Goebbels saying (“if you have nothing to hide, you have nothing to fear” – yes, Goebbels said it first). As Madison also remarked in this context: “Crisis is the rallying cry of the tyrant”. |

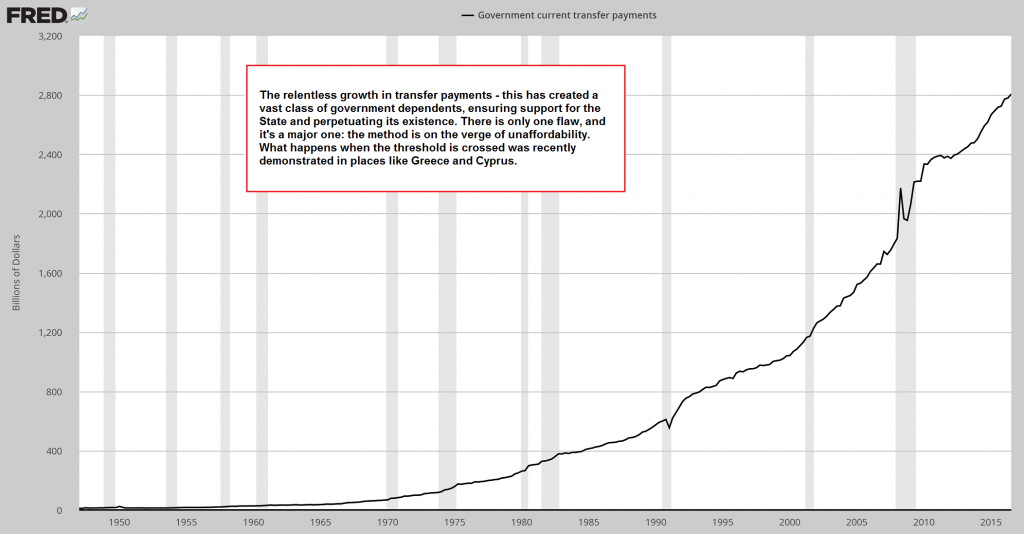

| So today, at home, 160 million Americans receive money from the feds – half of the nominal income gains in the last 16 years came from the feds’ “transfer payments” – and there are far more people getting money from “the government” than there are voters.

And overseas, according to the Watson Institute at Brown University, America’s hapless romp in the Middle East and the associated War on Terror has now cost $4.8 trillion. The institute goes on to remark that the wars have been paid for “almost entirely by borrowing.” And that, by 2053, including interest charges, the total bill will reach almost $8 trillion. |

Transfer payments Transfer payments – one of the world’s biggest “growth industries”. It keeps large parts of the population enthralled and unwilling to challenge the system – but it is also one of the things that guarantee the eventual demise of the system, because funding these payments becomes ever more difficult – and one day it will become impossible – click to enlarge. - Click to enlarge |

Distributed among the voters, this would work out to about $61,538 apiece. But wait – we’ve run out of time and space, and we haven’t even gotten to Mr. Schwarzman yet.

Stay tuned…

Charts by: StockCharts, St. Louis Federal Reserve Research

Chart and image captions by PT

The above article originally appeared as “Can Trump End the Reign of “Bubble Finance”?” at the Diary of a Rogue Economist, written for Bonner & Partners.

Tags: newslettersent,On Economy,On Politics