Swiss Franc |

EUR/CHF - Euro Swiss Franc, December 27(see more posts on EUR/CHF, ) |

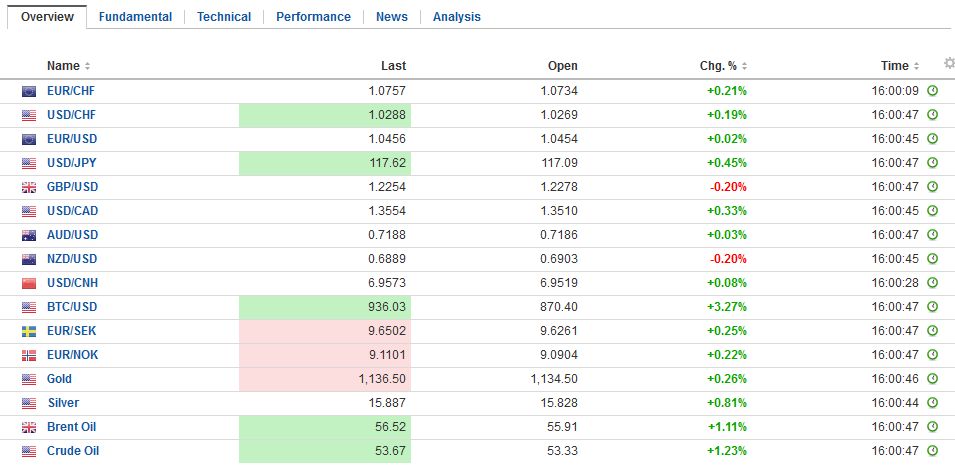

FX RatesAs skeleton teams return to the trading desks in New York, the US dollar is largely where they left it at the end last week. Japanese markets were open yesterday, while UK, Australia, New Zealand, Hong Kong and Canadian markets are still closed today. The Australian and New Zealand dollars are up about 0.2% from before the weekend. Sterling is trading with a downside bias after falling every session last week. The euro and yen are practically unchanged. Among emerging market, the South African rand and Russian ruble are faring best (~0.3%-0.4%). Equity markets are narrow mixed, but of note, bargain-hunting finally emerged to allow the Indonesian equities to post their first advance since December 9 (the longest losing streak since 2005. While most markets are quiet, we note that gold is up 0.8%, which, if sustained, would be the largest advance in a month. |

FX Daily Rates, December 27 |

| While the dollar is little changed, bond markets are mostly softer, though Germany appears to be experiencing mild, safe haven flows. Asian equities were mixed, while European equities are firmer. The MSCI Asia Pacific Index eked out a minor gain (less than 0.1%), but sufficient to snap a five-session pullback. Although the dollar is trying to end a four-session drop against the yen, the Topix extended its correction for a fourth session (and five of the past six). In contrast, the Nikkei edged higher (less than 0.1%) and broke ended its three-day decline. |

FX Performance, December 27 |

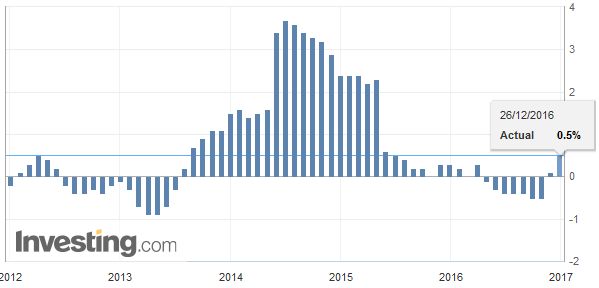

JapanJapan reported November inflation and employment figures. The key takeaway is that although the labor market remains tight, inflation remains elusive. The jobless rate ticked up to the still-enviable 3.1%. The job-to-applicant ratio stands a 1.41. |

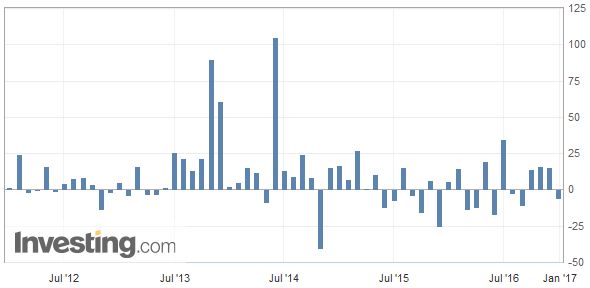

Japan Construction Orders YoY, November 2016(see more posts on Japan Construction Orders, ) Source: Investing.com - Click to enlarge |

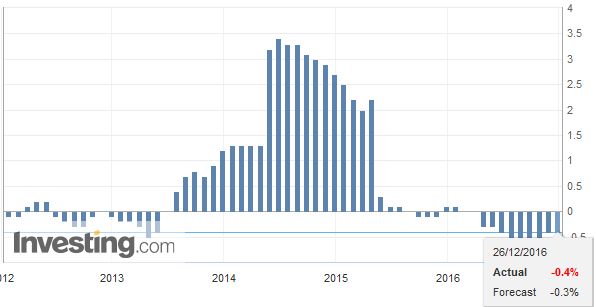

| However, the key measure of inflation, CPI minus fresh food, remained at minus 0.4%, which is what it has averaged this year. Excluding both food and energy, Japan’s CPI stood at 0.1% in November down from 0.2% in October. |

Japan National Core Consumer Price Index (CPI) YoY, November 2016(see more posts on Japan National Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The Tokyo data, which is reported with less of a lag, gives no reason to be optimistic. The December headline CPI fell to zero from 0.5%, and the core rate, which excludes fresh food, fell to minus 0.6% from minus 0.4%. |

Japan National Consumer Price Index (CPI) YoY, November 2016(see more posts on Japan National Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Moreover, the full employment is not only failing to boost prices, but it is not boosting consumption. Overall household spending slumped to minus 1.5% in November from minus 0.4% in October. The Bloomberg median had expected a rise to 0.1%. Japan also reported weak housing starts and construction orders. Forecasts for Q4 GDP will likely be revised lower. Japan will report industrial output and retail sales tomorrow. |

Japan Unemployment Rate, November 2016(see more posts on Japan Unemployment Rate, ) Source: Investing.com - Click to enlarge |

Eurozone

There are three developments to note from Europe. First, at the very end of last week, Fitch downgraded Belgium from AA to AA-. It cited the high debt-to-GDP ratio for an AA rating and noted that fiscal consolidation has been weak. There does not appear to be much of a market reaction. The 10-year yield is up half a basis point, in line with the change in French yields today.

Italy

Second, Italy is finding that supporting Monte Paschi may be more expensive than it may have anticipated. The ECB has argued that due to the deterioration in liquidity, the troubled bank needs 8.8 bln euros rather than five bln. Also, the Bundesbank has expressed concerned that the new EU rules are not being respected. Italy’s bank stock index is off 0.6%, or about what it had gained before the holiday weekend. Italian two and 10-year yields are half a basis point higher.

Greece

Third, after a short disagreement over what Greece could do given that its revenues surpassed targets and expenditures were below targets. The Greek government insisted on an extra pension payment to civil servants and a VAT break for a few islands overwhelmed by refugees. It appears that an agreement was reached. Greece’s 10-year bond yield is off nearly 12 bp.

United States

The US reports house prices, the Conference Board’s measure of consumer confidence, and the Richmond Fed’s manufacturing index. None are typically market-moving.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$JPY,EUR/CHF,FX Daily,Greece,Italy,Japan,Japan Construction Orders,Japan National Consumer Price Index,Japan National Core Consumer Price Index,Japan Unemployment Rate,newslettersent