Tag Archive: newslettersent

Crony Socialism and Failed CEOs

Whenever a failed CEO is fired with a cushy payoff, the outrage is swift and voluminous. The liberal press usually misrepresents this as a hypocritical “jobs for the boys” program within the capitalist class. In reality, the payoffs are almost always contractual obligations, often for deferred compensation, that the companies vigorously try to avoid.

Read More »

Read More »

Trump’s Trade Catastrophe?

It is worse than “voodoo economics,” says former Treasury Secretary Larry Summers. It is the “economic equivalent of creationism.” Wait a minute – Larry Summers is wrong about almost everything. Could he be right about this?

Read More »

Read More »

Dear Self-Proclaimed “Progressives”: as Apologists for the Neocon-Neoliberal Empire, You Are as Evil as the Empire You’ve Enabled

Dear Self-Proclaimed "Progressive": I love you, man, but it has become necessary to intervene in your self-destruction. Your ideological blinders and apologies for the Establishment's Neocon-Neoliberal Empire are not just destroying your credibility, they're destroying the nation and everywhere the Empire intervenes.

Read More »

Read More »

The Difference of an A and BBB for Italy

DBRS cut Italy's rating to BBB from A. It will increase the haircut on Italy's sovereign bonds used for collateral by Italian banks. It is not a mortal blow or a significant hit, but is not helpful, except to add pressure on Italy and further reduce its ability to respond to another shock.

Read More »

Read More »

Emerging Markets: What has Changed

China’s government has asked banks to balance their yuan inflows and outflows. Indonesia partially lifted a ban on exports of nickel ore and bauxite. Czech President Zeman picked two new central bankers as the end of the koruna cap looms. Turkish central bank is taking limited measures to support the lira. Turkey’s parliament voted 338-134 to discuss proposed constitutional changes that would increase the power of the presidency.

Read More »

Read More »

Trump’s Plan to Close the Trade Deficit with China

Jack Ma is an amiable fellow. Back in 1994, while visiting the United States he decided to give that newfangled internet thing a whirl. At a moment of peak inspiration, he executed his first search engine request by typing in the word beer.

Read More »

Read More »

What’s Truly Progressive?

What's progressive? Pushing power, agency, skills, capital and solutions down to the individual, household, community, enterprise, town and city levels and focusing on doing more with much less.

Read More »

Read More »

How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract.

Read More »

Read More »

FX Daily, January 13: Corrective Forces Persist

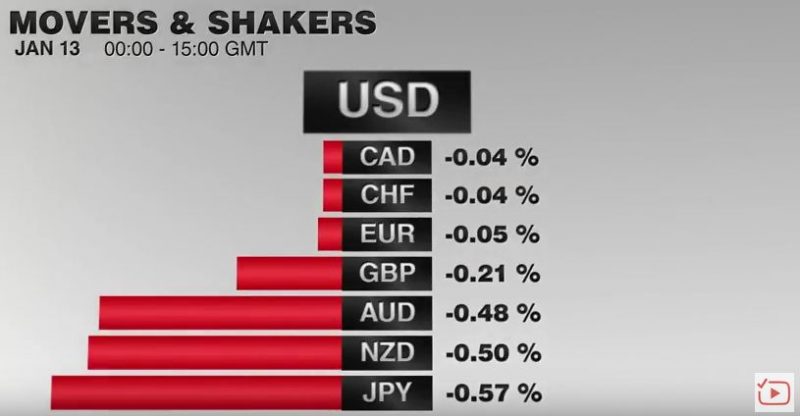

The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have indicated the majority of the judges are in favour of the parliamentary vote.

Read More »

Read More »

Saudis Cut More than Commitment, Lifts Prices

US refinery demand for oil is near a 30-year high. Demand growth will help catch up to supply. Saudi Arabia (and Kuwait) appear to have cut more output than promised.

Read More »

Read More »

Regime Change: The Effect of Trump’s Victory on Stock Prices

On January 20 2017 Donald Trump will be sworn in as the new president of the United States. On the stock market his victory has triggered a lot of advance cheer already: the Dow Jones Industrial Average rose by a sizable 7.80 percent between the election and the turn of the year.

Read More »

Read More »

The Eight Forces That Are Pressuring Profits

If there is any economic assumption that goes unquestioned, it's the notion that profits will remain robust for the foreseeable future. This assumption ignores the tidal forces that are now flowing against profits. Any discussion of corporate profits must start by noting the astonishing rise in U.S. corporate profits since the heyday of the late 1990s dot-com boom. From $800 billion to $2.4 trillion in a few years is not just extraordinary--it's...

Read More »

Read More »

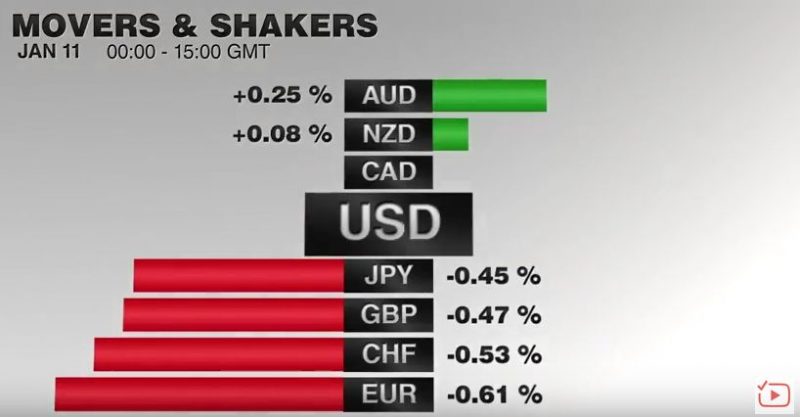

FX Daily, January 12: Dollar and Yields Ease Further, but Look for Recovery

After a choppy North American session yesterday, the dollar and US yields remain under pressure. The dollar is lower against all the major currencies and most emerging market currencies, including the recently shellacked Turkish lira and Mexican peso.

Read More »

Read More »

China Capital Flight: When $4 trillion is Too Much and $3 trillion is not Enough

All of China's capital outflows are not capital flight fleeing. Capital controls limiting outflows can be tightened. Paying down dollar loans, a major source of capital outflows, is not an infinite process.

Read More »

Read More »

Neo Feudalism and Basic Income

It is difficult to say exactly how, or when, the next collapse will be triggered, but, as SHTFPlan.com's Mac Slavo notes, of course all the conditions are ripe for it. What can be certain is that the technocrats intent on controlling the future are already engineering the post-collapse society.

Read More »

Read More »

First ZeroHedge Symposium and Live Fight Club

For over four decades, many of the planet's biggest trouble makers and assholes have met each year in Davos, Switzerland, for the World Economic Forum with the humble mission of, "Improving the state of the world."

Read More »

Read More »

FX Daily, January 11: Dollar Comes Back Bid

The pound has seen a sharp fall following the interview that Theresa May gave with Sky news on Sunday although there has been a small rebound this afternoon. GBP CHF exchange rates are hovering around 1.2350 for this pair.

Read More »

Read More »