Summary:

DBRS cut Italy’s rating to BBB from A.

It will increase the haircut on Italy’s sovereign bonds used for collateral by Italian banks.

It is not a mortal blow or a significant hit, but is not helpful, except to add pressure on Italy and further reduce its ability to respond to another shock.

| The ECB takes the best credit rating of four agencies to set the haircut on collateral provided by banks for loans. DBRS is often the most optimistic. After having put Italy’s A-rating on credit watch in August, DBRS delivered the news today. Italy’s rating was cut to BBB. The other three main rating agencies range from BBB- at the typically more pessimistic S&P, and Baa2 at Moody’s (=BBB), and BBB+ at Fitch.

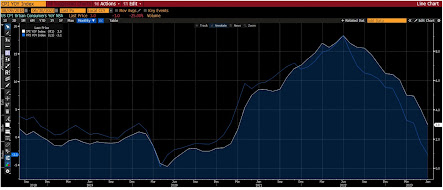

The immediate implication is that Italian banks, weighed down by non-performing loans, the need to raise new capital and dreadfully slow economic growth face higher borrowing costs. The haircut on Italian sovereign bonds, which the banks post for collateral to the ECB, increases from about 1.5%-2.5% to 7.5%-9%, according to reports. This will require Italian banks to post an additional 6.7-10 bln euros in collateral to secure the same level of borrowing. This does not seem to be particularly problematic for the Italian banking system as a whole, though some individual banks may be less prepared than others. It may be more onerous for Italy’s smaller banks. The Italian government and the Bank of Italy surely were aware of this risk. Discussions about it have appeared in the central bank’s financial stability report. There may have been some ideas that the government guaranteed bank bond program would have been in place now, given that it was approved nearly four weeks ago, which may have been sufficient to avoid the downgrade. Renzi’s political gamble is part of the problem. The rating agency cited his resignation and the idea that the new government will likely be unable to extend structural reforms. If Renzi had not resigned and continued to press a reform agenda, Italy might not have been downgraded now by DBRS. The downgrade will not be a major challenge for Italy. However, borrowing costs are already rising and will rise further. Italy is on a path from which if it does not emerge, problems will only intensify. Meanwhile, after a horrendous H1 16, Italian bank shares have recovered. The Great Graphic on the top of this post (created on Bloomberg) shows the FTSE-Italia All Bank Shares over the past six months. It rose 31% in H2 16, after falling 63% in the first half. The index fell a little more than 38% last year snapping a three-year 56%+ advance. Today, the bank share index rose nearly 3% to snap a five-session losing streak. |

Italian Bank Stocks |

The downgrade did not seem to disturb the euro, which if anything continued to recover from the pullback that pushed it briefly below $1.06 in late-European dealings.

Full story here Are you the author? Previous post See more for Next post

Tags: $EUR,Great Graphic,Italy,newslettersent