Tag Archive: newslettersent

Dollar Index: The Chart Everyone is Talking About

Many are discussing a possible head-and-shoulders pattern in the Dollar Index. We are skeptical as other technical signals do not confirm. We recognize scope for disappointment over the border tax and the next batch of employment data, but European politics is the present driver and may not be alleviated soon.

Read More »

Read More »

Great Graphic: US and Japan Five-Year Credit Default Swaps

For the first time since the financial crisis, the 5-year CDS on JGBs is dipping below the 5-year US CDS. It appears to be more a function of a decline in Japan's CDS than a rise in the US CDS. We are reluctant to read too much into the small price changes in the mostly illiquid instruments.

Read More »

Read More »

FX Daily, February 20: Marking Time on Monday

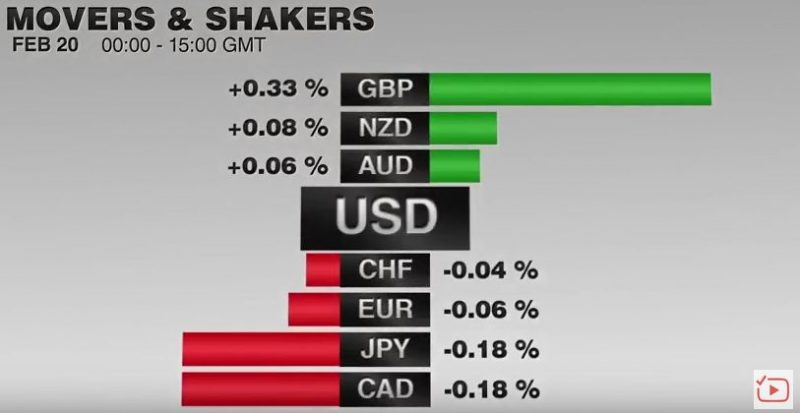

US markets are closed for the Presidents' Day holiday, but it hasn't prevented its pre-weekend gains giving a bullish tone to global equities. The S&P 500 and NASDAQ recovered from early weakness to close at new record levels before the weekend. Global equity markets are following suit today.

Read More »

Read More »

Greenspan Says Gold “Ultimate Insurance Policy” as has “Grave Concerns About Euro”

“The eurozone isn’t working …” warns Greenspan, “I view gold as the primary global currency” said Greenspan, “Significant increases in inflation will ultimately increase the price of gold”, “Investment in gold now is insurance…”

Read More »

Read More »

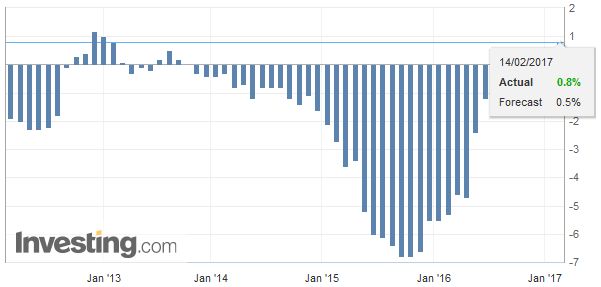

No Acceleration In Industry, Either

Industrial Production in the United States was flat in January 2017, following in December the first positive growth rate in over a year. The monthly estimates for IP are often subject to greater revisions than in other data series, so the figures for the latest month might change in the months ahead. Still, even with that in mind, there is no acceleration indicated for US industry.

Read More »

Read More »

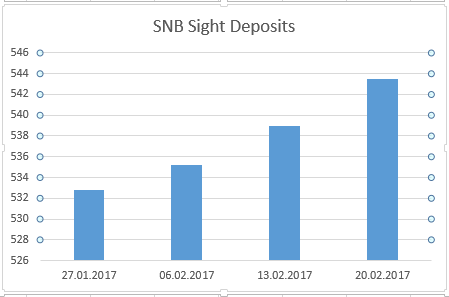

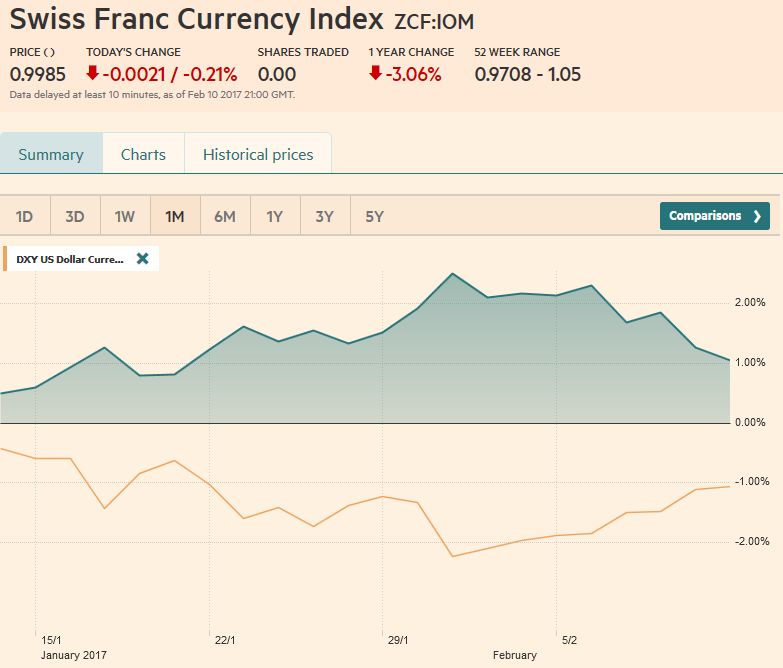

Weekly Sight Deposits and Speculative Positions: Once again a new SNB intervention record

Once again a massive SNB intervention and a post Trump election record: 4.5 billion CHF at a EUR rate of 1.0648.

Read More »

Read More »

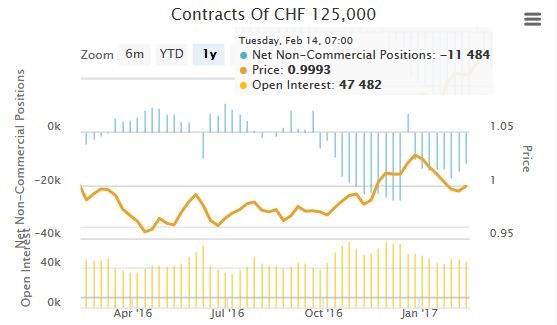

Weekly Speculative Position: Rising EUR shorts and falling CHF shorts point to weaker EUR/CHF

Speculators increased their EUR net short position against the dollar, but lowered their CHF net shorts (vs. USD). This tendency confirms our view that EUR/CHF will move towards parity.

Read More »

Read More »

FX Weekly Preview: Number One Rule of the Game is Stay in the Game

Light economic calendar in the week ahead, but anticipation of US tax reform may underpin dollar and equities. European politics are in flux (France, Italy, Greece) and this may see spreads widen over Germany. Russia's outlook was upgraded by Moody's before the weekend, and China has announced no coal imports this year from North Korea. Brazil is expected to cut Selic by 75 bps.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a soft note, as some risk off sentiment crept back into the markets. The dollar gained broadly on Friday despite lower US rates as bonds rallied, the yen gained and equities sold off. Markit PMI for February Tuesday and FOMC minutes Wednesday could give the markets some further clues regarding Fed policy.

Read More »

Read More »

Schuld an der Steuerklatsche sind die honorigen Ökonomen

Sieben Bundesräte, das Parlament, alle Finanzdirektoren und alle Wirtschaftsverbände waren für die Steuerreform. Millionen wurden in den Abstimmungskampf investiert. Trotzdem ging die geplante Steuerreform III mit rund 60 Prozent bachab. Ein klareres Misstrauensvotum kann man sich kaum vorstellen. Das Volk ist seiner Regierung nicht mehr gefolgt. Wo liegen die Gründe?

Read More »

Read More »

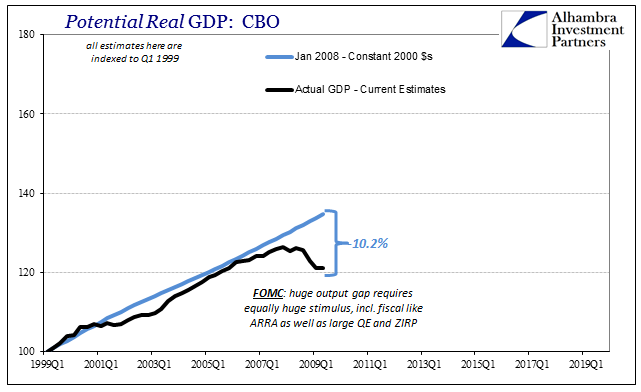

Their Gap Is Closed, Ours Still Needs To Be

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great “Recession” at around 10% of the CBO’s...

Read More »

Read More »

FX Weekly Review, February 13 – 18: Why still long the dollar?

Arguments for being long the dollar: FX investors because of the difference in monetary policy (e.g. higher US rates), Bond investors long US Bonds because higher bond yields, On the other side, European and Swiss equities are not so much overvalued as U.S. stocks are.

Read More »

Read More »

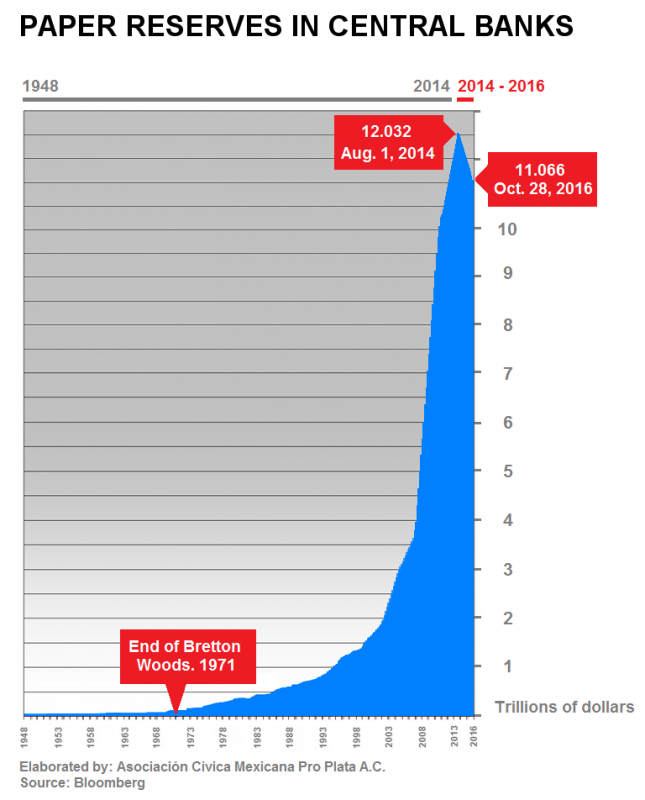

If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…

The U.S. will never go back on a gold standard. The notion that a U.S. Dollar backed by gold would solve our financial problems is pure folly. Why? Because, if the U.S. Empire didn’t abandon the gold standard in 1971, it would have collapsed decades ago. Unfortunately, some of the top experts in the precious metals community continue to suggest that revaluing gold much higher, to say…. $15,000-$50,000 an ounce, would bring confidence back into the...

Read More »

Read More »

Swiss Producer and Import Price Index in January 2017: +0.4 percent

The Producer and Import Price Index rose in January 2017 by 0.4% compared with the previous month, reaching 100.4 points (base December 2015 = 100). The rise is due in particular to higher prices for petroleum products, scrap and watches. Compared with January 2016, the price level of the whole range of domestic and imported products rose by 0.8%. These are the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

The Consensus Narrative does not Appreciate the Resilience of the System

The system of checks and balances is working. Populism-nationalism is not sweeping across the world. Even in US and UK, populist agenda was appropriated by the main-center right party. The attack on the body politics is activating the immune system in ways that the consensus narrative does not recognize.

Read More »

Read More »

Emerging Markets: What has Changed

Head of Samsung Group Jay Y. Lee was formally arrested on allegations of bribery, perjury, and embezzlement. The assassination of Kim Jong Un’s half-brother suggests the political situation in North Korea may be heating up. The Polish central bank is tilting more hawkish. The Turkish central bank said it will allow domestic companies to use liras to repay export loans.

Read More »

Read More »

Gold Is Undervalued Say Leading Money Managers

Gold is undervalued according to a record number of fund managers. Last time gold was considered undervalued, the price surged. BAML surveyed 175 money managers with $543 billion in assets under management. 34% of investors believe protectionism is the biggest threat to markets. Gold viewed as the best protectionist investment by a third of investors.

Read More »

Read More »

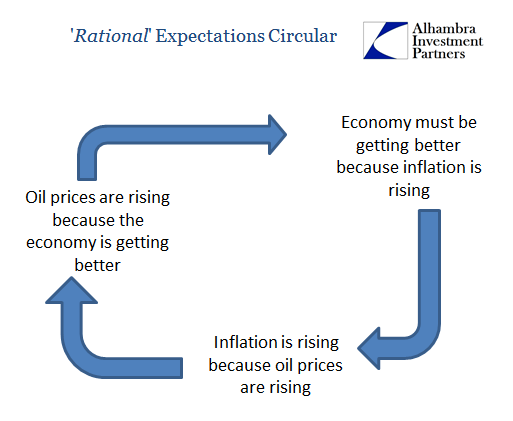

Why Aren’t Oil Prices $50 Ahead?

Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even 2014, it may at times seem the...

Read More »

Read More »

FX Daily, February 17: Greenback Stabilizes Ahead of the Weekend

The US dollar is finishing the week on a steady to firmer note against the major currencies but the Japanese yen. The softer yields and weaker equity markets often are associated with a stronger yen. For the week as a whole, the dollar is mostly lower, though net-net it has held its own against sterling, the euro and Canadian dollar.

Read More »

Read More »