Tag Archive: newslettersent

Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them.

Read More »

Read More »

Trump Administration Modifying Stance on Way to G20

Confrontation with China has been dialed down. Criticism of the Fed has been walked back. There is less talk about the dollar. Employment data has been embraced.

Read More »

Read More »

Boosting Stock Market Returns With A Simple Trick

Trading methods based on statistics represent an unusual approach for many investors. Evaluation of a security’s fundamental merits is not of concern, even though it can of course be done additionally. Rather, the only important criterion consists of typical price patterns determined by statistical examination of past trends.

Read More »

Read More »

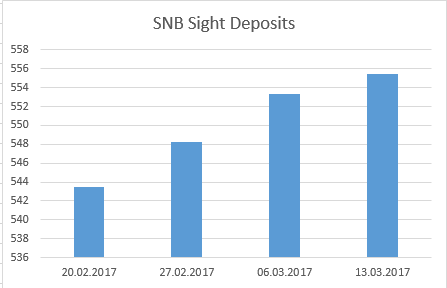

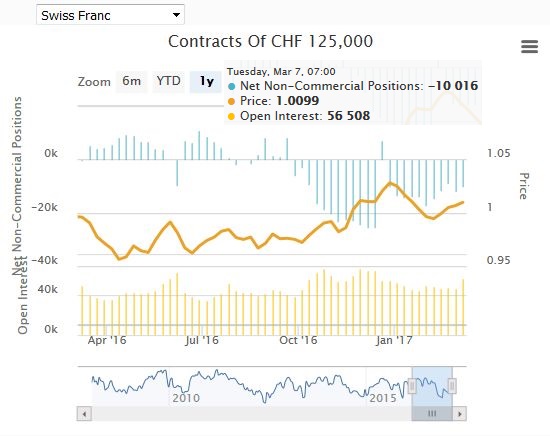

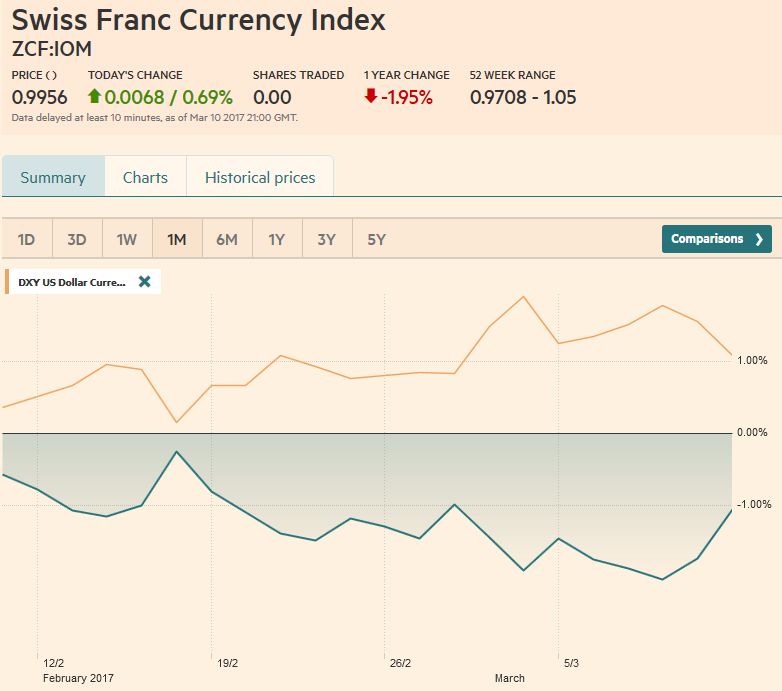

Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

The SNB intervened less than before. Investors might have changed their positions after a less dovish ECB.

Read More »

Read More »

Weekly Speculative Position: Less dovish ECB not include yet

The commitments of traders were released on March 7 before the ECB meeting of March 9. We expect a considerable re-adjustment.

Read More »

Read More »

FX Daily, March 13: Bonds and Equities Rally, Dollar Heavy

Hit by profit-taking ahead of the weekend, despite US jobs data that remove the last hurdle to another Fed hike this week, the greenback remains on the defensive. It has softened against all the major currencies and many of the emerging market currencies. The chief exception is those in eastern and central Europe.

Read More »

Read More »

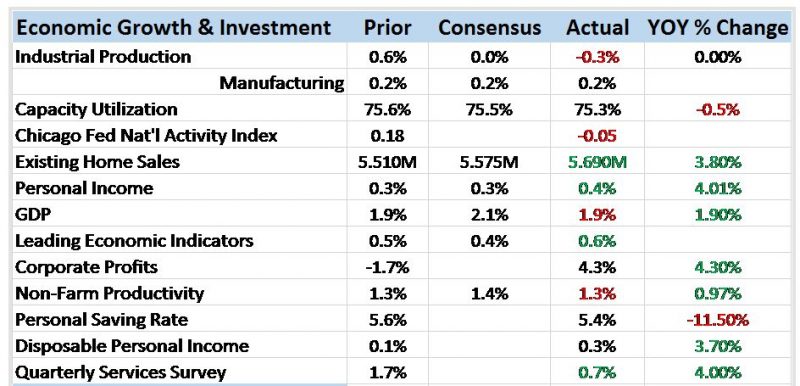

Bi-Weekly Economic Review

The Federal Reserve is widely expected to raise interest rates again at their meeting next week. They obviously view the recent cyclical upturn as being durable and the inflation data as pointing to the need for higher rates. Our market based indicators agree somewhat but nominal and real interest rates are still below their mid-December peaks so I don’t think a lot has changed.

Read More »

Read More »

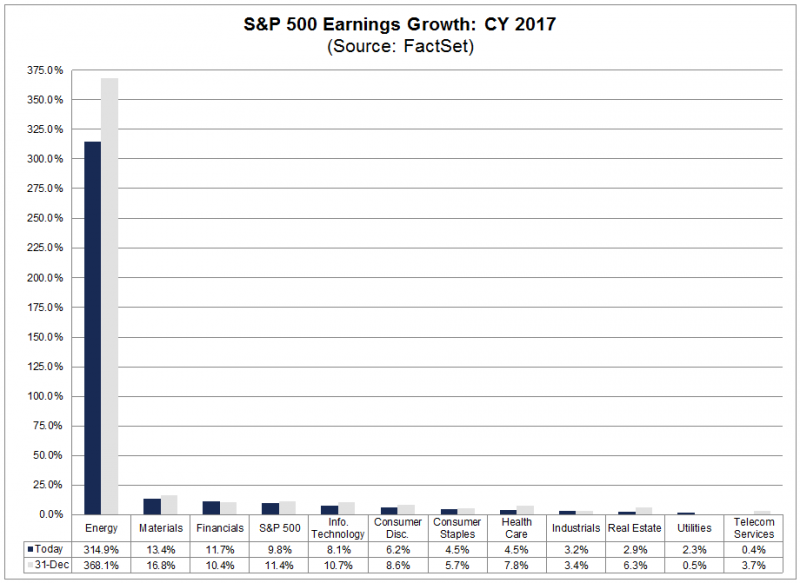

Earnings Update – A Poor Sort of Memory

“I don’t understand you,’ said Alice. ‘It’s dreadfully confusing!’

‘That’s the effect of living backwards,’ the Queen said kindly: ‘it always makes one a little giddy at first–‘

‘Living backwards!’ Alice repeated in great astonishment. ‘I never heard of such a thing!’

‘–but there’s one great advantage in it, that one’s memory works both ways.’

‘I’m sure mine only works one way,’ Alice remarked. ‘I can’t remember things before they happen.’...

Read More »

Read More »

FX Weekly Preview: Succinct Views of Ten Events and Market Drivers: Week Ahead

The week ahead is the busiest week of the first quarter. It sees four major central meetings, including the Federal Reserve which is likely to raise rates for the second time in four months. The Dutch hold the first European election of the year, and the populist-nationalist party remains in contention for the top slot. The week concludes with the G20 meeting, the first that the Trump Administration's presence will be felt.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a firm note despite the strong US jobs data, with the dollar succumbing to some “buy the rumor, sell the fact” price action. We think the dollar should recover as the week begins, as it seems risky to be short/underweight dollars going into the FOMC meeting. With the Fed poised to hike 3 or perhaps 4 times this year, we don't think EM FX can continue to rally the way it has so far this year.

Read More »

Read More »

FX Weekly Review, March 06 – March 11: CHF loses against the euro

The Swiss Franc lost this week in particular against the euro, given that Mario Draghi was less dovish than expected. If the stronger euro is driven only by speculators, or also by "real money" (investments in cash, bonds, stocks) will be visible in Monday's sight deposits release.

Read More »

Read More »

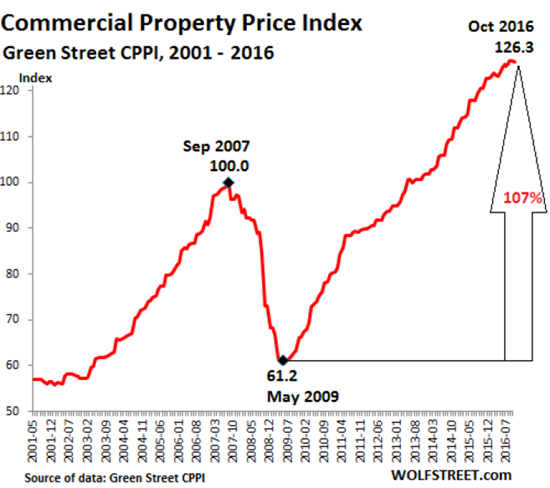

The Next Domino to Fall: Commercial Real Estate

Just as generals prepare to fight the last war, central banks prepare to battle the last financial crisis--which in the present context means a big-bank liquidity meltdown like the one that nearly toppled thr global financial system in 2008-09.

Read More »

Read More »

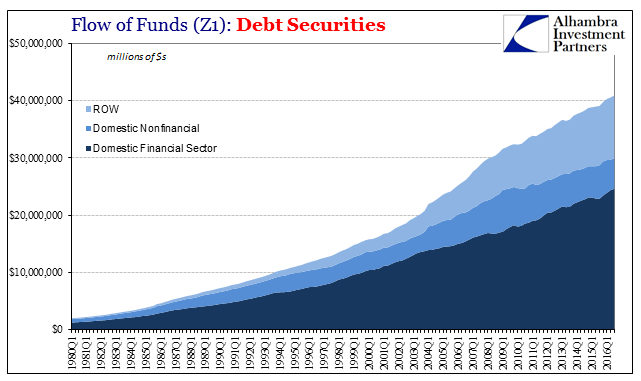

Do Record Debt And Loan Balances Matter? Not Even Slightly

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated with some of the worst. It...

Read More »

Read More »

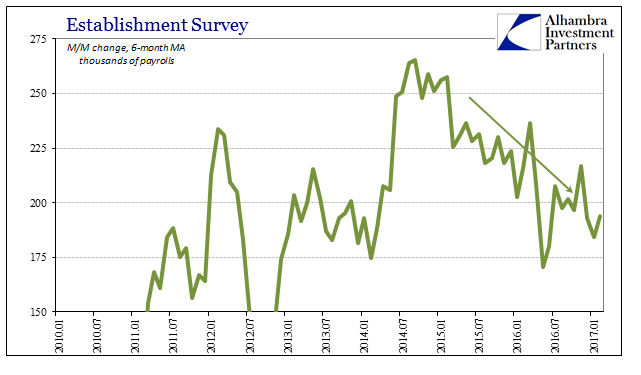

Payrolls Still Slowing Into A Third Year

Today’s bland payroll report did little to suggest much of anything. All the various details were left pretty much where they were last month, and all the prior trends still standing. The headline Establishment Survey figure of 235k managed to bring the 6-month average up to 194k, almost exactly where it was in December but quite a bit less than November. In other words, despite what is mainly written as continued “strength” is still pointing down...

Read More »

Read More »

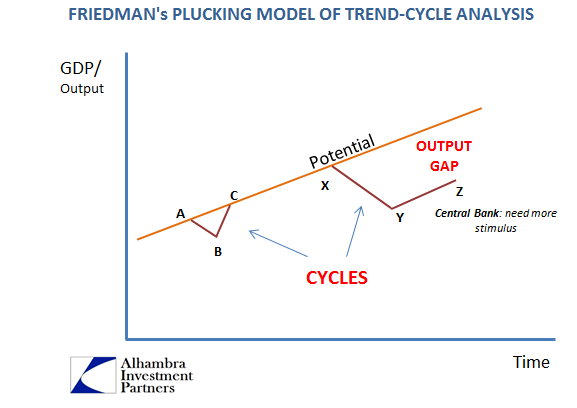

Time, The Biggest Risk

If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the failures of QE’s 1 and 2. This...

Read More »

Read More »

Are Central Banks Losing Control?

If you want a central banker to choke on his croissant, read him this quote from socio-historian Immanuel Wallerstein: "Countries (have lost the ability) to control what happens to them in the ongoing life of the modern world-system."

Read More »

Read More »

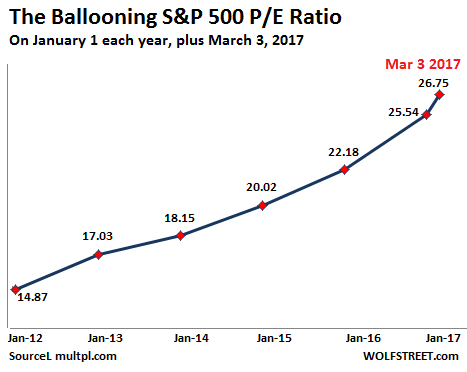

No Paradox, Economy to Debt to Assets

It is surely one of the primary reasons why many if not most people have so much trouble accepting the trouble the economy is in. With record high stock prices leading to record levels of household net worth, it seems utterly inconsistent to claim those facts against a US economic depression.

Read More »

Read More »

Emerging Markets: What has Changed

North Korean banks subject to international sanctions have been banned from using Swift. Korea’s Constitutional Court upheld Parliament’s motion to impeach President Park. Singapore eased some property market curbs after a three-year decline in home prices. Egypt partially reversed a cut in bread subsidies. Nigeria’s President Buhari returned to the nation after spending nearly two months in the UK. Moody’s moved its outlook on Argentina’s B3...

Read More »

Read More »