Tag Archive: newslettersent

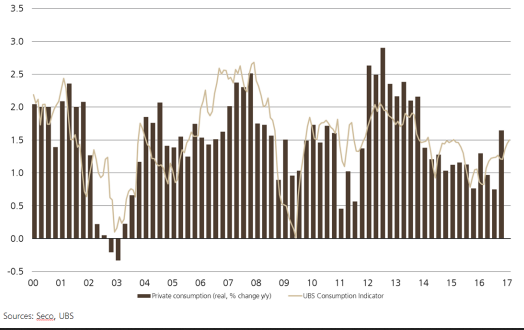

Switzerland UBS Consumption Indicator February: Domestic tourism rising

The UBS consumption indicator rose to 1.50 points in February from 1.44, indicating solid private consumption in the first quarter. Domestic tourism bottomed out and then rose significantly in January. On the other hand, dour sentiment in the retail trade is hemming further gains by the consumption indicator.

Read More »

Read More »

Cool Video: “Turn Around Tuesday” Call in Early Asia Yesterday

I had time this afternoon, as I prepare for my TMA presentation tomorrow night here in Hong Kong, to find my clip from yesterday on CNBC, where I suggested the risk of a dollar recovery after it lost downside momentum in North America on Monday.

Read More »

Read More »

Cool Video: Brexit, Europe and EU Challenges

Earlier today, I had the opportunity to discuss the outlook for sterling and the US dollar on Bloomberg TV with Rishaad Salamat and Haidi Lun. It is a momentous day with Article 50 of the Lisbon Treaty being formally triggered by UK Prime Minister May, nine months after what was, at least initially, a non-binding referendum.

Read More »

Read More »

Price Inflation – The Ultimate Contrarian Bet

If there is one thing apparently no-one believes to be possible, it is a resurgence of consumer price inflation. Actually, we are not expecting it to happen either. If one compares various “inflation” data published by the government, it seems clear that the recent surge in headline inflation was largely an effect of the rally in oil prices from their early 2016 low.

Read More »

Read More »

India: The next Pakistan?

India’s Rapid Degradation. This is Part XI of a series of articles (the most recent of which is linked here) in which I have provided regular updates on what started as the demonetization of 86% of India’s currency. The story of demonetization and the ensuing developments were merely a vehicle for me to explore Indian institutions, culture and society.

Read More »

Read More »

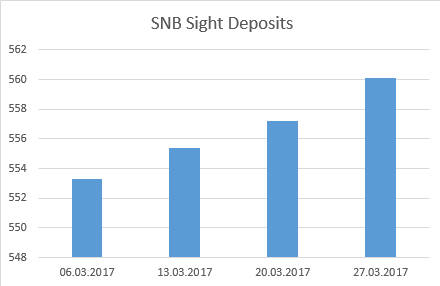

Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

The SNB intervenes for 2.9 bn CHF at EUR/CHF 1.07. For us, clearly too much and too risky; she will not maintain this pace over a longer term. Hence the EUR/CHF is prone to fall again.

Read More »

Read More »

FX Daily, March 28: Prospects for Turnaround Tuesday?

The slide in the US dollar and US interest rates faded in the North American session on Monday. US participants also had a fairly relaxed initial response to news that after years of complaining, the Republicans could not agree on an alternative to the Affordable Care Act.

Read More »

Read More »

Weekly Speculative Positions: Continued reduction of Euro Shorts

Another time speculators reduced their net Euro shorts after the less dovish ECB. But the net short of CHF nearly remains stable. This resulted in an appreciation of EUR/CHF.

Read More »

Read More »

100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world's largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump.

Read More »

Read More »

Don’t Confuse Immigration With Naturalization

As the immigration debate goes on, many commentators continue to sloppily ignore the difference between the concept of naturalization and the phenomenon of immigration. While the two are certainly related, they are also certainly not the same thing. Recognizing this distinction can help us to see the very real differences between naturalization, which is a matter of political privilege, and immigration, which simply results from the exercise of...

Read More »

Read More »

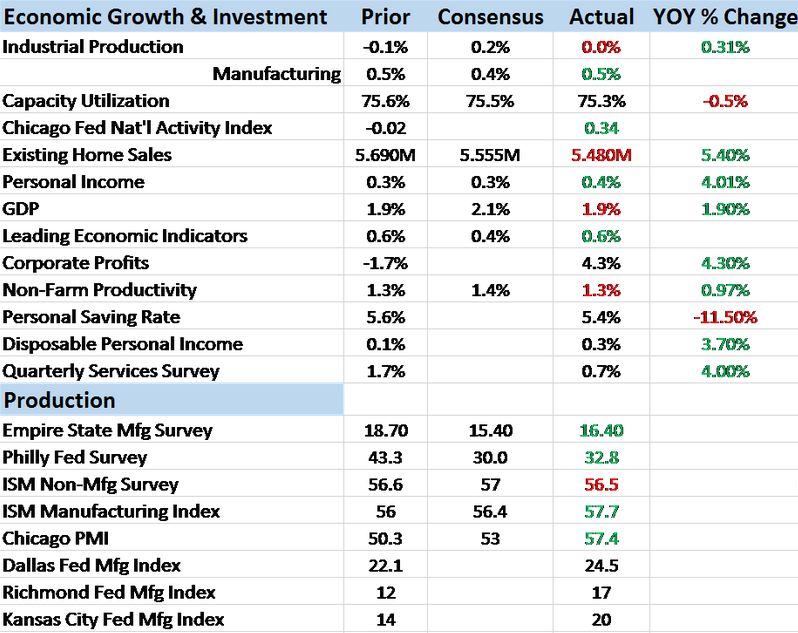

Bi-Weekly Economic Review

The Fed did, as expected, hike rates at their last meeting. And interestingly, interest rates have done nothing but fall since that day. As I predicted in the last BWER, Greenspan’s conundrum is making a comeback. The Fed can do whatever it wants with Fed funds – heck, barely anyone is using it anyway – but they can’t control what the market does with long term rates.

Read More »

Read More »

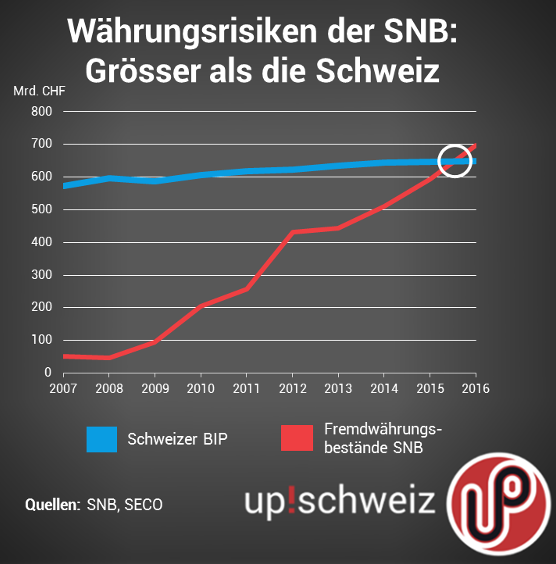

Riskante SNB-Politik: up! fordert Währungswettbewerb

Die Schweizerische Nationalbank (SNB) hat am Donnerstag ihren Geschäftsbericht publiziert und musste erneut heftige Kritik vor der Schweizer Unabhängigkeitspartei up! einstecken. up! kritisiert insbesondere die expansive Geldpolitik, die zu Fremdwährungsreserven von 692 Milliarden Franken geführt hat. Zudem fordert up! einen Übergang von der staatlichen Währung zu einem System von Marktwährungen.

Read More »

Read More »

FX Weekly Preview: After US Health Care, Now What?

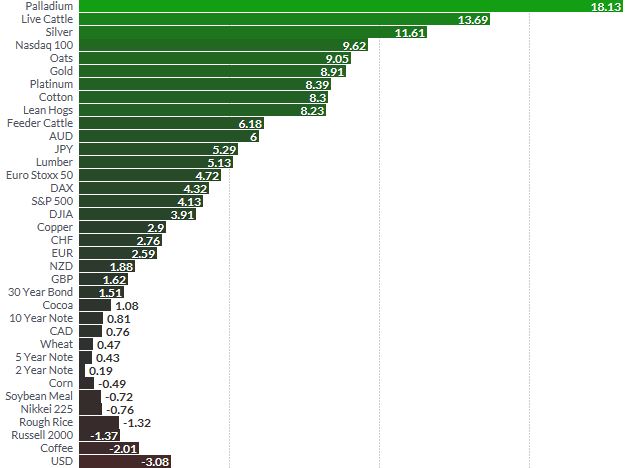

The first quarter winds down. The dollar moved lower against all the major currencies. The best performer in the first three months of the year has been the Australian dollar's whose 5.8% rally includes last week's 1% drop. The worst performing major currency has been the Canadian dollar.

Read More »

Read More »

Safe Haven Gold Rises 2.5 percent As Stocks Fall and ‘Trump Trade’ Fades

Gold and silver jumped another 1% overnight in Asia, building on the respective 1.5% and 2.2% gains seen last week. The ‘Trump trade’ is fading, impacting stock markets and risk off has returned to global markets with the Nikkei, S&P 500 futures and European stocks weakening.

Read More »

Read More »

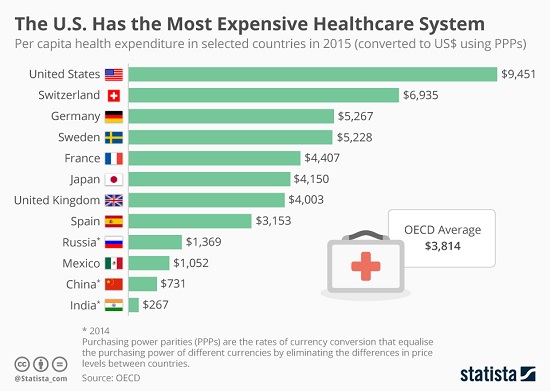

Forget ObamaCare, RyanCare, and any Future ReformCare-the Healthcare System Is Completely Broken

It's time to start planning for what we'll do when the current healthcare system implodes. As with many other complex, opaque systems in the U.S., only those toiling in the murky depths of the healthcare system know just how broken the entire system is.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week on a firm note. Indeed, virtually all of EM was up against the dollar last week, led by ZAR and MXN. BRL and PHP were the laggards. It remains to be seen how markets react to the failure to pass the health care reform in the US. Will Trump move on the tax reform? Can the Republicans proceed with its agenda in light of the fissures within the party?

Read More »

Read More »

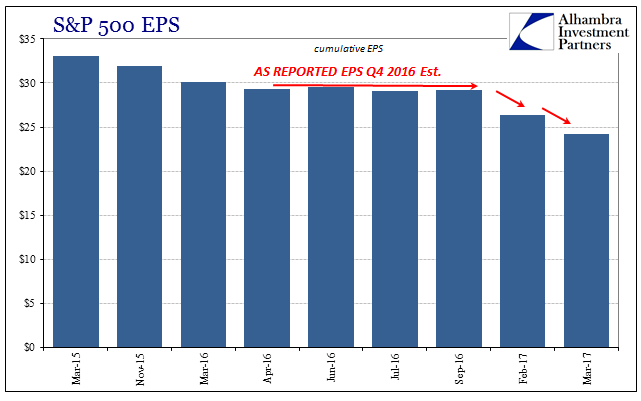

The Inverse of Keynes

With nearly all of the S&P 500 companies having reported their Q4 numbers, we can safely claim that it was a very bad earnings season. It may seem incredulous to categorize the quarter that way given that EPS growth (as reported) was +29%, but even that rate tells us something significant about how there is, actually, a relationship between economy and at least corporate profits.

Read More »

Read More »

FX Weekly Review, March 20 – March 25: Dollar Bottom Near?

In the last week, the Swiss Franc index recovered and gained about 2%. The dollar index lost 1.5%. Position adjustments: The dollar tended to trade heaviest against those currencies that speculators were short, like the euro, yen, and sterling.

Read More »

Read More »

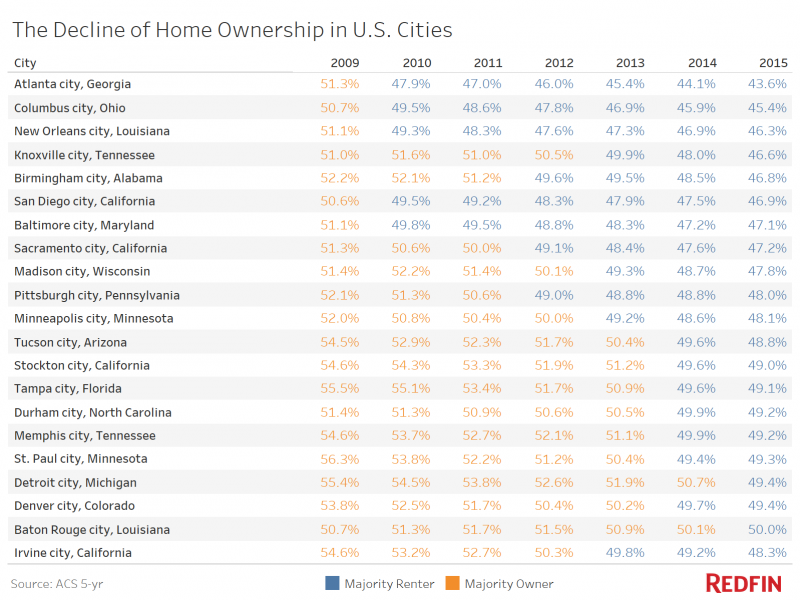

Renters Now Rule Half of U.S. Cities

The American Dream increasingly involves a lease, not a mortgage. Detroit was once known as a city where a working-class family could afford to own a home. Now it’s a city of renters. Just 49 percent of Motor City households were homeowners in 2015, down from 55 percent in 2009 and the lowest percentage in more than 50 years.

Read More »

Read More »

![The Modimobile is making the rounds amid a flower shower. [PT] Photo credit: PTI Photo](https://snbchf.com/wp-content/uploads/2017/03/Modi-Mobile.jpg)