Tag Archive: newslettersent

UBS escapes shareholder rebellion fate of rival

UBS shareholders overwhelmingly approved executive bonuses at the bank’s annual general meeting on Thursday. Why such a difference from the Credit Suisse shareholder rebellion seen just one week ago?

Read More »

Read More »

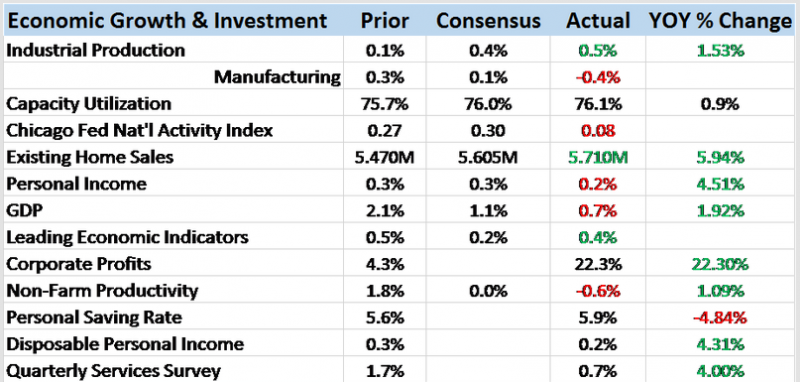

Bi-Weekly Economic Review

The economic reports since the last economic update were generally less than expected and disappointing. The weak growth of the last few years had been supported by autos and housing while energy has been a wildcard. When oil prices fell, starting in mid-2014 and bottoming in early 2016, economic growth suffered as the shale industry retrenched.

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank's interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the "the BoJ comes in big, the...

Read More »

Read More »

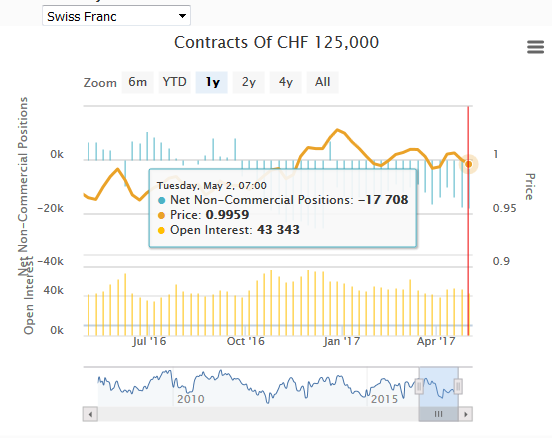

Weekly Speculative Positions (as of May 02): Euro Shorts Covered, Yen Longs Liquidated

The net short CHF position has risen to 17K contracts (against USD). It was feast or famine in the adjustment of speculative positions in the currency futures market during the CFTC reporting period ending May 2. Speculators either made large adjustments or very small adjustments, and little in between.

Read More »

Read More »

FX Daily, May 08: Euro Bought on Rumor, Sold on Fact

The euro initially opened higher in Asia following confirmation that Macron was elected the next president of France, but quickly fell below $1.0960 before bouncing back toward $1.10 only to be sold again in early Europe below the pre-weekend low near $1.0950. A break now of $1.0930 could signal a return to the lower end of the range seen since the first round of the French election near $1.0850-$1.0870.

Read More »

Read More »

Thousands of cross-border workers risk big bills for health insurance

Thousands of cross-border workers working in the canton of Geneva, who have not yet formally sorted out their health insurance situation, risk getting a big bill. This week the canton made a final call to those living in France and working in Geneva to make a formal choice between the French and Swiss health systems, something which must be done before the final deadline on 30 September 2017.

Read More »

Read More »

FX Weekly Preview: Dollar Drivers

US retail sales and CPI should help bolster confidence that the Fed was right about the transitory nature of Q1 slowdown. Bank of England meets; Forbes will likely continue with her dissent, but likely failed to convince her other colleagues of the merit of an immediate rate hike. French politics are center stage, but German state election and South Korea's national election are also important.

Read More »

Read More »

Emerging Markets Preview

EM FX got some limited traction as the week closed, helped by stabilizing commodity prices. However, oil, copper, and iron ore have all broken important technical levels that suggest further weakness ahead. We also think the FOMC and jobs data support our view that the next Fed hike will be in June. This backdrop should keep EM on the defensive this week.

Read More »

Read More »

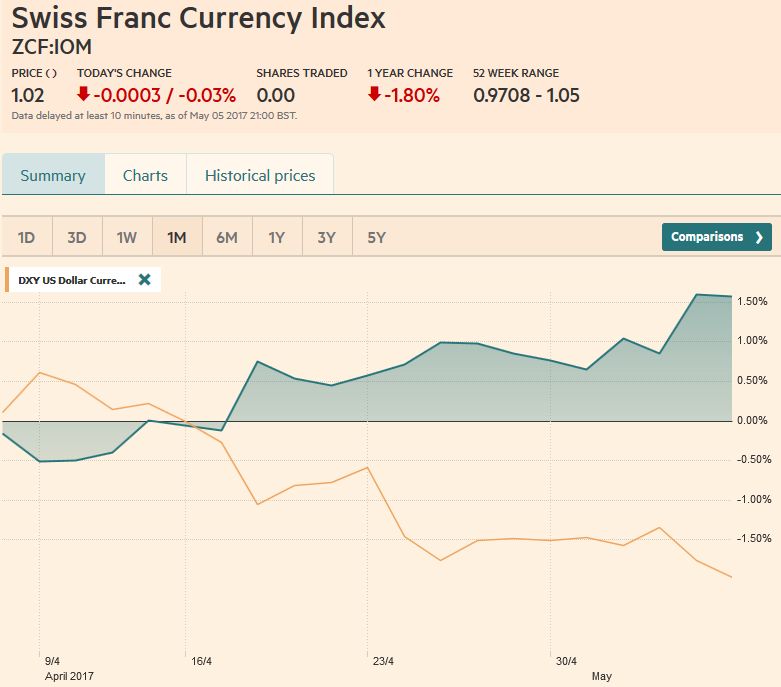

FX Weekly Review, May 01 – 06: Seasonal Patterns and Yen Crosses

The Swiss Franc index gained 1.5% in the last month, the biggest part of it is from the last week. The trade-weighted indices the Fed tracks are updated monthly. The Bank of England calculates the effective exchange rate on a daily basis. It has not fallen since April 24.

Read More »

Read More »

Swiss employees the best paid in Europe, according to study

According to a recent study, employees in certain roles in Switzerland are paid around 50% more than those second-placed Luxembourg. The premium applies to recent hires, middle managers and qualified professionals, says the study conducted by Willis Tower Watson.

Read More »

Read More »

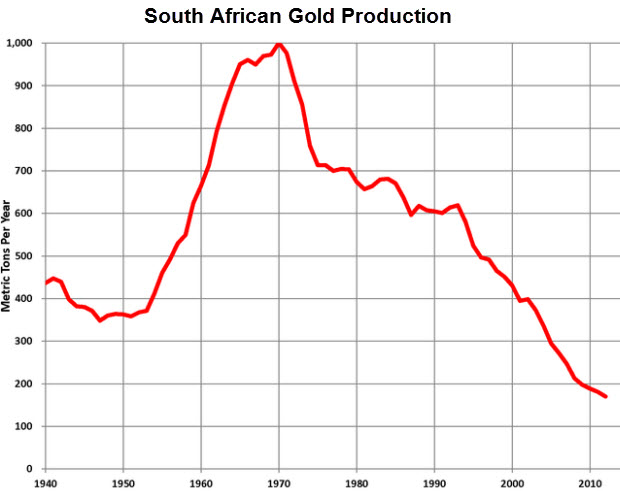

Keiser Report Interview: Peak Gold, Silver On Small Finite Planet

Peak Gold and Silver On “Small Finite Planet” With Near Infinite Currency. Peak gold and silver and the case for peak precious metals on “our small, finite planet” was the topic for discussion on the latest episode of the the Keiser Report.

Read More »

Read More »

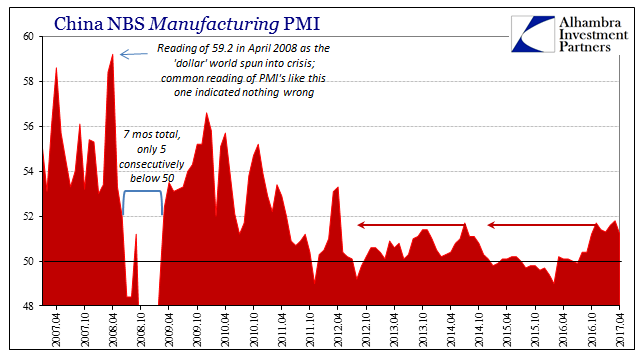

China: Blatant Similarities

Declines in several of the world’s PMI’s in April have furthered doubts about the global “reflation.” But while many disappointed, some sharply, it isn’t just this one month that has sown them. In China, for example, both the manufacturing and non-manufacturing sentiment indices declined to 6-month lows.

Read More »

Read More »

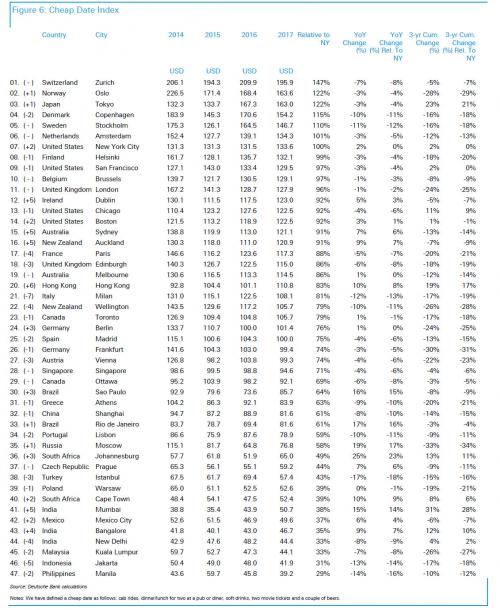

These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive - and in this year's edition, best - cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of & cheap dates in the world's top cities.

Read More »

Read More »

London Property Market Vulnerable To Crash

London property market vulnerable to crash. House prices in London are falling. London property up 84% in 10 years (see chart). House prices have risen over 450% in 20 years. Brexit tensions as seen over weekend and outlook for U.K. economy to impact property. Global property bubble fragile – Risks to global economy. Gold bullion a great hedge for property investors.

Read More »

Read More »

Emerging Markets: What has Changed

Relations between China and North Korea appear to be worsening. The THAAD missile shield has been deployed earlier than expected in South Korea. An amendment to India’s Banking Regulation Act gives the RBI more power to address bad loans. Tensions are rising between Czech Prime Minister Sobotka and Finance Minister Babis. Brazil pension reform bill was passed 23-14 in the lower house special committee.

Read More »

Read More »

Great Graphic: Gas and Oil

Steep falls in gasoline and oil prices. Large build in gasoline inventories and record refinery work shifted some surplus from oil to the products. OPEC is expected to roll over its output cuts, but non-OPEC may find it difficult and US output continues to rise.

Read More »

Read More »

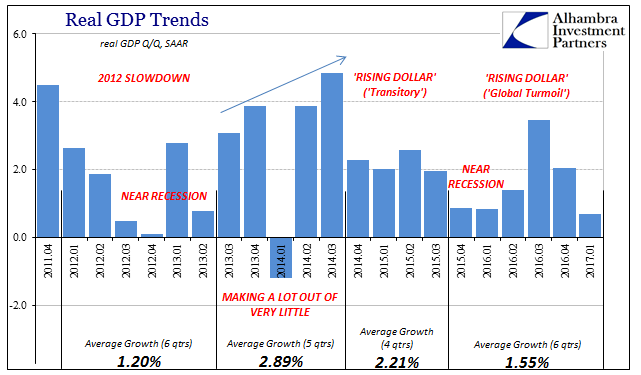

This Is Not Expansion

Back in October, the Bureau of Economic Analysis released GDP figures that suggested what those behind “reflation” had hoped. After a near miss to start 2016, the economy had shaken off the effects of “transitory” weakness, mainly manufacturing and oil, poised to perform in a manner consistent with monetary policy rhetoric.

Read More »

Read More »

April Jobs Won’t Change Minds

There is something for everyone in today's US jobs report, and at the end of the day, it is unlikely to sway opinion about the direction and timing of the next Fed move. The greenback itself may remain range bound after the initial flurry. On the other hand, the disappointing but noisy Canadian data underscores the risk of a more dovish slant to the central bank's neutral stance next week.

Read More »

Read More »

Digital Swiss Francs

The Swiss National Bank held its annual general meeting of shareholders (web TV). In response to one of the questions posed by shareholders Thomas Jordan suggested (2:58–2:59) that possibly a digital Swiss Franc might be introduced sometime in the future.

Read More »

Read More »