Tag Archive: newslettersent

Markozy, Merde, and now Meron

German Chancellor Merkel is one of the outstanding leaders of our era. She leads the world's fourth largest economy, which is still the locomotive for Europe. Recent state elections and polls leave little doubt that barring some kind of shock, she will be re-elected as Chancellor in September. It will be her fourth term.

Read More »

Read More »

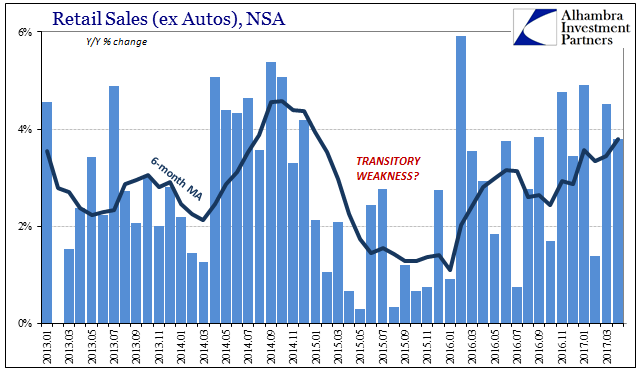

Reasonable Retail (Therefore Consumer) Expectations

Retail sales estimates are not adjusted for inflation, but even so whenever they get down toward the 3% growth level you can be sure there is serious economic trouble. The 6-month average for overall retail sales dropped below 3% in March 2001, the month that marked the start of the official dot-com recession (though that is not the official name for the cyclical peak, it probably should be).

Read More »

Read More »

FX Daily, May 19: Markets Trying to Stabilize Ahead of Weekend

Judging from investors' reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices.

Read More »

Read More »

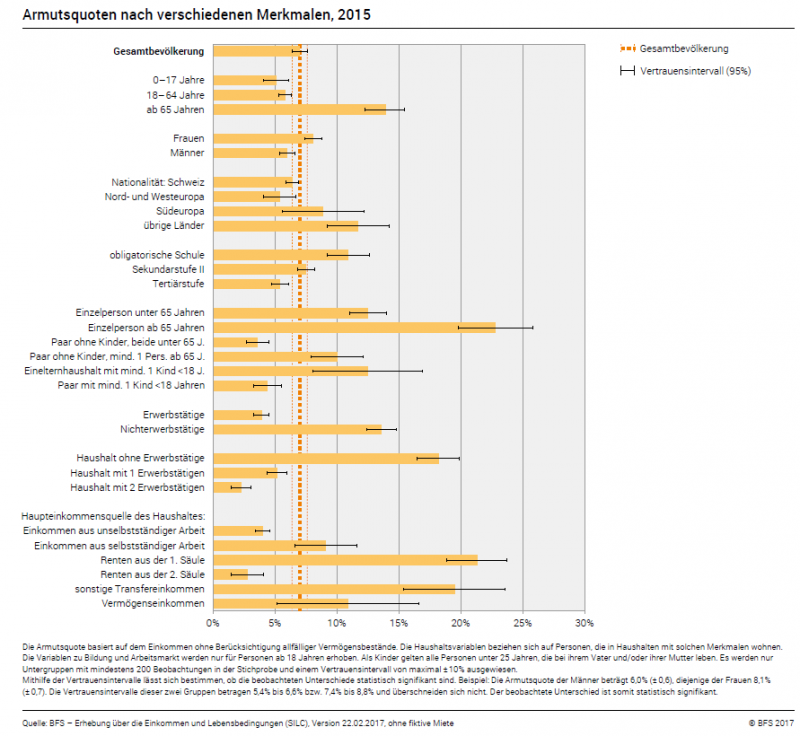

Income and living conditions (SILC) 2015: Poverty in Switzerland: 7 percent of the Swiss population were affected by income poverty

Neuchâtel, 15.05.2017 (FSO) - In 2015 approximately 570 000 people were affected by income poverty in Switzerland. Just under 145,000 of these were employed. The groups most affected were persons living alone or in single parent households with minor children, persons with no post-compulsory education and those living in households where no-one works.

Read More »

Read More »

Three Swiss Farms Close a Day

The trend for fewer but larger farms continued in Switzerland last year, with the total number dropping by 990 to 52,263. While small and conventionally farmed businesses were throwing in the towel, organic agriculture flourished.

Read More »

Read More »

Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies

Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies – Cyberattacks expected to spread today in “second phase”– UK intelligence says scale of threat significant– Microsoft slams NSA for letting hacking tools cause global malware epidemic– Ransomware attack already crippled more than 200,000 computers in 150 countries– 1.3 million computer systems believed to be at risk

Read More »

Read More »

Syngenta deal will ‘drive modernisation’ of Chinese farming

Syngenta, the Swiss agribusiness group which is being acquired by ChemChina in the biggest foreign takeover by a Chinese company, will help Beijing modernise China's farm sector while simultaneously remaining firmly a "western company", its chairman has said. Michel Demaré told The Financial Times that, under its new owners, Syngenta would become "a partner of the Chinese government to basically drive the modernisation of Chinese agriculture – so...

Read More »

Read More »

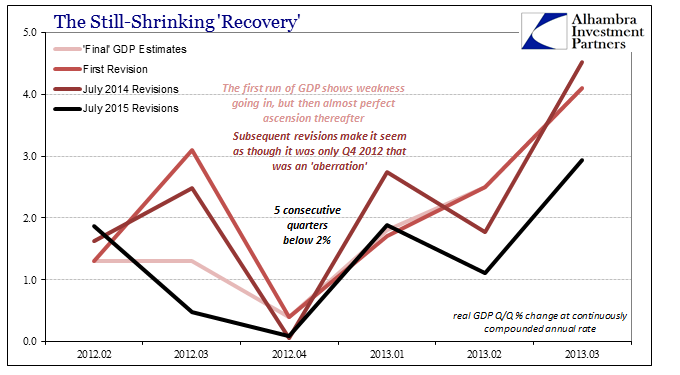

Hopefully Not Another Three Years

The stock market has its earnings season, the regular quarterly reports of all the companies that have publicly traded stocks. In economic accounts, there is something similar though it only happens once a year. It is benchmark revision season, and it has been brought to a few important accounts already. Given that this is a backward looking exercise, that this season is likely to produce more downward revisions shouldn’t be surprising.

Read More »

Read More »

FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

Yesterday's dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI's investigation into Russia's attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump Administrations economic program is back the front burners, but it is sufficient to stem the time for the moment.

Read More »

Read More »

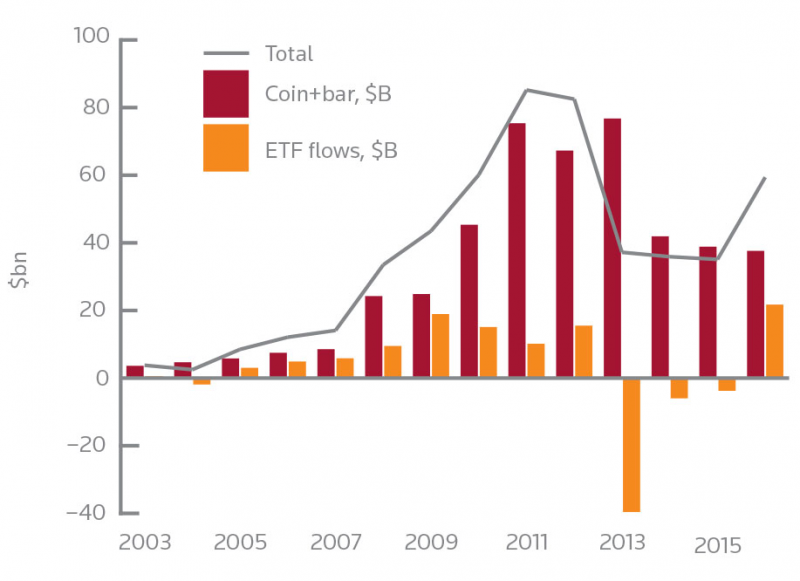

History of Gold – Interesting Facts and Changes Over 50 Years

History of Gold – How the gold industry has changed over 50 years. Thomson Reuters GFMS have compiled an interesting high level history of the gold industry in the last fifty years. Topics covered and interesting historical facts to note include: Gold market size– Gold mine production “peaked in 2015”. South African production collapse from 1,000 tonnes.

Read More »

Read More »

Cabinet sees no need to regulate social media

Remain vigilant, continue to monitor, but no need for concerted federal action. This was the conclusion of a cabinet report Wednesday on social media and the problems it can provoke, including “fake news” and distorting public opinion. The cabinet decided that, for now, more regulation is not the solution.

Read More »

Read More »

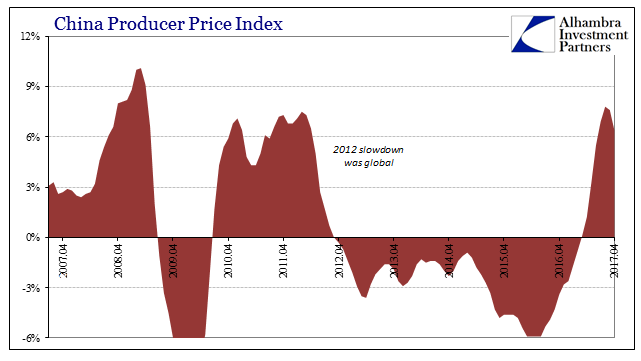

China Inflation Now, Too

We can add China to the list of locations where the near euphoria about inflation rates is rapidly falling apart. This is an important blow, as the Chinese economy has been counted on to lead the world out of this slump if through nothing other than its own sheer recklessness. “Stimulus” was all the rage one year ago, and for a time it seemed to be producing all the right effects. This was “reflation”, after all.

Read More »

Read More »

Swiss National Bank releases updated banknote app

The Swiss National Bank (SNB) is releasing an app for mobile devices, designed to help the public familiarise themselves with the new banknotes. The app – an updated version of the ‘50-franc’ app launched last year to accompany the issue of the new 50-franc note – is now called ‘Swiss Banknotes’ and can be downloaded free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores.

Read More »

Read More »

FX Daily, May 17: Drama In Washington Adds To Dollar Woes

The US dollar has drifted lower against most of the major currencies as the culmination of news from Washington, escalating already rising concerns about the economic agenda that was to bolster growth with dramatic tax reform, infrastructure initiative, and re-orienting trade.

Read More »

Read More »

Cool Video: Oil, US Inflation

I was on Bloomberg's Day Break with the team and guest Anne Lester from JP Morgan discussing oil and inflation. Oil prices had bounced back at the end of last week and were lifted further on news that Saudi Arabia and Russia were inclined to support extending output cuts not just until the end of the year, but through Q1 18.

Read More »

Read More »

Swiss export products banned as toxic at home

In the wake of a Chinese takeover of the Swiss agribusiness group Syngenta, a Swiss advocacy group raises concerns about Switzerland's regulatory role. Switzerland exports two powerful herbicides, atrazine and paraquat, to developing countries. However, these products, manufactured by Basel giant Syngenta, are prohibited in the Swiss territory.

Read More »

Read More »

Rising Oil Prices Don’t Cause Inflation

A very good visual correlation between the yearly percentage change in the consumer price index (CPI) and the yearly percentage change in the price of oil seems to provide support to the popular thinking that future changes in price inflation in the US are likely to be set by the yearly growth rate in the price of oil (see first chart below).

Read More »

Read More »

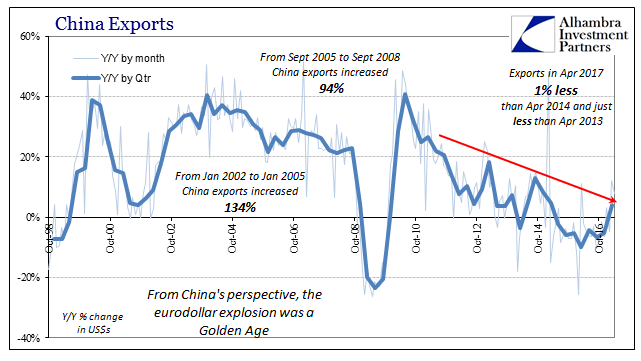

Lackluster Trade, China April Edition

China’s trade statistics for April 2017 uniformly disappointed. They only did so, however, because expectations are being calibrated as if the current economy is actually different. It is instead merely swinging between bouts of contraction and low-grade growth, but so low-grade it really doesn’t qualify as growth.

Read More »

Read More »

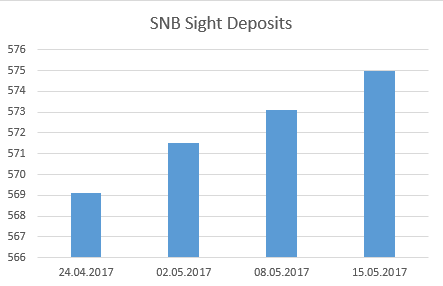

Weekly SNB Interventions and Speculative Positions: More Interventions at higher Euro rate

The pro-European politician Macron has won the French elections. His success moved the EUR/CHF up to 1.0980, mostly caused by FX speculators. But "serious" investors (not FX speculators) did not follow the political event, but focus on monetary policy. A ECB rate hike is very, very far, see why....

Read More »

Read More »