Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 17(see more posts on EUR/CHF, ) |

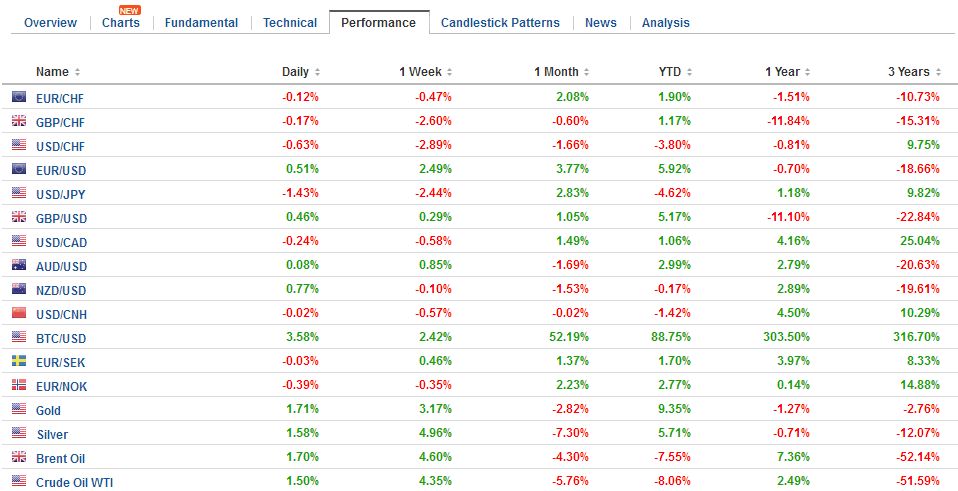

GBP/CHFInflation data weakens Sterling. Yesterday saw the release of Consumer Price Index (CPI) data. CPI is a measure of inflation and yesterday we saw a rise from 2.3% to 2.7% month on month. Usually a rise in inflation is deemed as good for an economy, but on this occasion it is a worrying sign. The rapid rise is a direct result of the vote to leave the EU. Sterling has weakened considerably against the majority of major currencies since the vote and a result imported goods have become far more expensive. With retailers now facing higher costs they are filtering the increase on price down to the consumer. This can be sustainable provided wage growth is increasing at a similar rate. On this occasion, it is not, in fact it is some way behind which is why we have seen Sterling weaken so significantly. If you have a currency requirement involving Sterling be sure to keep a close eye on CPI data it could have a big impact on GBP value. How will the UK election effect the pound? Usually a snap election would could cause the currency in question to weaken, but on this occasion the opposite occurred. It is a shrewd move from the PM to call for an election while the opposition is so weak. A conservative victory is deemed as positive for the UK economy and is the reason Sterling has strengthened as of late. Some may expect heavy volatility as the election draws closer, but I am of the opinion a conservative victory is already factored in, if they do win I would not expect big movement on the exchange. |

GBP/CHF - British Pound Swiss Franc, May 17(see more posts on GBP/CHF, ) |

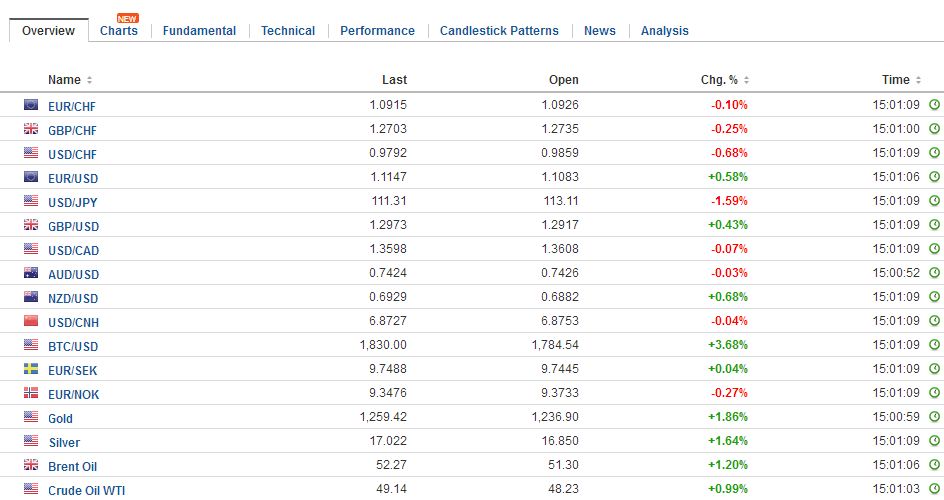

FX RatesThe US dollar has drifted lower against most of the major currencies as the culmination of news from Washington, escalating already rising concerns about the economic agenda that was to bolster growth with dramatic tax reform, infrastructure initiative, and re-orienting trade. The political morass that has engulfed the Trump Administration is a major distraction at the same time that the investors had grown more concerned about the momentum of the US economy following the recent disappointment with retail sales, housing starts, and consumer prices. We have consistently argued that interest rates are the critical driver of the US dollar. The US 10-year yield reached 2.42% a week ago. It is now below 2.30%. The two-year note yield, which ought to be anchored by Fed policy, has fallen 10 bp to 1.26%. The market appears to be gradually reconsidering a Fed hike in June. Bloomberg, whose calculation for the June meeting always seemed aggressive, has eased to 90% probability form 95% a week ago. In contrast, the CME sees the odds as having fallen from nearly 88% a week ago to a little more than 69% presently. Our own calculation concurs with the CME. The economic data did not weigh on the yen. The more compelling yen driver is the interest rate differential between the US and Japan. Since the BOJ has succeeded in keeping Japan’s 10-year yield fairly stable near zero, the key is the US 10-year yield. Its latest leg down has seen the dollar ease toward JPY112.25. Recall last week it was stalling in front of JPY114.40. The JPY112.00-JPY112.25 is important technically as it houses the 20-day moving average and a retracement objective of the run-up over the past month. A break of this area could spur another quick yen decline toward JPY111.00-JPY111.25. |

FX Daily Rates, May 17 |

| Sterling is unperturbed. It continues to be confined to its recent trading range between almost $1.28 and nearly $1.30. The intraday technicals suggest this range will likely hold. The euro briefly pushed through GBP0.8600 for the first time since late March, but has reversed lower. It was below GBP0.8400 a week ago. A close below GBP0.8560 today would suggest a near-term top in the cross may be in place.

With today’s upticks, the euro has nearly met our retracement target of $1.1130. It corresponds to the 61.8% retracement of the decline since last May when the euro reached poked through $1.16. A move through the $1.1130 area would target $1.12 initially, but traders will likely look for a little more than $1.13 to test the initial US election high. |

FX Performanc, May 17 |

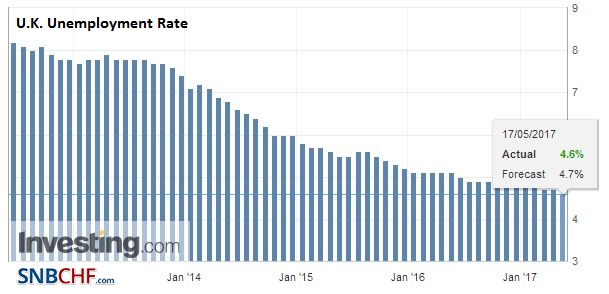

United KingdomThe second economic report was the UK employment data. On one hand, the unemployment rate unexpectedly eased to 4.6% from 4.7%. This is the lowest ILO measure since 1975. On the other hand, the claimant count rose by 19.4k and the March increase was revised to 33.5k from 25.5k. Note that the claimant count average 0.15k in 2016, while the three-month average now stands at 15.6k, the highest since Q3 11. |

U.K. Unemployment Rate, March 2017(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

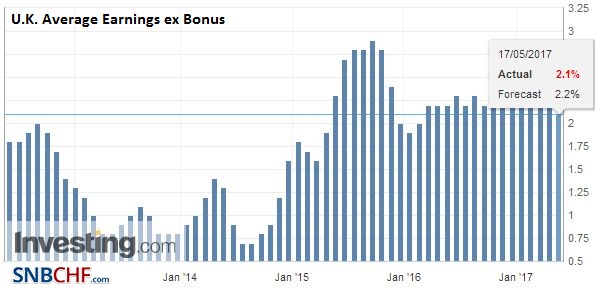

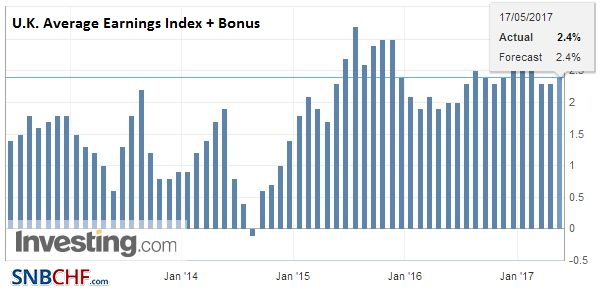

| Excluding bonuses, average weekly earnings growth slowed to 2.1% from 2.2%. Given the recent inflation report, it means that real wages in the UK fell in Q1 for the first time in nearly three years. Weakness in real wages is thought to limit consumption, which is part of the reason why the MPC is expected to look past the near-term increase in price pressures, which are the now still the echo of the past decline in sterling and the vagaries of energy. |

U.K. Average Earnings ex Bonus, March 2017(see more posts on U.K. Average Earnings, ) Source: Investing.com - Click to enlarge |

U.K. Average Earnings Index +Bonus, March 2017(see more posts on U.K. Average Earnings Index, ) Source: Investing.com - Click to enlarge |

|

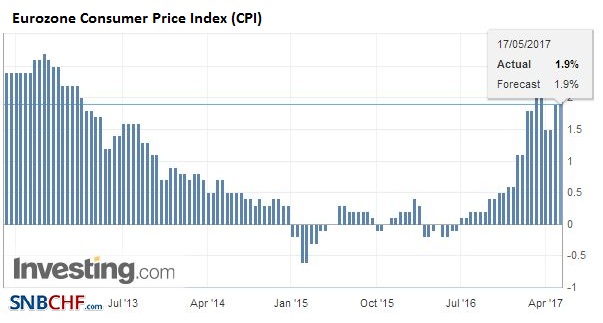

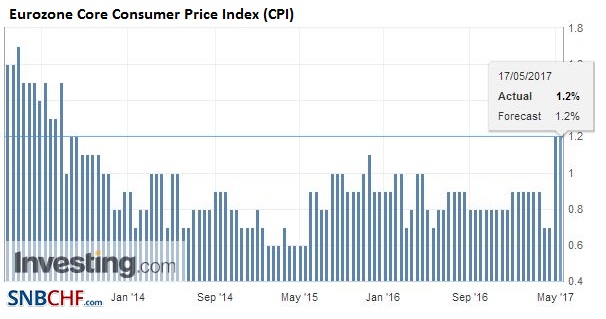

Eurozone |

Eurozone Consumer Price Index (CPI) YoY, May 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Eurozone Core Consumer Price Index (CPI) YoY, April 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

|

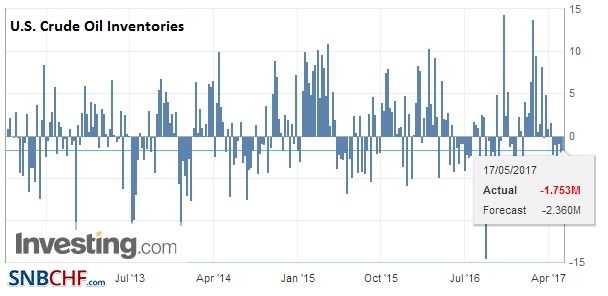

United StetesThe North American session has a light economic diary. The EIA energy report is important after the API showed an unexpected increase in US oil inventory. The EIA is expected to report a nearly 2.5 mln barrel draw and gasoline stocks easing by nearly 925k barrels. Bernanke’s speech toward the end of the London session may draw interest. |

U.S. Crude Oil Inventories, May 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

While the news from Washington is disturbing, we worry that talk of impeachment and the like is grossly exaggerated. Neither sharing intelligence with Russia nor asking the FBI head to consider dropping an investigation are not criminal even if poor politics. Trump’s overall approval rating is low, but there are two aspects that many might not appreciate. First, Trump’s approval rating, but some measures, appears slightly higher than when he was initially elected. Second, his approval rating among his supporters and Republicans remains high. In the past, when other presidents have gotteninto trouble, the withdrawal of support from their own party was critical.

Claims that American democracy is ending are also wildly hyperbolic. As Bismarck famously quipped, in a democracy one should not see the way laws or sausages are made seems apropos. Surely, the republic form of government that has been evolving for more than 240 years is more formidable and resilient than these doomsayers are claiming. It has survived the assassination of presidents, the resignation of Nixon and the Watergate, and the impeachment of Clinton. It has survived the leaking of the Pentagon Papers and Iran-Contra.

There were two economic reports today that ought to not be lost in the focus on US politics. The first was disappointing Japanese core machine orders in March. The 1.4% increase contrasts with expectations of a rise nearly twice as large. This puts the expectation at risk for Q1 GDP that will be released early Thursday in Tokyo. The median forecast in the Bloomberg survey was 0.5% for the quarter 1.7% at an annualized pace. The risk is slightly lower after today’s report. Moreover, forecasts for Q2 capex were reduced. Also, there is risk that the GDP deflator shows that deflationary forces are still lingering. After falling 0.1% in Q4 16, the GDP deflator is expected to fall to minus 0.7%, which would be the most in four years.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,FX Daily,gbp-chf,newslettersent,U.K. Average Earnings,U.K. Average Earnings Index,U.K. Unemployment Rate,U.S. Crude Oil Inventories