Tag Archive: newslettersent

Remembering A Still Falling Hero: Small Business

On this holiday weekend known here in the U.S. as Memorial Day, I would like to make a slight turn in the narrative that many give little to no attention too, yet, is one of the most important underlying principles or fundamentals which helped shape, lift, mold, sustain, and create one of the world’s greatest economic powerhouses bar none.

Read More »

Read More »

FX Daily, May 30: Mixed Dollar as Market Awaits Preliminary EMU CPI and US Jobs

With the backdrop of US interest rates unable to get much traction, despite the strong probability of another Fed rate hike in a couple of weeks, the third since last November election, the US dollar mixed today. The chief story today, though, is not the greenback but the euro. The euro is trading heavily for the fourth session.

Read More »

Read More »

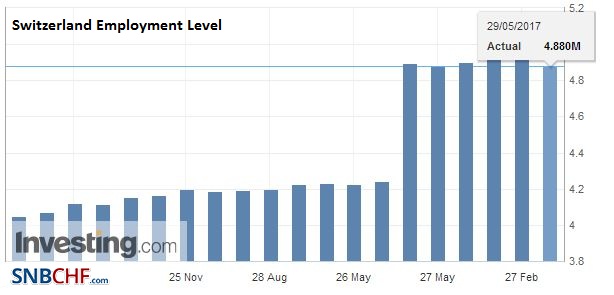

Strong franc scares off investment in Switzerland

The strong franc continues to scare off foreign investors to Switzerland, while at the same time driving Swiss manufacturing abroad. These are the findings of the latest annual Ernst & Young foreign direct investment (FDI) survey released on Friday.

Read More »

Read More »

Swiss farmers expect meagre fruit harvest after losses

An unusual end-of-April frost is expected to cost Swiss fruit producers some CHF100 million ($102 million) in damages and as much as three-quarters of their crop this year.

Read More »

Read More »

Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean.

Read More »

Read More »

Weekly Speculative Positions (as of May 23): Speculators Remain Bearish the Dollar and Bullish Bonds

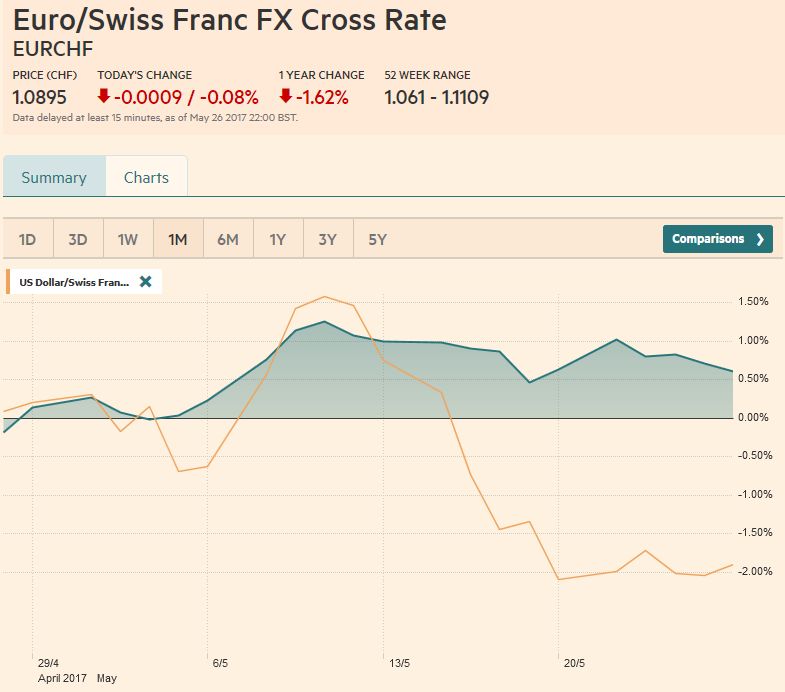

The net short CHF position has fallen from 21.1 short to 19.8K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. In the CFTC reporting week ending May 23 speculators in the futures market continued to largely position themselves for further dollar weakness.

Read More »

Read More »

FX Weekly Preview: Twin Peaks: US Economy and EMU Inflation

US economic data, culminating with the employment report, should be consistent with a re-acceleration of the world's largest economy after a typical slowdown in Q1. Eurozone price pressures likely eased considerably in May. For the UK economy, the bounce in April was a fluke, and gradual slowdown continues. Japanese investors have bought foreign bonds for three weeks in a row, which is the longest streak in six months.

Read More »

Read More »

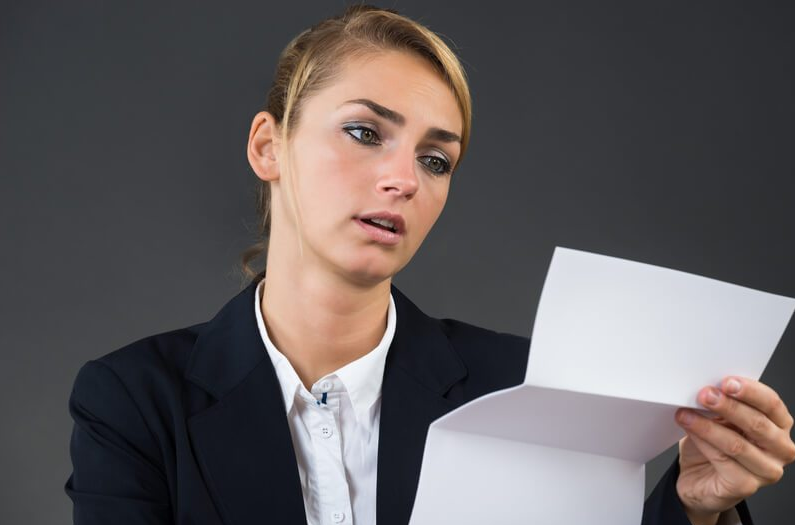

Big debts at 18 because parents didn’t pay Swiss health insurance bills

A recent article in the newspaper 20 Minutes highlights the nasty surprise some young people experience when their parents fail to pay their health insurance premiums. Turning 18 is one of life’s key milestones. It corresponds with the end of school and entry into a new world. In Switzerland it is also a health insurance milestone.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX closed last week on a mixed note, with markets struggling to find a compelling investment theme. The US jobs data this week could provide some more clarity on Fed policy. We still think markets are still underestimating political risk in the big EM countries, including Brazil (Moody’s outlook moved to negative), Mexico (election in state of Mexico), South Africa (ANC debates Zuma’s fate), and Turkey (ongoing crackdown on opposition).

Read More »

Read More »

FX Weekly Review, May 22 – 27: Is the Dollar Going To Turn?

The Swiss Franc recovered a lot of the losses that came with the French elections. That political event was mostly driven by speculators that will close their positions. We expected the EUR to trade around 1.07 to 1.0750 CHF in some time.

Read More »

Read More »

Some Swiss cantons overwhelmed with confessions of tax evasion

Ahead of the automatic exchange of bank account information, which comes into effect at the beginning of next year, Swiss residents with undeclared foreign bank accounts are rushing to come clean to the tax authorities, according to Swiss broadcaster RTS.

Read More »

Read More »

Swiss mobile providers perform well

Speed, availability, network responsiveness: on all counts, the mobile experience in Switzerland is “an excellent one”, according to a new report. But improvements could still be made to advance on the leader board. This is the verdict published Wednesday May 24 by OpenSignal, a London-based private held company that issues industry reports based on crowdsourced data from worldwide users of its OpenSignal app.

Read More »

Read More »

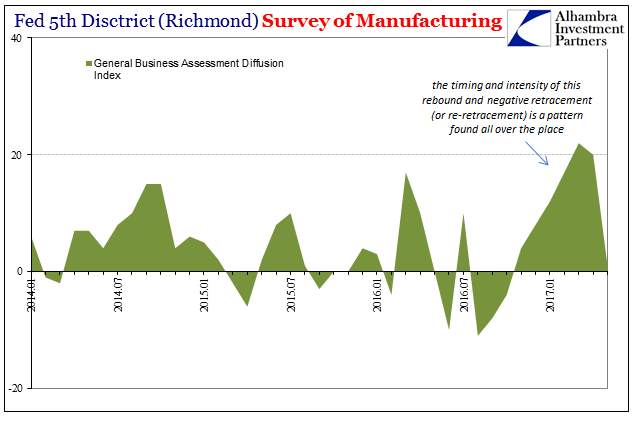

Suddenly Impatient Sentiment

Two more manufacturing surveys suggest sharp deceleration in momentum, or, more specifically, the momentum of sentiment (if there is such a thing). The Federal Reserve’s 5th District Survey of Manufacturing (Richmond branch) dropped to barely positive, calculated to be just 1.0 in May following 20.0 in April and 22.0 in March.

Read More »

Read More »

Emerging Markets: What has Changed

Moody's downgraded China's rating from Aa3 to A1 with stable outlook. Reports suggest that the PBOC has informed local banks that it is changing the way it sets the daily fix. Moody's downgraded Hong Kong’s rating to Aa2 from Aa1 with stable outlook. Philippine President Duterte declared martial law on Mindanao island. Egypt's central bank unexpectedly hiked rates by 200 bp. S&P moved the outlook on Bolivia’s BB rating from stable to negative....

Read More »

Read More »

Moving Closer to the Precipice

The decline in the growth rate of the broad US money supply measure TMS-2 that started last November continues, but the momentum of the decline has slowed last month (TMS = “true money supply”). The data were recently updated to the end of April, as of which the year-on-year growth rate of TMS-2 is clocking in at 6.05%, a slight decrease from the 6.12% growth rate recorded at the end of March.

Read More »

Read More »

Swiss working conditions slip

The Swiss spend three hours more per week on average at the office than other Europeans, but working conditions are still good. While the overall health and well-being of Swiss employees is still good, a new survey shows that Switzerland has lost its place ahead of 34 other European countries when it comes to stress and autonomy in the workplace.

Read More »

Read More »

New LafargeHolcim CEO given market approval

The markets have welcomed LafargeHolcim’s choice of chief executive to guide the company out of a reputational hole. Jan Jenisch, who will take over in October, has experienced difficult situations having spent the last two and a half years driving up Sika’s results against the backdrop of a shareholder civil war.

Read More »

Read More »