Tag Archive: newslettersent

Swiss government moves a step closer to axing capital withdrawals from pensions

Swiss pensions have three parts. The first is a standard payment based on the number of years you have paid social security taxes (AVS / AHV). The second (2nd pillar) is based on a personal pot of money built up from compulsory salary deductions. And the third is a personal pot derived from optional tax deductible savings, known as a 3rd pillar.

Read More »

Read More »

World’s longest railway tunnel victim of own success

Almost 10,000 passengers and around 67,000 tonnes of freight pass through the 57-kilometre-long Gotthard Base Tunnel each day. Opened a year ago on June 1, the Gotthard's success is putting the structure to the test.

Read More »

Read More »

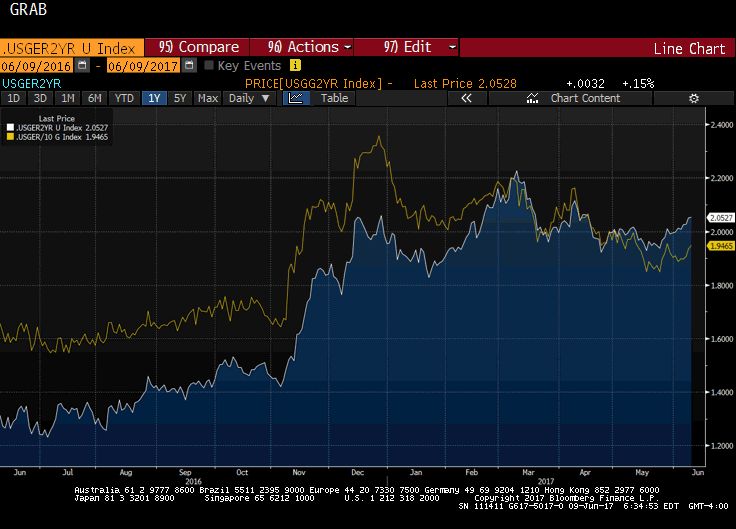

Great Graphic: Another Look at US-German Rate Differentials

This Great Graphic, created on Bloomberg, depicts the interest rate differential between the US and Germany. The euro-dollar exchange rate often seems sensitive to the rate differential. The white line is the two-year differential and the yellow line is the 10-year differential.

Read More »

Read More »

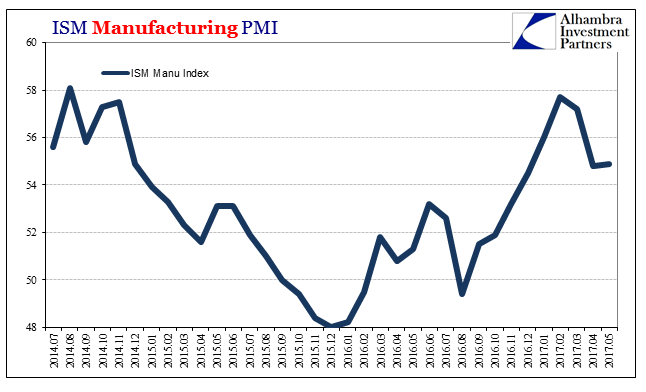

Dollars And Sent(iment)s

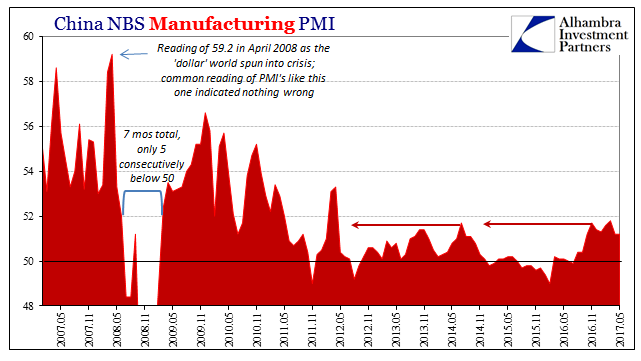

Both US manufacturing PMI’s underwhelmed just as those from China did. The IHS Markit Index was lower than the flash reading and the lowest level since last September. For May 2017, it registered 52.7, down from 52.8 in April and a high of 55.0 in January. Just by description alone you can appreciate exactly what pattern that fits. The ISM Manufacturing PMI was slightly higher in May than April, 54.9 versus 54.8, but still down from a February peak...

Read More »

Read More »

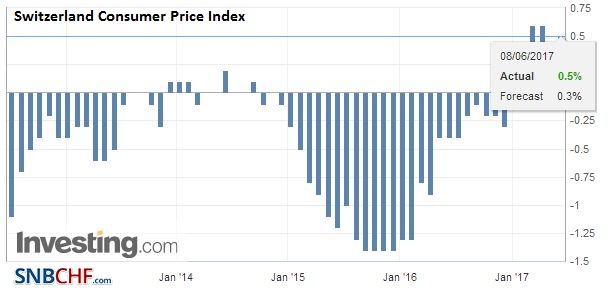

Swiss Consumer Price Index in May 2017: Up +0.5 percent against 2016, +0.2 percent against last month

The consumer price index (CPI) increased by 0.2% in May 2017 compared with the previous month, reaching 101.0 points (December 2015=100). Inflation was 0.5% compared with the same month in the previous year.

Read More »

Read More »

FX Daily, June 08: Thursday’s Show

Today has an anti-climactic feel to it. Yesterday's leak of what is purported to be the ECB staff forecasts point to small downward revisions to inflation forecasts and an ever small upward tweak to growth. This would be in line with only mild changes in the forward guidance language. The clear indication is that inflation is still not the conditions of a self-sustaining path toward the target.

Read More »

Read More »

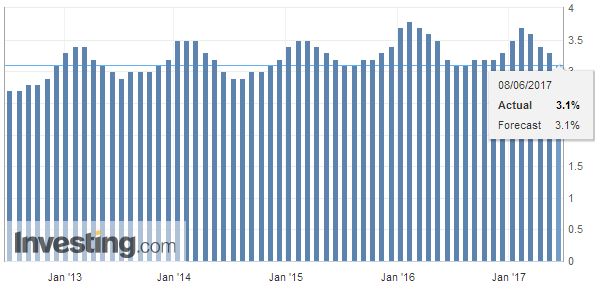

Switzerland Unemployment in May 2017: Decreased from 3.3 percent to 3.1 percent, seasonally adjusted decreased from 3.3 percent to 3.2 percent

Registered unemployment in May 2017 - According to the SECO surveys, 139,778 unemployed were registered at the Regional Employment Services Centers (RAV) at the end of May 2017, 6,549 less than in the previous month. The unemployment rate thus fell from 3.3% in April 2017 to 3.1% in the reporting month. Compared to the previous month, unemployment fell by 5,000 persons (-3.5%).

Read More »

Read More »

Switzerland not the most expensive in Europe for some mobile packages

Yesterday, the price comparison website Verivox published a study comparing mobile phone costs across 13 european countries. On most measures Switzerland was the most expensive, and by a wide margin. A plan including 100 minutes of talk and 1 Go (gigaoctet1) of data per month costs an average of CHF 25 per month in Switzerland

Read More »

Read More »

Gold Prices Steady On UK Election Risk; ECB Meeting and Geopolitical Risk

Gold held steady on Thursday as investors awaited cues on market direction amid a number of geopolitical events later in the day that could boost the safe-haven demand for the metal.

Read More »

Read More »

Pay No Attention To 50

China’s PMI’s were uniformly disappointing with respect to what Moody’s was on about last week. Chinese authorities expended great effort and resources to get the economy moving forward again after several years of “dollar”-driven deceleration. here was a massive “stimulus” spending program where State-owned FAI expenditures of about 2% of GDP were elicited to make up for Private FAI that at one point last year was actually contracting.

Read More »

Read More »

Ist unser Geldsystem etwa doch teuflisch?

In seinem Standpunkt „Wie entsteht Geld“ (Inside Paradeplatz vom 31.5.2017) bekräftigt Marc Meyer seine These, dass die herrschende Geldschöpfungstheorie grundlegend falsch sei, weil sie auf Goethes Mephisto basiere. Schon vor vielen Jahren hat sich Meyer für eine alternative Theorie der Geldschöpfung eingesetzt. Dass er deswegen seine Stelle verlor und ein Leben lang vom Arbeitsmarkt der Banken ausgeschlossen wurde, ist ein Skandal.

Read More »

Read More »

FX Daily, June 07: Markets Mark Time Ahead of Tomorrow

Tomorrow may be the most important day of the quarter for investors. The ECB meets. The UK goes to the polls. Former FBI Comey testifies. Ahead of these significant events, the global capital markets are mostly quiet, with some pockets of activity.

Read More »

Read More »

Giant carbon-sucking commercial plant launches in Zurich

The world’s first commercial plant to extract carbon dioxide at industrial scale from the air and sell it directly to a buyer opened near Zurich on Wednesday. The machine pipes the gas to a nearby greenhouse to help grow vegetables. The Swiss firm Climeworks external linkturned on the so-called ‘Direct Air Capture (DAC)’ plant in the farming village of Hinwil, Switzerland. The plant aims to supply 900 tonnes of CO2 annually to a nearby greenhouse...

Read More »

Read More »

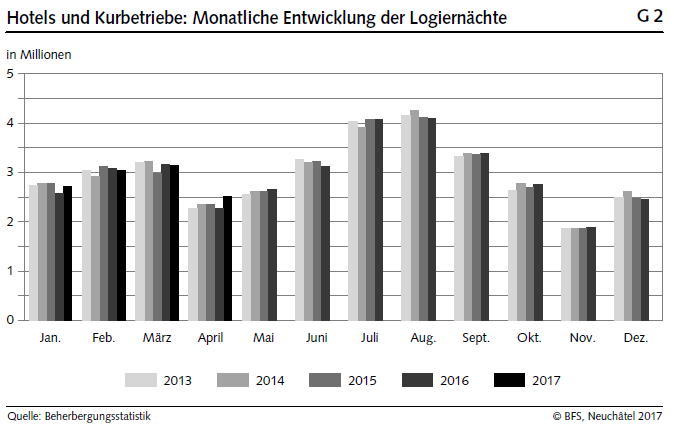

Tourist Accommodation in the Winter Season 2016/2017: Overnight stays Increased by 2.0 percent in Switzerland

The hotel sector registered 15.7 million overnight stays in Switzerland during the winter tourist season (from November 2016 to April 2017). This represents an increase of 2.0% (+314,000 overnight stays) compared with the same period a year earlier. With a total of 8.2 million overnight stays, foreign demand rose by 2.1% (+171,000). Domestic visitors registered a 1.9% increase (+143,000) with 7.5 million units. These are the provisional results...

Read More »

Read More »

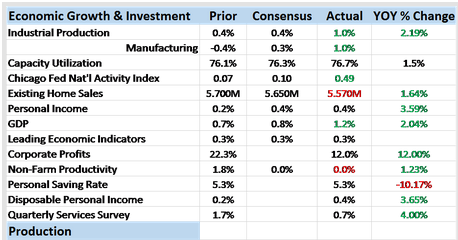

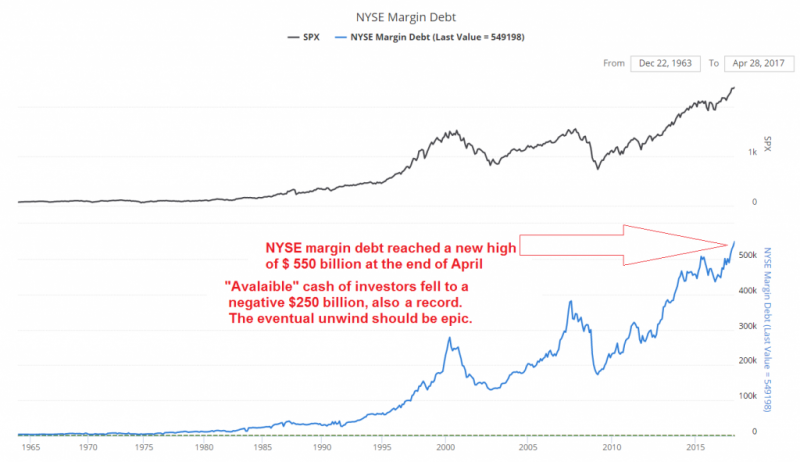

Bi-Weekly Economic Review: The Return of Economic Ennui

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters.

Read More »

Read More »

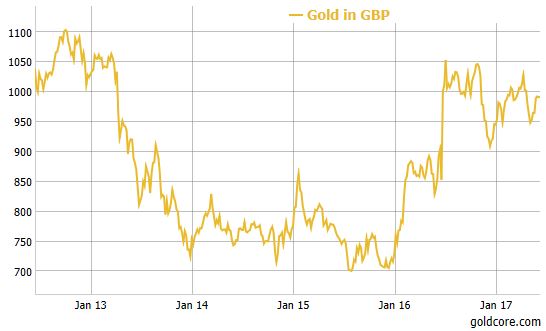

Gold Prices Break 6-Year-Long Downtrend On Safe Haven and 50percent Surge In Chinese Demand

Gold prices break 6 year down trend on safe haven demand (see charts). Chinese gold demand set to surge 50% to 1,000 metric tonnes. Chinese demand for gold bars on track to surge more than 60 percent in 2017. Geopolitical risk internationally leading to safe haven demand. UK election, terrorism and rising tensions in Middle East supporting gold after attacks in London and attacks in Iran today.

Read More »

Read More »

FX Daily, June 06: Yen Propelled Higher

The week was supposed to be dominated by the UK election and the ECB meeting, but the yen is stealing the show in the first part of the week. The US dollar has been sold through JPY110 for the first time since late April. The euro has fallen from JPY125.30 before the weekend to JPY123.25 today.

Read More »

Read More »

Euro Shrugs off European Banking Woes

Spain's Banco Popular is scrambling ahead of its meeting with the ECB tomorrow; shares are around 50% in three sessions. Italy has two banks that may see the same deal Monte Paschi negotiated with the EU. Portugal banks are still putting loan loss reserves and provisions aside.

Read More »

Read More »