Tag Archive: newslettersent

Swiss state pension fund stops investing in arms firms

The leading Swiss state pension fund, Publica, has announced that it plans to disinvest from five weapons companies. This follows a national campaign by a responsible investment pension group to blacklist 15 international arms firms.

Read More »

Read More »

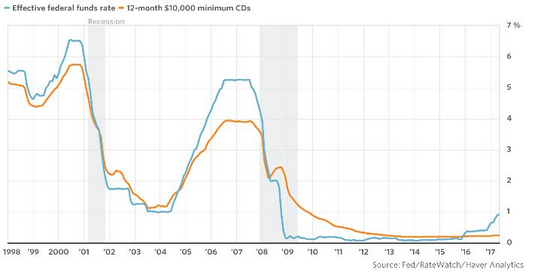

Great Graphic: Sticky Pass Through

This Great Graphic was posted by Steve Goldstein at MarketWatch. The blue line shows the effective Fed funds rate. The orange line depicts the average interest rate on a $10,000 one-year CD.

Read More »

Read More »

Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant.

Read More »

Read More »

Parabolic Coin

When writing an article about the recent move in bitcoin, one should probably not begin by preparing the chart images. Chances are one will have to do it all over again. It is a bit like ordering a cup of coffee in Weimar Germany in early November 1923. One had to pay for it right away, as a cup costing one wheelbarrow of Reichsmark may well end up costing two wheelbarrows of Reichsmark half an hour later.

Read More »

Read More »

News conference Swiss National Bank, Thomas Jordan

It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I will then hand over to Fritz Zurbrügg, who will present this year’s Financial Stability Report. After that, Andréa Maechler will review developments on the financial markets. Finally, we will – as ever – be pleased to take your questions.

Read More »

Read More »

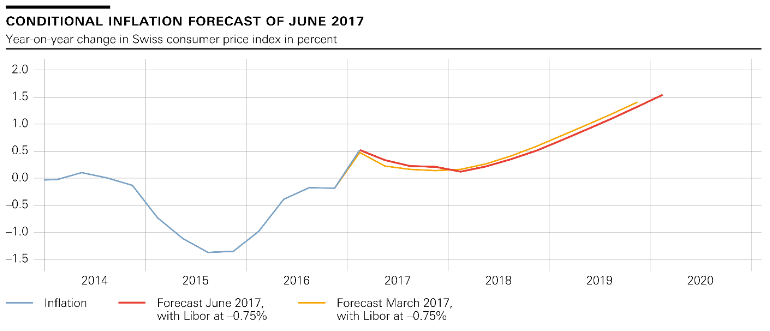

SNB Monetary Policy Assessment June 2017 and Comments

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%.

Read More »

Read More »

News conference Swiss National Bank 2017, Fritz Zurbrügg

In my remarks today, I will present the key findings from this year’s Financial Stability Report, published by the Swiss National Bank this morning. In the first part of my speech, I will look at the situation of the big banks, focusing on the progress made in implementing the revised ‘too big to fail’ regulations (TBTF2) that came into effect almost a year ago.

Read More »

Read More »

SNB Monetary Assessment June 2017, Introduction

I will begin by reviewing the situation on the international financial markets. I will then address some developments on the Swiss money and foreign exchange markets – specifically

the establishment of SARON as the leading reference rate for interest rate derivatives and the adoption of a global code of conduct for foreign exchange market transactions.

Read More »

Read More »

FX Daily, June 15: Dollar Trades Higher in Wake of the FOMC

The US dollar gains scored yesterday in response to what appeared to be a more hawkish FOMC than expected have been extended today. The euro and the Swiss franc have recorded new lows for the month.

Read More »

Read More »

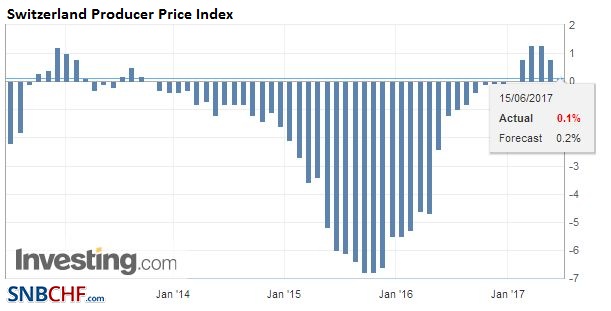

Swiss Producer and Import Price Index in May 2017: +0.1 YoY, -0.3 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation.

Read More »

Read More »

Ecouter le silence des abstentionnistes!

Les législatives françaises qui se sont tenues le 11 juin 2017 apportent la preuve que nous sommes bel et bien entrés dans une ère post-démocratique. Près de 52% ont refusé de se prêter au processus électoral. Pourtant ce silence crie des émotions et des opinions non relayés sur la place publique.

Read More »

Read More »

FX Daily, June 14: FOMC and upcoming SNB

The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow.

This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen.

It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates.

Read More »

Read More »

Swiss holiday homes becoming cheaper to buy

The cost of owning a holiday home in the Swiss Alps has declined appreciably in many towns and villages in the last five years. The biggest falls in property prices have been observed in the last 12 months, according to UBS bank researchers. Prices have dipped anywhere from 3% to 9 % year-on-year in some of the best-known Swiss tourist destinations, such as St Moritz and Verbier.

Read More »

Read More »

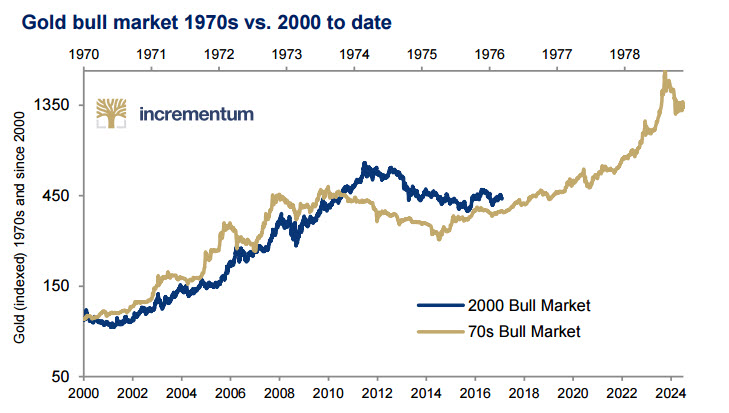

In Gold we Trust Report: Must See Gold Charts and Research

The 11th edition of the annual “In Gold we Trust” is another must read synopsis of the fundamentals of the gold market, replete with excellent charts by our friend Ronald-Peter Stoeferle and his colleague Mark Valek of Incrementum AG.

Read More »

Read More »

All About Inventory

Andy Hall has been called the God of Oil. As chief of Astenbeck Capital, he has proven at times that even gods can be mortal. In the “rising dollar” period, for example, after making money on the way down Mr. Hall went bullish.

Read More »

Read More »

Quantitative Easing Explained

We have noticed that lately, numerous attempts have been made to explain the mechanics of quantitative easing. They range from the truly funny as in this by now ‘viral’ You Tube video with two robotic teddy-bears discussing the Fed chairman’s qualifications (‘my plumber has a beard too’), to outright obfuscation such as the propagation of this ‘Bernanke explains he’s not printing money, it’s just an asset swap‘ notion.

Read More »

Read More »

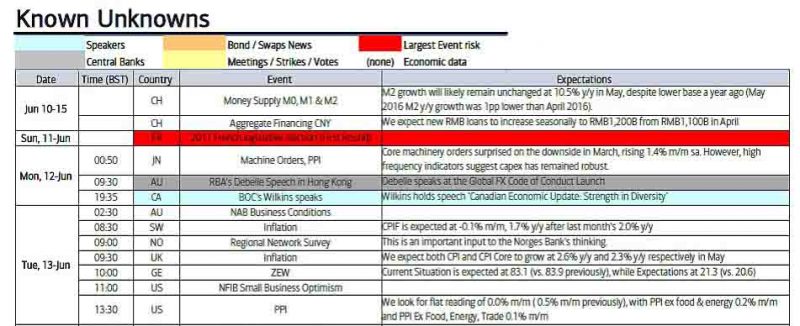

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected.

Read More »

Read More »