Tag Archive: newslettersent

FX Daily, June 19: Dollar Mixed while Equities Recover to Start Eventful Week

The US dollar is mixed against the major currencies, and while it is firmer against the euro and yen, it is within last week's ranges. The success of Macron's new party in France, and the majority is secured, was well anticipated by investors and is having little effect on today's activity in the capital markets.

Read More »

Read More »

Concern over pesticides in drinking supplies

Higher-than-normal levels of pesticides have been found in 20% of the nation’s drinking water supplies from groundwater, prompting industry calls for tougher action to cut the costs of treating the water.class='lead-text'>A fifth of the samples seen in national monitoring data contained pesticide levels higher than the acceptable limit of 0.1 microgram (0.001 milligram) per liter. Some measurement points even exceeded 70%, Swiss newspaper NZZ am...

Read More »

Read More »

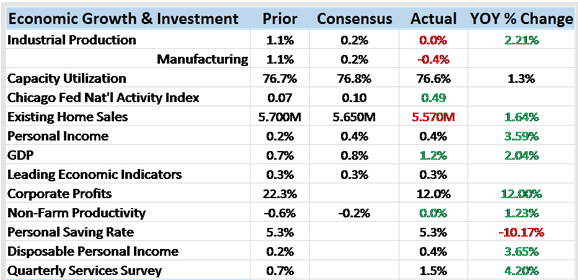

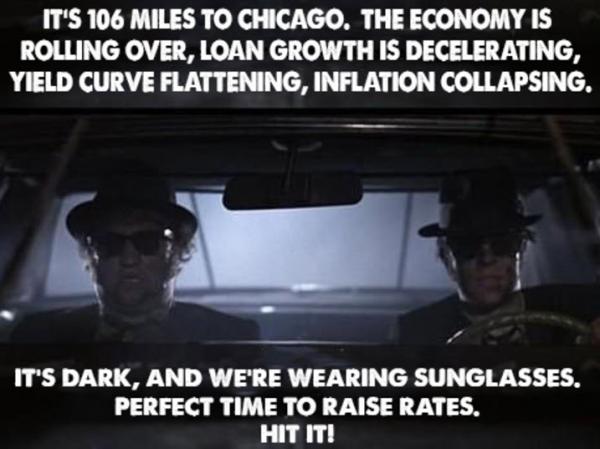

Bi-Weekly Economic Review: Has The Fed Heard Of Amazon?

The economic surprises keep piling up on the negative side of the ledger as the Fed persists in tightening policy or at least pretending that they are. If a rate changes in the wilderness can the market hear it? Outside of the stock market one would be hard pressed to find evidence of the effectiveness of all the Fed’s extraordinary policies of the last decade.

Read More »

Read More »

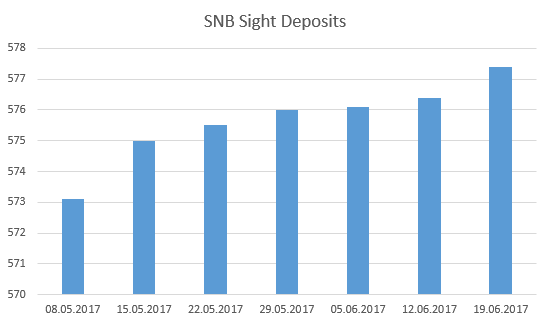

Weekly SNB Interventions Update: Slight Rise after Weeks of Near-Zero Interventions

The pro-European politician Macron has won the French elections. His success moved the EUR/CHF up to 1.0980, mostly caused by FX speculators. But "serious" investors (not FX speculators) did not follow the political event, but focus on monetary policy. A ECB rate hike is very, very far, see why....

Read More »

Read More »

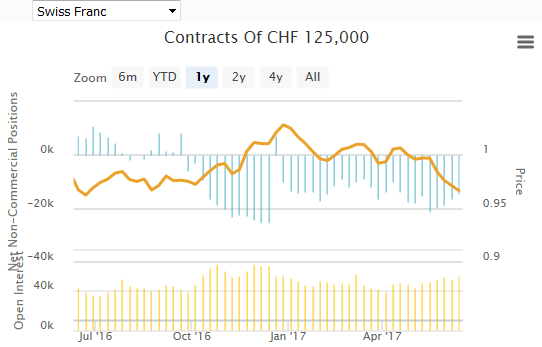

Weekly Speculative Positions (as of June 13): Specs Cut Euro, Yen, and Aussie Exposure and Do Little Else

The net short CHF position has fallen from 16.5 short to 14.5K contracts short (against USD). We wonder how long this will be the case, given that we expect Euro zone inflation to fall under 1% from December 2017 onward.

Read More »

Read More »

FX Weekly Preview: Events Not Data Key in Week Ahead

Light economic data calendar, but look for downtick in eurozone flash PMI. Soft Canadian retail sales (volume) and softer CPI (base effect) could take some of the sting from the recent BoC official comments. MSCI decision on China, Argentina, Saudi Arabia, and South Korea may have the broadest and long-lasting impact of the five key events we highlight.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mixed Friday to cap off a mostly lower week. Obviously, we're seeing a bit of a washout in EM after the hawkish FOMC. Market was overly complacent and very long EM going into the FOMC meeting. The big question is how deep this selloff gets. For the better part of this year, EM dips have been met with renewed buying. We remain cautious on EM and think that investors should avoid the high beta currencies like ZAR, TRY, BRL, MXN.

Read More »

Read More »

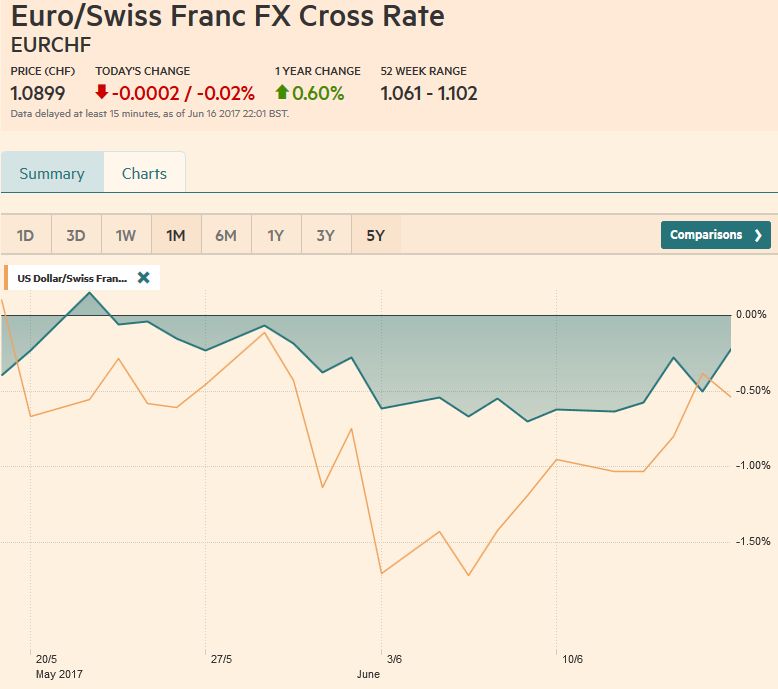

FX Weekly Review, June 12 – June 17: Greenback Still Trying To Turn

Swiss Franc vs USD and EUR Rarely in the foreign exchange market is there a V-shaped extreme. Most of the time, the high or low is a process that is carved over time. Although the explanation of the dollar’s weakness here in H1 vary, we continue to believe that the longer-term cyclical rally, the third since … Continue reading »

Read More »

Read More »

UberPop drivers in Zurich operating outside the law

UberPop drivers who do not hold an official professional taxi licence are operating illegally, according to the government in Zurich. They need to get a permit or risk facing punishment. Even if they readily meet the conditions set by Uber – having a four-door car, being at least 21 years old – not having a taxi licence means they are operating outside Swiss law, said the Zurich executive, responding to a parliamentary question.

Read More »

Read More »

Parking clampdown in Zurich yields windfall

Traffic police issued 21% more parking tickets in Zurich last year as the city dropped its ten-minute grace period for tardy motorists. The policy change was largely responsible for a CHF3.3 million ($3.4 million) penalty bonus that seems to have taken the authorities by surprise.

Read More »

Read More »

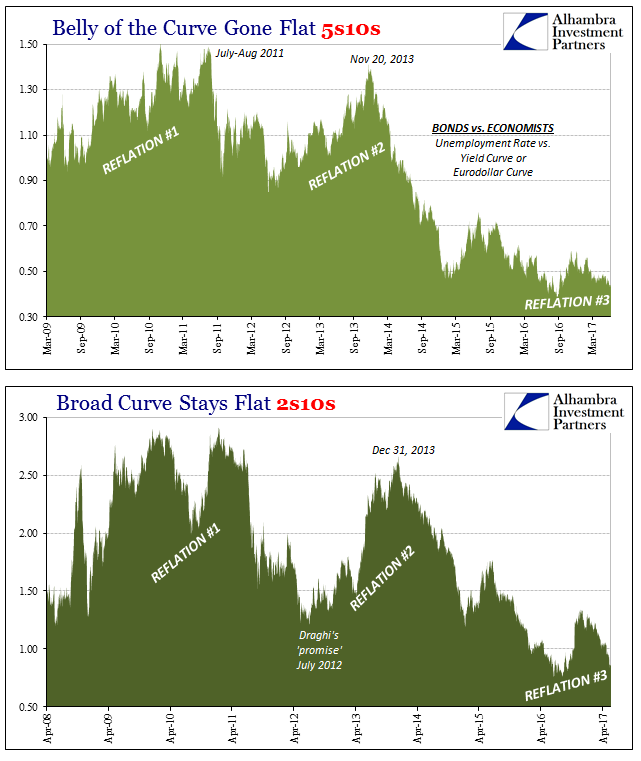

Deciphering Curves

What is the yield curve supposed to look like? It’s a simple question that doesn’t actually have an answer. And because it doesn’t, there is a whole lot of confusion about bond yields.

Read More »

Read More »

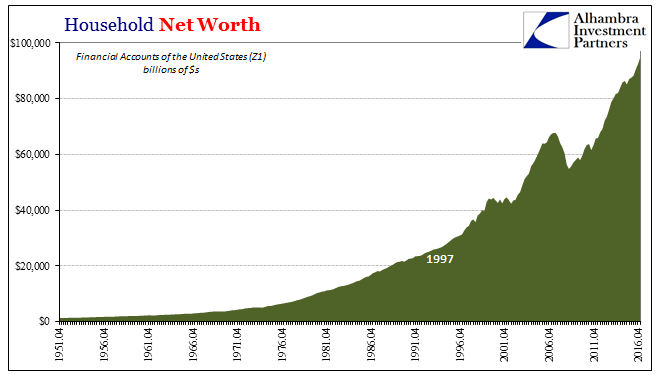

Wealth Paradox Not Effect

US Household Net Worth rose to a record $94.8 trillion in Q1 2017. According to the Federal Reserve’s Financial Accounts of the United States (Z1), aggregate paper wealth rose by more than 8% year-over-year mostly as the stock market shook off the effects of “global turmoil.” It was the best rate of expansion since the second quarter of 2014 just prior to this “rising dollar” interruption.

Read More »

Read More »

Swiss remain top of world innovation ranking

Switzerland is the leading nation for innovation for the seventh year in a row, according to the Geneva-based World Intellectual Property Organization (WIPO). The other countries in the top five for 2017 were Sweden, the Netherlands, the United States and Britain, the WIPO Global Innovation Indexexternal link said on Thursday. Switzerland has held the top spot since 2011.

Read More »

Read More »

Property prices fall in Swiss resorts but climb elsewhere, says UBS report

A real estate report by the bank UBS, which looks at 25 top resorts in Switzerland, Austria, France and Italy, shows vacation home price drops across Switzerland. These price falls contrast with price rises in resorts in Austria, France and Italy.

Read More »

Read More »

Great Graphic: Value vs Growth

This Great Graphic, created on Bloomberg show the performance of growth and value stocks since the start of December 2016. The yellow line is the Russell 1000 Growth Index. The white line is the Russell 1000 Value Index. The outperformance of the former is clear.

Read More »

Read More »

Emerging Markets: What has Changed

Philippines central bank forecast a current account deficit this year, the first one in fifteen years. Kuwait refrained from matching the Fed’s 25 bp hike. The US Senate voted overwhelmingly to step up sanctions against Iran and Russia. Moody’s downgraded South Africa by a notch to Baa3 with negative outlook. South Africa plans to require that all local mines be 30% black-owned.

Read More »

Read More »

Questions Persist About China Trade

Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became noticeable.

Read More »

Read More »

“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside.

Read More »

Read More »

FX Daily, June 16: Dollar Slips In Consolidation, but Extends Recovery Against the Yen

As the market heads into the weekend, the US dollar is trading softer as it consolidates. It is within yesterday's ranges against the major currencies but the Japanese yen. The dollar has made a dramatic recovery against the yen. It traded near JPY108.80 in the middle of the week and pushed through JPY111 in late in the Tokyo morning. The greenback is above its 20-day moving average against the yen for the first time in a month.

Read More »

Read More »