Tag Archive: newslettersent

The Wealth Effect, Report 24 Jun 2018

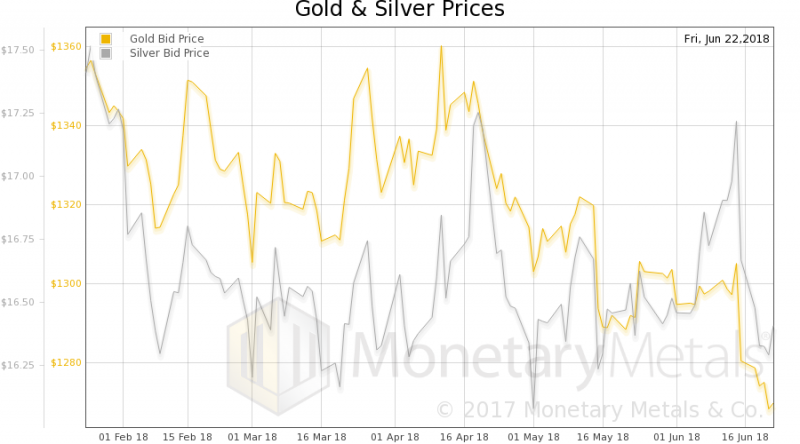

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

FX Daily, June 26: Trade Tensions and Approaching Quarter-End Cast Pall Over Markets

The global capital markets have stabilized today after yesterday's rout in equities, softer yields, and US dollar. The implementation of US tariffs on China and China's retaliatory tariffs on the US is still ten days off. The immediate focus is on actions expected to curb the technology transfer.

Read More »

Read More »

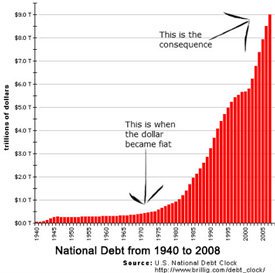

Sound Money Needed Now More Than Ever

The sound money movement reemerged on the national political scene a decade ago. In 2008, the financial crisis brought in a fresh wave of U.S. gold and silver investors.

Ron Paul and the Tea Party advocated for limiting government and ending the Federal Reserve system. Sound money advocates made real inroads in recruiting Americans to their cause based on evidence that the nation is headed for bankruptcy.

Read More »

Read More »

Nearly 1 in 20 in Switzerland are millionaires, according wealth to report

The 2017, a wealth report, published by Capgemini, shows there were 389,000 US$ millionaires in Switzerland, around 4.5% of the population, or close to 1 in 20. If children under the age of 15 are excluded, Switzerland’s millionaire percentage rises to 7.3%. In addition, these figures include only investable wealth, which does not include the value of family homes.

Read More »

Read More »

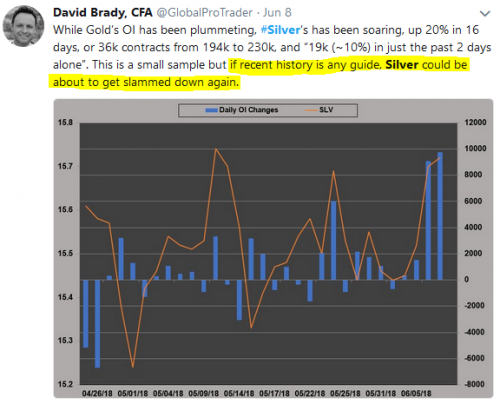

Manipulation of Gold and Silver Is “Undeniable”

Manipulation in precious metals is undeniable. Now so chronic that it is obvious and therefore predictable. Central banks around the world are repatriating their gold from the U.S. in preparation for some major event to come. I want to be long … “when that event occurs”.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday mixed, and capped off a mixed week overall as the dollar’s broad-based rally was sidetracked. EM may start the week on an upbeat after PBOC cut reserve requirements over the weekend. Best EM performers last week were ARS, MXN, and TRY while the worst were THB, IDR, and BRL.

Read More »

Read More »

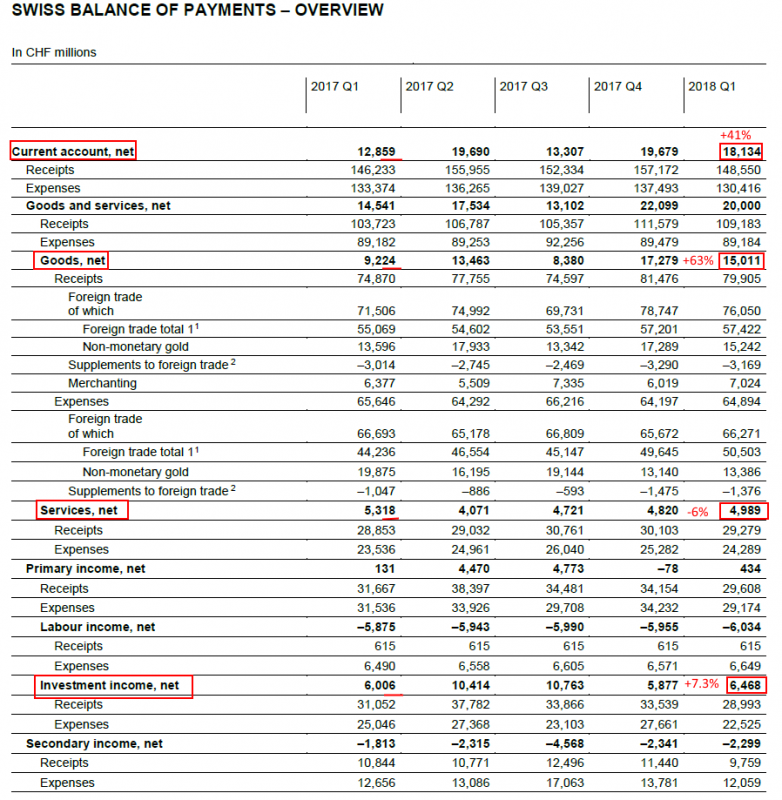

Swiss Balance of Payments and International Investment Position: Q1 2018

The current account surplus amounted to CHF 18 billion in the first quarter of 2018, an increase of CHF 5 billion over the same quarter of 2017. This rise was attributable to the higher receipts surplus on trading in non-monetary gold, which is recorded under trade in goods. In the case of services as well as primary and secondary income, the balances remained stable.

Read More »

Read More »

Strikes mooted over construction retirement age

Unions on Friday threatened warning strikes for the building sector this autumn if the current retirement age of 60 for construction workers is dropped. At a press conference on Friday, Switzerland’s biggest trade union Unia, and the union Syna called for early retirement, as well as more worker protection and less temporary work on sites.

Read More »

Read More »

FX Weekly Preview: Trade Tensions and EU Summit Highlight Q2’s Last Week

We argue there are three major disruptive forces that are shaping the investment climate: the US policy mix in relative and absolute terms, the escalation of trade tensions, and immigration. In the week ahead, trade issues may eclipse the US policy mix, and immigration will compete with the economic and financial agenda at the European heads of state summit at the end of the week.

Read More »

Read More »

Emerging Markets: What Changed

Nor Shamsiah Mohd Yunus was named the new Governor of Malaysia’s central bank. Moody's cut the outlook on Pakistan's B3 rating to negative from stable. National Bank of Hungary tiled more hawkish. Israeli Prime Minister Benjamin Netanyahu’s wife was charged with misusing public funds. MSCI added Saudi Arabia and Argentina to its Emerging Markets index.

Read More »

Read More »

‘Cryptocurrencies too primitive for national money’: SNB director

Cryptocurrencies and the blockchain technology they run on are currently far too primitive for the Swiss central bank to consider issuing a digital franc, says board director Thomas Moser. Moser’s comments on Thursday reflected the previously stated stance taken by the Swiss National Bank (SNB) towards an e-franc version of bitcoin.

Read More »

Read More »

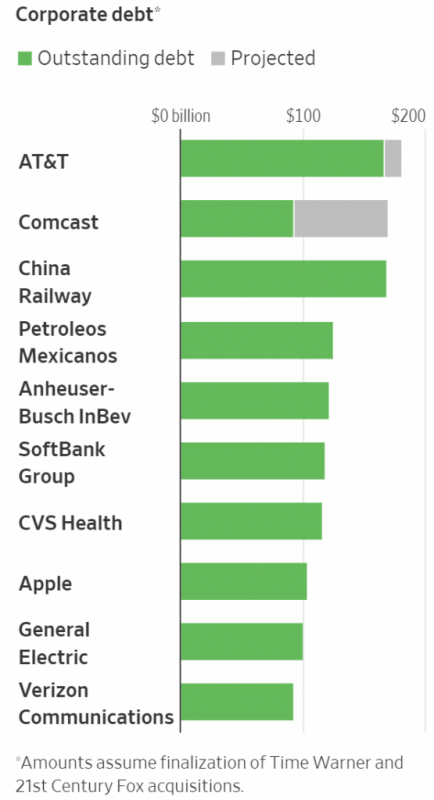

Merger Mania and the Kings of Debt

Another Early Warning Siren Goes Off. Our friend Jonathan Tepper of research house Variant Perception (check out their blog to see some of their excellent work) recently pointed out to us that the volume of mergers and acquisitions has increased rather noticeably lately. Some color on this was provided in an article published by Reuters in late May, “Global M&A hits record $2 trillion in the year to date”, which inter alia contained the following...

Read More »

Read More »

Bi-Weekly Economic Review (VIDEO)

Information and opinions about the economy and markets from Alhambra Investments CEO Joe Calhoun.

Read More »

Read More »

Executives still paid exorbitant salaries at big Swiss firms

The gap between the top-paid and least-paid employees of the 39 largest companies in Switzerland remains high, despite a 2013 vote against excessive executive pay. According to Switzerland's largest trade union, Unia, in 2017 the average ratio between top and bottom in these companies was 1:143.

Read More »

Read More »

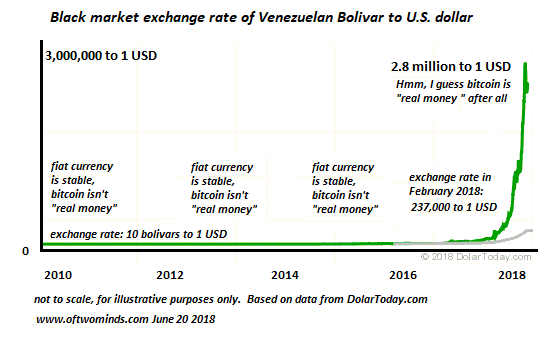

Gresham’s Law and Bitcoin

Rather suddenly, the state issued fiat currency bolivar lost 99% of its purchasing power. Gresham's law holds that "bad money drives out good money," meaning that given a choice of currencies (broadly speaking, "money" that serves as a store of value and a means of exchange), people use depreciating "bad" to buy goods and services and hoard "good" money that is appreciating or holding its value.

Read More »

Read More »

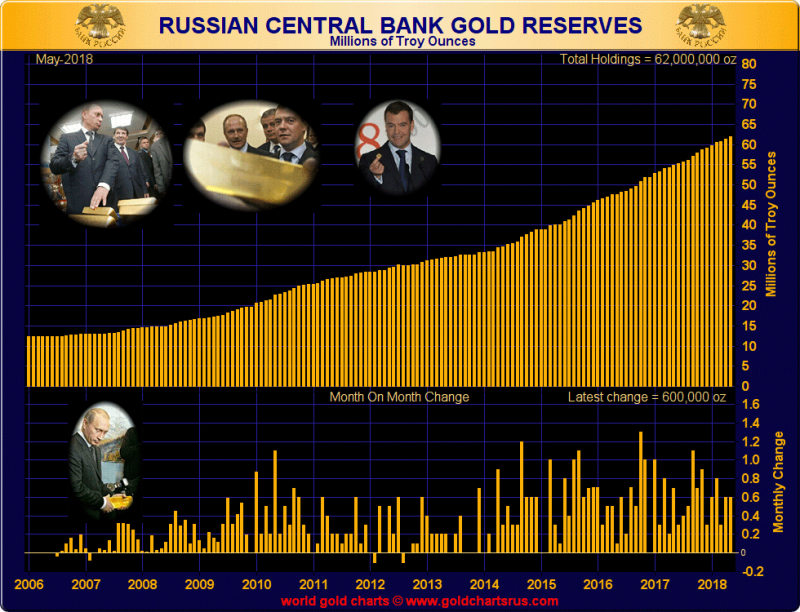

Russia Buys 600,000 oz Of Gold In May After Dumping Half Of US Treasuries In April

Russia adds another 600,000 oz to it’s gold reserves in May. Holdings of U.S. government debt slashed in half to $48.7 billion in April. ‘Keeping money safe’ from U.S. and Trump – Danske Bank. Trump increasing the national debt by another 6% to $21.1 trillion in less than 18 months. Asian nations accumulating gold as shield against dollar devaluation and trade wars.

Read More »

Read More »

Swiss residential property risks growing in buy to let, according to Swiss National Bank

On 21 June 2018, the Swiss National Bank (SNB) announced its decision on interest rates, which it left unchanged. Switzerland’s economy has been sailing into the headwinds of a strong currency since the SNB scrapped its exchange rate cap in January 2015 and the Swiss franc briefly went beyond parity with the euro.

Read More »

Read More »

FX Daily, June 22: BOE Spurs Dollar Pullback

The Bank of England's hawkish hold yesterday, spurred by three dissents in favor of an immediate hike, changed the near-term dynamics in the foreign exchange market. Both the euro and sterling fell to new lows for the year before reversing higher. Yesterday's gains are being extended today.

Read More »

Read More »

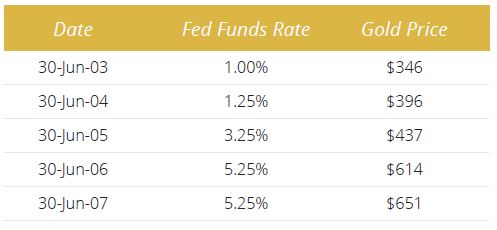

“Perfect Environment For Gold” As Fed To Weaken Dollar and Create Inflation

“Fed is tightening into weakness and will eventually over-tighten and cause a recession”. “More inflation and a weaker dollar” is “the perfect environment for gold”. Geopolitical shocks will return when least expected and gold will soar in flight to safety.

Read More »

Read More »

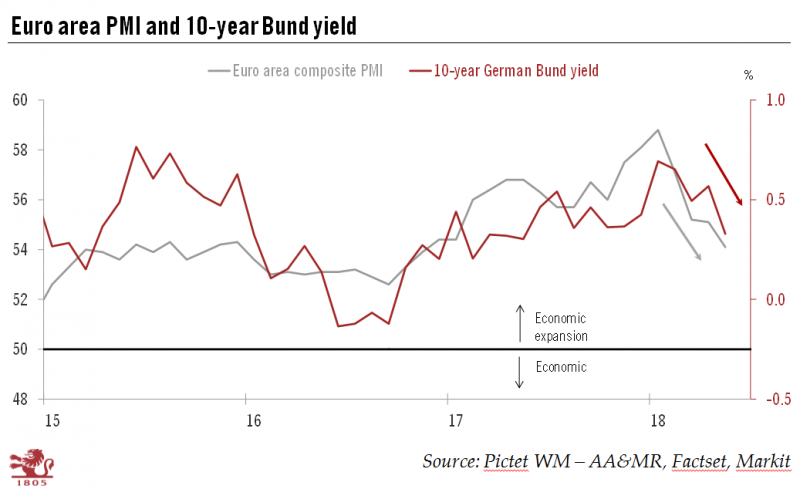

Rise in Bund yield will be limited

With the faltering in euro area business sentiment since February, the Italy-led sell-off of risk assets at the end of May and the European Central Bank’s (ECB) dovish meeting in June, we are revising our year-end forecast for the German 10-year Bund yield from 0.9% to 0.6%, as we hinted we might do in a previous note.

Read More »

Read More »