Tag Archive: newslettersent

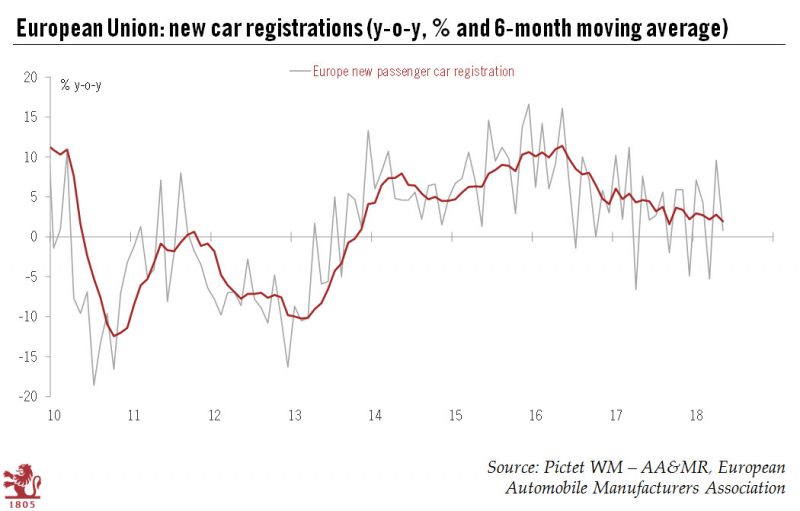

European cars at a crossroad

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry.Last weekend’s G7 summit in Canada ended badly, with President Trump withdrawing his support for the summit’s final statement. Heightening tensions between Europe and the US are Trump’s hints that the White House is considering import tariffs on cars and car parts.

Read More »

Read More »

Swiss Offshore Wealth Management Sector still World’s Largest by far

A report by The Boston Consulting Group highlights the size of Switzerland’s personal offshore wealth management sector. Total personal offshore wealth grew by 6% to reach US$8.2 trillion in 2017. US$2.3 trillion (28%) of this was managed in Switzerland. The top three offshore centres: Switzerland ($2.3 trillion), Hong Kong ($1.1 trillion) and Singapore ($0.9 trillion) made up more than half (52%) of the total.

Read More »

Read More »

FX Daily, June 18: Politics and Economics Weigh on European Currencies

The US dollar is rising against most of the major and emerging market currencies. The prospects of escalating trade tensions and the divergence of policy that was confirmed by the major central banks are disrupting the markets. Norway's central bank meets later this week.

Read More »

Read More »

FX Weekly Preview Warning: Treacherous Week Ahead

All three of the major central banks met last week and confirmed that monetary policy would continue to diverge for at least another year. The clarity of the trajectory of monetary policy reduces the impact of high-frequency economic data.

Read More »

Read More »

Emerging Markets: What Changed

US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned.

Read More »

Read More »

Union européenne. Les chiffres de la dette. LHK

Le volume cumulée d’endettement de l’UE atteint en 2017 le chiffre respectable de 12, 46664 billions d’euros (à ne pas confondre avec le billion américain!). - Cela revient à un endettement cumulé de 12 466 640 000 000 euros, soit 12 trillions d’euros (référence de mesure US)

Read More »

Read More »

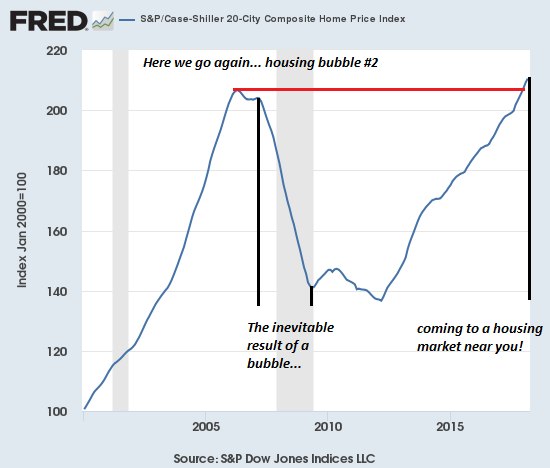

Here We Go Again: Our Double-Bubble Economy

The bubbles in assets are supported by the invisible bubble in greed, euphoria and credulity. Well, folks, here we go again: we have a double-bubble economy in housing and stocks, and a third difficult-to-chart bubble in greed, euphoria and credulity.

Read More »

Read More »

Switzerland remains biggest offshore wealth centre

The stock market boom boosted personal financial wealth around the globe by 12% last year – to the benefit of Switzerland. It is still the world’s biggest centre for managing offshore wealth at $2.3 trillion (CHF2.3 trillion). Figures revealed in a Boston Consulting Group report published on Thursday put the country ahead of Hong Kong ($1.1 trillion) and Singapore ($900 billion). The Swiss sum is the equivalent of almost one third of all global...

Read More »

Read More »

Swiss Unemployment Continues to Fall

The number of registered unemployed in Switzerland dropped by 9% in May 2018 to a rate of 2.4%, down from 2.7% in April, according to a report by the State Secretariat for Economic Affairs (SECO). The rate in May 2018 was 22% lower than in May 2017.

Read More »

Read More »

Switzerland’s parliament narrowly votes for women’s quotas on company boards

Yesterday, Switzerland’s National Council, or parliament, voted 95 to 94, with 3 abstentions, to introduce quotas for the management and boards of quoted companies. Boards will be required to have 30% women and management teams 20%. The rules could affect 250 companies.

Read More »

Read More »

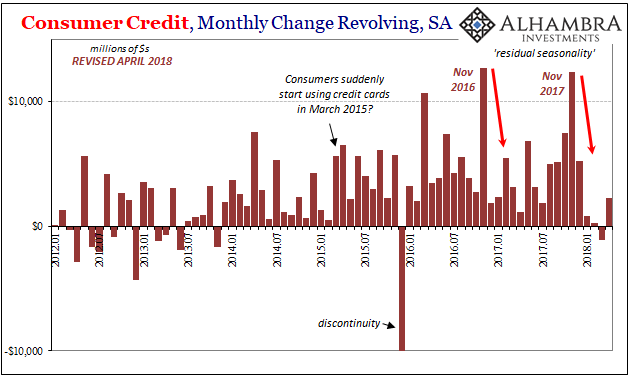

Recent Concerning Consumer Credit Trends Carry On Into April

US consumers continue to recover from their debt splurge at the end of last year. Combined with still weaker income growth, the Federal Reserve estimates that aggregate revolving credit balances grew only marginally for the fourth straight month in April 2018. To put it in perspective, the total for revolving credit (seasonally adjusted) is up a mere $2.2 billion for all four months of this year combined, compared to +$5.2 billion in December 2017...

Read More »

Read More »

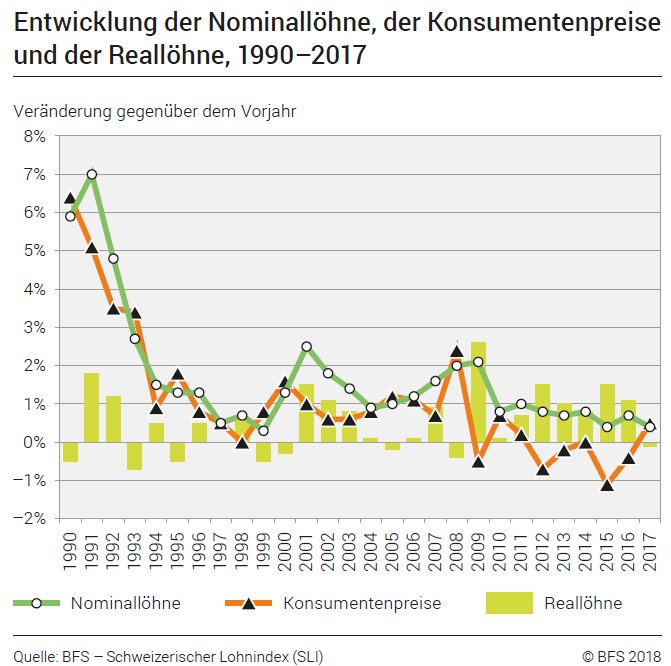

Swiss wage index 2017: Nominal wage increase of 0.4percent in 2017 – real wages decrease by 0.1percent

The Swiss nominal wage index rose by +0.4% on average in 2017 compared with 2016. It settled at 101.1 points (base 2015 = 100). Given an average annual inflation rate of +0.5%, real wages registered a decrease of -0.1% (101.0 points, base 2015 = 100) according to calculations by the Federal Statistical Office (FSO).

Read More »

Read More »

Financial watchdog accuses Raiffeisen of major governance failings

The Swiss Financial Market Supervisory Authority (FINMA) has concluded its investigation into Swiss bank Raiffeisen, saying it identified “serious shortcomings” in governance. “FINMA has found that the bank’s handling of conflicts of interest was inadequate,” the regulatory body said in a statementexternal link on Thursday.

Read More »

Read More »

FX Daily, June 15: Dollar Slips While Escalating Trade Tensions may Roil Markets

The Dollar Index edged higher to its best level this year before turning down as market attention shifts from central banks to trade tensions. Reports confirm that the US will go ahead with the 25% tariff on $50 bln of Chinese goods and provide some specificity today. The final list is expected to be similar to the goods that had been identified in the preliminary list, with an emphasis on electronic goods, apparently on ideas that they may have...

Read More »

Read More »

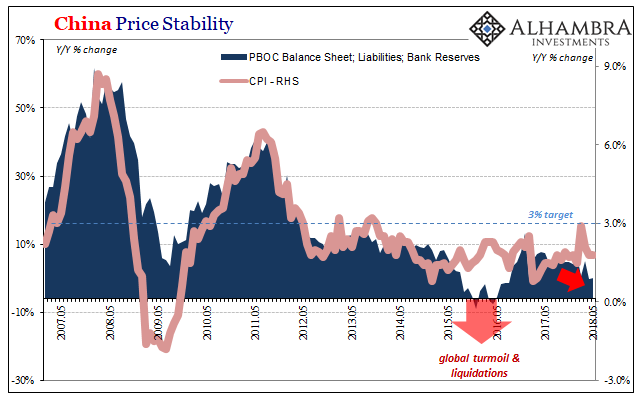

Chinese Inflation And Money Contributions To EM’s

The People’s Bank of China won’t update its balance sheet numbers for May until later this month. Last month, as expected, the Chinese central bank allowed bank reserves to contract for the first time in nearly two years. It is, I believe, all part of the reprioritization of monetary policy goals toward CNY. How well it works in practice remains to be seen.

Authorities are not simply contracting one important form of base money in China (bank...

Read More »

Read More »

Credit Spreads: Polly is Twitching Again – in Europe

The famous dead parrot is coming back to life… in an unexpected place. With its QE operations, which included inter alia corporate bonds, the ECB has managed to suppress credit spreads in Europe to truly ludicrous levels.

Read More »

Read More »

Swiss health costs set to exceed CHF10,000 per person

The average Swiss will for the first time spend more than CHF10,000 ($10,159) on health care in 2018 and 2019, according to an economic research institute and think tank. KOF, part of the federal technology institute ETH Zurich, says this is down to the growing economy: the more people earn, the more they spend on their health. It also bases its calculations on the growing proportion of old people in the Swiss population.

Read More »

Read More »

FX Daily, June 14: Dollar Punished Ahead of ECB

The US dollar is slumping against all the major currencies in the aftermath of the hawkish Federal Reserve. In fact, the inability of the greenback to hold on to the gains scored in the initial reaction to the Fed's hike, optimism on the economy, and the signal of hikes in September and December, foretold today's push lower.

Read More »

Read More »