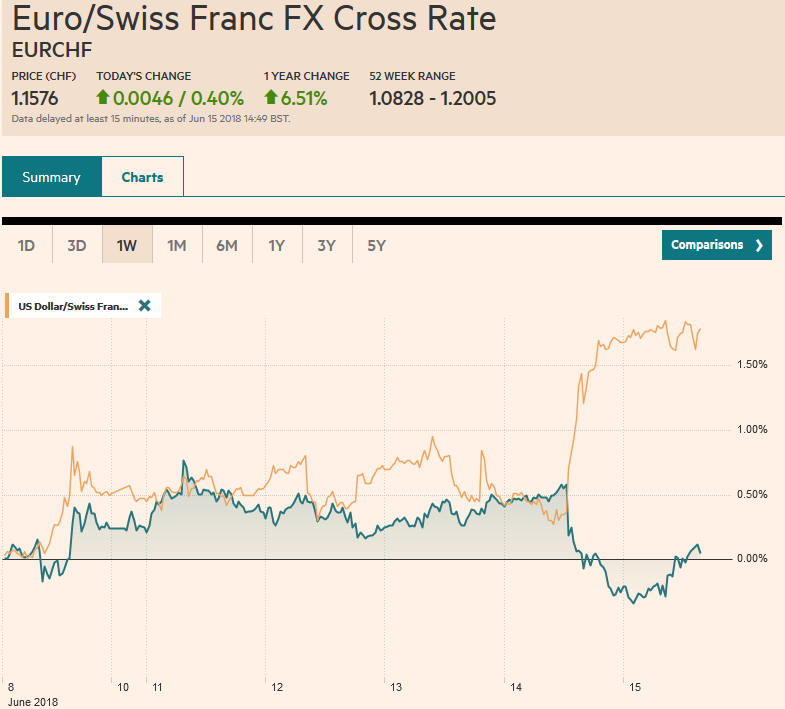

Swiss FrancThe Euro has risen by 0.40% to 1.1576 CHF. |

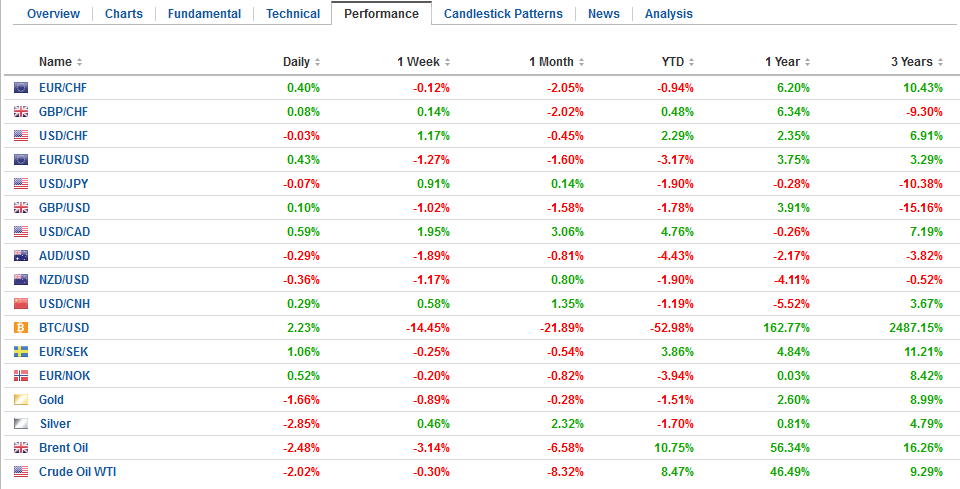

EUR/CHF and USD/CHF, June 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

| The Dollar Index edged higher to its best level this year before turning down as market attention shifts from central banks to trade tensions. Reports confirm that the US will go ahead with the 25% tariff on $50 bln of Chinese goods and provide some specificity today. The final list is expected to be similar to the goods that had been identified in the preliminary list, with an emphasis on electronic goods, apparently on ideas that they may have the largest multiplier effect and the US can challenge some of the areas China has targeted under Made in China 2025.

The US dollar made a marginal new high for the week against the yen, rising to about JPY110.90 in Asia before retreating to JPY110.40. It looks poised to retest the highs. There is a $1.2 bln option at JPY110.50 that expires today, and $1.6 bln struck between JPY111.00-JPY111.05. Barring a large setback, this will be the third weekly advance of the dollar against the yen. Sterling held above $1.3200 level and the year’s lows seen in late May. There is nearly a billion pound option struck at $1.3250 that expires today. We suggest a near-term target in the $1.3300-$1.3330 area. We think there is a reasonable chance that the BOE hikes rates in August, but it may not be the next major central bank to hike. That role may go to the Bank of Canada. |

China is expected to retaliate. It has indicated that putting new tariffs on during negotiations in a sign of bad faith and China will retract the concessions it has offered. That said, the press reports that China will approve the $43 bln acquisition of NXP Semiconductor by Qualcomm. Previously Trump threatened to slap a tariff on another $100 bln of Chinese goods if it retaliates for the intellectual property violation action, potentially setting the stage for a further escalation of tensions.

At the same time, the growth trajectories of the two largest economies are diverging. Economic data from China disappointed this week, while in the US economic data continues to point to a robust Q2. The Atlanta Fed GDPNow, updated after yesterday’s stronger than expected retail sales sees the US economy tracking 4.8% annualized growth in Q2. The slowing Chinese growth could make it more difficult for officials to sacrifice foreign demand, while the pick-up in US growth likely translates into a wider trade deficit, despite the protectionist measures.

Investors are still struggling to make sense of this week’s central bank meetings. The Federal Reserve hiked rates and the median dot indicated that most officials see two hikes instead of one as likely appropriate in H2. It upgraded its assessment of the economy and projected a continued decline in unemployment. The forecasts also indicate that in 2019 and 2020, the Fed funds rate is expected to be above the long-run equilibrium rate. And yet the dollar sold off.

The ECB forward guidance was stronger than most expected. It provided a hard stop to the asset purchases in December and provided details on its Q4 tapering plans. Many thought the ECB would wait for the next meeting in July for such an announcement. And yet, the euro suffered its largest decline since the Brexit reaction in late June 2016. We suspect that the price action colored the way many interpreted the ECB: The euro fell so the ECB must have been dovish.

The ECB did say interest rates would not be raised until after next summer. The implied yield of the December 2019 Euribor futures contract fell five basis points. Yet rather than take it to unchartered waters, the market seemed to simply return to where it was before the rogue press report claiming the meeting was “live” (which in the market’s jargon means action was reasonably likely). The soft economic data, including the weak survey data and disappointing April industrial output (-0.9%, the third and largest monthly decline in this year) had encouraged ideas that the first hike would come later in Q3 2019, and the market has returned to that view. Surely a 2% slide in the euro yesterday was disproportionate with the five basis point decline in the December 2019 Euribor futures.

As the euro plunged, many turned their attention from the ECB per se and toward reports that Germany’s coalition was under threat by a dispute over refugees between CSU’s head Seehofer who is also the interior minister. Bavaria, which is the home of the CSU holds regional elections in October. Last year it, like the CDU and SPD saw their support wane in the face of the rise of the AfD. The CSU had been critical of Merkel’s immigration policies, and this is a continuing source of tensions. Cooler heads seem to be prevailing now as the cost of a serious fissure of the CDU/CSU alliance is high for both parties.

Consistent with the seemingly counter-intuitive market reactions to both the Fed and ECB, the yen is stronger even though the BOJ lefts rates on hold and downgraded its inflation assessment, ahead of next month’s updated forecasts. The optimism that prompted an upgrade in January has been reversed. Indeed, its reassessment of price pressures was greater than expected. It now sees core CPI (excludes fresh food prices) 0.5%-1.0% down from “around 1.0%). Although the BOJ reduced its bond-buying program twice in recent weeks, investors recognize that it will lag behind the other central banks in normalizing policy.

BOJ Governor Kuroda linked the lack of recent progress on inflation to the rise of the yen and fall in accommodation prices, though he argued that progress toward the 2% target remains intact. However, Kataoka disagreed. Core CPI has fallen for two consecutive months, and he did not think it was likely that progress was still being made. At next month’s meeting, the BOJ will update its growth and inflation forecasts. Surveys suggest that the vast majority of participants do not expect any measures toward normalization until after 2020 after the impact of the October 2019 sales tax increase can be assessed.

We have been tracking the rise (five of the past six weeks) of the gross long euro position in the futures market. As of last week, the gross long euro position was larger than it was at the end of last year. It remains near the record high seen near the middle of Q1. The net long position has fallen, not because long have liquidated, but because the gross shorts have grown faster. This week’s CFTC data will not cover the price action after the FOMC and ECB meetings.

We suspect, and will have to wait for the data to confirm, that market positioning helped exaggerate yesterday’s price action, though on a medium-term basis we are still bearish the euro. More immediately, though some backing-and-filling is likely. Expiring options may influence the price action. There are around 2 bln euro in options struck between $1.1600 and $1.1615 that will be cut and another 1.1 bln euros at $1.1650, which may cap the single currency today.

With NAFTA negotiations now tipped to continue in the coming months, and the US investigation of auto imports on national security grounds is unlikely to be concluded in the coming months, the Bank of Canada may see next month’s meeting as an opportunity to remove some accommodation. Technically, we had thought the Canadian dollar was poised to outperform this week, but it did not. It did perform slightly better than the Australian dollar, where we had thought the risk-reward was the greatest, but both currencies were the worst performers among the majors.

Canada reports its international securities transactions, manufacturing sales and existing home sales. The market may be most sensitive to the latter. May existing home sales are expected to have fallen for the fourth time this year after falling in five months in 2017. The US reports the June Empire manufacturing survey and the May industrial production/manufacturing output figures. With strong confidence that the Fed will hike rates in September, outside of some headline risk, the data is unlikely to have much impact. The TIC data that will be released after close may offer insight, but the data is for April. We do know that the Fed’s custody holdings for foreign central banks slipped in April, six-week decline streak that began in April ended and the Fed’s custody holdings have risen for the past three weeks.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,newslettersent,USD/CHF