Tag Archive: newslettersent

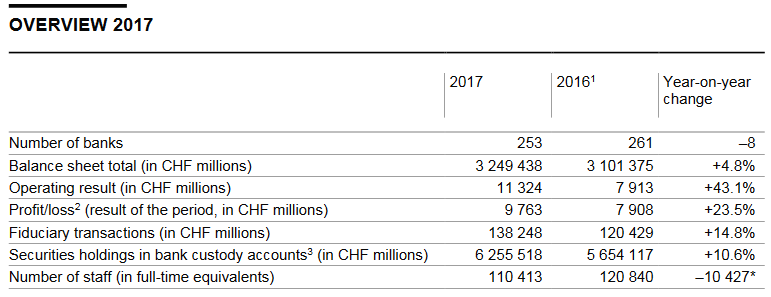

Swiss banking sector continues to shrink but survivors profitable

Switzerland lost a total of nine banks in 2017 bringing the total to 253. Around 20 years ago the country boasted more than 400 banks. According to the annual “Banks in Switzerland” report released by the Swiss National Bank (SNB) on Thursday, only one foreign bank opened a Swiss branch last year. The number of people working for banks also declined. Staff numbers in Switzerland fell by 7.7% to 93,554 full-time equivalents (FTEs).

Read More »

Read More »

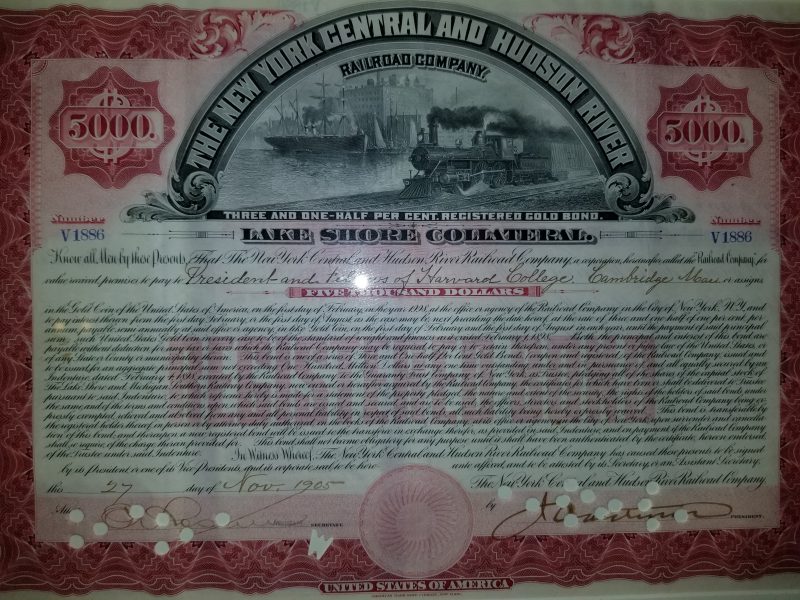

The Benefits of Issuing Gold Bonds

A gold bond is debt obligation that is denominated in gold, with interest and principal paid in gold. As I will explain below, it’s a way for the issuer to pay off its debt in full, and there are other advantages. Sometimes, I find that it’s helpful to show a picture of what I’m talking about. At the Harvard Club in New York, an old gold bond is hanging on the wall among other memorabilia.

Read More »

Read More »

Swiss banks urged to step up fight against financial crime

Swiss financial institutions and public authorities must do more to prevent organised crime and money laundering within the financial system, a study by the consulting firm KPMG published on Tuesday has found. The authors of the study called “Clarity on Crime in Financial Services” highlighted several challenges and problems which must be addressed if banks want to successfully prevent and identify criminal financial activities in future.

Read More »

Read More »

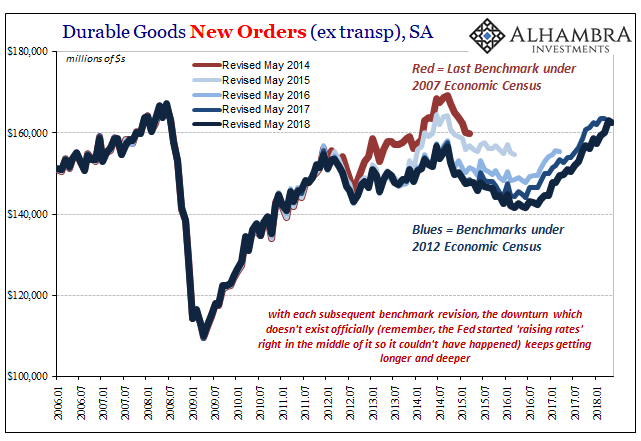

Revisiting The Revised Revisions

I missed durable goods last month for scheduling reasons, which was a shame given that May is the month each year for benchmark revisions to the series. Since new estimates under the latest revisions were released today, it seems an appropriate time to revisit the topic of data bias, and why that matters. What happens with durable goods (or any data for that matter, the process is largely the same) is that the Census Bureau conducts smaller surveys...

Read More »

Read More »

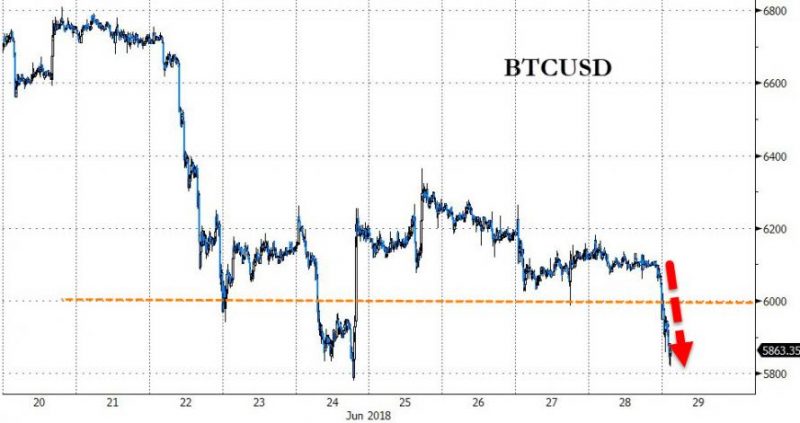

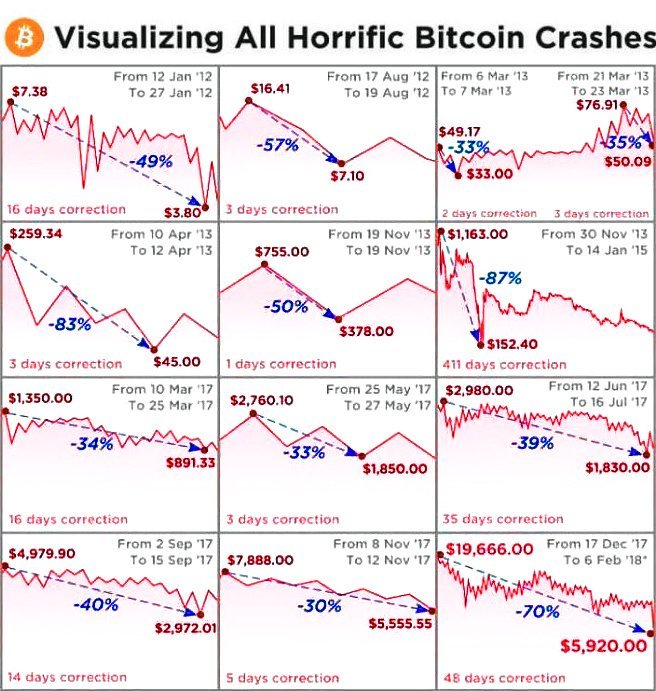

Cryptos Slide Accelerates Since Congress Warned Bitcoin Poses Threat To US Election

Bitcoin has tumbled back below $6,000 in early Asia trading and the rest of the crypto space is following suit. No imediate catalyst for the move - aside from technical pressure - but tougher AML rules in South Korea and US Congress being told Bitcoin is a threat to the US election may have sparked it earlier in the week and this is follow-through.

Read More »

Read More »

What’s so special about crypto?

Towards the end of 2017, Bitcoin — and with it other cryptocurrencies — experienced a real hype. Within a few months, prices shot through the ceiling. The euphoria was ginormous and in hindsight pure madness. With the new year, the disillusionment arrived. The market capitalization of all cryptocurrencies fell by more than half and prices plunged.

Read More »

Read More »

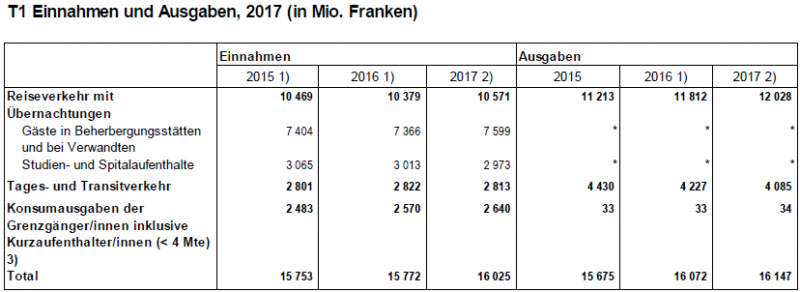

Tourism Balance of Payments Slightly Negative in 2017

For the second consecutive year, the tourism balance of payments was negative in 2017. This means that expenditure by Swiss residents during visits abroad exceeded the expenditure of non-residents during their stay in Switzerland. In an economic climate still marked by a strong franc, the tourism balance of payments was CHF -122 million, according to initial estimates from the Federal Statistical Office (FSO).

Read More »

Read More »

Swiss Town Tests Blockchain-Based Voting

On 25 June 2018, the city of Zug, the town at the heart of Switzerland’s crypto valley, started testing a voting system based on blockchain technology. During the trial, which runs until 1 July 2018, around 200 voters will cast non-binding municipal votes on mock questions in a trial designed to identify any bugs in a system built by the company Luxsoft and the computer science department of Lucerne’s University of Applied Sciences.

Read More »

Read More »

Bitcoin: les causes de la chute historique sous la barre des 6 000$.

Bitcoin : les causes de la chute historique sous la barre des 6 000$. 2 articles de Adrien Pittore/ Entreprise news. Le 21 juin dernier était historique pour les cryptomonnaies. Le cours du Bitcoin a fait une chute spectaculaire, passant sous la barre des 6 000$. Une valeur qu’il dépassait depuis novembre 2017. Pour autant, les spécialistes ne s’accordent pas sur les raisons de ce plongeon. Tour d’horizon.

Read More »

Read More »

Banks in Switzerland 2017, Results from the Swiss National Bank’s data collection

Summary of the 2017 banking year. Of the 253 banks in Switzerland, 229 recorded a profit in 2017, posting a total profit of CHF 10.3 billion. The remaining 24 institutions recorded an aggregate loss of CHF 0.5 billion. The result of the period for all banks was CHF 9.8 billion. The aggregate balance sheet total rose by 4.8% to CHF 3,249.4 billion.

Read More »

Read More »

London House Prices Fall 1.9 percent In Quarter – Bubble Bursting?

London house prices down 1.9 per cent in Q2 (yoy). London house prices still 50% above 2007 bubble peak (see chart). Brexit and weak consumer confidence to blame say experts. Little sign that U.K. property “weakness” is likely to change. London property bubble appears to be bursting.

Read More »

Read More »

FX Daily, June 28: US Dollar Remains Firm, Sends Yuan, Rupee, Sterling and Kiwi to New 2018 Lows

The US dollar is consolidating its gains against most of the major currencies, but the underlying strength remains evident. Several major and emerging market currencies are at new lows for the year, including sterling and the New Zealand dollar, but also the yuan, rupee, and the rupiah.

Read More »

Read More »

Geneva set to vote on world’s highest minimum wage

In May 2014, Switzerland voted against a minimum wage of CHF 22 an hour. At some point voters in the canton of Geneva will get to vote on a similar initiative, which would apply only in the canton. Similar to the federal vote, which was rejected by 76.3% of Swiss voters, the plan calls for a minimum hourly wage of CHF 23 ($US 23.40). Based on a 40-hour week, this works out at around CHF 4,000 per month.

Read More »

Read More »

Make Capital Cheap and Labor Costly, and Guess What Happens?

Employment expands in the Protected cartel-dominated sectors, and declines in every sector exposed to globalization, domestic competition and cheap capital. If you want to understand why the global economy is failing the many while enriching the few, start with the basics: capital, labor and resources. What happens when central banks drop interest rates to near-zero? Capital becomes dirt-cheap.

Read More »

Read More »

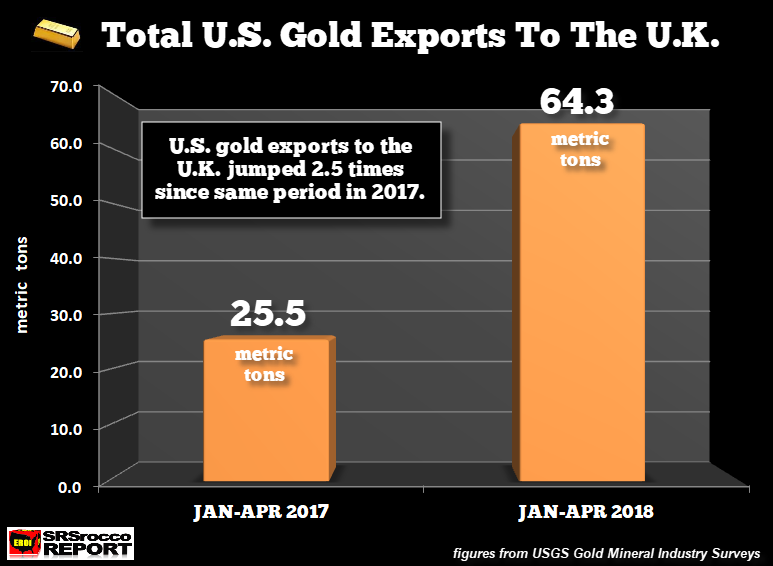

Gold Exports To London From U.S. Surge 152 percent In 2018

Gold Exports To London From U.S. Surge 152% In 2018. – U.S. gold exports to UK (primarily) London jumped over 150% from 25.5 metric tons to 64.3 mt in the first four months of 2018 (yoy). – Largest countries receiving U.S. gold exports are China/ Hong Kong, Switzerland and the UK. – U.S. gold exports to London (UK) alone nearly as much as total U.S. gold production. – Gold flowing from weak hands in West to strong hands in the East

Read More »

Read More »

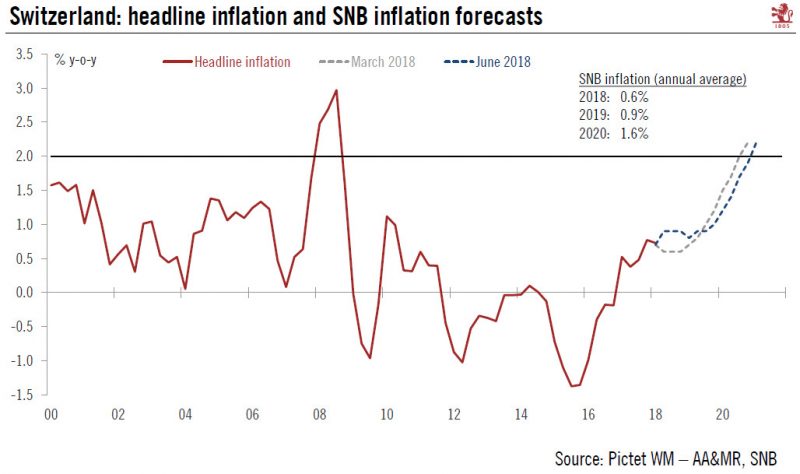

Buying more time

At its quarterly monetary policy assessment last week, the Swiss National Bank (SNB) kept unchanged the target range for the three-month Libor at between -1.25% and -0.25% and the interest rate on sight deposits at a record low of -0.75%. The SNB reiterated its willingness to intervene in the foreign exchange market if needed.

Read More »

Read More »

EU Unemployment Rule change could cost Switzerland dearly

Currently, across EU and EFTA countries, unemployment benefits are paid by the country of residence. Last week, the EU announced plans to make the country of employment pay unemployment benefits instead. This change could be costly for Swiss cantons with large numbers of cross-border workers, workers who live in the EU but work in Switzerland.

Read More »

Read More »

FX Daily, June 27: Renminbi Slide Continues and Oil Extends Surge

The US dollar is mostly firmer today, though has slipped back below the JPY110 level, as lower yields and equities support the Japanese yen. The main story in the foreign exchange market today is the continued slide in the Chinese renminbi. The decline is the sharpest since the 2015 devaluation.

Read More »

Read More »

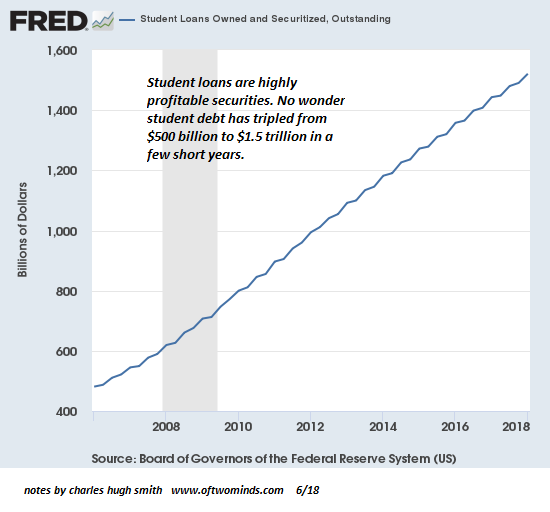

Dear High School Graduates: the Status Quo “Solutions” Enrich the Few at Your Expense

You deserve a realistic account of the economy you're joining. Dear high school graduates: please glance at these charts before buying into the conventional life-course being promoted by the status quo. Here's the summary: the status quo is pressuring you to accept its "solutions": borrow mega-bucks to attend college, then buy a decaying bungalow or hastily constructed stucco box for $800,000 in a "desirable" city, pay sky-high income and property...

Read More »

Read More »