You deserve a realistic account of the economy you’re joining.

Dear high school graduates: please glance at these charts before buying into the conventional life-course being promoted by the status quo.

Here’s the summary: the status quo is pressuring you to accept its “solutions”: borrow mega-bucks to attend college, then buy a decaying bungalow or hastily constructed stucco box for $800,000 in a “desirable” city, pay sky-high income and property taxes on your earnings, and when the stress of all these crushing financial burdens ruins your health, well, we’ve got meds to “help” you–lots of meds at insane price points paid for by insurance– if you have “real” insurance without high deductibles, of course.

Here’s the truth the status quo marketers don’t dare acknowledge: every one of these conventional “solutions” only makes the problem worse. Student loan debt only makes your life harder, not easier, as the claimed “value” of a college degree is based on the distant past, not the present. The economy is changing fast and the conventional “solutions” no longer match the new realities. But don’t expect anyone profiting from the predatory profiteering higher-education cartel to admit this.

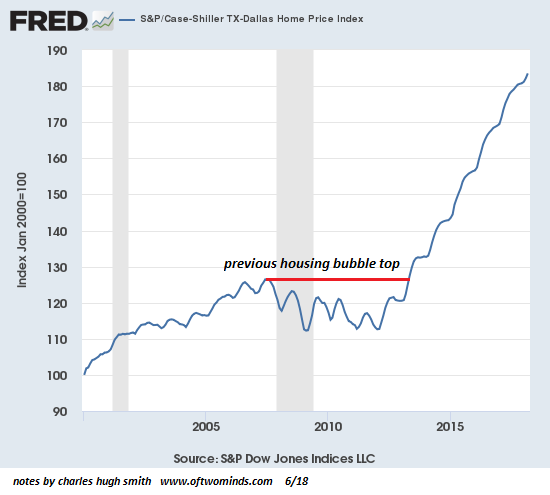

The high cost of housing isn’t “solved” by buying in at the top of an unprecedented bubble. Buying into bubbles only makes the problem worse, for all bubbles eventually pop.

The “solution” to crushing levels of debt is not to borrow more just to prop up a rotten, corrupt, dysfunctional and self-serving status quo. In effect, the young generations are being groomed to be the hosts for the parasitic classes that feed on young taxpayers, student loan debt-serfs, young buyers of bubble-priced housing, unaffordable sickcare “insurance” and all the rest of the status quo “solutions.”

As writer Peter Turchin has explained, societies in decline overproduce elites.Those promised an elite slot who are left out become the engine of social unrest.

The status quo claims that getting a college diploma more or less guarantees you a slot in the elite class of folks with secure incomes and opportunities to get ahead and build real wealth.

|

The reality is only the top 5% of the work force are doing well. So of the 33% of the work force with university diplomas, the system only creates slots for the top 15% of that educational elite. The next 15% (the rest of the top 10% of the entire work force) can pick up the 2nd tier technocrat positions and everyone else gets the scraps: insecure jobs, mediocre pay, limited opportunities.

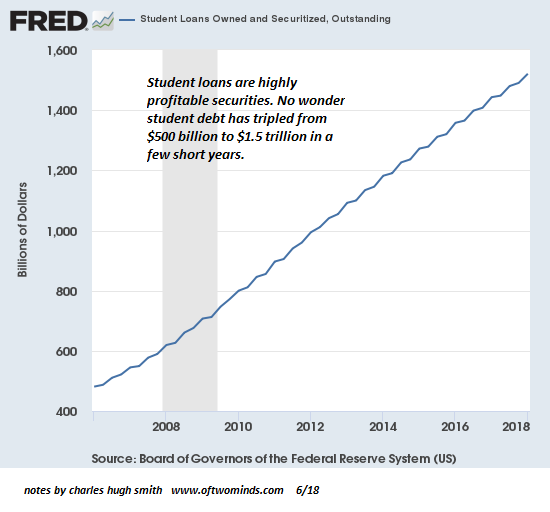

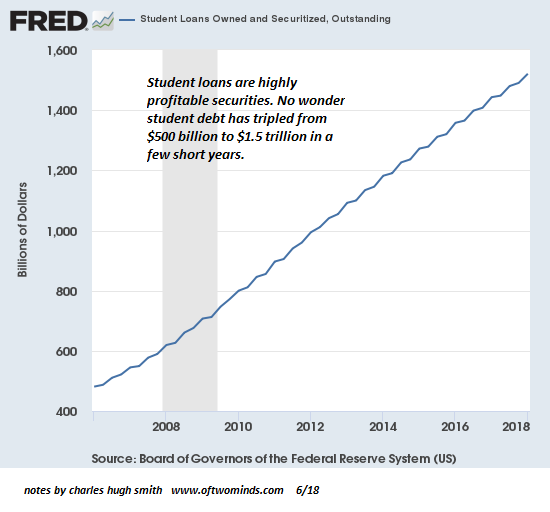

Before you accept that becoming a debt-serf to get a college diploma is a “solution,” check out the other side of that trade: the mostly older, wealthier folks profiting from your debt-serfdom:

|

Student Loans Debt 2008-2018 - Click to enlarge |

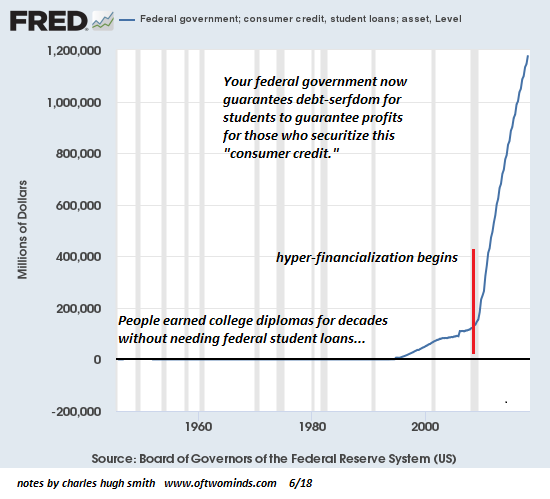

| This parasitic predation is guaranteed by your federal government: you know, the institution everyone looks to for “solutions.” |

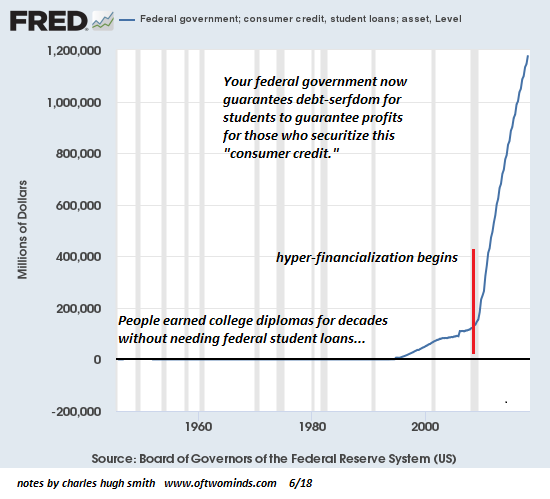

Student Loans Federal Government 1960-2018 - Click to enlarge |

|

How did millions of students earn college diplomas before the hyper-financialization of the economy and before assistant deans made $350,000 a year in “competitive” salaries? It’s a mystery lacking any mainstream explanation.

Speaking of debt–here’s the nation’s total debt level: note that the amount of debt required to push GDP higher keeps increasing far faster than GDP:

|

Debt Securities and Loans 1960-2018 - Click to enlarge |

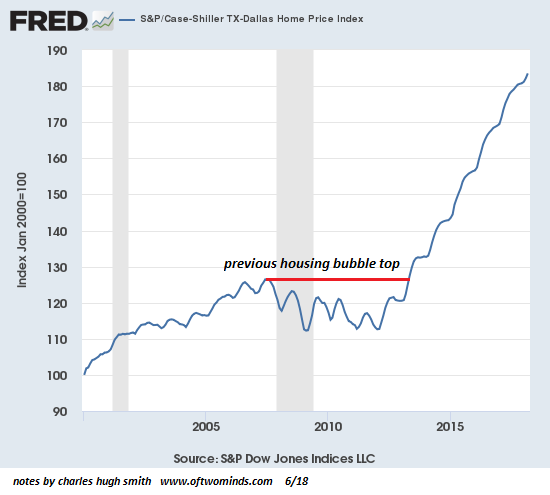

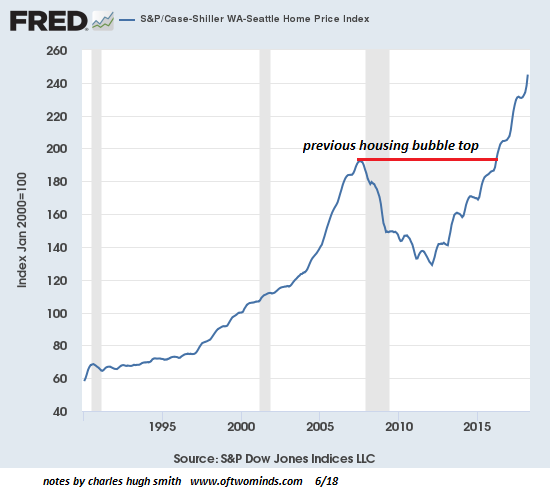

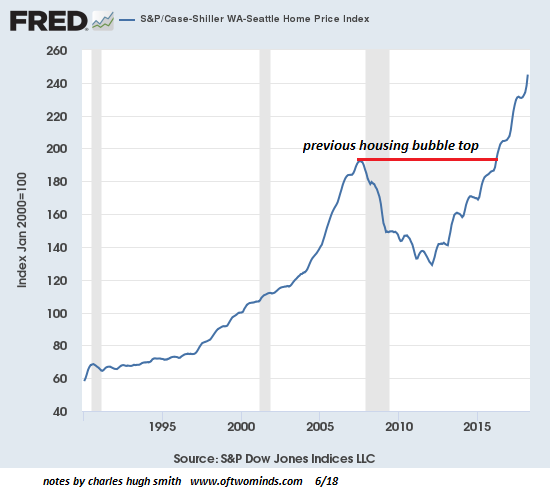

| As for plunking down hundreds of thousands of dollars for that little cheaply constructed stucco/particle board/plastic box: housing prices in hot markets such as Dallas and Seattle have far exceeded the previous hyper-financialized housing bubble top in the mid-2000s: |

S&P Case-Shiller Index 2005-2018 - Click to enlarge |

| Don’t worry about soul-crushing commutes, homeless encampments or rapidly rising taxes: asset bubbles make everything bearable, until they pop. |

S&P Case-Shiller Index Seattle 1995-2018 - Click to enlarge |

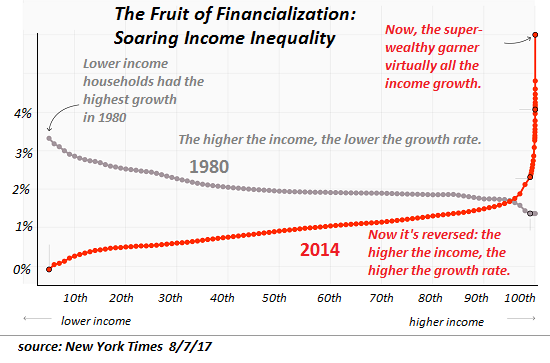

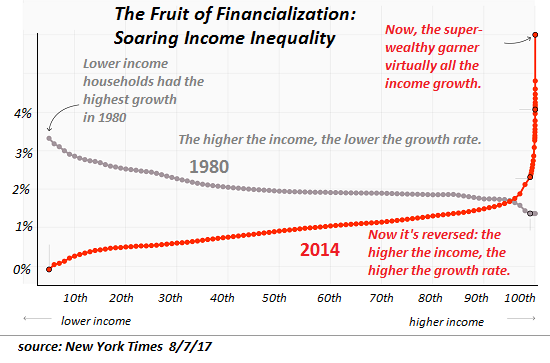

| You deserve a realistic account of the economy you’re joining. Here’s reality: the vast majority of the gains reaped since your birth have flowed to the very top of the hyper-financialized wealth-power pyramid. |

The Fruit of Financialization: Soaring Income Inequality 1980-2014 - Click to enlarge |

As Bucky Fuller noted in his famous dictum, “You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete.”

Rather than fight a system designed to stripmine you for life, seek a model for your life that obsoletes all the perverse conventional “solutions.”

I’m putting four books on sale which may help provide an alternative context for your life-decisions.

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the

book's website.

Full story here

Are you the author?

At readers' request, I've prepared a biography. I am not confident this is the right length or has the desired information; the whole project veers uncomfortably close to PR. On the other hand, who wants to read a boring bio? I am reminded of the "Peanuts" comic character Lucy, who once issued this terse biographical summary: "A man was born, he lived, he died." All undoubtedly true, but somewhat lacking in narrative.

Previous post

See more for 5.) Charles Hugh Smith

Next post

Tags:

newslettersent