Tag Archive: newsletter

Why Home Ownership is Warped By Lending Gimmicks

(7/19/22) Monday's rally fails (thanks, Apple); things are so negative, it's positive. Investors' "fear of missing out (FOMO)" has become a "fear of missing the bottom (FOBO);" this market performance isn't as bad as post 2008 or post-Lehman markets; the "American Dream" of home ownership has been warped by lending gimmicks; Markets' reaction to Apple hiring freeze--there's bad news and not-as-bad news.

Read More »

Read More »

Kaufsignale voraus? | Echtes Geld | Echtes Trading

Profitrader Martin Goersch vermittelt in dieser monatlichen Webinarreihe bei CapTrader sein Tradingwissen, das auf jahrelanger Erfahrung beruht, an die Webinarteilnehmer.

Read More »

Read More »

The Dollar is on its Back Foot

The dollar’s downside correction continues today, helped by hawkish signals from the Reserve Bank of Australia and unnamed sources who have played up the chances of a 50 bp hike by the European Central Bank on Thursday.

Read More »

Read More »

Covid-19 and the Continuing Erosion of Private Property Rights

Even though the downhill trajectory we've seen over the last decades in terms of property rights is bad enough, nothing could have ever prepared us for what the covid-19 crisis would bring. Even those of us who have read enough history to know that there's really no line that the state will not cross in its fervent pursuit of absolute power were sincerely surprised.

Read More »

Read More »

AUDUSD technical analysis

See the complete technical analysis for the Aussie dollar vs the US dollar here https://www.forexlive.com/technical-analysis/audusd-technical-analysis/

Read More »

Read More »

ETHEREUM MERGE!! BESSER ALS BITCOIN??

Im heutigen Video erzähle ich dir, was ich nachgekauft habe und warum. Weiterhin gehe ich auf den Ethereum Merge ein, der für September angekündigt wurde und welche Auswirkungen dieser auf den Preis haben könnte. Lass mir deine Meinung dazu in den Kommentaren da!

Read More »

Read More »

Interview mit Prof. Dr. Dr. h.c. mult. Hans-Werner Sinn auf der 4. INVESTMENTexpo

Prof. Dr. Dr. h.c. mult. Hans-Werner Sinn spricht über das neue globale Regime zwischen Inflation, Zinsentwicklung und geopolitische Risiken für Geldströme und deutsche Investments im Ausland.

Read More »

Read More »

Weiter vorsichtig bleiben: DJE-Marktausblick Juli 2022

Das konjunkturelle Marktumfeld dürfte auch in den kommenden Monaten äußerst anspruchsvoll bleiben: Bei den fundamentalen und den monetären Indikatoren ist kurzfristig keine Besserung in Sicht, und auch die geopolitische Lage dürfte schwierig bleiben.

Read More »

Read More »

Markt erholt sich, doch haben wir die Talsohle wirklich durchschritten?

Die Signale sind in den letzten Tagen wieder auf Grün gesprungen. Im gesamten Markt gibt es ein klares Kursplus. Bitcoin legte im Wochenvergleich 10 Prozent zu. Doch ist dies der Anfang eines Bullenruns oder könnte es in naher Zukunft wieder runtergehen?

Read More »

Read More »

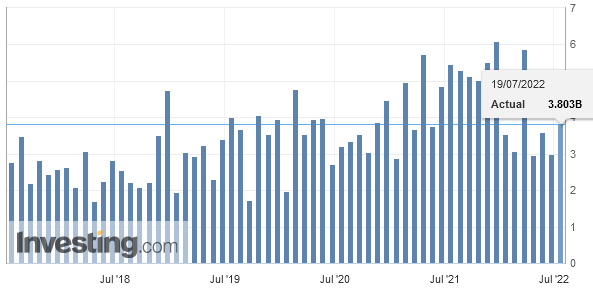

Swiss Trade Balance 2nd quarter 2022: 8th consecutive quarterly increase

Swiss foreign trade strengthened further in both traffic directions in the 2nd quarter of 2022, reaching new highs. Exports increased by 0.9% and imports by 2.4% compared to the previous quarter. Prices have risen both at entry and exit. The trade balance closes with a surplus of 7.6 billion francs.

Read More »

Read More »

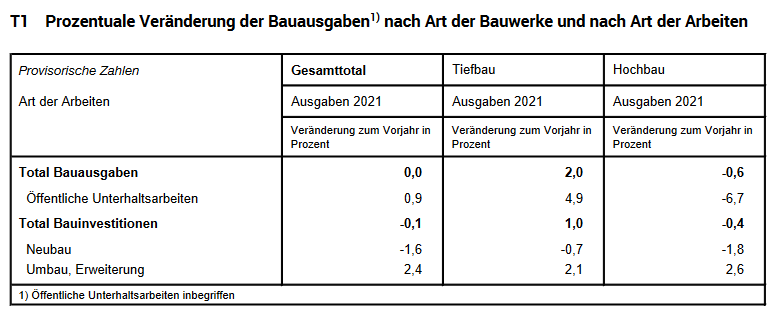

Construction expenditure remains at the same level in 2021 for the second time in a row

17.07.2022 - Construction expenditure again remained stable in 2021 compared with the previous year. Investments in civil engineering rose by 1.0% and those in building construction fell by 0.4%. As a result, total investment in construction showed a decline of 0.1%. These are the provisional findings from the Construction Statistics from the Federal Statistical Office (FSO).

Read More »

Read More »

Ukraine war hits Swiss asset management industry

The ongoing war in Ukraine has been partly blamed for losses at a prominent Swiss asset management company. The entire Swiss industry suffered a dip in fortunes in the first six months of year as extreme market volatility reduced the value of investments and caused clients to play safe with their money.

Read More »

Read More »

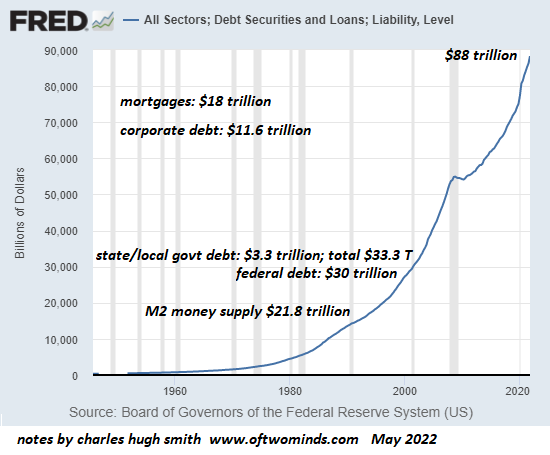

The Only Real Solution Is Default

The destruction of 'phantom wealth' via default has always been the only way to clear the financial system of unpayable debt burdens and extremes of rentier / wealth dominance. The notion that the world could always borrow more money as long as interest rates were near-zero was never sustainable.

Read More »

Read More »

Die Banken zocken wieder und Du darfst sie wieder retten!

Banken zocken wieder - Nach Meinung von Markus Krall geht es wieder los - unsere Banken zocken schon einige Zeit wieder so, wie sie es 2008 schon getan haben.

Read More »

Read More »

How the World Embraced Nationalism, and Why It’s Not Going Away Soon

Perhaps one of the more astute observers of Russian foreign policy in recent decades has been John Mearsheimer at the University of Chicago. He has spent years warning against US-led NATO enlargement as a tactic that would provoke conflict with the Russian regime. Moreover, Mearsheimer has sought to explain why this conflict exists at all.

Read More »

Read More »

Own These Assets To Survive The Bear Market

Hot inflation is crashing corporate profits, as consumer spending falls and the Fed's rate hikes make the cost of capital more expensive. As a result, stocks remain under pressure and bond default risks grow.

Read More »

Read More »