Tag Archive: newsletter

Leerverkäufe erklärt: Hedgefonds wetten 250 Mrd $ gegen den Markt

Bricht der US-Aktienmarkt ein? Hedgefonds wetten 250 Mrd $ gegen den Markt. Saidi geht im heutigen Video auf einen Artikel aus dem Handelsblatt ein.

Read More »

Read More »

Alasdair Macleod: Banker’s Nightmare! Protect Yourself With Silver

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3NZzjHY

▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactSilverNews_subscribe

▶︎ Keep your financial education strong with our CompactClub ▶︎ http://bit.ly/CompactClub

Alasdair has been a celebrated stockbroker and Member of the London Stock Exchange for over four decades. His experience encompasses equity and bond markets, fund management, corporate finance and investment strategy. After...

Read More »

Read More »

Money Mistakes to Avoid in a Bear Market

(6/17/22) Richard Rosso channels his inner Janet Yellen; markets have lost all confidence in the Executive Branch and the Federal Reserve; money tips for a bear market: Household liquidity is key for survival; examine spending, and hold off on major purchases; a Recession is necessary for restoring value to the system; recognizing the difference between a reflexive rally & a bullish trend. The Financial Efficacy of Solar Panels; ESG's are about...

Read More »

Read More »

Unheeded warnings: Václav Klaus at the Marmara Forum

This not the first time that Václav Klaus’ astute observations and experience-based predictions turn out to be shockingly accurate years later, and I’m pretty confident it will not be the last. Even before the examples that follow and that he clearly laid out in his address at the Marmara Forum, the former President of the Czech Republic has repeatedly proven to be quite prophetic in his assessment of the future.

Read More »

Read More »

Enteignung von Immobilien und Vermögensabgaben – Aktuelle Infos 2022

Immobilienenteignung und Vermögensabgabe aktuell wahrscheinlicher denn je!

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Thorsten Homepage: https://thorstenwittmann.com/

Enteignungen sind bereits da und Vermögens- und Immobilienabgaben werden immer wahrscheinlicher

Es gibt wieder Neues von der „Enteignungsfront“ und die Enteignungstendenzen schreiten weiter voran in Deutschland.

Hast du den Antrag zum Immobilienregister...

Read More »

Read More »

FINANZRUDEL COMMUNITY TREFFEN 1. JULI 2022 in ZÜRICH ????

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

ICH VERSCHENKE...

Ankündigung zum Finanzrudel Community-Treffen in der Insider-Bar in Zürich. Seid gespannt wer alles dabei sein wird dieses mal, für spannenden Austausch untereinander. Bis du auch dabei? Schreib es mir gerne in die Kommentare.

#community #zurich #Finanzrudel

?? Alle Infos zum Community-Treffen ►►...

Read More »

Read More »

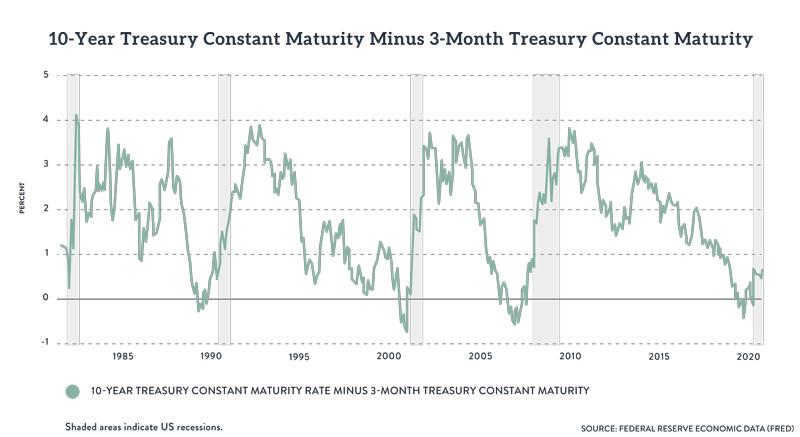

The Inverted Yield Curve and Recession

The “yield curve” refers to a graph showing the relationship between the maturity length of bonds—such as one month, three months, one year, five years, twenty years, etc.—plotted on the x axis, and the yield (or interest rate) plotted on the y axis.1

Read More »

Read More »

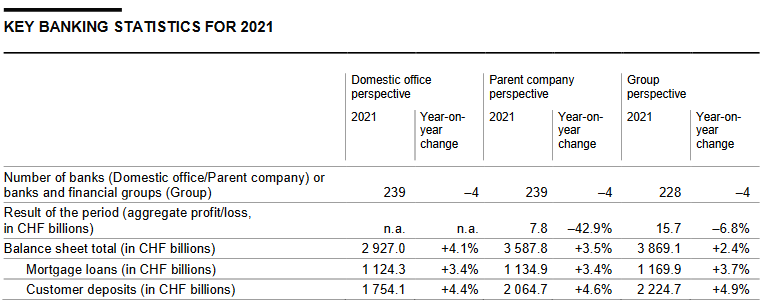

Annual banking statistics for 2021

The Swiss National Bank has today published data on the annual financial statements of banks in Switzerland for the 2021 financial year. For the first time, the published data also comprises bank office data (Domestic office perspective) in addition to the data from individual financial statements (Parent company perspective) and consolidated financial statements (Group perspective).

Read More »

Read More »

The Great Reset: Turning Back the Clock on Civilization

The covid-19 pandemic featured an unprecedented fusion of the interests of large and powerful corporations with the power of the state. Democratically elected politicians in many countries failed to represent the interests of their own citizens and uphold their own constitutions and charters of rights.

Read More »

Read More »

Wie schnell erholt sich die Börse? Wie schützt man sich vor Massenpanik am Aktienmarkt?

Wie war das Anlegerverhalten bei vergangen Krisen? Wie wird Euphorie und Panik individuell wahrgenommen?

_

Dr. Markus Elsässer, Investor und Gründer des Value Fonds

„ME Fonds - Special Values“ [WKN: 663307]

„ME Fonds - PERGAMON“ [WKN: 593117]

_

1.? "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als Hörbuch *https://amzn.to/3xnT6rW

2.? "Des klugen Investors Handbuch" *https://amzn.to/38UCXQg

Als Hörbuch...

Read More »

Read More »

Could Retail “Bagholders” Spark a Rally “Smart Money” Will Be Forced to Chase?

There would be some deliciously karmic justice in the "dumb money" driving a rally that forced the "smart money" to cover their shorts and chase the rally that shouldn't even be happening.

Read More »

Read More »

Nasdaq Index Technical Analysis created on 17 June 2022

Analyzing and charting the Nasdax Index on the monthly chart. Created on 17 June and relevant for June and July 2022.

Read More »

Read More »

Alien life: are we about to find it?

The thought of finding alien life has fascinated people since the time of the ancient Greeks—but developments in astrobiology could be about to turn this possibility into reality. How do you hunt for life beyond Earth—and might this be the decade when we find it?

00:00 - Is there life beyond Earth?

00:56 - How has the search for life evolved?

02:36 - What signs of life are scientists looking for?

03:48 - What are biosignatures?

04:28 - How to find...

Read More »

Read More »

Ron Bielecki, Fynn Kliemann, AlleAktien – Mein Statement zur Berichterstattung

? bis zu 2 Gratisaktien bei Depotempfehlung für ETFs & Sparpläne ► http://link.aktienmitkopf.de/Depot *

Finvestigativ auf Insta https://www.instagram.com/finvestigativ/

? Kostenlose Anmeldung bei Spatz Portfolio Software ►►► https://gospatz.com/signup

MyDividends24 App Downloaden ► http://myfinances24.de/mydividends24

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT...

Read More »

Read More »

Man muss sich seine Auszeit suchen – Ernst Wolff im Gespräch mit POLITIK SPEZIAL

Der Wirtschaftsexperte, Journalist und Drehbuchautor Ernst Wolff eröffnete als Referent am 18. Mai in Köln die neue Kamingesprächsreihe von Professor Dr. Max Otte. Wolff wurde in China geboren und studierte in den USA. Er gehört zu den bestinformierten kritischen Experten der aktuellen Geopolitik und ihrer Hintergründe. Zu diesem Themenbereich zählt die Vernetzung im digital-finanziellen Komplex, der über seine eigene Vernetzung sowie die vielen...

Read More »

Read More »

Bitcoin stabilisiert sich oberhalb von 20K

Die Abwärtsbewegung des BTC-Preises wurde erst einmal gestoppt. Oberhalb von 20.000 US-Dollar kam es zur Stabilisierung des Kurses. Damit hat der Bitcoin dennoch im 10-Tages-Vergleich etwa 50 Prozent seines Wertes verloren. Allerdings kommt die Stabilisierung zu diesem Zeitpunkt überraschend. Bitcoin News: Bitcoin stabilisiert sich oberhalb von 20KIn den USA kündigten die Zentralbanken einen Anstieg der Zinsen an, den es in dieser Höhe zuletzt vor...

Read More »

Read More »

Das Chaos in der EZB / Hans A. Bernecker im Rahmen von Bernecker.TV

Themen-Check mit Hans A. #Bernecker ("Die Actien-Börse") - in diesem Video als VERKÜRZTE FreeTV-Variante des ansonsten umfangreicheren Gesprächs im Rahmen von Bernecker.tv vom 15.06.2022. Schlaglichter:

++ Schwächeanfall als guter Qualitätstest

++ Geldschwemme vorbei

++ Italienisch/Französischer Flair in der #EZB

++ #Euro in seiner jetzigen Stellu ng nicht zu halten?

++ Hinweis auf Bernecker-#Webinar am 07.07.2022 mit Trading-Experte...

Read More »

Read More »