| Note: Ce post est une erreur. Son contenu correspond en fait à la page dédiée à l’or suisse de la banque centrale.

https://lilianeheldkhawam.com/lor-de-la-banque-nationale-suisse/ Cette erreur est intervenue dans le cadre de la création de la page sur la Monnaie, que je vous invite à visiter ici: https://lilianeheldkhawam.com/monnaie-dossier/ Avec mes excuses. LHK |

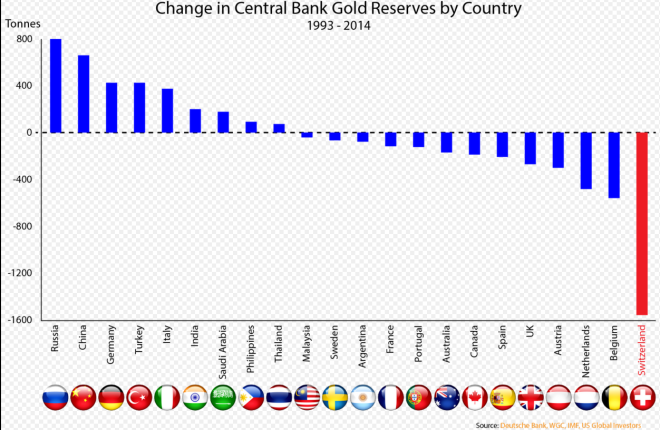

Change in Central Bank Gold Reserves by Country |

Tags: Autres articles,newsletter